Australia Natural Gas Market Size, Share, Trends and Forecast by Type and Region, 2026-2034

Australia Natural Gas Market Summary:

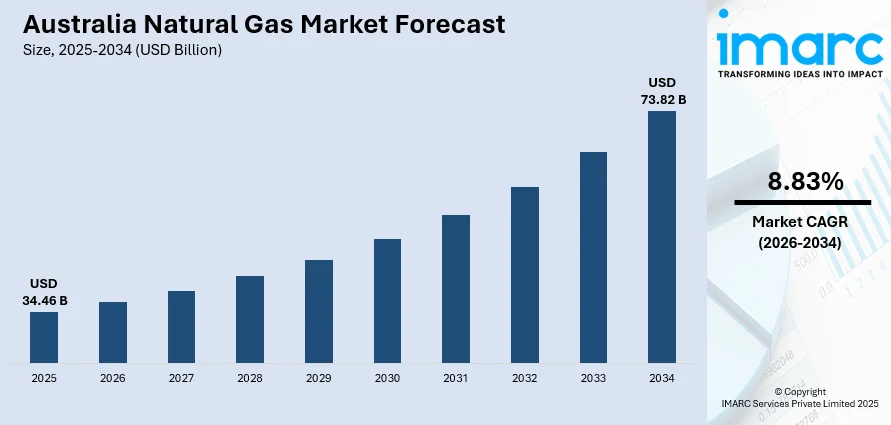

The Australia natural gas market size reached USD 34.46 Billion in 2025 and is projected to reach USD 73.82 Billion by 2034, growing at a compound annual growth rate of 8.83% from 2026-2034.

The Australia natural gas market is experiencing robust momentum driven by expanding domestic energy requirements and strategic export partnerships with Asia-Pacific economies. The country's position as a leading global LNG supplier continues to strengthen as nations across the region accelerate their transition from coal to cleaner fuel alternatives. Rising industrial consumption, infrastructure modernization, and government-led energy security initiatives are reshaping the supply landscape, while technological advancements in extraction and processing enhance operational efficiencies, collectively supporting the Australia natural gas market share.

Key Takeaways and Insights:

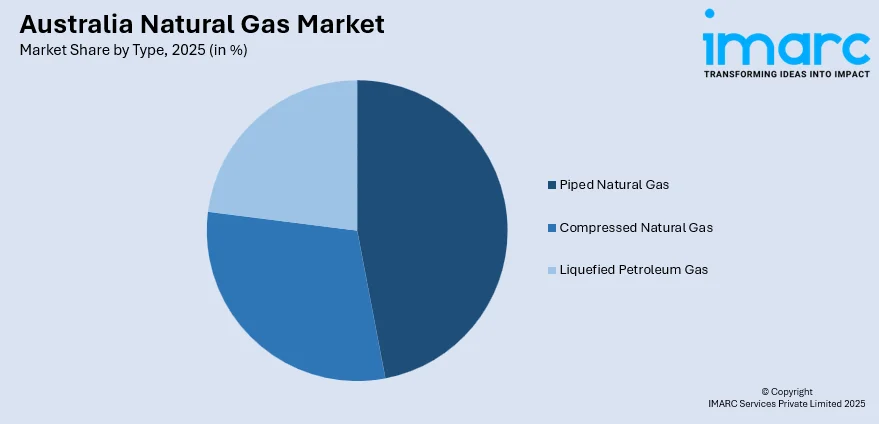

- By Type: Piped natural gas dominates the market with a share of 47% in 2025, driven by extensive pipeline infrastructure connecting major production basins to industrial centers and urban distribution networks across the country.

- Key Players: The Australia natural gas market is characterized by a consolidated competitive landscape where established energy corporations leverage integrated operations spanning exploration, production, processing, and distribution to maintain market leadership and secure long-term supply agreements with domestic and international buyers.

