Australia Mobile and Wireless Backhaul Market Size, Share, Trends and Forecast by Equipment Type, Network Topology, Service, and Region, 2025-2033

Australia Mobile and Wireless Backhaul Market Overview:

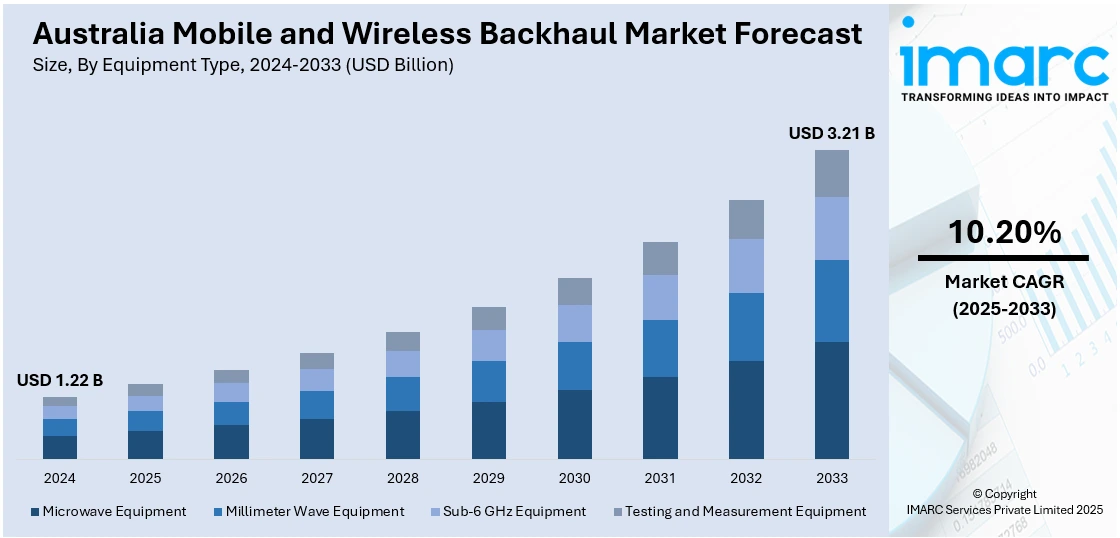

The Australia mobile and wireless backhaul market size reached USD 1.22 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.21 Billion by 2033, exhibiting a growth rate (CAGR) of 10.20% during 2025-2033. Growing mobile data traffic, nationwide fifth generation (5G) rollout, and government-funded National Broadband Network (NBN) initiatives are favoring the market growth. Moreover, surging adoption of fiber and microwave technology, escalating Internet of Things (IoT) deployments, smart city initiatives, and enterprise private 5G network adoption are other growth-inducing factors. Furthermore, software-defined networking (SDN) and virtualization adoption, rural connectivity improvement focus, low-latency edge computing requirement, millimeter-wave (mmWave) spectrum usage, and growing competition among mobile network operators (MNOs) are fostering the Australia mobile and wireless backhaul market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.22 Billion |

| Market Forecast in 2033 | USD 3.21 Billion |

| Market Growth Rate 2025-2033 | 10.20% |

Australia Mobile and Wireless Backhaul Market Trends:

Rising Mobile Data Traffic

Australia's mobile data usage has risen significantly due to smartphone use, streaming services and mobile apps. Consumers need faster speeds and uninterrupted connectivity with increasing frequency, which exerts greater pressure on existing network infrastructure. This boom is not limited to the city centers, rural and suburban locations are also seeing increasing demand as users shift to digital platforms for communication, work, and entertainment. Mobile network operators are responding by investing in higher-scale and more advanced backhaul systems to handle increased throughput. For instance, in March 2024, EM Solutions and EMClarity disclosed trials of the Exomux mobile platform, achieving 10Gbps line-of-sight backhaul between mobile platforms, changing high-speed communications in defense and commercial sectors. Furthermore, this includes upgrading current links and deploying additional fiber and high-capacity microwave systems to keep pace with user demand. The sifting emphasis from increasing coverage to making sure that backhaul networks are capable of handling the amount and sophistication of contemporary mobile traffic is driving the Australia mobile and wireless backhaul market growth.

To get more information on this market, Request Sample

Nationwide 5G Rollout

The deployment of 5G across Australia is a central factor driving backhaul infrastructure upgrades. 5G requires a dense network of small cells and high-capacity transport links to support faster speeds, ultra-low latency, and massive device connectivity. This shift demands backhaul solutions that are both scalable and flexible, particularly in dense urban environments. Unlike previous generations, 5G places a greater emphasis on network performance and reliability, which places additional pressure on the backhaul segment to deliver consistent speed and quality. Telcos are upgrading existing fiber links and exploring millimeter-wave and microwave backhaul options to meet these new requirements. The competitive push to offer advanced 5G services has further accelerated investments in this area. Without robust backhaul, even the most advanced 5G radio access networks will underperform, making this component a critical focus area.

