Australia Network Automation Market Size, Share, Trends and Forecast by Component, Deployment Mode, Organization Size, Network Type, End Use Industry, and Region, 2025-2033

Australia Network Automation Market Overview:

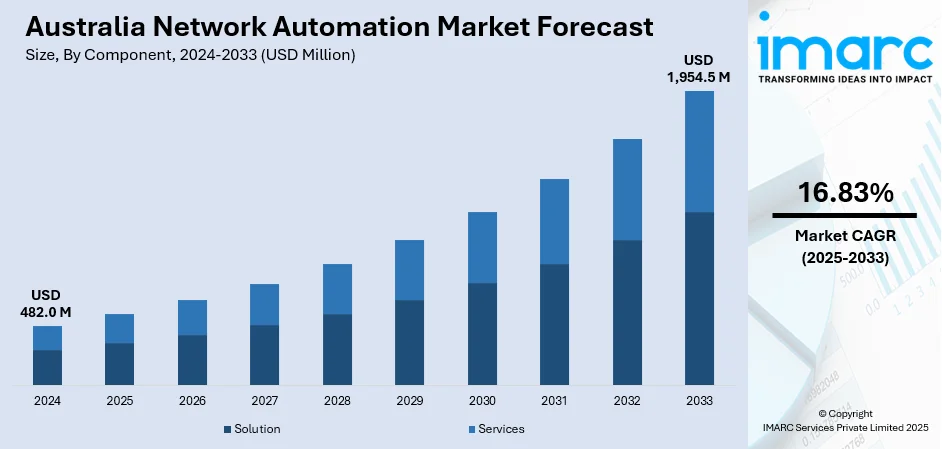

The Australia network automation market size reached USD 482.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,954.5 Million by 2033, exhibiting a growth rate (CAGR) of 16.83% during 2025-2033. Telecommunications modernization, SDN and NFV deployment, multi-cloud integration, programmable infrastructure, 5G service orchestration, sustainable network operations, dynamic power management, edge node configuration, zero-touch provisioning, real-time policy enforcement, AI-based threat analytics, cross-industry collaboration, compliance with SOCI and ISO standards, digital healthcare networks, campus-wide automation, and scalable government infrastructure are some of the factors positively impacting the Australia network automation market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 482.0 Million |

| Market Forecast in 2033 | USD 1,954.5 Million |

| Market Growth Rate 2025-2033 | 16.83% |

Australia Network Automation Market Trends:

Nationwide Network Modernization and Carrier Innovation

Australia’s telecommunications and enterprise sectors are undergoing widespread network modernization as digital demand accelerates across both metro and regional areas. Network automation is a critical enabler in this transformation, allowing carriers and businesses to implement scalable, self-managing infrastructure that ensures high service availability and performance consistency. Traditional manual network management processes are giving way to dynamic, programmable systems capable of adapting to complex operational environments and fluctuating traffic volumes. A core indicator of this movement is the Australia network automation market forecast, which reflects the deployment of software-defined technologies including SDN (Software-Defined Networking), NFV (Network Functions Virtualization), and programmable WANs. These solutions are being used to unify multi-cloud environments, minimize operational disruptions, and improve the agility of digital services. Telecommunications providers are also turning to network automation to optimize 5G deployment strategies, enabling faster provisioning, fault isolation, and service orchestration across distributed edge nodes. On February 12, 2025, XENON Systems, a high-performance computing specialist in Australia, partnered with Netris, a U.S.-based network automation firm, to deliver multi-tenant GPU cloud networking solutions tailored for AI/ML infrastructure. The collaboration leverages Netris’s software, optimized for NVIDIA Spectrum-X, to provide dynamic, cloud-like network automation across complex GPU clusters. Australia’s drive toward green and sustainable IT operations is also reinforcing automation. Intelligent network systems are being leveraged to dynamically manage power consumption, deactivate unused network paths, and support carbon reduction initiatives. These innovations are significantly contributing to Australia network automation market growth, especially within energy, public services, and education sectors looking to align digital modernization with environmental sustainability targets.