To get more information on this market Request Sample

The Australia natural gas market is advancing as government policies prioritize energy security while supporting the broader transition toward sustainable fuel sources. The market benefits from the country's strategic proximity to high-demand Asian markets, enabling efficient LNG transportation and fostering long-term trade partnerships. Domestic consumption continues to grow across power generation, manufacturing, and residential sectors, underpinned by reliable pipeline networks and expanding storage capabilities. In August 2024, Arrow Energy, a joint venture between Shell and PetroChina, approved the Phase 2 expansion of its Surat Gas Project in Queensland, adding up to 450 new wells and infrastructure upgrades expected to produce 22,400 BOE/D to supply both domestic and export markets. This investment reflects ongoing confidence in Australia's gas sector and its capacity to meet evolving regional energy demands.

Australia Natural Gas Market Trends:

Rising Demand for Cleaner Transitional Fuels

Australia's natural gas sector is benefiting from increasing recognition of natural gas as a cleaner bridge fuel during the broader energy transition. Industries and utilities are progressively substituting coal with gas-fired generation to reduce carbon emissions while maintaining reliable baseload power. This shift is particularly evident in manufacturing, chemicals, and fertilizer production, where consistent heat supply requirements favor natural gas adoption, positioning the fuel as essential to the Australia natural gas market growth. For instance, in December 2025, amid an impending natural gas shortfall on Australia’s east coast, Eastern Gas Corporation, a subsidiary of Pure One, is initiating a $5.5 million initial public offering to fund exploration activities across its promising portfolio of gas assets in Queensland.

Expansion of LNG Infrastructure and Export Capacity

Major infrastructure developments are enhancing Australia's liquefied natural gas export capabilities and reinforcing its global energy standing. Large-scale facilities across Western Australia and Queensland are undergoing capacity expansions through new drilling programs, pipeline construction, and processing upgrades. These investments strengthen supply chains connecting offshore fields to export terminals, ensuring consistent delivery to international buyers seeking reliable, long-term energy partnerships with established suppliers. For instance, in November 2025, US-based independent energy company ConocoPhillips commenced drilling its initial exploration well as part of a broader campaign to locate natural gas offshore in eastern Australia, according to its junior partner, 3D Energi. Operations on the Essington-1 well started over the weekend and are expected to reach a depth of 2,650 meters (8,694 feet) over a 32-day drilling period, 3D Energi reported in an ASX filing.

Integration of Digital Technologies in Gas Operations

Technological innovation is transforming gas exploration, extraction, and processing across Australian operations. Advanced directional drilling techniques, digital reservoir modeling, and artificial intelligence-driven monitoring systems are improving exploration accuracy, reducing operational waste, and enhancing safety protocols. These technological advancements enable access to previously uneconomical reserves while lowering production costs, strengthening the competitive positioning of Australian gas producers in global markets.

Market Outlook 2026-2034:

The Australia natural gas market is positioned for sustained expansion as domestic consumption requirements and international export demand continue strengthening. Government initiatives focused on energy security are encouraging infrastructure investments across pipeline networks, storage facilities, and processing plants. The market outlook remains favorable as Asian economies maintain their reliance on Australian LNG supplies while transitioning toward cleaner energy portfolios. The market generated a revenue of USD 34.46 Billion in 2025 and is projected to reach a revenue of USD 73.82 Billion by 2034, growing at a compound annual growth rate of 8.83% from 2026-2034.

Australia Natural Gas Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Piped Natural Gas | 47% |

Type Insights:

Access the comprehensive market breakdown Request Sample

- Compressed Natural Gas

- Piped Natural Gas

- Liquefied Petroleum Gas

Piped natural gas dominates the market with a share of 47% of the total Australia natural gas market in 2025.

Piped natural gas maintains its leadership position through extensive transmission and distribution networks connecting major production basins to industrial centers, commercial establishments, and residential areas. The well-established pipeline infrastructure across eastern and western corridors enables efficient fuel delivery to power generation facilities, manufacturing plants, and urban consumption centers. Continuous investment in pipeline expansion, interconnectors, and network modernization reinforces supply reliability while supporting growing demand from diverse end-user segments.

