Australia Off-the-Road Tire Market Size, Share, Trends and Forecast by Vehicle Type, Tire Type, Distribution Channel, Rim Size, End-Use, and Region, 2025-2033

Australia Off-the-Road Tire Market Overview:

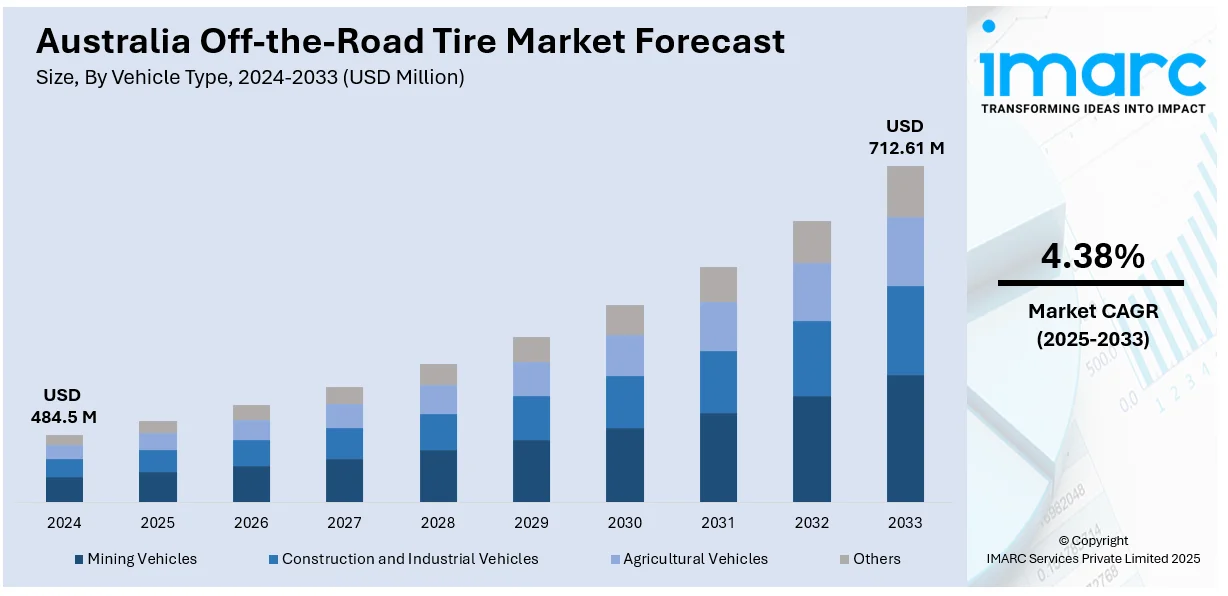

The Australia off-the-road tire market size reached USD 484.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 712.61 Million by 2033, exhibiting a growth rate (CAGR) of 4.38% during 2025-2033. Growth in the mining and construction sectors, increased demand for heavy-duty vehicles, infrastructure expansion, and rising agricultural mechanization are some of the factors propelling the growth of the market. Additionally, technological advancements in tire durability and performance, along with strong aftermarket demand, support the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 484.5 Million |

| Market Forecast in 2033 | USD 712.61 Million |

| Market Growth Rate 2025-2033 | 4.38% |

Australia Off-the-Road Tire Market Trends:

Rising Demand for Advanced All-Terrain Tires

Australia’s off-road vehicle segment is increasingly adopting tyres designed for enhanced durability and performance. Recent product developments reflect a shift toward designs that offer improved wear resistance and grip, especially in rugged conditions. A newly launched all-terrain tyre featuring a reworked tread pattern, refined footprint, and deeper sipes addresses the need for greater longevity and even wear. With plans to introduce 60 size variants over the next two years, suppliers are aligning more closely with the diverse vehicle base and demanding driving environments across the region. This focus on performance upgrades and expanded availability highlights a broader movement toward premium, high-performance solutions in the off-the-road category. For example, in September 2024, BFGoodrich introduced the All-Terrain T/A KO3 tyre in Australia, replacing the KO2 model. The KO3 features a new tread pattern, optimized footprint, and full-depth 3D locking sipes for improved durability and even wear. BFGoodrich plans to offer 60 sizes within the next two years, catering to Australia's growing off-road market.

To get more information on this market, Request Sample

Sustainability Driving Tire Lifecycle Management

Efforts to reduce environmental impact are gaining momentum in Australia’s off-the-road tire segment. A major recovery initiative recently collected hundreds of tons of used tires and conveyor belts from a remote mine site, transporting the material across the region for processing. The reclaimed rubber was repurposed into infrastructure applications, signaling a push toward circular resource use in heavy industries. This approach supports waste reduction and promotes the reuse of materials that would otherwise require specialized disposal. Such large-scale recycling operations reflect growing alignment between mining operations and sustainable practices, particularly in region where transport and logistics present additional challenges. The focus is shifting toward lifecycle management and closed-loop systems within the off-the-road segment. For instance, in November 2023, Australia's inaugural large-scale off-the-road (OTR) tire recovery initiative reclaimed 800 tons of used tires and conveyor belts from the Argyle Diamond Mine in Western Australia. These materials were transported over 3,200 kilometers to Queensland, processed into crumb rubber, and utilized in road construction on the Sunshine Coast. The project, a collaboration between Rio Tinto and Carroll Engineering Services, exemplifies sustainable waste management in the mining sector.

