Australia Mobile Phone Insurance Market Size, Share, Trends and Forecast by Phone Type, Coverage, Distribution Channel, End User, and Region, 2025-2033

Australia Mobile Phone Insurance Market Overview:

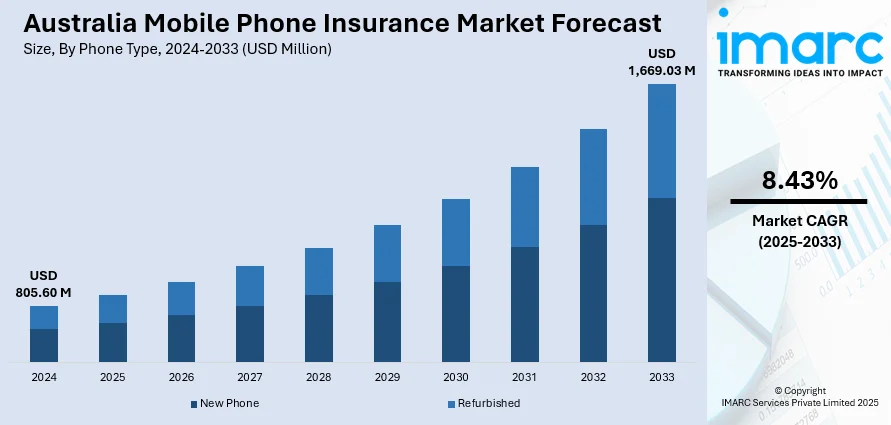

The Australia mobile phone insurance market size reached USD 805.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,669.03 Million by 2033, exhibiting a growth rate (CAGR) of 8.43% during 2025-2033. The market is being driven by the increasing cost of smartphones, rising consumer reliance on mobile devices for personal and professional use, the escalating demand for comprehensive coverage plans, and the growing popularity of flexible, on-demand insurance options for device protection and repair.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 805.60 Million |

| Market Forecast in 2033 | USD 1,669.03 Million |

| Market Growth Rate 2025-2033 | 8.43% |

Australia Mobile Phone Insurance Market Trends:

Rising Mobile Phone Costs and Premium Smartphone Penetration

One of the most significant drivers driving the Australian mobile phone insurance market is the higher price of smartphones, especially Apple, Samsung, and Google models. With high-end devices now frequently costing in excess of AUD 1,500, customers are looking for coverage for financial loss due to theft, damage, or breakdown. When compared to previous generations, current smartphones are filled with the latest technologies, such as sophisticated camera systems, foldable displays, biometric authentication, and AI-driven software, which greatly increase repair and replacement expenses. As such, the growing popularity of premium models, especially among millennials and professionals, has heightened the perceived value of mobile phones. Customers now perceive smartphones as necessary investments instead of luxury gadgets. This shift in attitude has prompted more people to pay for longer coverage or insurance packages that exceed standard manufacturer warranties. Retailers and carriers are taking advantage of this trend by offering insurance services bundled with device sales or contract plans, which further propel the market.

To get more information on this market, Request Sample

Increased Digital Dependency and Remote Work Culture

Another key driver of the mobile phone insurance industry in Australia is the surge in digital reliance and standardization of remote and hybrid workspaces. The COVID-19 pandemic was a turning point in transforming how Australians operate using mobile technology. Smartphones are no longer secondary tools but core centers of productivity, collaboration, and connectivity for those working from home or on the road. This added dependency has brought device uptime to a priority level, and damage or downtime can cause massive personal and professional inconvenience. Consumers have thus become interested in seamless access to their devices, and that has escalated demand for total mobile insurance covering swift repair, loan phones, or instant replacement. The contemporary workforce requires frictionless access to mobile services, cloud platforms, and communication tools such as Zoom or Microsoft Teams, all of which are widely accessed through smartphones. Insurance policies that provide minimal downtime and value-added services have grown in attractiveness, particularly among professionals, freelancers, and digital nomads.

Australia Mobile Phone Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on phone type, coverage, distribution channel, and end user.

Phone Type Insights:

- New Phone

- Refurbished

The report has provided a detailed breakup and analysis of the market based on the phone type. This includes new phone and refurbished.

Coverage Insights:

- Physical Damage

- Electronic Damage

- Virus Protection

- Data Protection

- Theft Protection

A detailed breakup and analysis of the market based on the coverage have also been provided in the report. This includes physical damage, electronic damage, virus protection, data protection, and theft protection.

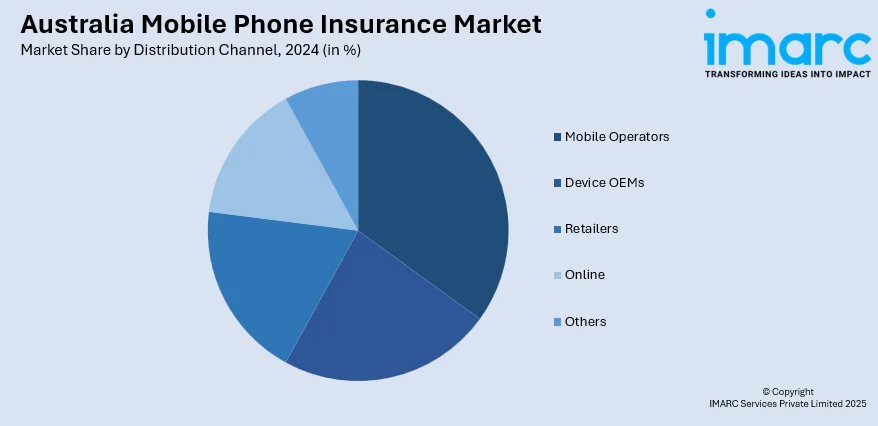

Distribution Channel Insights:

- Mobile Operators

- Device OEMs

- Retailers

- Online

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes mobile operators, device OEMs, retailers, online, and others.

End User Insights:

- Corporate

- Personal

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes corporate and personal.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Mobile Phone Insurance Market News:

- September 2024: Reebelo and SquareTrade launched ReebeloCare in Australia, offering a 24-month device protection plan that includes options for device refresh, replacement, and extended warranty. The plan provides multiple service options such as mail-in, walk-in, or on-site support, with global coverage and a 24/7 self-service portal.

- May 2023: Switched On Insurance, a UK-based provider, launched its mobile phone insurance in Australia. The offering includes two coverage levels: Standard, covering accidental and liquid damage, and Premium, adding theft protection. It features immediate protection, worldwide coverage, flexible payments, and unlimited claims.

Australia Mobile Phone Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Phone Types Covered | New Phone, Refurbished |

| Coverages Covered | Physical Damage, Electronic Damage, Virus Protection, Data Protection, Theft Protection |

| Distribution Channels Covered | Mobile Operators, Device OEMs, Retailers, Online, Others |

| End Users Covered | Corporate, Personal |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia mobile phone insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia mobile phone insurance market on the basis of phone type?

- What is the breakup of the Australia mobile phone insurance market on the basis of coverage?

- What is the breakup of the Australia mobile phone insurance market on the basis of distribution channel?

- What is the breakup of the Australia mobile phone insurance market on the basis of end user?

- What are the various stages in the value chain of the Australia mobile phone insurance market?

- What are the key driving factors and challenges in the Australia mobile phone insurance market?

- What is the structure of the Australia mobile phone insurance market and who are the key players?

- What is the degree of competition in the Australia mobile phone insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia mobile phone insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia mobile phone insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia mobile phone insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)