The segment is supported by strong economic advantages over other delivery options, providing a more affordable way to transport fuel across long distances without the need for liquefaction. Industrial users prefer pipeline supply because it ensures steady, reliable delivery essential for continuous operations. Recent project approvals in Western Australia also reinforce long-term supply by expanding connections between offshore fields and existing infrastructure.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

In Australia Capital Territory and New South Wales, natural gas demand is driven by urban population growth, industrial activity, and increasing electricity generation requirements. Gas is critical for balancing renewable energy intermittency and supporting low-emission transition goals. Infrastructure expansion, including pipeline upgrades and interconnections, along with policy incentives for cleaner energy sources, further stimulates adoption in both residential and commercial sectors.

Victoria and Tasmania’s gas market growth is propelled by industrial usage, particularly in manufacturing and processing sectors, and by residential heating and cooking demand. Transition strategies to low-carbon energy encourage gas as a reliable backup to renewables. Investments in pipeline networks, LNG imports, and inter-state connectivity enhance supply security. Policy support for energy reliability and decarbonization also underpins the sector’s steady expansion.

Queensland’s natural gas market is supported by rich coal seam gas reserves and expanding LNG export infrastructure. Domestic consumption is rising across power generation, industrial, and residential segments. Gas-fired power plants help stabilize the grid amid growing renewable penetration. Continuous exploration, upstream investments, and state-level incentives to develop clean energy projects drive regional market growth. Queensland also benefits from proximity to export markets in Asia.

Northern Territory and Southern Australia see growing natural gas demand from electricity generation, mining, and industrial sectors. Gas is crucial for energy security and supporting renewable integration. Offshore and onshore exploration projects, combined with infrastructure investments, enhance supply reliability. Government policies promoting clean energy transition and support for LNG exports further stimulate market activity, while regional initiatives encourage gas use in remote and industrial applications.

Western Australia’s gas market is driven by abundant offshore reserves, significant LNG export facilities, and strong domestic consumption in power generation and industry. Large-scale projects like Gorgon and Wheatstone support both domestic and international demand. Infrastructure development, pipeline expansions, and ongoing exploration contribute to market growth. The region also leverages gas as a transitional energy source, supporting renewable integration and reducing overall carbon intensity in energy supply.

Market Dynamics:

Growth Drivers:

Why is the Australia Natural Gas Market Growing?

Strategic Export Partnerships with Asia-Pacific Economies

Australia's geographic proximity and abundant reserves position it as a preferred natural gas supplier for major Asian importing nations. Countries including Japan, China, and South Korea are accelerating their transition away from coal, driving substantial increases in LNG import volumes. Long-term supply agreements with these buyers provide revenue stability and justify continued infrastructure investments across production, processing, and export facilities. Established port infrastructure, reliable shipping routes, and consistent supply chain performance give Australia competitive advantages over emerging suppliers. The North West Shelf facility, a cornerstone of Australia's LNG export sector, has delivered over 6,000 shipments since operations commenced, processing sufficient volumes to satisfy the annual LNG requirements of mid-sized importing nations.

Government Policies Supporting Energy Security

Federal and state governments are implementing policies that prioritize domestic energy security while positioning natural gas as a critical transitional fuel. Initiatives supporting new gas basin development, domestic reservation schemes, and infrastructure investment incentives encourage private sector participation and project sanctioning. The Gas Market Code introduced regulatory frameworks promoting supply transparency and fair pricing mechanisms. These coordinated policy measures stimulate exploration activity, production capacity expansion, and distribution network modernization. Strategic government support provides investment certainty essential for developing capital-intensive gas projects that require extended planning and construction timelines before generating returns.

