Australia Off-Road Vehicles Market Size, Share, Trends and Forecast by Product, and Region, 2025-2033

Australia Off-Road Vehicles Market Overview:

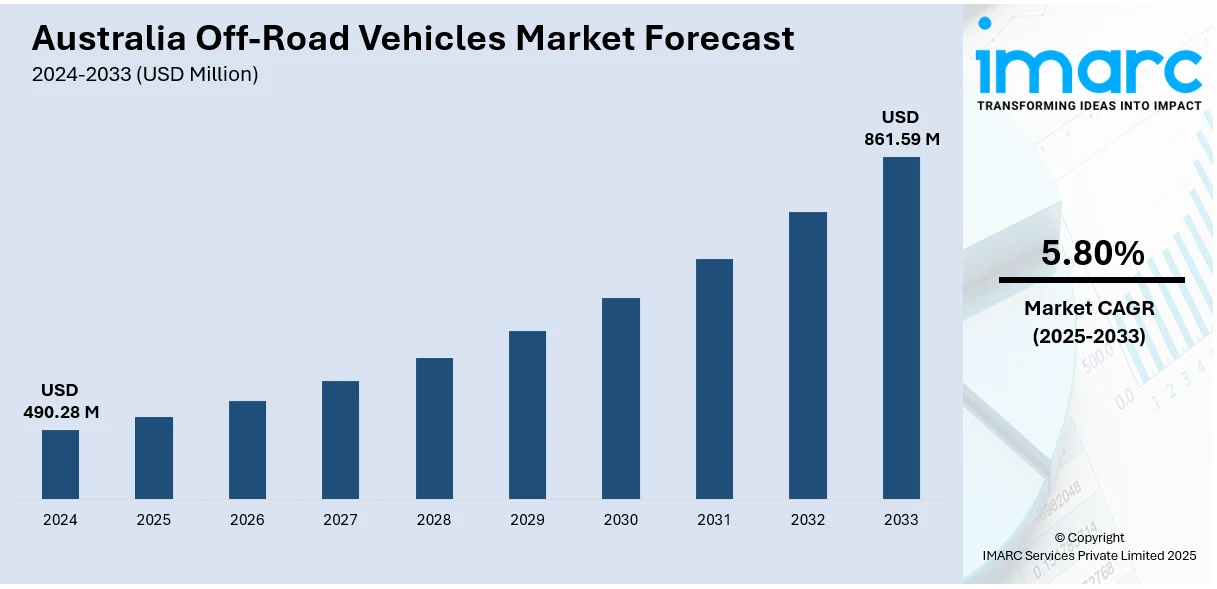

The Australia off-road vehicles market size reached USD 490.28 Million in 2024. Looking forward, the market is expected to reach USD 861.59 Million by 2033, exhibiting a growth rate (CAGR) of 5.80% during 2025-2033. The market is driven by the rising adoption of electric off-road vehicles, supported by environmental regulations, cost efficiency, and advancements in battery technology, catering to both recreational and commercial users. Growing adventure tourism is accelerating demand for high-performance 4WDs and UTVs, as travelers and rental operators seek rugged, feature-rich vehicles for remote exploration. Additionally, expanding charging infrastructure and influencer-driven off-road culture are further augmenting the Australia off-road vehicles market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 490.28 Million |

| Market Forecast in 2033 | USD 861.59 Million |

| Market Growth Rate 2025-2033 | 5.80% |

Key Trends of Australia Off-Road Vehicles Market:

Rising Demand for Electric Off-Road Vehicles

The market is moving toward electric models due to environmental concerns as well as advances in battery technology. Utility task vehicles (UTVs), electric all-terrain vehicles (ATVs), and 4x4s are on the radar of consumers and businesses due to reduced emissions, noise, and overall cost of ownership. Government incentives for ecologically friendly vehicles and tighter emission regulations will drive electric off-road vehicles forward. Established manufacturers continue to produce electric off-road models, extending range and longevity to serve the requirements of the unforgiving Australian landscape initially. Farming and off-road use are driving the demand for electric vehicles, partially for their extra torque and reduced noise, which enables smoother operation for recreational or farm use. As charging infrastructure expands in rural areas, the adoption of electric off-road vehicles is expected to rise significantly, further propelling the Australia off-road vehicles market growth. Australia's electric vehicle (EV) charging infrastructure is poised for substantial growth, with the government intending to allocate funds for the establishment of 27,500 additional public charging stations by 2033 to meet the growing demand, particularly in regional and rural areas. In 2023, public charging sites increased by 75% to reach 812 stations, with New South Wales (NSW) leading the way with fast and ultrafast chargers. As the off-road car industry becomes increasingly electrified, a robust charging infrastructure will be necessary to support the performance of such vehicles in areas where they are commonly used and to ensure a sustainable future for off-road travel, which will further contribute toward the growth of Australia off-road vehicles market demand.

