Australia Modified Starch Market Size, Share, Trends and Forecast by Raw Material, Type, Function, Application, and Region, 2025-2033

Australia Modified Starch Market Overview:

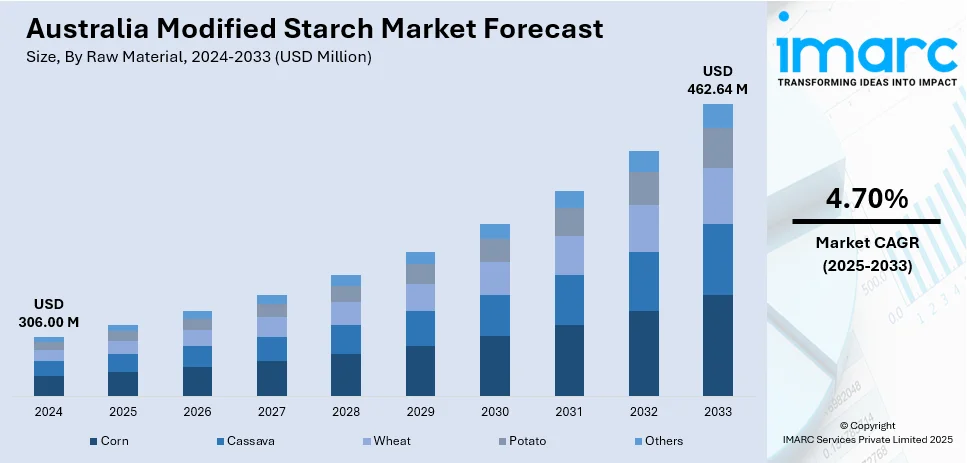

The Australia modified starch market size reached USD 306.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 462.64 Million by 2033, exhibiting a growth rate (CAGR) of 4.70% during 2025-2033. Increased food manufacturing reliance, emphasis on clean-label products, localized production advantages, rising dietary-specific applications, diversified industrial use, preference for biodegradable additives, alignment with sustainability mandates, support for eco-friendly innovation, and efficiency-driven procurement in automated systems…are some of the factors positively impacting the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 306.00 Million |

| Market Forecast in 2033 | USD 462.64 Million |

| Market Growth Rate 2025-2033 | 4.70% |

Australia Modified Starch Market Trends:

Rising Utilization of Modified Starch in the Food and Beverage Sector

A key factor influencing the market is the increasing incorporation of modified starch in food and beverage manufacturing. The demand from manufacturers for functional ingredients that meet both performance and labeling standards is steadily expanding. In parallel, competition among suppliers has become more pronounced, with Australia Modified Starch Market Trends becoming a pivotal metrics for both multinational and regional producers. The capacity to provide tailored starch solutions—aligned with industry specifications and regulatory norms—enhances the strategic relevance of local producers. Australian-led study demonstrates how Vortex Fluidic Device (VFD) processing—developed at Flinders University—enhances Barramundi kamaboko quality by reducing starch particles to 100-190 nm, achieving 1,708 g/cm² gel strength (double conventional methods) and 56.10 N chewiness, outperforming Alaska pollock while providing a sustainable use for Australia's native barramundi. Sensory tests confirmed the 5% starch-fish gelatin blend as optimal, offering Australian manufacturers a science-backed method to produce premium seafood products locally. In Australia, proximity to raw material sources such as maize, wheat, and tapioca offers domestic players a logistical advantage. Additionally, investments in enzymatic processing and non-GMO product lines are allowing companies to differentiate their offerings while meeting customer-specific requirements in the retail and foodservice sectors. Simultaneously, increased interest in health-centric and dietary-specific products is strengthening Australia modified starch market growth within this segment. Modified starches are increasingly integral to gluten-free, reduced-sugar, and plant-based alternatives, where their technical function supports both taste and structure. Food manufacturers are prioritizing these alternatives in response to consumer demands for nutritionally balanced options that do not compromise on texture or stability. This has led to a greater dependency on versatile starch ingredients, thereby encouraging producers to expand their R&D pipelines to develop differentiated starch grades capable of supporting dynamic formulation needs across evolving dietary trends.