Technological Advancements Enhancing Production Efficiency

Innovation across exploration, extraction, and processing technologies is driving operational improvements throughout Australia's natural gas value chain. Advanced seismic imaging, directional drilling techniques, and digital reservoir characterization enhance resource identification and recovery rates while minimizing environmental footprints. Automation systems, predictive maintenance capabilities, and real-time monitoring platforms improve operational safety and reduce downtime. These technological advances enable economically viable development of previously marginal reserves while lowering per-unit production costs. In March 2025, ExxonMobil and Woodside committed USD 221 million to offshore drilling projects in the Bass Strait, targeting the Turrum and North Turrum gas fields to address projected supply requirements through advanced extraction techniques.

Market Restraints:

What Challenges the Australia Natural Gas Market is Facing?

Intensifying Global Competition from Emerging Suppliers

Australia faces mounting competitive pressure from expanding LNG export capacity in the United States, Qatar, and emerging African producers. These competitors offer cost advantages through lower extraction expenses, newer infrastructure, and shorter shipping distances to key Asian markets. Flexible pricing models and accelerated project timelines attract buyers seeking diversified supply sources. Australian producers must continuously optimize operations and pricing strategies to maintain market position against lower-cost alternatives.

Regulatory Complexity and Extended Approval Timelines

Multi-layered regulatory requirements involving federal, state, and local authorities create extended approval processes for gas development projects. Environmental assessments, native title consultations, and permitting procedures can delay project timelines significantly, increasing development costs and uncertainty. Inconsistent regulatory frameworks across jurisdictions complicate planning and investment decisions, potentially deterring capital allocation toward Australian gas projects requiring lengthy approvals.

Underdeveloped Domestic Storage and Distribution Networks

Despite substantial export infrastructure, domestic gas storage and intrastate distribution networks remain inadequate for managing seasonal demand fluctuations. Limited underground storage capacity and insufficient pipeline interconnections create supply vulnerabilities during peak consumption periods. Fragmented infrastructure planning across states leads to bottlenecks affecting price stability and supply reliability, particularly in southern regions dependent on interstate gas transfers during winter months.

Competitive Landscape:

The Australia natural gas market exhibits a consolidated competitive structure with established energy corporations dominating production, processing, and distribution activities. Major players maintain integrated operations spanning exploration through export, leveraging economies of scale and established customer relationships. Companies are investing in operational efficiency improvements, infrastructure modernization, and carbon management technologies to enhance competitive positioning. Strategic partnerships and joint ventures enable sharing of development risks while accessing complementary capabilities and market channels. The competitive environment encourages continuous innovation in extraction technologies, processing efficiency, and environmental performance as producers seek differentiation in increasingly competitive global markets.

Recent Developments:

- December 2025: Chevron and its partners approved the USD 2 Billion Gorgon Stage 3 development offshore Western Australia, linking the Geryon and Eurytion gas fields to existing infrastructure on Barrow Island. The project involves drilling six wells across two fields as part of planned subsea tiebacks to maintain gas supply to existing LNG trains and domestic gas facilities.

Australia Natural Gas Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Compressed Natural Gas, Piped Natural Gas, Liquified Petroleum Gas |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia natural gas market size was valued at USD 34.46 Billion in 2025.

The Australia natural gas market is expected to grow at a compound annual growth rate of 8.83% from 2026-2034 to reach USD 73.82 Billion by 2034.

Piped natural gas held the largest revenue share of 47% in 2025, driven by extensive pipeline infrastructure enabling efficient distribution to industrial centers, power generation facilities, and urban consumption areas across eastern and western corridors.

Key factors driving the Australia natural gas market include strategic export partnerships with Asia-Pacific economies, government policies supporting energy security, technological advancements in extraction and processing, rising domestic industrial consumption, and infrastructure modernization initiatives.

Major challenges include intensifying competition from emerging global LNG suppliers, complex multi-jurisdictional regulatory requirements causing project delays, limited domestic storage and distribution infrastructure, seasonal supply-demand imbalances, and environmental compliance obligations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)