Australia Office Supplies Market Size, Share, Trends and Forecast by Product Type, Application, Distribution Channel, and Region, 2026-2034

Australia Office Supplies Market Overview:

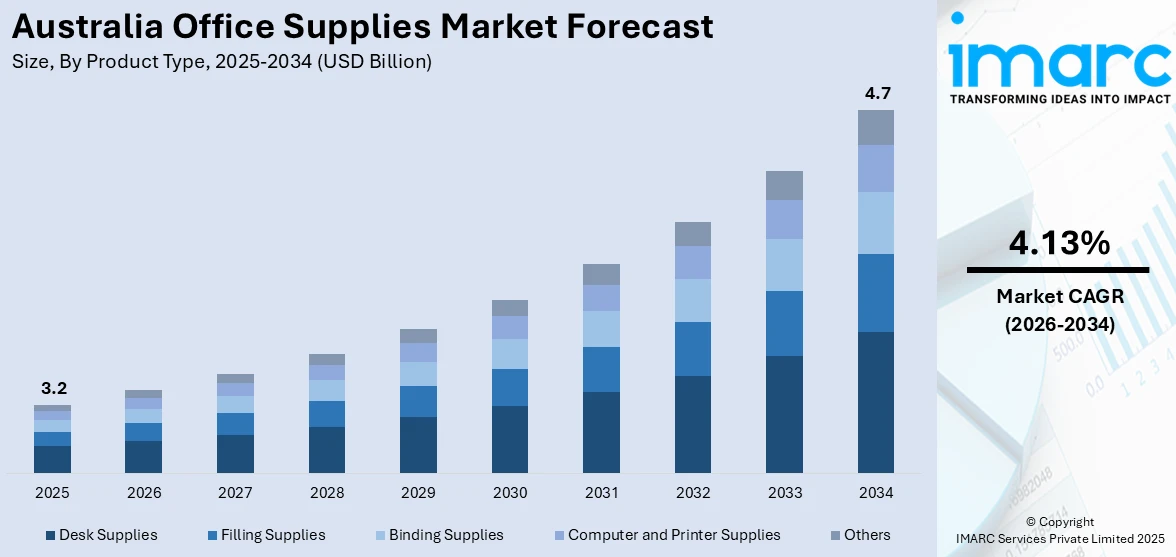

The Australia office supplies market size reached USD 3.2 Billion in 2025. Looking forward, the market is expected to reach USD 4.7 Billion by 2034, exhibiting a growth rate (CAGR) of 4.13% during 2026-2034. The growing demand for eco-friendly products due to corporate sustainability goals and stricter regulations are some of the major factors driving the market. Additionally, the shift toward online and subscription-based purchasing, fueled by hybrid work models and cost efficiency, is augmenting the Australia office supplies market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 3.2 Billion |

| Market Forecast in 2034 | USD 4.7 Billion |

| Market Growth Rate 2026-2034 | 4.13% |

Key Trends of Australia Office Supplies Market:

Rising Demand for Eco-Friendly Office Supplies

The significant shift toward sustainable and eco-friendly products is majorly driving the Australia office supplies market growth. Businesses and consumers are increasingly prioritizing environmentally responsible options, driven by stricter corporate sustainability policies and growing environmental awareness. Demand for recycled paper, biodegradable pens, and non-toxic stationery has increased, with many companies seeking suppliers that align with their green initiatives. Additionally, government regulations and incentives promoting sustainable procurement practices are accelerating this trend. Major retailers and wholesalers are expanding their eco-friendly product range to meet this demand, while manufacturers are innovating with materials including bamboo, plant-based plastics, and soy-based inks. As remote and hybrid work models persist, the need for sustainable home office supplies has also risen. This trend is expected to grow, with businesses willing to pay a premium for products that reduce environmental impact, making sustainability a key driver in the office supplies market.

