Australia Network as a Service Market Size, Share, Trends and Forecast by Type, Application, End Use Industry, and Region, 2025-2033

Australia Network as a Service Market Overview:

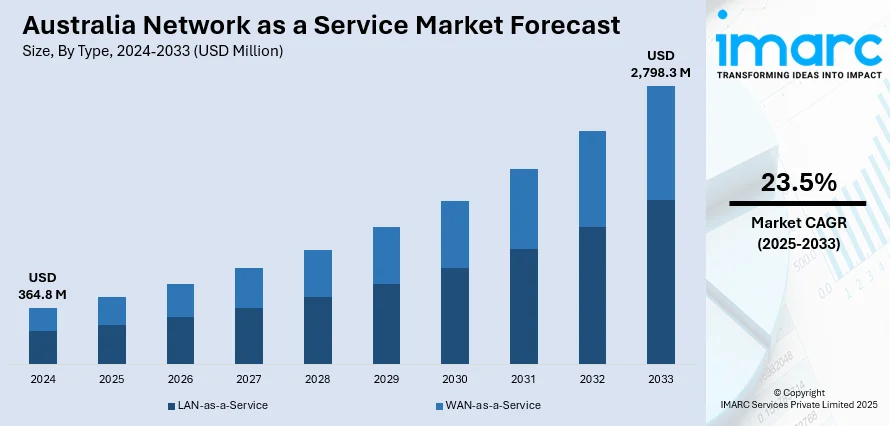

The Australia network as a service market size reached USD 364.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,798.3 Million by 2033, exhibiting a growth rate (CAGR) of 23.5% during 2025-2033. Growing multi-cloud environments, replacing outdated hardware, supporting remote workforces, deploying software-defined wide area network (SD-WAN) solutions, expanding Internet of Things (IoT) networks, strengthening cybersecurity, and accelerating fifth-generation (5G) rollout are factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 364.8 Million |

| Market Forecast in 2033 | USD 2,798.3 Million |

| Market Growth Rate 2025-2033 | 23.5% |

Australia Network as a Service Market Trends:

Growth in Hybrid and Multi-Cloud Strategies

The growing reliance on hybrid and multi-cloud architectures across enterprises is a key factor driving the Australia network as a service (NaaS) market growth. As organizations diversify their cloud investments, spanning public, private, and on-premises environments, they face increasing complexity in network management, data flow optimization, and security enforcement. Traditional static networks are often ill-suited to handle such dynamic and distributed infrastructures. NaaS addresses these gaps by offering programmable and cloud-integrated network services that adapt to evolving workloads and environments. It enables centralized visibility, policy-based routing, and seamless interconnectivity across multiple cloud platforms. With businesses seeking to avoid vendor lock-in while ensuring application performance and data sovereignty, NaaS offers a scalable and flexible approach to align network operations with diverse cloud strategies, which is creating a positive Australia network as a service (NaaS) market outlook.

To get more information on this market, Request Sample

Cost Savings from Replacing Legacy Infrastructure

Enterprises across Australia are shifting away from capital-intensive network models in favor of cost-efficient, subscription-based alternatives. NaaS enables organizations to retire outdated hardware and avoid the high upfront investments associated with traditional network deployments. This shift from capital expenditures (CapEx) to operating expenditures (OpEx) is particularly appealing in a period where IT budgets are under scrutiny and scalability is critical. NaaS allows companies to align network expenditure with usage patterns, scale on demand, and reduce maintenance costs associated with legacy infrastructure. It also minimizes the need for in-house expertise to manage complex network environments, as providers typically offer full lifecycle support, including monitoring, upgrades, and security. By eliminating the long refresh cycles and hidden costs tied to hardware ownership, NaaS delivers financial flexibility, which is another factor boosting the Australia network as a service (NaaS) market share.