Australia Off-the-Road Tire Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on vehicle type, tire type, distribution channel, rim size, and end-use.

Vehicle Type Insights:

- Mining Vehicles

- Construction and Industrial Vehicles

- Agricultural Vehicles

- Others

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes mining vehicles, construction and industrial vehicles, agricultural vehicles, and others.

Tire Type Insights:

- Radial Tire

- Bias Tire

A detailed breakup and analysis of the market based on the tire type have also been provided in the report. This includes radial tire and bias tire.

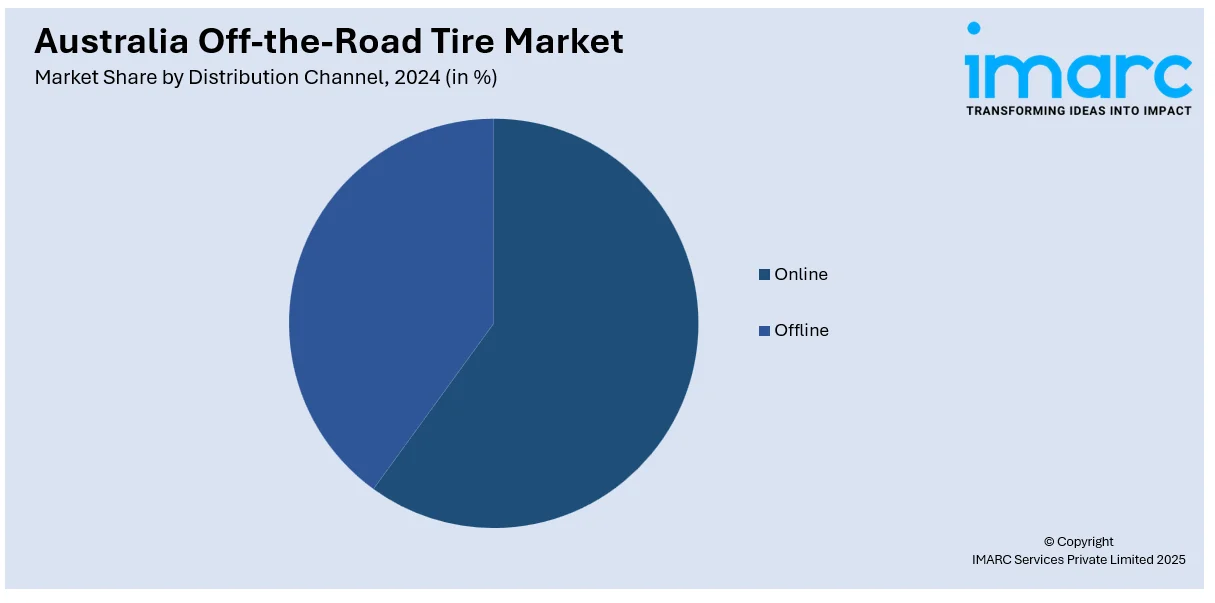

Distribution Channel Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline.

Rim Size Insights:

- Below 29 inches

- 29-45 inches

- Above 45 inches

A detailed breakup and analysis of the market based on the rim size have also been provided in the report. This includes below 29 inches, 29-45 inches, and above 45 inches.

End-Use Insights:

- OEM

- Replacement

The report has provided a detailed breakup and analysis of the market based on the end-use. This includes OEM and replacement.

Region Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Off-the-Road Tire Market News:

- In February 2025, Tyrecycle launched Australia's first dedicated off-the-road (OTR) mining tire recycling facility in Port Hedland, Western Australia. The plant can process over 30,000 tons of OTR tires annually, addressing a significant gap in recycling capacity. Located near major mining operations, the facility aims to reduce landfill waste and enhance sustainability in the Pilbara region.

- In November 2024, Continental's General Tire introduced two new all-terrain tires in Australia, i.e., the Grabber ATX and Grabber APT. The Grabber ATX is designed for aggressive off-road use, while the Grabber APT targets on-road comfort with off-road capability. Both models cater to Australia's diverse terrains, expanding options for off-road enthusiasts and commercial users.

Australia Off-the-Road Tire Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Mining Vehicles, Construction and Industrial Vehicles, Agricultural Vehicles, Others |

| Tire Types Covered | Radial Tire, Bias Tire |

| Distribution Channels Covered | Online, Offline |

| Rim Sizes Covered | Below 29 inches, 29-45 inches, Above 45 inches |

| End-Uses Covered | OEM, Replacement |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia off-the-road tire market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia off-the-road tire market on the basis of vehicle type?

- What is the breakup of the Australia off-the-road tire market on the basis of tire type?

- What is the breakup of the Australia off-the-road tire market on the basis of end-use?

- What is the breakup of the Australia off-the-road tire market on the basis of distribution channel?

- What is the breakup of the Australia off-the-road tire market on the basis of rim size?

- What is the breakup of the Australia off-the-road tire market on the basis of region?

- What are the various stages in the value chain of the Australia off-the-road tire market?

- What are the key driving factors and challenges in the Australia off-the-road tire?

- What is the structure of the Australia off-the-road tire market and who are the key players?

- What is the degree of competition in the Australia off-the-road tire market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia off-the-road tire market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia off-the-road tire market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia off-the-road tire industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)