Australia Oat Milk Market Report by Source (Conventional, Organic), Flavor (Plain, Flavored), Packaging Form (Carton, Bottle, Can), and Region 2025-2033

Australia Oat Milk Market Size and Share:

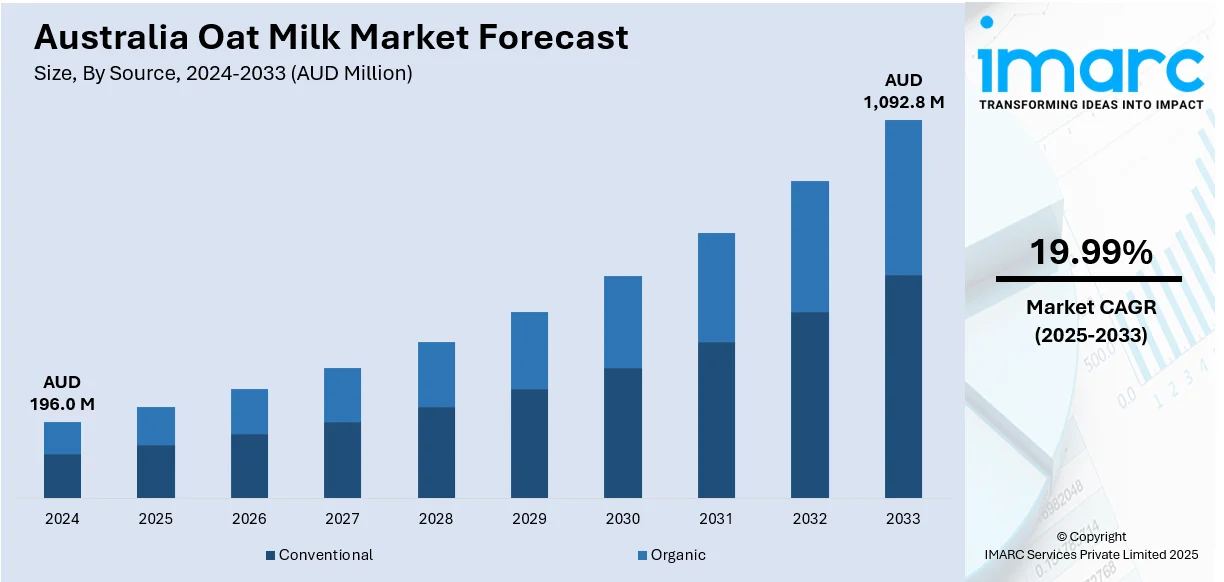

The Australia oat milk market size reached AUD 196.0 Million in 2024. Looking forward, the market is expected to reach AUD 1,092.8 Million by 2033, exhibiting a growth rate (CAGR) of 19.99% during 2025-2033. The expanding vegan and vegetarian population, rising prevalence of lactose intolerance, increasing health consciousness, and the launch of oat milk in unique flavors across the country represent some of the key factors driving the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

AUD 196.0 Million |

|

Market Forecast in 2033

|

AUD 1,092.8 Million |

| Market Growth Rate 2025-2033 | 19.99% |

Oat milk is a plant-based beverage obtained from liquified oats and serves as a vegan-friendly and lactose-free alternative to dairy milk. Characterized by a rich, creamy texture and neutral taste, it is an excellent source of essential nutrients, such as iron, calcium, potassium, folate, manganese, zinc, thiamine, magnesium, and vitamin D. Its regular consumption provides numerous health benefits, including strengthening bones, regulating blood cholesterol levels, and maintaining heart health. It is commonly used to replace milk in various beverages, such as tea, coffee, milkshakes, smoothies, and health drinks. It is also utilized in the production of bakery goods and confectionery food items, including cakes, muffins, cupcakes, and chocolates. As a result, oat milk has gained immense popularity as a milk replacement in the food and beverage (F&B) industry and is widely consumed by health-conscious consumers across Australia.

To get more information on this market, Request Sample

Key Trends of Australia Oat Milk Market:

Increasing Demand and Consumer Choices in Australia

The Australian oat milk market has experienced a significant shift in consumption trends, mirroring an overall shift toward plant-based alternatives. This behavior is strongly connected to shifting consumer trends, where health awareness and sustainability are central factors. Australian consumers are increasingly becoming familiar with the environmental benefits of oat milk and prefer it to conventional dairy, as it has a lower carbon footprint and less water usage. Furthermore, the richness in oat milk's texture has been particularly popular with Australians, who tend to appreciate a milk alternative that can be easily integrated into flat whites, lattes, and specialty coffee. Increased knowledge of lactose intolerance and dairy allergies has also prompted several consumers to look for non-dairy alternatives, placing oat milk firmly in the running as a top urban and regional choice throughout the country.

