Australia Molecular Diagnostics Market Size, Share, Trends and Forecast by Product, Technology, Application, End User, and Region, 2025-2033

Australia Molecular Diagnostics Market Overview:

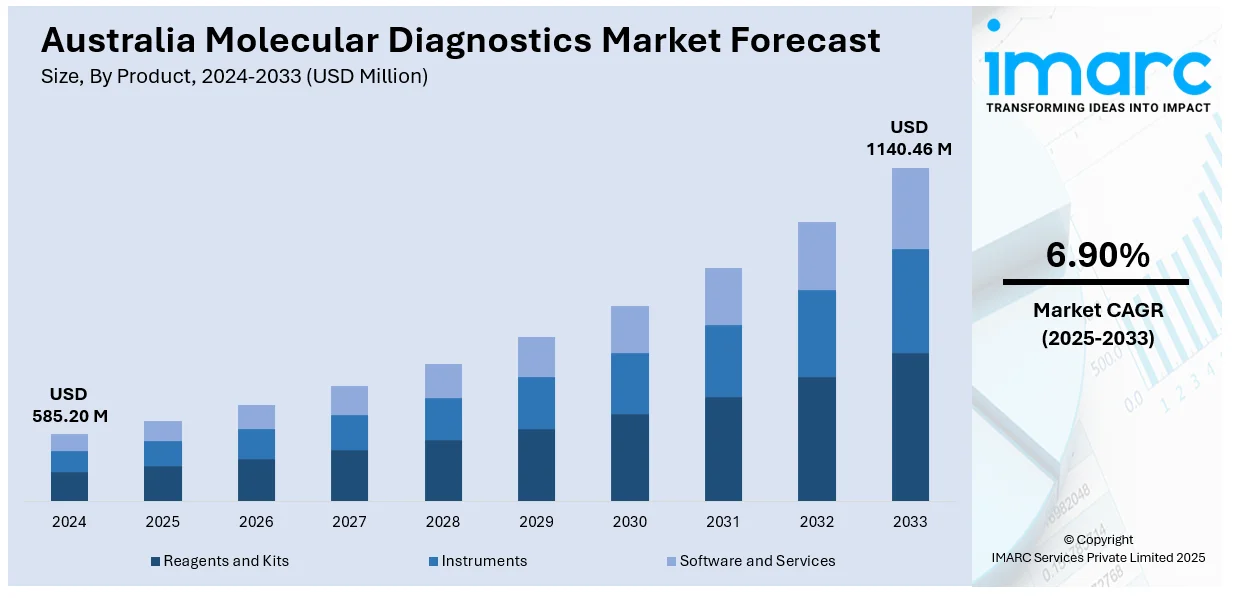

The Australia molecular diagnostics market size reached USD 585.20 Million in 2024. Looking forward, the market is expected to the market to reach USD 1,140.46 Million by 2033, exhibiting a growth rate (CAGR) of 6.90% during 2025-2033. Personalized medicine adoption, expanded genomic testing programs, and growing demand for early disease detection are reshaping diagnostic needs. Regulatory fast-tracking, infrastructure upgrades, automation, and the considerable rise in the number of decentralized molecular platforms are enhancing diagnostic accessibility. Public-private partnerships, point-of-care innovations, and genomic integration are some of the factors positively impacting the Australia molecular diagnostics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 585.20 Million |

| Market Forecast in 2033 | USD 1140.46 Million |

| Market Growth Rate 2025-2033 | 6.90% |

Key Trends of Australia Molecular Diagnostics Market:

Rising Demand for Personalized Medicine and Early Disease Detection

Australia's healthcare system has witnessed a strategic shift toward precision medicine, particularly within oncology, infectious diseases, and rare genetic disorders. This transition is underpinned by growing investments in genomic research and national initiatives such as the Genomics Health Futures Mission, which allocates public funding for translational research and clinical application of molecular diagnostics. Hospitals and diagnostic laboratories are increasingly adopting PCR-based, NGS, and microarray platforms to deliver faster, more targeted testing capabilities. On February 24, 2025, Immunexpress, headquartered in Seattle and Brisbane, presented new data at the SCCM 2025 Congress in Orlando on its SeptiCyte® RAPID test, which rapidly differentiates sepsis from non-infectious inflammation using host gene expression. The test, now approved by Australia’s Therapeutic Goods Administration (TGA), supports faster clinical decisions in managing over 90,000 annual sepsis cases in Australia, which carry an estimated AUD 700 million (USD 460 million) in direct and AUD 4 billion (USD 2.6 billion) in total costs. SeptiCyte RAPID is validated across diverse patient groups and enhances early intervention, antibiotic stewardship, and healthcare efficiency. This is particularly important in oncology, where molecular testing informs therapeutic decisions and predicts drug response.

