Australia Nuclear Power Equipment Market Size, Share, Trends and Forecast by Reactor Type, Equipment Type, and Region, 2025-2033

Australia Nuclear Power Equipment Market Overview:

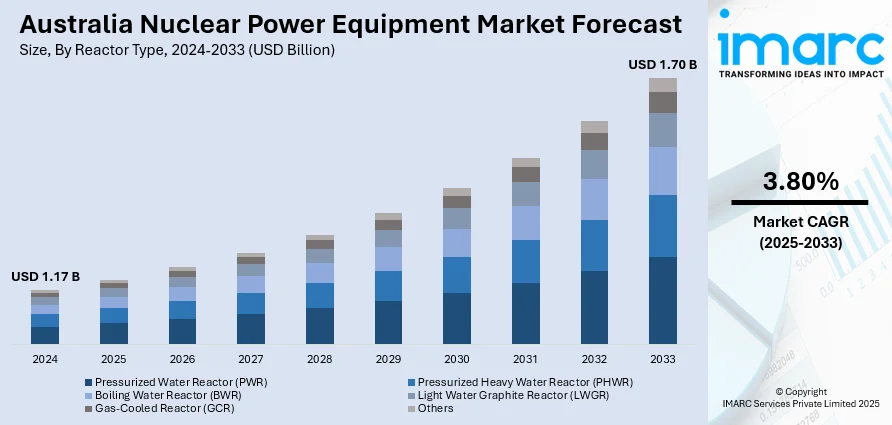

The Australia nuclear power equipment market size reached USD 1.17 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.70 Billion by 2033, exhibiting a growth rate (CAGR) of 3.80% during 2025-2033. The market is expanding due to significant investments in nuclear-powered submarines and infrastructure. At the same time, government initiatives, such as the AUKUS Submarine Industry strategy, are driving growth and boosting demand for advanced technologies. Furthermore, this continues to strengthen Australia nuclear power equipment market share, particularly in defense and energy sectors.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.17 Billion |

| Market Forecast in 2033 | USD 1.70 Billion |

| Market Growth Rate 2025-2033 | 3.80% |

Australia Nuclear Power Equipment Market Trends:

Strategic Investments in Nuclear Submarine Technology

Australia’s market is seeing substantial growth through strategic investments aimed at enhancing national defense capabilities in the nuclear power equipment industry. Concurrent with this trend, the AUKUS Submarine Industry Strategy, launched in March 2025, is at the heart of these efforts. Supported by a AUSD 262 Million investment, this initiative focuses on advancing Australia’s nuclear-powered submarine capabilities. This step is crucial in positioning Australia to enhance its technological capabilities in the nuclear energy and defense sectors. The initiative is expected to generate 20,000 jobs over the next 30 years, signaling a major shift in the country’s workforce and industrial capabilities. Moreover, Australia is laying the groundwork for a thriving nuclear sector that can meet both defense and energy needs with Australia nuclear power equipment market growth at the core of this strategy. These investments will support the development of a self-sustaining nuclear industry, boosting demand for cutting-edge nuclear technology equipment and services. Overall, this strategy will lead to significant advancements in the nuclear power sector, providing a solid foundation for future growth and market expansion in the coming decades.

To get more information on this market, Request Sample

Expansion of Nuclear Infrastructure and Workforce Capabilities

The Australian government’s commitment to enhancing nuclear infrastructure is driving significant growth in the nuclear power equipment market. Aligned with this, in March 2025, the AUKUS Submarine Industry Strategy allocated USD 2 Billion in South Australia, aiming to further develop the country’s nuclear-powered submarine program. This initiative focuses on building a robust industrial base that supports the design, construction, and maintenance of advanced nuclear submarines, as well as associated nuclear power equipment. Furthermore, the funds will enable essential infrastructure upgrades, positioning Australia as a leader in global nuclear technology. Alongside these physical investments, the strategy also prioritizes workforce development through targeted training programs designed to equip Australians with the skills necessary to operate and maintain nuclear technologies. The creation of thousands of highly skilled jobs in the nuclear power sector will not only drive innovation in nuclear equipment but also ensure long-term growth and sustainability. This strategic approach strengthens market trends, thereby creating a favorable environment for nuclear technology to flourish and support the country’s economic and security goals.