Local Innovation and Product Development

Local Australian oat milk production is now a hotbed of innovation with a number of locally developed brands creating innovative variations to suit local tastes. Australian manufacturers are testing blends featuring indigenous grains, gently imbuing this emerging sector with indigenous character. For instance, certain oat milk products are being developed with a hint of sweetness evoking the Australian outback and appealing to those who are looking for a distinctly Australian taste profile. Manufacturers also emphasized making fortified oat milks with calcium and vitamins D and B12 to satisfy nutritional criticism that sometimes haunts plant-based milks. Production facilities and equipment have been set up in core states such as Victoria and Queensland to guarantee freshness and streamline supply chains, illustrating a devotion to locally grown ingredients and serving local agricultural communities.

Retail Expansion and Integration

Oat milk's acceptance across Australia's leading stores has propelled its mainstream retail growth across supermarkets and independent retailers alike. In Melbourne, Adelaide, and Brisbane, baristas within cities commonly include oat milk as the default plant-based choice, further increasing its acceptability among customers regardless of dietary choice. Consequently, large supermarket chains have increased shelf space for various brands and formats—from barista-style cartons to shelf-stable versions—making the product more available countrywide, including in smaller regional towns. In addition, partnerships between large coffee roasteries and oat milk manufacturers have introduced co-branded products, emphasizing the harmony of Australia's coffee e culture and the versatility of oat milk. The regular inclusion of oat milk in mainstream breakfast routines and cafe offerings has cemented its place as a permanent, instead of niche, feature in Australia's changing dairy alternative market.

Growth Drivers of Australia Oat Milk Market:

Health & Dietary Trends Driving Oat Milk Adoption

Australia's oat milk expansion is rooted in a broad cultural movement toward healthier, plant-based diets. An increasing number of consumers throughout the nation are taking charge of lactose intolerance and dairy sensitivity by making the switch from cow's milk to oat alternatives. Oat milk's inherent creaminess and subtle sweetness make it particularly appealing to Australians are that it offers a lactose-free beverage that is easier to digest than conventional dairy. It is also free from typical allergens such as soy and nuts, so it is a generally available option for various dietary requirements. This has been further bolstered by the increasing popularity of flexitarianism and veganism—dietary practices increasingly popular in Australia. Both these lifestyles focus on plant-based foods due to their health benefits, and oat milk is naturally aligned with both diets. Nutrition-focused consumers in urban areas such as Sydney's eastern suburbs or Melbourne's inner north are particularly attracted to nutrient-fortified oat milk with calcium and B-vitamins as a healthy alternative to dairy. Such changes indicate fundamental shifts in the way Australians perceive food and well-being, which further drives the Australia oat milk market demand.

Environmental Responsibility and Local Sourcing

One distinctly Australian stimulus for oat milk consumption is the great focus on sustainability and local agriculture. Australians are highly conscious of sustainability in conventional dairy farming—especially its high-water and greenhouse gas emissions—and hence they increasingly seek out plant-based alternatives with environmentally friendly credentials. Oat milk, specifically, fits the need as oats use significantly less water and produce fewer carbon emissions than dairy, and other plant milks such as almond. Brands at the local level, such as Alternative Dairy Co., operating from NSW's Central Coast, emphasize this through employing GMO-free, locally sourced oats, direct supply to cafés and supermarkets to double up on environmental and regional provenance. In addition, plants such as Vitasoy's Victoria-based Baranduda factory—originally constructed to make 10 million liters annually—have increased capacity significantly to more than 70 million liters, illustrating the infrastructure investment going into Australia's plant-based value chain. This local focus resonates with environmental-conscious consumers but also provides farmers with alternative revenue streams to dairy, promoting a more robust, diversified agricultural system in the country's major farming areas like Victoria and Western Australia.