To get more information on this market, Request Sample

The growing need for early and accurate disease detection also fuels demand, especially in managing outbreaks of respiratory illnesses, sexually transmitted infections, and antimicrobial resistance. Molecular assays offer higher specificity and sensitivity compared to traditional diagnostic techniques, allowing for better patient stratification and timely intervention. In addition, public-private collaborations are facilitating the rollout of decentralised diagnostic models across regional and remote areas, addressing healthcare disparities and streamlining access to genomic testing. The expanded diagnostic reach, enabled by technological integration and public health priorities, plays a direct role in Australia molecular diagnostics market growth as healthcare providers seek to improve clinical outcomes and optimize resource allocation.

Regulatory Support and Laboratory Infrastructure Modernization

Governmental backing for diagnostic innovations has emerged as a core enabler of market expansion. Regulatory bodies such as the Therapeutic Goods Administration (TGA) have established adaptive pathways for the expedited approval of molecular tests, particularly those relevant to pandemic response, cancer care, and pharmacogenomics. This regulatory clarity has encouraged manufacturers to introduce region-specific assays and establish local manufacturing or distribution agreements. Australia’s involvement in the Asia-Pacific Economic Cooperation (APEC) Regulatory Harmonization Steering Committee has also fostered alignment with global standards, ensuring that domestic laboratories can adopt cutting-edge molecular solutions without delay. At the same time, healthcare institutions are modernizing laboratory infrastructure to accommodate high-throughput molecular workflows. The shift toward automated sample preparation, digital data management, and multiplex testing has improved both accuracy and turnaround time. Investments in regional laboratory hubs, alongside national digitization programs for health data interoperability, have enhanced diagnostic scalability.

On November 26, 2024, QIAGEN announced the inclusion of its QIAcuityDx digital PCR system in the Australian Register of Therapeutic Goods (ARTG), expanding digital PCR into clinical diagnostics across Australia and New Zealand. The system enables absolute quantitation of low-abundance DNA/RNA targets, supporting applications in oncology (e.g., liquid biopsies, BCR::ABL testing) and infectious diseases, with processing speeds as fast as 2 hours and capacity for 4 nanoplates simultaneously. With over 2,000 global placements and cited in 450+ publications, QIAcuityDx integrates imaging, thermocycling, and analysis into a single instrument, and includes IVD and Utility modes, LIMS integration, and a validated audit-ready setup. Additionally, the proliferation of point-of-care molecular platforms has reduced the diagnostic burden on centralized labs, expanding service reach to underserved populations. Collectively, these developments are shaping Australia molecular diagnostics market trends through a combination of policy alignment, automation, and decentralized testing innovation.

Growth Drivers of Australia Molecular Diagnostics Market:

Increasing Burden of Chronic and Infectious Diseases

Australia is experiencing a constant increase in chronic conditions like cancer, cardiovascular diseases, and diabetes, as well as ongoing threats from infectious diseases. This increasing disease burden is demanding high-performance diagnostic solutions that can provide reliable, fast, and accurate results. In this regard, molecular diagnostics are particularly noteworthy as they allow for early and precise disease detection, enabling proper treatment planning and follow-up. Their capacity to detect specific genetic markers or disease-causing organisms assists clinicians in making targeted therapy for each patient, ultimately enhancing health outcomes. Furthermore, with healthcare systems being constrained to cut costs and enhance efficiency, the use of molecular diagnostics is becoming imperative in reducing misdiagnoses, maximizing the use of resources, and managing the nation's growing healthcare needs.

Advancements in Genomic Technologies

Technological progress in genomics is playing a pivotal role in expanding the Australia molecular diagnostics market demand. Advancements like next-generation sequencing (NGS), polymerase chain reaction (PCR) technology advancements, and sophisticated bioinformatics algorithms are making more advanced and accurate testing techniques possible. These technologies enable clinicians to screen for genetic mutations, identify biomarkers, and interpret disease mechanisms more profoundly. The ability to have faster, more precise, and more affordable diagnostic tools is expanding applications in the areas of oncology, infectious diseases, and rare genetic diseases. In addition, continuous advancements in automation and data integration are improving the efficiency and scalability of laboratory operations. These advances not only enhance patient care but also stimulate healthcare institutions and research organizations to embrace molecular diagnostics more for precision medicine programs.

