Australia Offshore Wind Power Market Size, Share, Trends and Forecast by Installation, Water Depth, Capacity, and Region, 2025-2033

Australia Offshore Wind Power Market Size and Share:

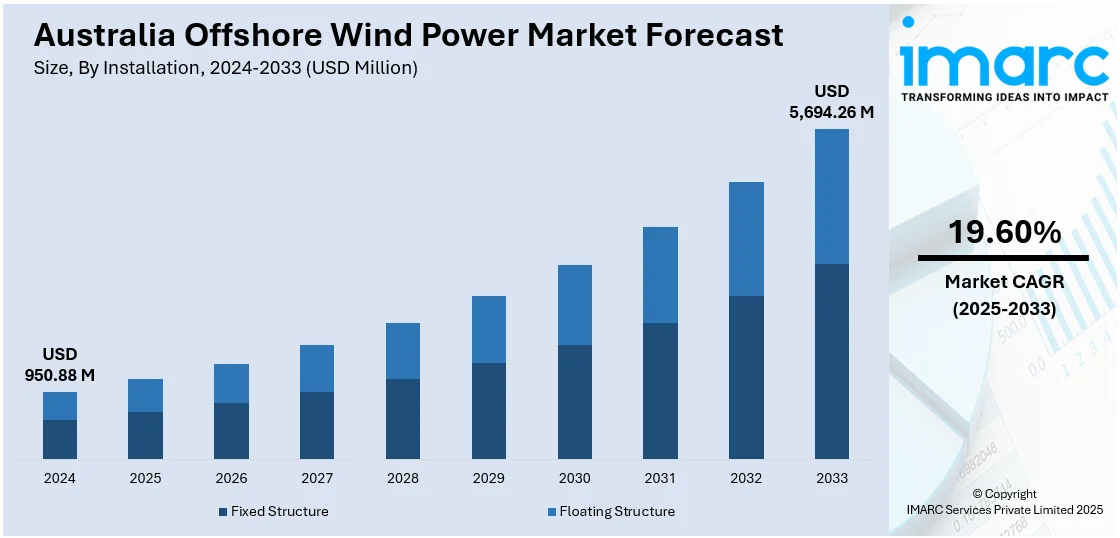

The Australia offshore wind power market size reached USD 950.88 Million in 2024. Looking forward, the market is expected to reach USD 5,694.26 Million by 2033, exhibiting a growth rate (CAGR) of 19.60% during 2025-2033. The market is fueled by renewable energy policies at the government level, innovation in wind turbine performance, and heightened demand for clean energy. Its extensive coastline and favorable wind environment make it all the more lucrative, with high impact on the Australia offshore wind power market share in recent years.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 950.88 Million |

| Market Forecast in 2033 | USD 5,694.26 Million |

| Market Growth Rate 2025-2033 | 19.60% |

Key Trends of Australia Offshore Wind Power Market:

Government Support and Policy Framework

The Australian government’s commitment to reducing carbon emissions and increasing renewable energy adoption has been a major driver of the Australia Offshore Wind Power market growth. Policy frameworks like the Renewable Energy Target (RET) and incentives for offshore wind projects have been key to attracting investments. For instance, in May 2024, Australia’s offshore wind industry moved closer to realization with the Albanese Government granting feasibility licenses for six projects in Gippsland, Victoria. These projects, which could generate 25 GW of electricity, offer significant job creation and support regional economies. As the government sets more ambitious renewable energy goals, offshore wind projects are expected to play a vital role. Furthermore, regulatory support for infrastructure development and streamlined approval processes are accelerating project timelines. This policy alignment fosters investor confidence and fuels the overall market’s expansion.

To get more information on this market, Request Sample

Strong Investment and International Collaboration

A growing influx of investment from both domestic and international sources is fostering the Australia offshore wind power market growth. Major energy companies and private investors are recognizing the potential of Australia’s offshore wind resources, leading to significant funding for large-scale projects. Moreover, international collaborations between Australian and European firms have been instrumental in knowledge transfer and technology exchange. This cooperation is helping to refine the local supply chain, reduce costs, and improve the efficiency of offshore wind farms. As a result, the Australia Offshore Wind Power market share is poised for consistent growth with further investments fueling the industry’s expansion. For instance, in September 2024, GE Vernova, a global company, announced that it will supply 38 6 MW turbines for the 228 MW Boulder Creek Wind Farm in Queensland, Australia, the country’s first split-scope, project-financed wind farm. The project, set to power 85,000 homes and cut 379,000 tons of CO₂ annually, includes a five-year service deal. This deal highlights GE Vernova’s growing role in Australia’s energy transition and expands its installed 6 MW platform footprint in the region.

