Australia Non-Alcoholic Beverages Market Size, Share, Trends and Forecast by Product Type, Packaging Type, Distribution Channel, and Region, 2026-2034

Australia Non-Alcoholic Beverages Market Summary:

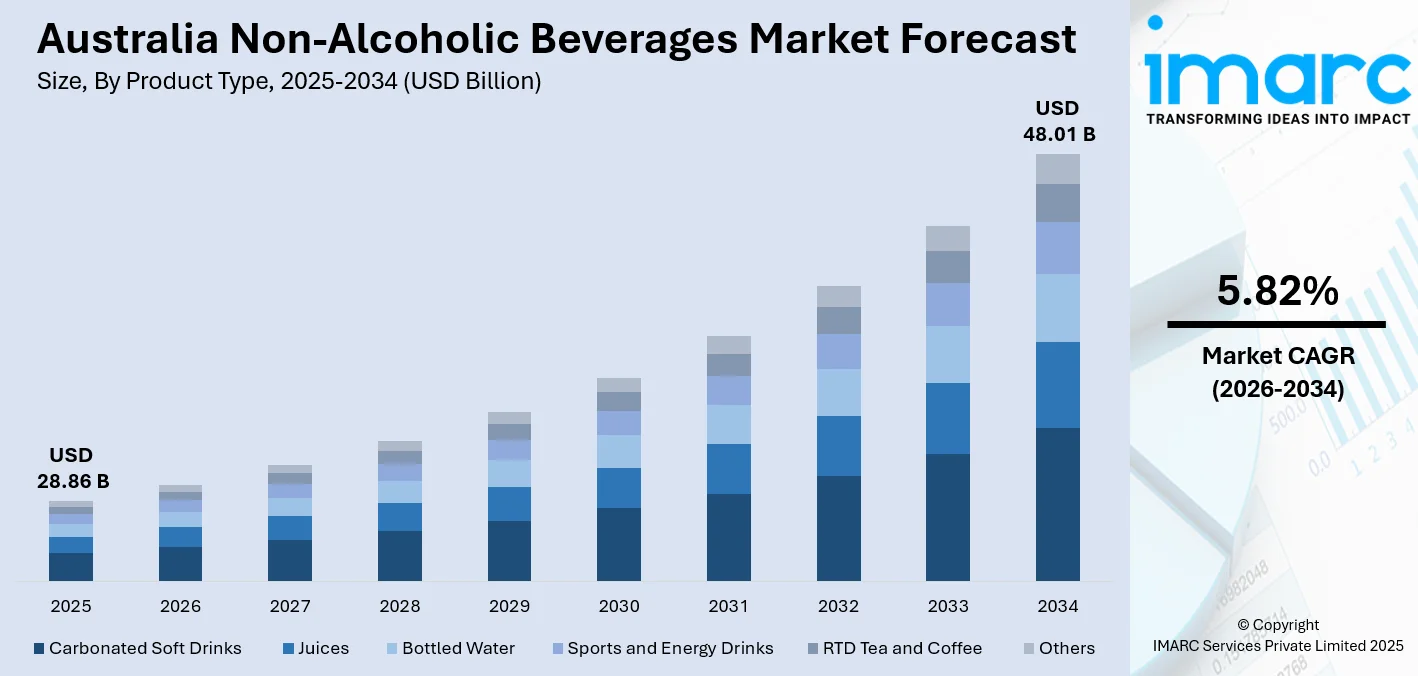

The Australia non-alcoholic beverages market size was valued at USD 28.86 Billion in 2025 and is projected to reach USD 48.01 Billion by 2034, growing at a compound annual growth rate of 5.82% from 2026-2034.

The market is driven by increasing health consciousness among consumers, rising demand for low-sugar and functional beverages, and growing preference for plant-based alternatives. The shift towards wellness-focused lifestyles, combined with innovations in product offerings such as flavored water, kombucha, and energy drinks, continues to propel market expansion. Sustainable packaging initiatives and premiumization trends further strengthen the Australia non-alcoholic beverages market share.