Café Culture & Innovation Driving Market Penetration

One of the strongest drivers of growth for oat milk in Australia is the nation's thriving café culture. Australia's cafe scene—famous worldwide for its excellence and creativity—rapidly adopted oat milk onto espresso menus, where it quickly emerged as the dairy alternative of choice because of its barista-approved consistency and flavor. In some regions, plant-based milk accounts for close to 90% of non-dairy purchases, with oat milk frequently being the most popular. Brands such as Chobani, Minor Figures, and Oatly have partnered with cafés and chains to make oat milk visible and normalized within everyday coffee culture. Furthermore, packaging and flavor profile innovations such as recyclable cartons or barista-blend formats specifically optimized for silky froth resonate with Australian consumers' need for convenience as well as sustainability. As supermarket chains increase their range and price points—from premium single-serve cartons to family-pack multipacks—oat milk is better positioned to be embedded within daily shopping routines. Combined with café adoption, branding partnerships, and retail innovation, they form a feedback loop that keeps oat milk front-of-mind and on-shelf throughout Australia's urban and regional markets.

Opportunities of Australia Oat Milk Market:

Expansion into Regional and Rural Markets

According to the Australia oat milk market analysis, one of the greatest potential opportunities for oat milk in the region is expanding past metropolitan hubs into regional and rural communities. While cities such as Melbourne, Sydney, and Brisbane are already well along in adopting oat milk as part of their café and supermarket scene, rural towns and regional communities have just started to see steady availability. As people become health-conscious and adopt plant-based diets in all age groups, these markets become accepting of dairy alternatives. Regional Australians, who have an agricultural presence among many of their population, might also be willing to support oat milk if the oats are locally produced and processed. In addition, as the national supply chains get stronger and logistics become better, oat milk brands are in a better position to penetrate outlying supermarkets, schools, and coffee shops. This lays a solid groundwork for oat milk to become an integral part of daily consumption well beyond the city limits, particularly as local retailers seek to diversify products to satisfy changing consumer tastes.

Product Diversification and Functional Health Positioning

Another major opportunity in the Australian oat milk market lies in the creation of diversified product lines that appeal to changing health and wellness trends. While the classic oat milk is easily consumed, there exists scope for innovation in protein-enriched, low-sugar, and blends with native Australian ingredients such as wattle seed or lemon myrtle. These distinctive regional tastes can bring a very local appeal, enabling brands to stand out in an expanding market. Australian consumers also look for functional foods providing additional health benefits over and above regular nutrition. The trend provides an opening for oat milk with added probiotics, prebiotics, or adaptogens to support immunity, digestion, or energy. Brands reaching into these wellness-inspired niches, especially with simple, clean-label packaging and transparent sourcing from Australian farms, are optimally placed to appeal to both mainstream consumers and niche wellness consumers. As more Australians incorporate plant-based diets into their lifestyle, functional oat milk formats can carve out a useful niche in the health food market.

Foodservice, Exports, and Tourism-Driven Demand

Australia's oat milk market similarly has considerable potential within the foodservice and tourism markets, as well as through export overseas. Within tourist hotspots such as the Gold Coast, Byron Bay, and Tasmania, customers of cafes and restaurants increasingly demand plant-based options, particularly those that promote local sustainability. To meet these needs, providing high-quality, barista-grade oat milk improving the experience at cafes is an ideal fit. Moreover, as global tourism bounces back, Australia's profile for high-quality coffee and lifestyle-driven eating has the potential to promote its oat milk globally to international visitors. This offers a two-way benefit: to harvest tourist dollars at home and build brand recognition that can drive international demand. Australian oat milk, with a value proposition centered on clean agriculture and traceability, is also poised to compete in foreign markets like Southeast Asia and the Middle East, where dairy substitutes are increasingly popular. These markets present strong incentives for brands to expand production and emphasize quality-oriented, export-grade offerings.

Challenges of Australia Oat Milk Market:

Price Elasticity and Consumer Perception

One of the major problems confronting the Australian oat milk market is price sensitivity, especially as living expenses increase across the country. Although oat milk has captured the attention of consumers concerned about health and the environment, its premium price over conventional dairy milk or other plant-based competitors can act as a hindrance to wider market uptake. In places like Western Sydney or Brisbane's outer suburbs, where budgets are tighter, consumers might be less likely to buy oat milk regularly at premium price points. There remains a continued perception among some consumers that plant milks are a trend or luxury product and not an everyday practical staple. To compete in price-sensitive markets, manufacturers must identify how to optimize manufacturing and supply chains without the loss of quality while also informing consumers of its long-term value. This means oat milk is being positioned as a value-aligned, viable alternative to dairy.