To get more information on this market, Request Sample

Increasing Popularity of Adventure Tourism Enhancing Off-Road Vehicle Sales

Adventure tourism is accelerating in Australia, fueling demand for off-road vehicles designed for exploration and outdoor activities. With more travelers seeking off-grid experiences in regions like the Outback, Kimberley, and Tasmania, there is a growing need for durable, high-performance 4WDs, UTVs, and modified off-road rigs. Rental companies and tour operators are investing in fleets of off-road vehicles to cater to this trend, while individual buyers are purchasing customized models for personal adventures. Social media and influencer marketing have also played a key role in popularizing off-road travel, encouraging more consumers to invest in capable vehicles. Influencer marketing in Australia is expected to grow beyond AUD 1.25 Billion (approximately USD 800 Million) by 2028, driven by a 46% purchase influence rate and high consumer confidence in endorsements by influencers. With social media platforms, including Instagram and TikTok, leading the way, 52% of Australians between 18-29 years are more likely to make purchases influenced by their favorite influencers. Off-road vehicle companies can capitalize on this trend by leveraging micro and nano influencers, who generate higher levels of engagement, to promote adventure-capable vehicles and advertise on these highly interactive platforms. Manufacturers are responding by introducing advanced features such as enhanced suspension systems, all-terrain tires, and integrated navigation technology. As domestic and international adventure tourism continues to grow, the off-road vehicle market is expected to see sustained demand, particularly in rugged and remote areas of Australia.

Growth Drivers of Australia Off-Road Vehicles Market:

Government Expenditure in Regional Infrastructure and Tourism

Among the major factors driving the expansion of Australia's off-road vehicles market is expanded government expenditure in regional infrastructure and domestic tourism. In a bid to increase economic activity outside urban areas, numerous state and federal programs have aimed at opening up remote and rural areas. Better roads, signs, campsites, and off-road trails are opening up once-inaccessible sites to a wider range of users. This improvement in infrastructure has provided new opportunities for the recreational use of off-road vehicles, particularly in regions like the Northern Territory, Western Australia, and Far North Queensland. With increased numbers of Australians discovering Australia themselves by road and nature-based travel, off-road vehicles now play a crucial role in reaching remote terrain, national parks, and heritage sites. These government-supported initiatives promote domestic travel and underpin related industries such as vehicle hire, aftermarket products, and guided tours, which further drives robust and sustained growth in the off-road vehicle market.

Growing Rural and Agricultural Uses

The large agricultural industry and rural environment of Australia also contribute significantly toward the growth of the market for off-road vehicles. Cattle stations, farms, and remote properties throughout the country mostly depend on off-road vehicles for daily activities like transporting supplies, monitoring livestock, and traversing undulating terrain. In areas such as Western Australia, Queensland, and the Northern Territory, where infrastructure might be sparse and distances extreme, off-road vehicles are invaluable assets. ATVs and side-by-side UTVs are especially prevalent in farm applications owing to their versatility, robustness, and lower costs of maintenance. The Australian government has also invested heavily in regional development and rural infrastructure, which indirectly fuels demand for such vehicles. In addition, with growing concern for enhancing farm productivity and safety, there is a rising inclination toward contemporary off-road vehicles with improved safety features, fuel economy, and smart technology. Such utilitarian requirements combined with the demanding environmental conditions of rural Australia provide constant and consistent demand.

Supportive Aftermarket Ecosystem and Customization Culture

Australia's strong aftermarket sector and strong vehicle customization culture are also driving forces for growth in the off-road vehicles market. Australian consumers are known for modifying and upgrading their off-road vehicles to meet specific performance needs, especially for long-distance travel, rugged terrain, or specialized agricultural tasks. From suspension kits and snorkels to roof racks, bull bars, and winches, the local aftermarket sector offers a vast range of accessories that support personalization and functional upgrades. This customization culture extends the life of off-road vehicles and contributes value to first-time buying, maintaining consumer involvement in the market. Moreover, workshops and local businesses have developed skills to manufacture accessories that cater to Australia's specific environment, which increases consumer confidence in vehicle customization being done safely and effectively. 4x4 expos and outdoor lifestyle events showcase new goods and technologies further, stimulating consumer demand and market expansion. With the off-road enthusiasts looking for customized and high-performance experiences, this environment keeps thriving.