Growth Drivers of Australia Offshore Wind Power Market:

Abundant Wind Resources and Coastal Geography

Australia is uniquely positioned to harness offshore wind due to its vast coastline and consistently high wind speeds over its surrounding waters. These geographic and climatic advantages provide optimal conditions for generating stable, large-scale renewable energy. Unlike land-based renewables, offshore wind farms do not compete with agriculture or urban development, minimizing land-use conflicts and environmental disruption. The shallow continental shelf in many coastal regions also allows for cost-effective installation of fixed-bottom turbines. Additionally, proximity to industrial centers and transmission infrastructure makes power integration into the grid more efficient. As Australia transitions away from coal and gas, its coastal geography makes offshore wind not only feasible but central to achieving national renewable energy goals and decarbonizing its power system over the coming decades.

Energy Export and Hydrogen Integration Potential

Australia’s offshore wind capacity not only meets domestic clean energy needs but also supports its growing role as a renewable energy exporter. With rising global demand for green hydrogen, especially from Asian markets like Japan and South Korea, offshore wind projects are increasingly designed to co-locate with hydrogen production facilities. According to the Australia offshore wind power market analysis, these hybrid models convert wind energy into hydrogen via electrolysis, enabling large-scale exports of zero-emission fuel. The federal government’s hydrogen strategy and investment in renewable export infrastructure strengthen this alignment. Offshore wind's high output and consistency make it ideal for powering energy-intensive hydrogen production, transforming Australia into a regional clean energy powerhouse. This export-oriented development creates significant economic opportunity while reinforcing offshore wind’s importance in global decarbonization strategies.

Advancements in Technology and Infrastructure

Ongoing advancements in wind turbine technology and marine engineering are making offshore wind more efficient and economically viable. Innovations such as floating platforms, taller towers, and higher-capacity turbines allow access to deeper waters and stronger wind resources, significantly boosting output per unit. These technologies reduce the cost per megawatt-hour, making offshore wind competitive with traditional energy sources. Concurrently, Australia is investing in critical infrastructure—upgrading ports for turbine assembly, expanding subsea transmission networks, and improving grid interconnectivity. These developments streamline project deployment, reduce logistical barriers, and support long-term scalability. By fostering a robust offshore wind ecosystem, technological and infrastructure progress is accelerating Australia’s ability to meet energy demands sustainably while laying the foundation for future regional integration and export capacity.

Government Support of Australia Offshore Wind Power Market:

Establishment of Feasibility Zones and Licensing Frameworks

The Australian government has taken a proactive role in accelerating offshore wind development by designating specific feasibility zones in coastal regions such as Victoria, New South Wales, and Tasmania. These zones help identify areas with high wind potential, suitable seabed conditions, and minimal environmental or community conflict. By pre-assessing these regions, the government reduces regulatory uncertainty and streamlines project planning. Complementing this is a structured licensing and permitting framework that offers greater clarity and transparency for investors and developers. This process sets timelines, environmental standards, and community consultation requirements, allowing for faster project progression. These measures are critical to attracting private capital and ensuring that developments proceed efficiently, responsibly, and in alignment with Australia’s broader renewable energy and decarbonization strategies.

Funding and Incentive Programs

The Australia offshore wind market growth is being propelled by a range of government-led funding mechanisms and incentive schemes that improve project economics and reduce early-stage risks. Financial support is available through institutions such as the Australian Renewable Energy Agency (ARENA), which offers grants and capital assistance to innovative and scalable offshore wind proposals. In addition, clean energy financing initiatives and green investment funds help unlock private sector participation by improving access to credit and reducing the cost of capital. Competitive renewable energy auctions also ensure price transparency and long-term revenue certainty. Together, these funding programs de-risk development, stimulate innovation, and accelerate timelines. By strategically allocating resources, the government is laying a strong financial foundation for offshore wind to become a major pillar of Australia’s clean energy transition.

Support for Domestic Supply Chain and Workforce Development

To ensure the long-term sustainability of the offshore wind sector, the Australian government is actively supporting the development of local supply chains and skilled labor. Initiatives include investments in port infrastructure, manufacturing hubs for turbine components, and vessel servicing facilities. These efforts aim to reduce dependency on international suppliers while strengthening national capabilities. Additionally, dedicated training programs and education pathways are being introduced to upskill workers in marine engineering, electrical systems, and environmental management. This dual focus on infrastructure and human capital not only enhances domestic readiness but also stimulates regional economies through job creation. By prioritizing local participation and capacity-building, the government is fostering an integrated offshore wind ecosystem that supports innovation, competitiveness, and long-term economic growth tied to the clean energy transition.

Australia Offshore Wind Power Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on installation, water depth, and capacity.

Installation Insights:

- Fixed Structure

- Floating Structure

The report has provided a detailed breakup and analysis of the market based on the installation. This includes fixed structure and floating structure.