Government Broadband Initiatives

Australia’s National Broadband Network (NBN) and related government programs have played a crucial role in strengthening mobile and wireless backhaul capabilities. By investing in fixed-line and wireless infrastructure across the country, these initiatives aim to ensure broader digital access and improve connectivity, especially in underserved and remote areas. As per the reports, in April 2024, Telstra pushed Australia's backhaul capabilities forward with trials of Starlink LEO satellite-to-smartphone texting, delivering improved 5G and IoT connectivity to remote regions through SATCOM and terrestrial network collaborations. Additionally, NBN’s reach provides telcos with a foundation to extend mobile backhaul without always requiring new network builds. The availability of government-supported infrastructure reduces capital costs and speeds up deployment timelines, encouraging more aggressive backhaul expansion. Moreover, regulatory backing provides a stable environment for long-term planning and investment. Through subsidies and public-private partnerships, the government is helping bridge the digital divide, and mobile backhaul development is directly benefitting from this approach. These initiatives are also aligned with national goals of economic inclusion and productivity, making them a structural enabler for sustained backhaul growth in Australia’s telecom sector.

Australia Mobile and Wireless Backhaul Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on equipment type, network topology, and service.

Equipment Type Insights:

- Microwave Equipment

- Millimeter Wave Equipment

- Sub-6 GHz Equipment

- Testing and Measurement Equipment

The report has provided a detailed breakup and analysis of the market based on the equipment type. This includes microwave equipment, millimeter wave equipment, sub-6 GHz equipment, and testing and measurement equipment.

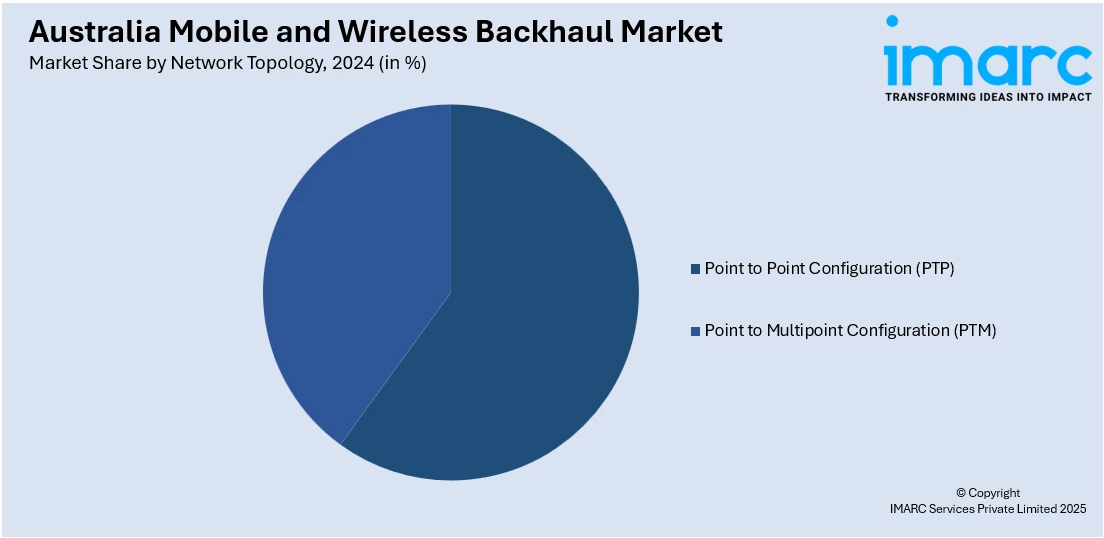

Network Topology Insights:

- Point to Point Configuration (PTP)

- Point to Multipoint Configuration (PTM)

The report has provided a detailed breakup and analysis of the market based on the network topology. This includes point to point configuration (PTP) and point to multipoint configuration (PTM).

Service Insights:

- Network Services

- System Integration Services

- Professional Services

The report has provided a detailed breakup and analysis of the market based on the service. This includes network services, system integration services, and professional services.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Mobile and Wireless Backhaul Market News:

- In April 2025, Singapore-based Transcelestial, in partnership with Paspalis Capital, initiated trials of its CENTAURI laser communication system in Northern Australia. The technology aims to enhance connectivity in remote areas, including mining and healthcare operations, and establish a laser-based optical ground station in Alice Springs for space-to-ground communication.

- In September 2024, the Australian Competition and Consumer Commission approved a USD 1.6 billion network-sharing agreement between Optus and TPG. The 11-year deal aims to enhance mobile coverage across regional Australia, allowing TPG to expand its network to cover 98.4% of the population and enabling Optus to accelerate its 5G rollout.

Australia Mobile and Wireless Backhaul Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered | Microwave Equipment, Millimeter Wave Equipment, Sub-6 GHz Equipment, Testing and Measurement Equipment |

| Network Topologies Covered | Point to Point Configuration (PTP), Point to Multipoint Configuration (PTM) |

| Services Covered | Network Services, System Integration Services, Professional Services |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia mobile and wireless backhaul market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia mobile and wireless backhaul market on the basis of equipment type?

- What is the breakup of the Australia mobile and wireless backhaul market on the basis of network topology?

- What is the breakup of the Australia mobile and wireless backhaul market on the basis of service?

- What is the breakup of the Australia mobile and wireless backhaul market on the basis of region?

- What are the various stages in the value chain of the Australia mobile and wireless backhaul market?

- What are the key driving factors and challenges in the Australia mobile and wireless backhaul market?

- What is the structure of the Australia mobile and wireless backhaul market and who are the key players?

- What is the degree of competition in the Australia mobile and wireless backhaul market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia mobile and wireless backhaul market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia mobile and wireless backhaul market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia mobile and wireless backhaul industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)