Australia Off-Road Vehicles Market Segmentation:

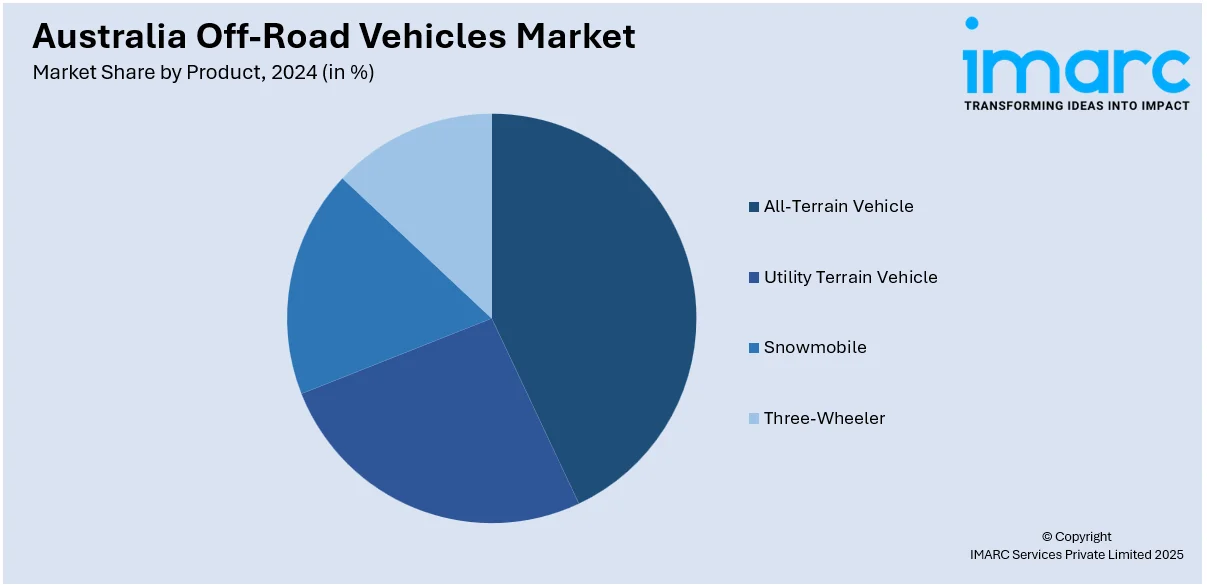

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product.

Product Insights:

- All-Terrain Vehicle

- Utility Terrain Vehicle

- Snowmobile

- Three-Wheeler

The report has provided a detailed breakup and analysis of the market based on the product. This includes all-terrain vehicle, utility terrain vehicle, snowmobile, and three-wheeler.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Off-Road Vehicles Market News:

- June 07, 2024: GWM officially launched the POER Sahar in Australia, marking the arrival of the country's first hybrid off-road pickup. With a powerful 255 kW hybrid engine, 648 Nm torque, and a generous towing capacity of 3.5 tonnes, the POER Sahar outclasses standard off-road utes in its segment. The pickup has been tailored for Australian conditions, giving enhanced city and demanding landscape performance, as well as smart towing features and premium safety technology.

Australia Off-Road Vehicles Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | All-Terrain Vehicle, Utility Terrain Vehicle, Snowmobile, Three-Wheeler |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia off-road vehicles market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia off-road vehicles market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia off-road vehicles industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia off-road vehicles market was valued at USD 490.28 Million in 2024.

The Australia off-road vehicles market is projected to exhibit a CAGR of 5.80% during 2025-2033.

The Australia off-road vehicles market is expected to reach a value of USD 861.59 Million by 2033.

The Australia off-road vehicles market trends include rising demand for electric and hybrid off-road models, increased integration of advanced safety and navigation technologies, and a surge in aftermarket customization. Consumers are also favoring multi-purpose vehicles that suit both work and recreation, driven by lifestyle shifts and expanding regional tourism infrastructure.

The Australia off-road vehicles market is driven by growing regional infrastructure development, increasing rural and agricultural applications, and a strong culture of vehicle customization. Expanding domestic tourism and outdoor recreation, particularly in remote and rugged areas, further fuels demand for durable, high-performance off-road vehicles suited to Australia’s unique and challenging terrain.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)