Australia Nuclear Power Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on reactor type and equipment type.

Reactor Type Insights:

- Pressurized Water Reactor (PWR)

- Pressurized Heavy Water Reactor (PHWR)

- Boiling Water Reactor (BWR)

- Light Water Graphite Reactor (LWGR)

- Gas-Cooled Reactor (GCR)

- Others

The report has provided a detailed breakup and analysis of the market based on the reactor type. This includes pressurized water reactor (PWR), pressurized heavy water reactor (PHWR), boiling water reactor (BWR), light water graphite reactor (LWGR), gas-cooled reactor (GCR), and others.

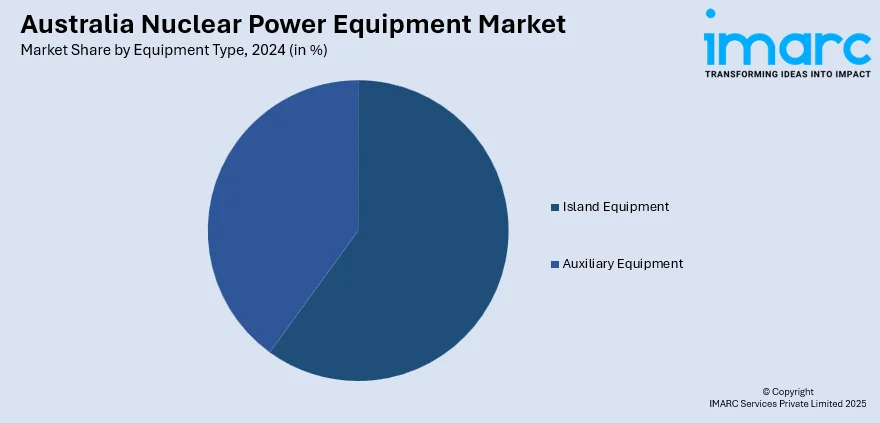

Equipment Type Insights:

- Island Equipment

- Auxiliary Equipment

The report has provided a detailed breakup and analysis of the market based on the equipment type. This includes island equipment and auxiliary equipment.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Nuclear Power Equipment Market News:

- June 2024: HII and Babcock launched H&B Defence to accelerate Australia’s nuclear-powered submarine program under AUKUS. The joint venture aimed to develop sovereign nuclear capabilities, including infrastructure and workforce development. This initiative significantly boosted demand for nuclear power equipment, strengthening Australia’s position in the global nuclear market.

- June 2024: Peter Dutton revealed seven sites for proposed nuclear power plants across Australia. These plants, expected to be operational by 2035-2037, would significantly boost demand for nuclear power equipment. This initiative is set to transform Australia’s energy landscape, driving market growth in nuclear infrastructure.

Australia Nuclear Power Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Reactor Types Covered | Pressurized Water Reactor (PWR), Pressurized Heavy Water Reactor (PHWR), Boiling Water Reactor (BWR), Light Water Graphite Reactor (LWGR), Gas-Cooled Reactor (GCR), Others |

| Equipment Types Covered | Island Equipment, Auxiliary Equipment |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia nuclear power equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia nuclear power equipment market on the basis of reactor type?

- What is the breakup of the Australia nuclear power equipment market on the basis of equipment type?

- What is the breakup of the Australia nuclear power equipment market on the basis of region?

- What are the various stages in the value chain of the Australia nuclear power equipment market?

- What are the key driving factors and challenges in the Australia nuclear power equipment market?

- What is the structure of the Australia nuclear power equipment market and who are the key players?

- What is the degree of competition in the Australia nuclear power equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia nuclear power equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia nuclear power equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia nuclear power equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)