Expanding Role in Preventive Healthcare

Preventive healthcare is gaining significant importance in Australia as part of efforts to reduce long-term disease burden and associated healthcare expenditures. Molecular diagnostics are becoming integral to this approach by supporting early detection, risk assessment, and timely intervention. By identifying genetic predispositions and disease markers before symptoms appear, these diagnostics empower individuals and healthcare providers to take proactive measures in managing health risks. Their integration into routine health screenings enables the early diagnosis of conditions like cancer or hereditary disorders, allowing for better treatment outcomes. Furthermore, molecular diagnostics strengthen population health management by reducing hospitalizations, lowering treatment costs, and promoting healthier lifestyles. This proactive application is positioning molecular diagnostics as a cornerstone of modern preventive healthcare strategies in the country.

Government Support for Australia Molecular Diagnostics Market:

National Health Prioritization

The Australian government has placed strong emphasis on strengthening national health outcomes, with particular focus on early detection and effective disease management. Investments in advanced diagnostic tools, including molecular diagnostics, are central to these efforts. These technologies support public policy objectives by enabling accurate diagnosis, personalized treatment planning, and ongoing disease monitoring across both urban and rural populations. The government’s prioritization ensures that molecular diagnostics are increasingly integrated into mainstream healthcare delivery, aligning with national strategies for improved patient outcomes. By encouraging their adoption in hospitals, laboratories, and community health services, authorities are ensuring that citizens benefit from faster, more reliable, and cost-effective medical solutions, ultimately driving the advancement of Australia’s healthcare infrastructure.

Support for Local Research and Innovation

Australia’s government has demonstrated a strong commitment to fostering domestic innovation within molecular diagnostics through substantial funding programs and targeted support initiatives. Research institutions, biotech firms, and healthcare providers benefit from grants and collaborative frameworks designed to advance new diagnostic technologies. According to the Australia molecular diagnostics market analysis, this emphasis on public–private partnerships strengthen the nation’s biomedical research ecosystem and accelerates the commercialization of locally developed solutions. By encouraging innovation at home, the government ensures that molecular diagnostics become more accessible and cost-efficient, addressing local healthcare needs effectively. Furthermore, this approach promotes knowledge sharing, enhances global competitiveness, and contributes to the growth of a sustainable life sciences industry in Australia, making the country a hub for diagnostic advancements and cutting-edge healthcare innovation.

Integration into Public Health Programs

The Australian government has actively embedded molecular diagnostics into public health programs as part of its strategy to strengthen disease prevention and control. These tools are widely used in infectious disease surveillance, cancer screening, and population health monitoring initiatives, ensuring timely detection and intervention. By incorporating advanced diagnostics into national programs, the government is expanding access to underserved regions and promoting equitable healthcare delivery. This integration also helps authorities manage public health risks more effectively, particularly in responding to outbreaks and reducing long-term treatment costs. Through these initiatives, molecular diagnostics are positioned not just as specialized technologies but as essential components of large-scale health strategies, ultimately improving the overall quality and reach of Australia’s healthcare system.

Australia Molecular Diagnostics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, technology, application, and end user.

Product Insights:

- Reagents and Kits

- Instruments

- Software and Services

The report has provided a detailed breakup and analysis of the market based on the product. This includes reagents and kits, instruments, and software and services.

Technology Insights:

- Polymerase Chain Reactions (PCR)

- Hybridization

- DNA Sequencing

- Microarray

- Isothermal Nucleic Acid Amplification Technology (INAAT)

- Others

The report has provided a detailed breakup and analysis of the market based on the technology. This includes polymerase chain reactions (PCR), hybridization, DNA sequencing, microarray, isothermal nucleic acid amplification technology (INAAT), and others.