Key Takeaways and Insights:

-

By Product Type: Carbonated soft drinks dominate the market with a share of 32% in 2025, driven by strong brand equity, extensive distribution reach, and ongoing innovation in low-sugar, zero-calorie offerings for health-conscious consumers nationwide.

-

By Packaging Type: Bottles lead the market with a share of 49% in 2025, owing to consumer preference for convenient, resealable formats providing portability, durability, and improved product freshness across multiple everyday consumption occasions nationwide.

-

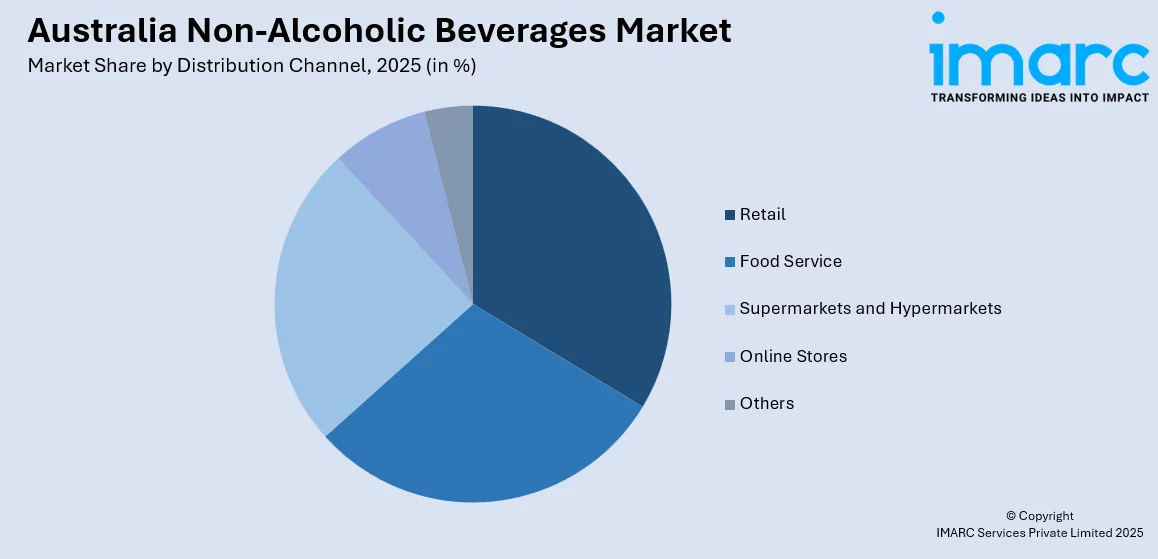

By Distribution Channel: Retail represents the largest segment with a market share of 34% in 2025, driven by wide product availability, competitive pricing, promotional visibility, and convenient one-stop purchasing across supermarkets, hypermarkets, and neighbourhood convenience stores nationwide networks.

-

By Region: Australia Capital Territory & New South Wales leads the market with a share of 31% in 2025, owing to dense urban populations, higher disposable incomes, developed retail infrastructure, and tourism-driven demand for non-alcoholic beverages consumption.

-

Key Players: The Australia non-alcoholic beverages market exhibits a moderately consolidated competitive structure, with multinational beverage corporations competing alongside domestic manufacturers and emerging craft beverage producers across diverse product segments and price points. Some of the key players operating in the market include Altina Drinks, Asahi Beverages, Brunswick Aces, Bundaberg Brewed Drinks, ETCH Sparkling, Lyre's Spirit Co, NON, Polka, Sobah Non-Alcoholic Beverages and Suntory Beverage & Food Australia Pty Ltd.