To get more information on this market Request Sample

Growth of Online and Subscription-Based Office Supply Purchases

The market is witnessing a rapid increase in online sales and subscription-based purchasing models, fueled by convenience and cost efficiency. A research report from the IMARC Group indicates that the e-commerce market in Australia was valued at USD 536.0 Billion in 2024. It is projected to grow to USD 1,568.60 Billion by 2033, reflecting a compound annual growth rate (CAGR) of 12.70% from 2025 to 2033. Thus, this is creating a positive Australia office supplies market outlook. Businesses, particularly SMEs, are shifting from traditional brick-and-mortar purchases to digital platforms that offer bulk discounts, automated replenishment, and fast delivery. E-commerce giants as well as specialized office supply retailers, are capitalizing on this trend by offering subscription services for recurring needs such as printer ink, paper, and stationery. The rise of hybrid work has further enhanced online demand, as companies seek flexible procurement solutions for distributed teams. Additionally, digital procurement tools with AI-driven inventory management are gaining traction, helping businesses optimize supply orders and reduce waste. This shift toward digital purchasing is reshaping the competitive landscape, pushing traditional retailers to enhance their online presence or risk losing market share. The trend is expected to continue as businesses prioritize efficiency and seamless supply chain solutions.

Growth Drivers of Australia Office Supplies Market:

Hybrid Work Models and Remote Office Infrastructure Development

The widespread adoption of hybrid work arrangements has fundamentally transformed office supply consumption patterns, creating sustained demand for both traditional workplace and home office equipment. Companies are establishing satellite offices, co-working spaces, and supporting remote employees with comprehensive office supply packages, requiring flexible procurement strategies that can accommodate distributed workforces. This shift has increased demand for portable office equipment, ergonomic furniture, technology accessories, and personal stationery items that employees need for productive home office setups. Organizations are investing in bulk purchasing programs that allow employees to order supplies directly to their homes, streamlining distribution while maintaining cost control. The trend toward hot-desking and flexible workspaces has also driven demand for mobile storage solutions, temporary desk supplies, and sanitization products that support clean workspace transitions. According to the Australia office supplies market analysis, businesses are establishing multiple smaller inventory locations rather than centralized storage, increasing overall supply requirements. This decentralization of work environments has created opportunities for suppliers to offer innovative delivery solutions, customized product bundles, and technology-integrated inventory management systems that can track supplies across multiple locations and employee households.

Digital Transformation and Technology Integration in Offices

The accelerating digital transformation across Australian businesses is driving substantial demand for technology-related office supplies and creating new product categories within the traditional market. Modern offices require extensive infrastructure for devices, connectivity, and digital workflows, including cables, adapters, charging stations, ergonomic accessories for computer use, and specialized storage solutions for electronic equipment. The integration of Internet of Things (IoT) devices, smart office systems, and collaborative technology platforms has increased demand for technical supplies that support these advanced workplace technologies. Organizations are investing in digital presentation tools, interactive displays, and conference room equipment that require specialized maintenance supplies and accessories, which is driving the Australia office supplies market demand. The shift toward paperless operations, while reducing traditional paper consumption, has increased demand for technology supplies including printer cartridges for specialized applications, protective equipment for devices, and organizational tools that support digital workflows. Furthermore, cybersecurity concerns have driven demand for physical security supplies including document shredders, secure storage solutions, and privacy screens. This technology-driven transformation is creating premium product segments with higher margins while establishing long-term replacement and upgrade cycles that provide predictable revenue streams.

Corporate Sustainability Mandates and ESG Compliance Requirements

Stringent corporate sustainability initiatives and Environmental, Social, and Governance (ESG) compliance requirements are fundamentally reshaping procurement decisions across Australian businesses. This is creating robust demand for environmentally responsible office supplies and boosting Australia office supplies market share. Government regulations, industry standards, and stakeholder expectations are pushing organizations to adopt comprehensive green procurement policies that prioritize recyclable, biodegradable, and sustainably sourced products throughout their operations. Large corporations are establishing ambitious carbon neutrality targets that include supply chain optimization, driving demand for locally manufactured products, minimal packaging solutions, and products with verified environmental certifications. The implementation of circular economy principles in office environments has increased demand for refillable products, modular furniture systems, and supplies designed for disassembly and recycling. Organizations are investing in sustainability tracking systems that require suppliers to provide detailed environmental impact data, creating opportunities for premium eco-friendly products with transparent supply chains. Additionally, corporate social responsibility programs are driving demand for supplies from social enterprises, indigenous businesses, and certified fair-trade suppliers. This sustainability focus is creating new product innovation cycles, encouraging manufacturers to develop breakthrough materials and processes while establishing long-term partnerships with environmentally conscious suppliers who can meet evolving compliance requirements.

Australia Office Supplies Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product type, application, and distribution channel.

Product Type Insights:

- Desk Supplies

- Filling Supplies

- Binding Supplies

- Computer and Printer Supplies

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes desk supplies, filling supplies, binding supplies, computer and printer supplies, and others.