Supply Chain and Agricultural Constraints

Australia's oat milk market is growing to become more dependent on secure domestic oat supply, but supply chain uncertainty and agricultural limitations pose significant barriers. Weather uncertainty, particularly droughts and floods in oat states such as Victoria, South Australia, and parts of New South Wales, can interfere with crop yields and create erratic supply to manufacturers. Furthermore, competition from other cereal crops as well as Australian oat export demand further constricts the supply of raw material required for oat milk manufacturing. In contrast to more mature industries such as dairy, the Australian oat milk industry continues to develop infrastructure and alliances that can facilitate long-term scalability. Most manufacturers rely on a few mills or processing plants, which exposes them to the risk of production hold-ups or plant breakdowns. To meet these challenges, the industry will need to make investments in localized processing facilities, farm partnerships, and drought-resistant oat varieties specific to Australian conditions. Without structural investments of this type, supply-side constraints might impede growth even as consumer demand is firm.

Market Saturation and Brand Differentiation

As domestic and foreign brands continue to enter the Australian oat milk market, one of the new challenges emerging is brand differentiation in a rapidly saturating space. Supermarket shelves, particularly in city centers like Melbourne and Sydney, now host an expanding array of oat milk variations—ranging from local upstarts to multinational players. Though this diversity presents consumers with greater variety, it also creates pressure for smaller or younger brands to differentiate themselves from simply being "plant-based" or "sustainable". The absence of clear identity can trigger commoditization, where oat milk becomes perceived as homogeneous and subject to mainly price competition. In addition, regulatory constraints on health claims and labels in Australia may limit how explicitly brands can promote nutritional advantages. For long-term success, brands must find niches that are different from each other, whether through innovation in taste, functional attributes, region of origin, or ethical manufacturing practices. Creating solid emotional bonds with consumers and appealing to Australian values such as localism and ecological responsibility will be key to cutting through this busy marketplace.

Key Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Australia oat milk market, along with forecasts at the regional and country levels from 2025-2033. Our report has categorized the market based on source, flavor, and packaging form.

Source Insights:

- Conventional

- Organic

The report has provided a detailed breakup and analysis of the Australia oat milk market based on the source. This includes conventional and organic. According to the report, conventional represented the largest segment.

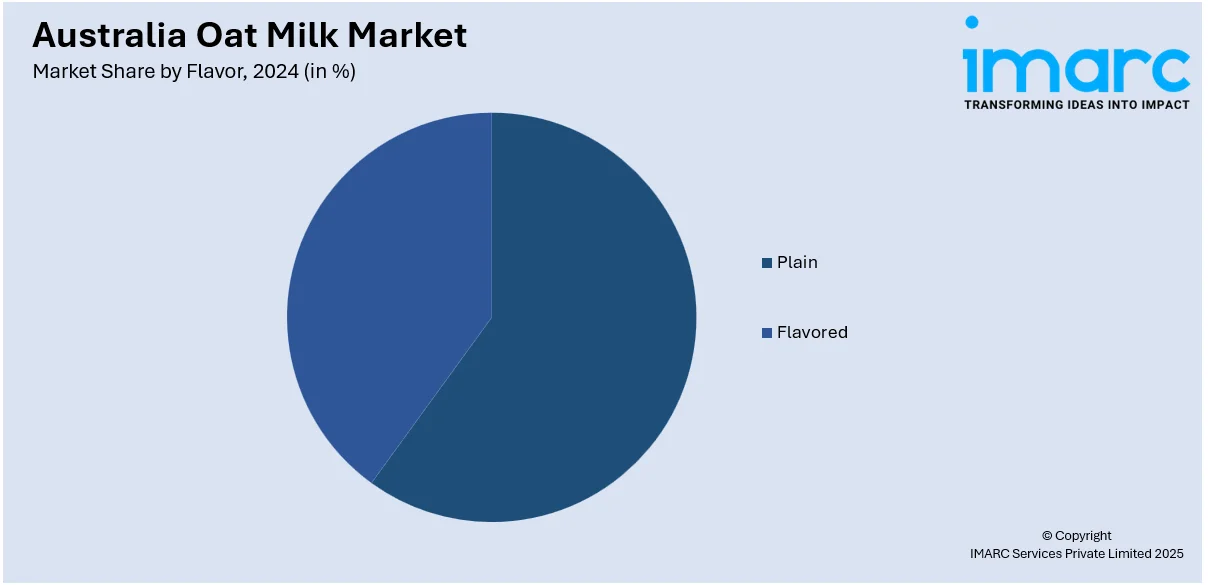

Flavor Insights:

- Plain

- Flavored

A detailed breakup and analysis of the Australia oat milk market based on the flavor has also been provided in the report. This includes plain and flavored. According to the report, plain accounted for the largest market share.