To get more information on this market Request Sample

The Australia non-alcoholic beverages market continues to evolve as consumers increasingly prioritize wellness, convenience, and sustainability in their purchasing decisions. There is a clear shift toward functional and better-for-you beverages that incorporate natural ingredients, plant-based extracts, and added nutritional benefits, reflecting changing lifestyle preferences. In April 2025, Melbourne-based company NON gained international recognition as the World Alcohol-Free Awards reported a 30% increase in entries, with nearly 600 non-alcoholic beverages from over 30 countries, underscoring strong global momentum in the category. Moreover, younger consumer groups, particularly millennials and Generation Z, are driving demand for products that emphasize clean labels, ingredient transparency, and reduced sugar content. The market also benefits from Australia’s active outdoor culture and warm climate, which support consistent demand for refreshing and hydrating beverage options throughout the year. Manufacturers are responding by expanding product portfolios, reformulating existing offerings, and focusing on environmentally responsible packaging solutions. Innovation in flavors, formats, and positioning remains central to differentiation, while convenience and accessibility continue to influence purchasing behaviour across retail channels nationwide.

Australia Non-Alcoholic Beverages Market Trends:

Rising Demand for Functional and Wellness Beverages

Australian consumers are increasingly gravitating towards beverages that offer health benefits beyond basic hydration. Functional drinks enriched with vitamins, probiotics, adaptogens, and botanical extracts are experiencing substantial growth as consumers view beverages as integral components of holistic wellness strategies. Products targeting immunity support, digestive health, mental clarity, and energy enhancement are particularly resonating with health-conscious demographics. The kombucha segment continues to expand significantly, with fermented beverages gaining mainstream acceptance in supermarkets, cafes, and fitness centers across the nation.

Premiumization and Experiential Consumption

The market is witnessing a pronounced shift towards premium and artisanal beverage offerings as consumers seek unique taste experiences and high-quality ingredients. According to reports, in March 2025, Circana reported that the share of Australians purchasing zero-alcohol beverages more than doubled between August 2020 and January 2025, reflecting a sustained national shift toward moderation-focused consumption. Moreover, non-alcoholic cocktails, craft sodas, and boutique beverage brands are becoming staples in hospitality venues, attracting consumers who desire sophisticated drinking experiences without intoxicating effects. Ingredient provenance, artisanship, and brand storytelling are increasingly influencing purchasing decisions. Limited-edition variants and exotic flavor profiles including native Australian botanicals are capturing consumer interest and commanding premium price positioning.

Sustainability and Eco-Conscious Packaging

Environmental consciousness is fundamentally reshaping packaging strategies within the Australian beverage industry. Consumers are actively seeking brands that demonstrate genuine commitment to sustainability through recyclable materials, biodegradable alternatives, and reduced plastic usage. Companies are responding by adopting recycled PET bottles, aluminum cans, and plant-based packaging solutions. As per sources, in March 2025, Visy, in partnership with Lion, Stone & Wood, Novelis, and Rio Tinto, launched a beverage can containing 83% recycled aluminium, achieving an estimated 59% reduction in carbon emissions. Further, carbon-neutral operations, water stewardship initiatives, and transparent sourcing practices are becoming critical differentiators. Brands that prioritize eco-friendly credentials are gaining competitive advantages among environmentally aware consumer segments.

Market Outlook 2026-2034:

The Australia non-alcoholic beverages market is positioned for sustained growth during the forecast period, driven by evolving consumer preferences and continuous product innovation. The market revenue is projected to expand significantly as health-consciousness becomes increasingly embedded in consumer purchasing behaviour. Functional beverages, premium offerings, and sustainable product lines are expected to generate substantial revenue contributions. The expansion of e-commerce channels and digital retail platforms will enhance market accessibility, while ongoing innovation in low-sugar formulations and natural ingredients will attract health-oriented demographics. The market generated a revenue of USD 28.86 Billion in 2025 and is projected to reach a revenue of USD 48.01 Billion by 2034, growing at a compound annual growth rate of 5.82% from 2026-2034.

Australia Non-Alcoholic Beverages Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Carbonated Soft Drinks | 32% |

| Packaging Type | Bottles | 49% |

| Distribution Channel | Retail | 34% |

| Region | Australia Capital Territory & New South Wales | 31% |

Product Type Insights:

- Carbonated Soft Drinks

- Juices

- Bottled Water

- Sports and Energy Drinks

- RTD Tea and Coffee

- Others

Carbonated soft drinks dominate with a market share of 32% of the total Australia non-alcoholic beverages market in 2025.