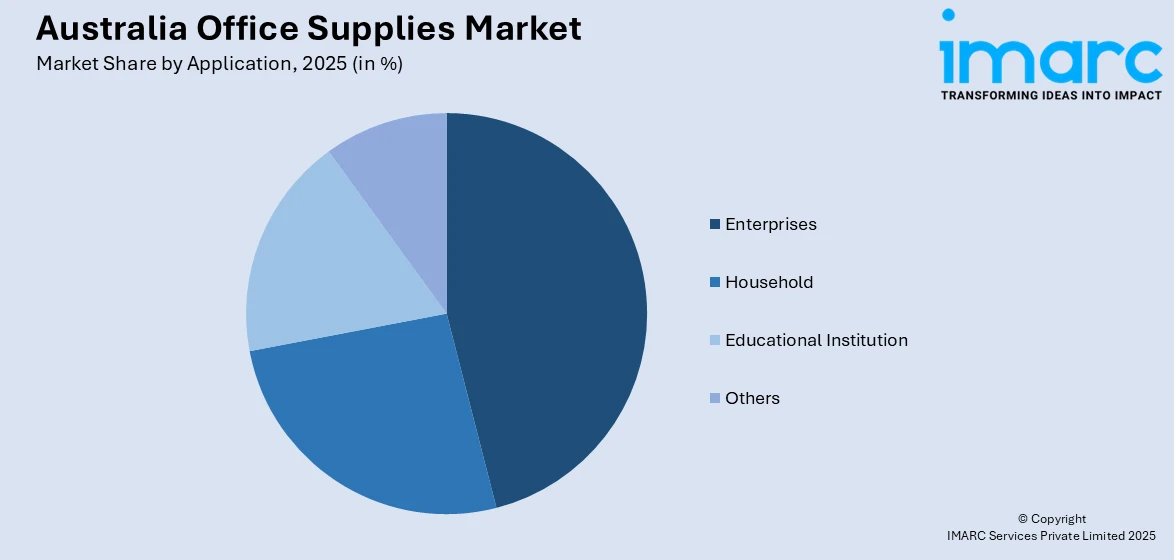

Application Insights:

Access the comprehensive market breakdown Request Sample

- Enterprises

- Household

- Educational Institution

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes enterprises, household, educational institution, and others.

Distribution Channel Insights:

- Supermarket and Hypermarket

- Stationery Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarket and hypermarket, stationery stores, online stores, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Office Supplies Market News:

- September 12, 2024: Officeworks launched "Officeworks for Business" to support Australian SMEs, including 5% off essential business supplies, free metro delivery on orders over $65, and 30-day payment terms. Officeworks is focused on lifting financial pressure from their customers and looking at ways to partner with their customers through tailored support and sustainability initiatives with over 260,000 businesses, 92% of which are SMEs.

- May 3, 2024: OfficeCatch, one of the top office supplies suppliers in Australia, released its entire range of eco 3D filaments, including PLA, Silk, ABS, and TPU, in over 50 colors. Designed by specialists and enthusiasts who understand the needs of engineers and hobbyists, these filaments offer top-quality materials at low prices with fast delivery in 1 to 2 days to many major cities around Australia. Additionally, customers can enjoy free shipping on orders exceeding $70, further improving convenience for shoppers nationwide.

Australia Office Supplies Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Desk Supplies, Filling Supplies, Binding Supplies, Computer and Printer Supplies, Others |

| Applications Covered | Enterprises, Household, Educational Institution, Others |

| Distribution Channels Covered | Supermarket and Hypermarket, Stationery Stores, Online Stores, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia office supplies market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia office supplies market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia office supplies industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia office supplies market was valued at USD 3.2 Billion in 2025.

The Australia office supplies market is projected to exhibit a CAGR of 4.13% during 2026-2034.

The Australia office supplies market is projected to reach a value of USD 4.7 Billion by 2034.

The market experiences growth driven by rising demand for eco-friendly products and corporate sustainability goals. Online and subscription-based purchasing models are gaining prominence, supported by hybrid work arrangements and digital transformation initiatives across Australian businesses.

The Australia office supplies market is driven by hybrid work models requiring distributed office infrastructure, digital transformation demands, and corporate sustainability mandates. ESG compliance requirements and technology integration further accelerate market expansion across diverse business sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)