To get more information on this market, Request Sample

Expansion of Industrial Applications Beyond Food Processing

Another central driver in the Australia modified starch market is its extended application beyond food into industrial sectors such as paper, textiles, pharmaceuticals, and construction. These industries utilize modified starch for its binding, thickening, film-forming, and moisture-retention capabilities. Within this broader adoption framework, the Australia modified starch market outlook is shaped by rising sustainability priorities, particularly in packaging and materials innovation. Modified starch presents a biodegradable solution aligned with global ESG frameworks. Companies are actively transitioning toward plant-based additives to reduce dependency on synthetic compounds. As a result, starch manufacturers in Australia are gaining traction among eco-conscious industries, especially in packaging and construction. This market sentiment is also supported by public-private initiatives aimed at incentivizing bio-based material development, positioning starch as a viable and scalable alternative across numerous verticals. A Curtin University study developed porous tapioca starch (via enzyme-ultrasound treatment) to enhance udon noodle quality, addressing Australia’s declining production of premium Australian Noodle Wheat (ANW) varieties—a critical export to Japan. The modified starch reduced cooking time by 10% (to ~10.35 minutes) and improved water absorption while maintaining texture, offering a viable solution for manufacturers using alternative wheat flours. Additionally, operational efficiency remains a significant contributor to increasing Australia modified starch market share in industrial sectors. As manufacturing firms seek to standardize inputs that offer reliability and multifunctionality, modified starch is emerging as a key resource.

Australia Modified Starch Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on raw material, type, function, and application.

Raw Material Insights:

- Corn

- Cassava

- Wheat

- Potato

- Others

The report has provided a detailed breakup and analysis of the market based on the raw material. This includes corn, cassava, wheat, potato, and others.

Type Insights:

- Starch Esters and Ethers

- Resistant

- Cationic

- Pre-gelatinized

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes starch esters and ethers, resistant, cationic, pre-gelatinized, and others.

Function Insights:

- Thickeners

- Stabilizers

- Binders

- Emulsifiers

- Others

The report has provided a detailed breakup and analysis of the market based on the function. This includes thickeners, stabilizers, binders, emulsifiers, and others.

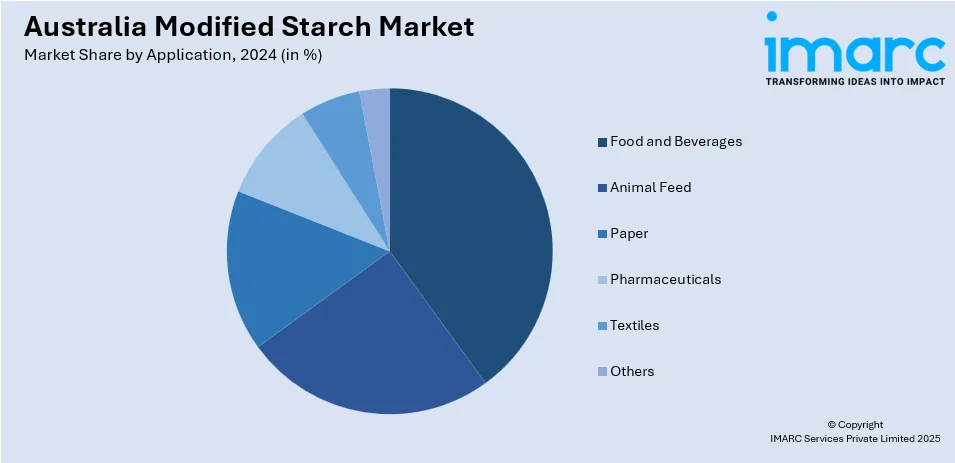

Application Insights:

- Food and Beverages

- Animal Feed

- Paper

- Pharmaceuticals

- Textiles

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes food and beverages, animal feed, paper, pharmaceuticals, textiles, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Modified Starch Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Corn, Cassava, Wheat, Potato, Others |

| Types Covered | Starch Esters and Ethers, Resistant, Cationic, Pre-gelatinized, Others |

| Functions Covered | Thickeners, Stabilizers, Binders, Emulsifiers, Others |

| Applications Covered | Food and Beverages, Animal Feed, Paper, Pharmaceuticals, Textiles, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia modified starch market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia modified starch market on the basis of raw material?

- What is the breakup of the Australia modified starch market on the basis of type?

- What is the breakup of the Australia modified starch market on the basis of function?

- What is the breakup of the Australia modified starch market on the basis of application?

- What is the breakup of the Australia modified starch market on the basis of region?

- What are the various stages in the value chain of the Australia modified starch market?

- What are the key driving factors and challenges in the Australia modified starch market?

- What is the structure of the Australia modified starch market and who are the key players?

- What is the degree of competition in the Australia modified starch market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia modified starch market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia modified starch market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia modified starch industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)