Carbonated soft drinks maintain market leadership through established brand recognition, extensive distribution networks, and continuous product reformulation to address health concerns. Major beverage manufacturers have invested significantly in developing zero-sugar and low-calorie variants that retain flavor profiles while reducing caloric content. As per sources, CocaCola Australia launched CocaCola Y3000 Zero Sugar, a limited-edition AI co-created flavour under CocaCola Creations, available nationwide, combining zero-sugar refreshment with an innovative digital experience. Moreover, the segment benefits from strong impulse purchase behavior, particularly in convenience store and food service channels. For instance, companies are introducing exotic flavor innovations including cucumber, passionfruit, and hibiscus variants to capture evolving taste preferences among younger consumers.

The carbonated soft drinks demonstrate resilience through premiumization strategies, with craft sodas and artisanal carbonated drinks commanding higher price points. Sparkling water variants have expanded significantly as consumers seek carbonated alternatives to traditional soft drinks without added sugars. Manufacturers are responding to regulatory pressures around sugar content by investing in natural sweetener alternatives and reformulating flagship products. The outdoor lifestyle culture and warm Australian climate sustain consistent demand for refreshing carbonated beverages across seasonal variations.

Packaging Type Insights:

- Bottles

- Cans

- Cartons

- Others

Bottles lead with a share of 49% of the total Australia non-alcoholic beverages market in 2025.

Bottles maintain market dominance due to consumer preferences for resealable convenience, product visibility, and extended freshness preservation. PET bottles offer lightweight portability and cost-effectiveness that appeals to both manufacturers and consumers. The segment is undergoing substantial transformation as sustainability concerns drive adoption of recycled PET materials and biodegradable alternatives. As per sources, Victoria’s largest PET bottle recycling plant opened in Melbourne, enabling Coca-Cola Europacific Partners and partners to produce 100 % recycled PET bottles, processing up to one billion bottles annually.

The bottles are experiencing renewed interest within premium beverage segments, offering perceived quality advantages and complete recyclability. Manufacturers are innovating with bottle designs that enhance consumer experience through ergonomic shapes and portion-controlled sizes. The single-serve bottle format continues dominating on-the-go consumption occasions, while larger multi-serve bottles cater to household consumption patterns. Sustainable bottle initiatives, including refill stations and take-back programs, are gaining traction among environmentally conscious consumer demographics.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Retail

- Food Service

- Supermarkets and Hypermarkets

- Online Stores

- Others

Retail exhibits a clear dominance with a 34% share of the total Australia non-alcoholic beverages market in 2025.

Retail maintains the market leadership through extensive outlet networks, competitive pricing structures, and convenient accessibility across urban and regional locations. Supermarkets and hypermarkets within the retail channel offer comprehensive product assortments that enable consumers to compare brands and make informed purchasing decisions. Promotional activities, loyalty programs, and strategic shelf placement drive sales volumes across retail environments. The channel benefits from high foot traffic and impulse purchase opportunities that characterize beverage category dynamics.

Retail in e-commerce and online are experiencing accelerated growth as digital shopping behaviours become increasingly normalized among the consumers. According to sources, Woolworths reported a 39 percent rise in fast grocery services, with Aussies overwhelmingly choosing collection and delivery within two hours via Direct to Boot and MILKRUN. Furthermore, subscription services and direct-to-consumer delivery models are expanding market reach for specialty and premium beverage brands. Online platforms enable smaller craft producers to access broader consumer bases without traditional retail distribution requirements. Manufacturers are optimizing packaging formats for e-commerce fulfillment, with smaller sizes and sustainable materials addressing delivery logistics and consumer preferences for convenience.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales dominates with a market share of 31% of the total Australia non-alcoholic beverages market in 2025.

Australia Capital Territory & New South Wales maintains market dominance through concentrated urban populations, elevated disposable incomes, and robust tourism activity centered around Sydney and surrounding metropolitan areas. The diverse demographic composition drives demand across varied beverage categories, from premium offerings to value-oriented products. Strong hospitality sector presence, including restaurants, cafes, and entertainment venues, generates substantial food service channel volumes. For instance, the region benefits from significant domestic tourism, with millions of visitors annually contributing to elevated beverage consumption patterns.

