Australia Motor Repair and Maintenance Market Size, Share, Trends and Forecast by Type, Service, End User Industry, and Region, 2025-2033

Australia Motor Repair and Maintenance Market Overview:

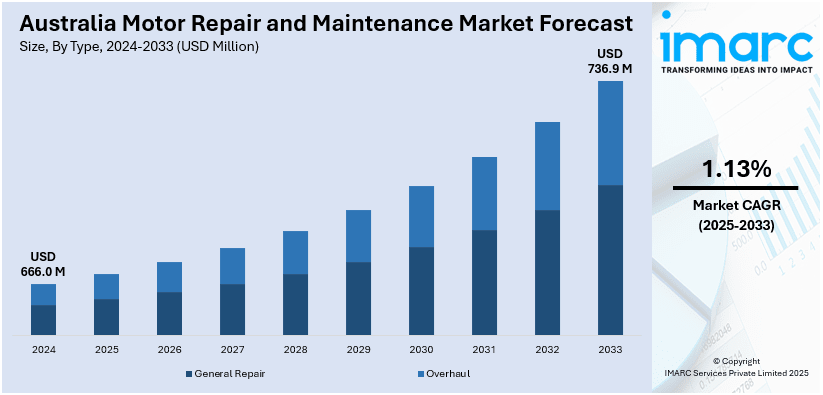

The Australia motor repair and maintenance market size reached USD 666.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 736.9 Million by 2033, exhibiting a growth rate (CAGR) of 1.13% during 2025-2033. The market is witnessing significant growth, driven by the shift toward electric vehicles and its impact on maintenance services and integration of advanced diagnostics and maintenance technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 666.0 Million |

| Market Forecast in 2033 | USD 736.9 Million |

| Market Growth Rate 2025-2033 | 1.13% |

Australia Motor Repair and Maintenance Market Trends:

Shift Towards Electric Vehicles (EVs) and Its Impact on Maintenance Services

The Australian automotive landscape is undergoing a significant transformation with the increasing adoption of Electric Vehicles (EVs). This shift is driven by environmental concerns, government incentives, and advancements in EV technology. For instance, in March 2025, BYD has surpassed 40,000 deliveries in Australia, marking a milestone two-and-a-half years after launching under its independent distributor with the Atto 3 electric SUV. Increased EV penetration has posed challenges and afforded opportunities for motor repair and maintenance service providers. Unlike ICE vehicles, which require a different methodology for maintenance, EVs comprise unique components such as high-voltage battery packs and electric drivetrains, necessitating special technician training and investment in the requisite diagnostic tools that can service specific EV systems. This has led repair shops to train their employees and acquire equipment to respond to the changing needs of EV owners. Moreover, the developing EV market impacts demand for aftermarket products and services. Consumers increasingly look for modifications that enhance vehicle performance and sustainability: advanced battery management systems and regenerative braking systems. Repair and maintenance providers are meeting these services with technology-oriented services, thereby diversifying their offerings and satisfying the changing demands of the green consumer.

To get more information on this market, Request Sample

Integration of Advanced Diagnostics and Maintenance Technologies

The Australian motor repair and maintenance industry is embracing technological advancements to enhance service efficiency and accuracy. The integration of digital diagnostic tools and data analytics is revolutionizing traditional repair processes. These technologies enable technicians to swiftly identify issues, reduce diagnostic time, and minimize the likelihood of errors. Workshops adopting such tools are experiencing improved operational workflows and increased customer satisfaction due to faster turnaround times and reliable repairs. Furthermore, the adoption of predictive maintenance strategies, facilitated by the Internet of Things (IoT) sensors and machine learning algorithms, is gaining momentum. For instance, in April 2024, Workshop Mate highlighted AI as a key trend in workshop management, enhancing efficiency, resource allocation, and productivity while reducing costs and improving service quality through streamlined processes. This approach allows for the monitoring of vehicle health in real time, enabling proactive identification of potential issues before they result in significant failures. For consumers, this translates to reduced unexpected breakdowns and optimized vehicle performance. For service providers, it offers opportunities to develop new business models centered around subscription-based monitoring services and data-driven insights. The emphasis on advanced diagnostics and predictive maintenance aligns with the broader industry trend toward sustainability and efficiency. By leveraging these technologies, repair shops can contribute to environmental goals through optimized resource utilization and reduced waste. Additionally, consumers benefit from enhanced vehicle longevity and reliability, reinforcing the value proposition of technologically advanced maintenance services.

Australia Motor Repair and Maintenance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, service, and end user industry.

Type Insights:

- General Repair

- Bearing

- Stator

- Rotor

- Others

- Overhaul

The report has provided a detailed breakup and analysis of the market based on the type. This includes General Repair (Bearing, Stator, Rotor, Others) and Overhaul.

Service Insights:

- On-site Service

- Off-site Service

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes On-site Service and Off-site Service.

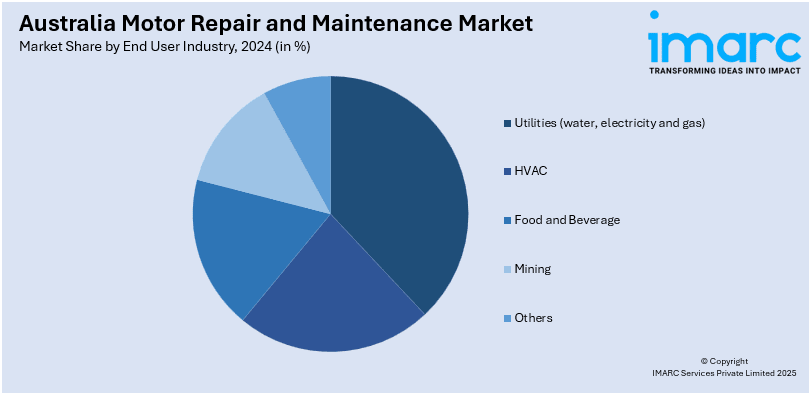

End User Industry Insights:

- Utilities (water, electricity and gas)

- HVAC

- Food and Beverage

- Mining

- Others

A detailed breakup and analysis of the market based on the end user industry have also been provided in the report. This includes Utilities (water, electricity and gas), HVAC, Food and Beverage, Mining, and Others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Motor Repair and Maintenance Market News:

- In February 2024, Suncorp Group partnered with the Australian Collision Industry Alliance (ACIA) through a two-year sponsorship to address workforce shortages and an ageing demographic in the motor repair industry. This marks Suncorp as the first insurer to support ACIA since its launch.

Australia Motor Repair and Maintenance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Services Covered | On-site Service, Off-site Service |

| End User Industries Covered | Utilities (water, electricity and gas), HVAC, Food and Beverage, Mining, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia motor repair and maintenance market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia motor repair and maintenance market on the basis of type?

- What is the breakup of the Australia motor repair and maintenance market on the basis of service?

- What is the breakup of the Australia motor repair and maintenance market on the basis of end user industry?

- What is the breakup of the Australia motor repair and maintenance market on the basis of region?

- What are the various stages in the value chain of the Australia motor repair and maintenance market?

- What are the key driving factors and challenges in the Australia motor repair and maintenance?

- What is the structure of the Australia motor repair and maintenance market and who are the key players?

- What is the degree of competition in the Australia motor repair and maintenance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia motor repair and maintenance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia motor repair and maintenance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia motor repair and maintenance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)