To get more information on this market, Request Sample

Security Prioritization, Compliance, and Industry Convergence

The rise in cyber threats, data privacy concerns, and regulatory mandates is a major factor accelerating network automation adoption in Australia. Organizations are seeking solutions that can enforce consistent policy controls, automate threat detection, and maintain compliance with frameworks such as the Security of Critical Infrastructure (SOCI) Act and ISO 27001. Automated networks enable faster reaction times, reduce the potential for misconfiguration, and support secure access enforcement in dynamic environments. In line with these dynamics, the Australia network automation market outlook highlights increased investments in zero-touch provisioning, intent-based networking, and AI-powered threat analytics. These capabilities allow both enterprises and service providers to reduce manual intervention while maintaining full visibility across all layers of the network. Healthcare, defense, and banking sectors in particular are prioritizing automation to meet stringent security and uptime standards. There is also a clear trend of cross-industry collaboration involving telecoms, software vendors, and infrastructure providers to develop tailored automation frameworks that address sector-specific challenges. On April 14, 2025, Nokia announced it has been selected by Australian cloud provider ResetData to deliver a high-speed networking backbone using its FP5-based 7750 Service Routers, enabling low-latency, lossless interconnectivity between ResetData’s sovereign AI Factory data centers across Australia. These AI data centers, up to 10x more efficient than traditional models, will feature immersion cooling and are expected to reduce emissions by 45%, with Nokia’s solution cutting energy use by 75% compared to previous routing platforms.

Australia Network Automation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, deployment mode, organization size, network type, and end use industry.

Component Insights:

- Solution

- Network Automation Tools

- SD-WAN and Network

- Virtualization

- Internet-Based Networking

- Services

- Professional Service

- Managed Service

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution (network automation tools, SD-WAN and network, virtualization, and internet-based networking) and services (professional service and managed service).

Deployment Mode Insights:

- On-premises

- Cloud-based

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based.

Organization Size Insights:

- Large Enterprises

- Small and Medium-size Enterprises

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes large enterprises and small and medium-size enterprises.

Network Type Insights:

- Physical

- Virtual

- Hybrid

The report has provided a detailed breakup and analysis of the market based on the network type. This includes physical, virtual, and hybrid.

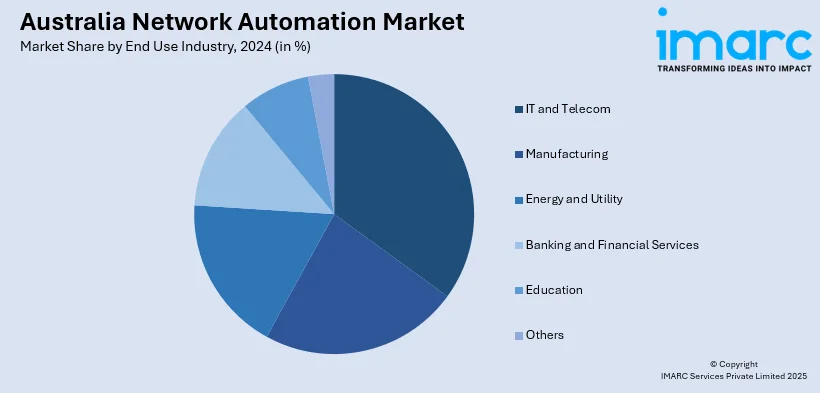

End Use Industry Insights:

- IT and Telecom

- Manufacturing

- Energy and Utility

- Banking and Financial Services

- Education

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes IT and telecom, manufacturing, energy and utility, banking and financial services, education, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Network Automation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Deployment Modes Covered | On-premises, Cloud-based |

| Organization Sizes Covered | Large Enterprises, Small and Medium-size Enterprises |

| Network Types Covered | Physical, Virtual, Hybrid |

| End Use Industries Covered | IT and Telecom, Manufacturing, Energy and Utility, Banking and Financial Services, Education, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia network automation market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia network automation market on the basis of component?

- What is the breakup of the Australia network automation market on the basis of deployment mode?

- What is the breakup of the Australia network automation market on the basis of organization size?

- What is the breakup of the Australia network automation market on the basis of network type?

- What is the breakup of the Australia network automation market on the basis of end use industry?

- What is the breakup of the Australia network automation market on the basis of region?

- What are the various stages in the value chain of the Australia network automation market?

- What are the key driving factors and challenges in the Australia network automation?

- What is the structure of the Australia network automation market and who are the key players?

- What is the degree of competition in the Australia network automation market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia network automation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia network automation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia network automation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)