Surge in Remote and Mobile Workforce

The increasing normalization of remote and hybrid work models in Australia has highlighted the limitations of traditional network setups and accelerated demand for agile, cloud-centric connectivity solutions. NaaS offers businesses the ability to provide secure, reliable, and scalable network access to employees regardless of their location. This model ensures consistent performance through software-defined traffic management, zero-trust access protocols, and real-time network monitoring. As workforce mobility increases, organizations are prioritizing the user experience, data security, and system availability. NaaS enables dynamic bandwidth allocation and endpoint management tailored to remote operations, which is critical for maintaining productivity across geographically dispersed teams. It also simplifies the onboarding of new users and devices, reduces dependency on VPNs, and allows IT departments to manage and troubleshoot networks remotely. With more enterprises embracing flexible work as a permanent feature, NaaS is becoming an essential enabler of secure and resilient network infrastructure.

Australia Network as a Service Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, application, and end use industry.

Type Insights:

- LAN-as-a-Service

- WAN-as-a-Service

The report has provided a detailed breakup and analysis of the market based on the type. This includes LAN-as-a-Service and WAN-as-a-Service.

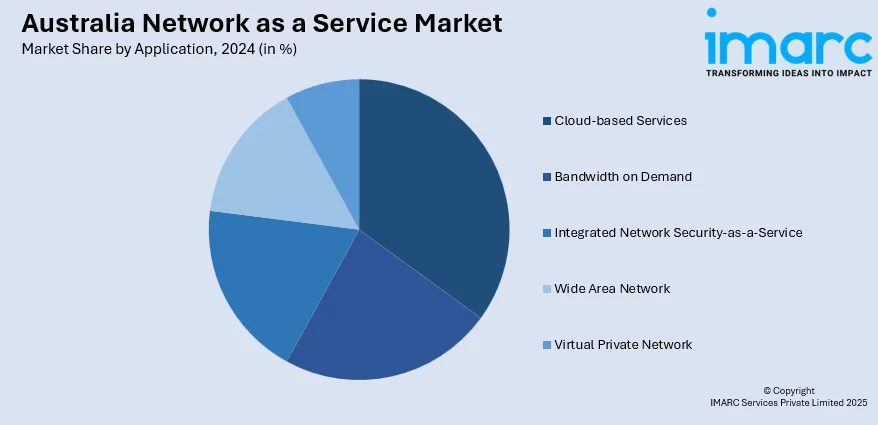

Application Insights:

- Cloud-based Services

- Bandwidth on Demand

- Integrated Network Security-as-a-Service

- Wide Area Network

- Virtual Private Network

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes cloud-based services, bandwidth on demand, integrated network security-as-a-service, wide area network, and virtual private network.

End Use Industry Insights:

- Healthcare

- BFSI

- Retail and E-Commerce

- IT and Telecom

- Manufacturing

- Transportation and Logistics

- Public Sector

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes healthcare, BFSI, retail and e-commerce, IT and telecom, manufacturing, transportation and logistics, and public sector.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Network as a Service Market News:

- In 2024, Vocus announced the acquisition of TPG Telecom's fibre network assets for USD 5.25 billion. This acquisition positions Vocus as a major player in Australia's fibre infrastructure, enhancing its NaaS capabilities.

Australia Network as a Service Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | LAN-as-a-Service, WAN-as-a-Service |

| Applications Covered | Cloud-based Services, Bandwidth on Demand, Integrated Network Security-as-a-Service, Wide Area Network, Virtual Private Network |

| End Use Industries Covered | Healthcare, BFSI, Retail and E-Commerce, IT and Telecom, Manufacturing, Transportation and Logistics, Public Sector |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia network as a service market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia network as a service market on the basis of type?

- What is the breakup of the Australia network as a service market on the basis of application?

- What is the breakup of the Australia network as a service market on the basis of end use industry?

- What is the breakup of the Australia network as a service market on the basis of region?

- What are the various stages in the value chain of the Australia network as a service market?

- What are the key driving factors and challenges in the Australia network as a service?

- What is the structure of the Australia network as a service market and who are the key players?

- What is the degree of competition in the Australia network as a service market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia network as a service market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia network as a service market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia network as a service industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)