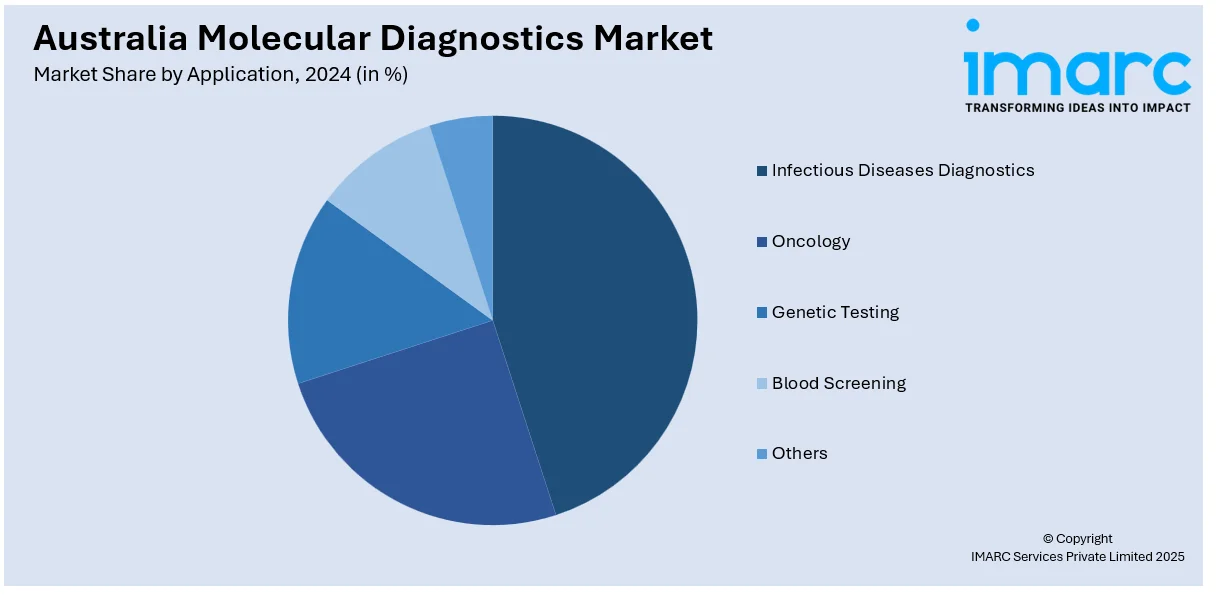

Application Insights:

- Infectious Diseases Diagnostics

- Oncology

- Genetic Testing

- Blood Screening

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes infectious diseases diagnostics, oncology, genetic testing, blood screening, and others.

End User Insights:

- Hospitals

- Laboratories

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes hospitals, laboratories, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has provided a comprehensive analysis of all major regional markets, including demand trends by component, deployment mode, enterprise size, application, and end user. This includes Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Abbott Laboratories

- AusDiagnostics

- Bio-Rad Laboratories, Inc

- Genetic Signatures Ltd.

- Hologic, Inc.

- MOL Diagnostics

- Promega Corporation

- SpeeDx Pty Ltd

Australia Molecular Diagnostics Market News:

- On June 1, 2024, Abacus dx announced a commercial partnership with Roche to distribute its Life Science product portfolio in Australia, including advanced molecular diagnostics and tissue diagnostics technologies. The agreement covers key systems such as the LightCycler® 96, LightCycler® 480 II, MagNA Pure 24, MagNA Pure 96, and the Ventana Discovery Ultra, along with a suite of sequencing reagents. This collaboration enhances access to Roche’s molecular and tissue diagnostics solutions for Australian research institutes, academic laboratories, and biotech firms.

Australia Molecular Diagnostics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Reagents and Kits, Instruments, Software and Services |

| Technologies Covered | Polymerase Chain Reactions (PCR), Hybridization, DNA Sequencing, Microarray, Isothermal Nucleic Acid Amplification Technology (INAAT), Others |

| Applications Covered | Infectious Diseases Diagnostics, Oncology, Genetic Testing, Blood Screening, Others |

| End Users Covered | Hospitals, Laboratories, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Abbott Laboratories, AusDiagnostics, Bio-Rad Laboratories, Inc, Genetic Signatures Ltd., Hologic, Inc., MOL Diagnostics, Promega Corporation, SpeeDx Pty Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia molecular diagnostics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia molecular diagnostics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia molecular diagnostics market industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The molecular diagnostics market in Australia was valued at USD 585.20 Million in 2024.

The Australia molecular diagnostics market is projected to exhibit a CAGR of 6.90% during 2025-2033.

The Australia molecular diagnostics market is projected to reach a value of USD 1,140.46 Million by 2033.

The Australia molecular diagnostics market is witnessing trends such as growing adoption of point-of-care testing, increasing use of next-generation sequencing for precision medicine, and integration of AI-driven analytics. Rising focus on preventive healthcare and expanding applications in oncology, infectious disease detection, and genetic testing are further shaping market growth.

The growth of the Australia molecular diagnostics market is driven by rising chronic and infectious disease prevalence, advancements in genomic and sequencing technologies, and increasing focus on preventive healthcare. Expanding applications in oncology, genetic testing, and personalized medicine further enhance adoption across healthcare systems.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)