The region demonstrates pronounced adoption of health-conscious beverage trends, with functional drinks, plant-based alternatives, and premium waters experiencing strong consumer uptake. Urban consumers exhibit heightened awareness of sustainability credentials, driving demand for eco-friendly packaging solutions. Distribution infrastructure advantages enable efficient market coverage across metropolitan and regional areas. The concentration of corporate headquarters and retail chain operations positions the region as a primary focus for product launches and marketing initiatives by major beverage manufacturers.

Market Dynamics:

Growth Drivers:

Why is the Australia Non-Alcoholic Beverages Market Growing?

Escalating Health Consciousness and Wellness Prioritization

Australian consumers are increasingly embracing health-focused lifestyles that fundamentally influence beverage purchasing decisions. Growing awareness of diet-related health concerns, including obesity, diabetes, and cardiovascular conditions, is driving sustained demand for healthier beverage alternatives. Consumers actively seek products featuring lower sugar content, natural ingredients, and functional health benefits. This wellness orientation is particularly pronounced among millennial and Generation Z demographics who demonstrate sophisticated understanding of nutritional content and ingredient transparency. Beverages are increasingly viewed as integral components of holistic wellness strategies encompassing physical fitness, mental clarity, and long-term health optimization. The market responds through continuous innovation in formulations featuring vitamins, probiotics, adaptogens, and botanical extracts that address specific health objectives. In October 2025, Jim launched Australia’s first functional soda with 5 g protein, prebiotics, and BCAAs per can, now stocked in over 100 wellness centres, health food stores, and recovery hubs

Growing Preference for Functional and Fortified Beverages

The functional beverages segment is experiencing substantial expansion as consumers prioritize products offering benefits beyond basic hydration. Demand for beverages enriched with probiotics, antioxidants, electrolytes, and immunity-supporting compounds continues accelerating across demographic groups. As per sources, Australian wellness brand Hyro, launched in early 2024, is projected to surpass $10 Million in 2026 revenue, fueled by influencer collaborations and growing demand for healthy electrolyte drinks. Moreover, gut health awareness has particularly elevated interest in fermented beverages including kombucha and probiotic-infused drinks that support digestive wellness. Energy and performance beverages appeal to active lifestyle consumers seeking natural alternatives to traditional caffeinated products. Ready-to-drink protein beverages and meal replacement options address convenience-oriented consumption occasions. This functional orientation reflects broader consumer movement towards preventive health approaches where daily beverage choices contribute to overall wellbeing objectives.

Expanding E-Commerce and Digital Retail Channels

Digital commerce transformation is substantially reshaping beverage distribution and consumer accessibility across the Australian market. Online retail platforms enable convenient home delivery, subscription services, and expanded product discovery beyond traditional retail limitations. E-commerce channels provide smaller craft producers and specialty beverage brands access to broader consumer audiences without extensive distribution infrastructure investments. Consumers increasingly value the convenience of digital ordering combined with direct-to-door delivery that accommodates busy lifestyles. Manufacturers are developing e-commerce-optimized packaging formats and digital marketing strategies that engage consumers through personalized recommendations and targeted promotions. This channel expansion enhances market accessibility while supporting innovation in product offerings that might not achieve viable shelf space in conventional retail environments.

Market Restraints:

What Challenges the Australia Non-Alcoholic Beverages Market is Facing?

Environmental Concerns Over Single-Use Packaging

The beverage industry faces mounting pressure regarding environmental impacts of single-use plastic packaging. Consumer advocacy groups and regulatory bodies increasingly scrutinize plastic bottle usage that contributes to landfill accumulation and ocean pollution. Brands perceived as environmentally irresponsible risk consumer backlash and diminished market positioning. Transitioning to sustainable packaging alternatives requires substantial capital investment and supply chain modifications that challenge smaller manufacturers disproportionately.