Packaging Form Insights:

- Carton

- Bottle

- Can

The report has provided a detailed breakup and analysis of the Australia oat milk market based on the packaging form. This includes carton, bottle, and can. According to the report, carton represented the largest segment.

Regional Insights:

- New South Wales

- Victoria

- Queensland

- Western Australia

- South Australia

- Tasmania

- Others

The report has also provided a comprehensive analysis of all the major regional markets, which include New South Wales, Victoria, Queensland, Western Australia, South Australia, Tasmania, and Others. According to the report, New South Wales was the largest market for oat milk. Some of the factors driving the New South Wales oat milk market included the emerging trend of vegan diets, rising adoption of plant-based foods and beverages, new product launches, heavy investments in aggressive promotional activities by key players, etc.

Competitive Landscape:

The report has also provided a comprehensive analysis of the competitive landscape in the Australia oat milk market. Detailed profiles of all major companies have been provided. Some of the companies covered include Califia Farms AU (Califia Farms, LLC), Chobani Australia Pty Ltd. (Chobani, LLC), Inside Out Nutritious Goods Pty Ltd., Minor Figures AU (Minor Figures Limited), Noumi Limited, Oatly AB (Cereal Base Ceba AB), PureHarvest, Sanitarium, Uncle Tobys (Nestlé), Vitasoy Australia (Vitasoy International Holdings Limited), Wide Open Agriculture, etc. Kindly note that this only represents a partial list of companies, and the complete list has been provided in the report.

Australia Oat Milk Market News:

- In May 2025, Kiwi oat milk brand Boring, which focuses on plant-based products, has finalized a distribution agreement with Woolworths, Australia’s largest supermarket chain. Boring will provide 95% of Woolworths locations in Australia – comprising 953 supermarkets and 80 metro sites with its Original and Barista oat milk types.

- In August 2024, in a USD 3.42 million deal, the health and wellness food company Forbidden Foods announced its intention to buy Oat Milk Goodness (OMG), an Australian plant-based non-dairy milk company. Australian cricketer Steve Smith co-founded OMG with the goal of creating a locally sourced oat milk product that makes use of the country's abundant natural oats and is free of commercial seed oils that might cause inflammation, such as canola, rapeseed, or sunflower oil.

- In August 2024, in Australia, Oatly, a Swedish company that makes plant-based alternative milk, unveiled three new oat drinks, including its first low-sugar variety. Oatly Full, which is renowned for its rich and creamy flavor; Oatly Light, which has a sophisticated formula ideal for coffee and baking; and Oatly Low Sugar, which has a milder, less sweet flavor ideal for tea or meals with less sweetness, are all part of the new collection.

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | AUD Million |

| Sources Covered | Conventional, Organic |

| Flavors Covered | Plain, Flavored |

| Packaging Forms Covered | Carton, Bottle, Can |

| Regions Covered | New South Wales, Victoria, Queensland, Western Australia, South Australia, Tasmania, Others |

| Companies Covered | Califia Farms AU (Califia Farms, LLC), Chobani Australia Pty Ltd. (Chobani, LLC), Inside Out Nutritious Goods Pty Ltd., Minor Figures AU (Minor Figures Limited), Noumi Limited, Oatly AB (Cereal Base Ceba AB), PureHarvest, Sanitarium, Uncle Tobys (Nestlé), Vitasoy Australia (Vitasoy International Holdings Limited), Wide Open Agriculture, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia oat milk market from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Australia oat milk market.

- The study maps the leading, as well as the fastest-growing, regional markets. It further enables stakeholders to identify the key country-level markets within each region.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia oat milk industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia oat milk market was valued at AUD 196.0 Million in 2024.

The Australia oat milk market is projected to exhibit a CAGR of 19.99% during 2025-2033.

The Australia oat milk market is expected to reach a value of AUD 1,092.8 Million by 2033.

Some of the most significant drivers for the Australia oat milk market are growing demand for plant-based eating, heightened awareness about lactose intolerance, and concern about sustainability. Local production from locally grown oats and deep integration into café culture also drive the market, making oat milk a convenient and sustainable dairy substitute across various consumer groups.

The Australian oat milk industry is expanding rapidly, fueled by consumer health demand, sustainability trends, and a robust café culture. Indigenous brands are developing barista blends and using regionally grown oats. With the growth of plant-based living, oat milk remains a standout dairy alternative in urban and regional markets.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)