Regulatory Pressures on Sugar Content

Intensifying regulatory scrutiny around sugar consumption presents ongoing challenges for traditional beverage formulations. Potential sugar taxation policies and mandatory labeling requirements influence product reformulation strategies and marketing approaches. Health advocacy campaigns targeting sugar-sweetened beverages affect consumer perceptions and purchasing behaviours. Manufacturers must balance taste profile expectations with sugar reduction imperatives while managing reformulation costs.

Intense Market Competition and Price Sensitivity

The Australian beverage market exhibits intense competitive dynamics with multinational corporations, domestic manufacturers, and emerging craft producers competing across price segments. Private label products from major retailers exert pricing pressure that constrains profit margins for branded alternatives. Economic pressures influence consumer price sensitivity, potentially limiting premium product adoption during constrained spending periods. Smaller manufacturers face challenges achieving distribution scale necessary for sustainable market positioning.

Competitive Landscape:

The Australia non-alcoholic beverages market features a dynamic competitive environment characterized by the presence of established multinational corporations alongside innovative domestic producers and emerging craft beverage companies. Major beverage manufacturers leverage extensive distribution networks, substantial marketing resources, and diversified product portfolios to maintain market positioning. Domestic producers differentiate through localized formulations, authentic brand narratives, and responsiveness to regional consumer preferences. The market demonstrates increasing competition from craft and artisanal beverage producers who emphasize premium ingredients, unique flavor profiles, and sustainability credentials. Strategic partnerships, product innovation, and digital marketing capabilities represent critical competitive factors.

Some of the key players include:

- Altina Drinks

- Asahi Beverages

- Brunswick Aces

- Bundaberg Brewed Drinks

- ETCH Sparkling

- Lyre's Spirit Co

- NON

- Polka

- Sobah Non-Alcoholic Beverages

- Suntory Beverage & Food Australia Pty Ltd

Recent Developments:

-

In May 2025, Nexus Airlines has partnered with Spinifex Brewing Co. to launch a co-branded range of non-alcoholic soft drinks, crafted using native Western Australian botanicals. The beverages will be served onboard Nexus flights from early June and rolled out to select retail and hospitality venues, celebrating local flavours and Indigenous partnerships.

-

In March 2025, Bundaberg Brewed Drinks launched its new Refreshingly Light range in Australia and New Zealand. The low-sugar line includes Raspberry & Pomegranate, Lemon & Watermelon, and Apple & Lychee, each can contain just 20 calories, with no artificial sweeteners or colours, packaged in convenient 250ml slimline cans.

Australia Non-Alcoholic Beverages Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Carbonated Soft Drinks, Juices, Bottled Water, Sports and Energy Drinks, RTD Tea and Coffee, Others |

| Packaging Types Covered | Bottles, Cans, Cartons, Others |

| Distribution Channels Covered | Retail, Food Service, Supermarkets and Hypermarkets, Online Stores, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Altina Drinks, Asahi Beverages, Brunswick Aces, Bundaberg Brewed Drinks, ETCH Sparkling, Lyre's Spirit Co, NON, Polka, Sobah Non-Alcoholic Beverages, Suntory Beverage & Food Australia Pty Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia non-alcoholic beverages market size was valued at USD 28.86 Billion in 2025.

The Australia non-alcoholic beverages market is expected to grow at a compound annual growth rate of 5.82% from 2026-2034 to reach USD 48.01 Billion by 2034.

Carbonated soft drinks held the held the largest Australia non-alcoholic beverages market share, driven by established brand presence, extensive distribution networks, and continuous innovation in healthier low-sugar and zero-calorie formulations that appeal to evolving consumer preferences.

Key factors driving the Australia non-alcoholic beverages market include rising health consciousness among consumers, growing demand for functional and wellness beverages, increasing preference for sustainable packaging solutions, and expanding e-commerce distribution channels.

Major challenges include environmental concerns over single-use plastic packaging, regulatory pressures on sugar content and potential taxation policies, intense competition from multinational corporations and private label products, price sensitivity among consumers, and the need for continuous product innovation to meet evolving health and sustainability expectations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)