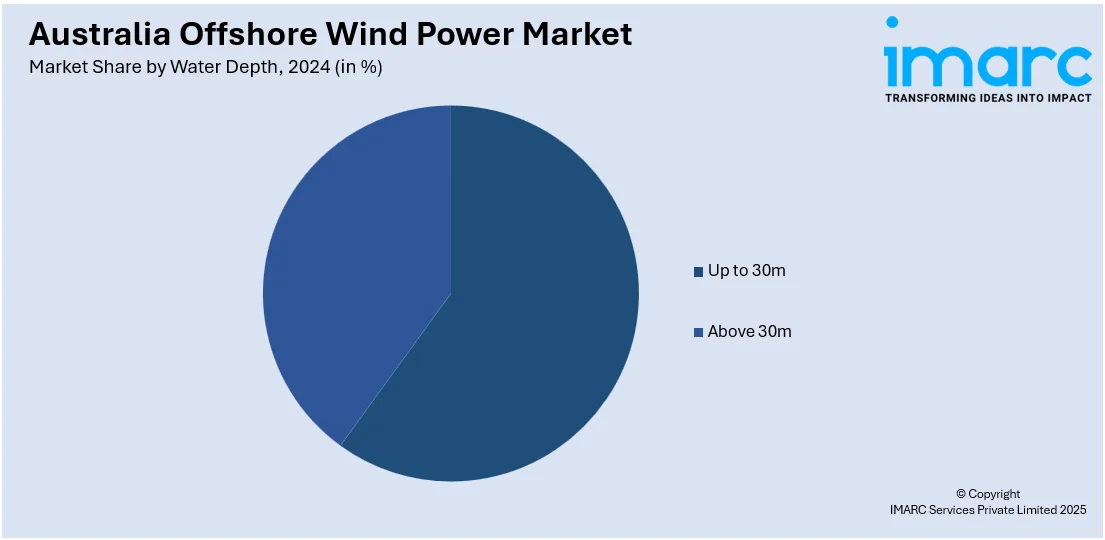

Water Depth Insights:

- Up to 30m

- Above 30m

A detailed breakup and analysis of the market based on the water depth have also been provided in the report. This includes up to 30m and above 30m.

Capacity Insights:

- Up to 3MW

- 3MW to 5MW

- Above 5MW

The report has provided a detailed breakup and analysis of the market based on the capacity. This includes up to 3MW, 3MW to 5MW, and above 5MW.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Offshore Wind Power Market News:

- In July 2024, RWE secured its first offshore wind site in Australia, located in Bass Strait, Victoria. The Kent Offshore Wind Farm, with a capacity of up to 2 GW, will power 1.6 million homes and is expected to be operational in the 2030s. This marks RWE’s entry into Australia's offshore wind market, adding to its existing renewable energy projects in the country.

- In June 2024, Vestas secured a 577 MW contract for Stage 2 of Australia's 1.3 GW Golden Plains Wind Farm, featuring 93 V162-6.2 MW EnVentus turbines. This adds to the 756 MW already under construction in Stage 1, making it Vestas’ largest onshore wind project globally. The deal includes full EPC responsibilities and a 30-year service agreement.

- In May 2024, Ocean Winds, a joint venture of ENGIE and EDP Renewables, secured a 1.3 GW offshore wind project off Gippsland, Victoria, through Australia’s first offshore wind tender. The project, named High Sea Wind, will power 1 million homes and cut 5.3 million tons of CO₂ annually, supporting Victoria’s 95% renewable target by 2035.

- In May 2024, Ørsted secured a feasibility licence for one offshore wind project in Gippsland, Victoria, and is set to receive a second, aiming to develop 4.8 GW of capacity by the early 2030s. These far-shore projects, located 56–100 km offshore, will support Victoria’s 9 GW offshore wind target and are expected to power 4 million homes. Ørsted will conduct site investigations and environmental assessments, leveraging global expertise to deliver renewable energy and economic benefits while engaging closely with local communities and Traditional Owners.

Australia Offshore Wind Power Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Installations Covered | Fixed Structure, Floating Structure |

| Water Depths Covered | Up to 30m, Above 30m |

| Capacities Covered | Up to 3MW, 3MW to 5MW, Above 5MW |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia offshore wind power market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia offshore wind power market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia offshore wind power industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The offshore wind power market in Australia was valued at USD 950.88 Million in 2024.

The Australia offshore wind power market is projected to exhibit a CAGR of 19.60% during 2025-2033.

The Australia offshore wind power market is projected to reach a value of USD 5,694.26 Million by 2033.

Australia’s offshore wind sector is witnessing rapid momentum with declared feasibility zones, increased investment in floating wind technologies, and hybrid energy projects. There is a shift toward local supply chain development, digital integration, and larger turbines. Regulatory frameworks and environmental assessments are shaping project approvals and long-term market structure.

Strong government support, ambitious net-zero goals, and abundant coastal wind resources drive offshore wind growth. Falling technology costs, large-scale energy export potential, and integration with hydrogen initiatives enhance viability. Infrastructure upgrades, leasing frameworks, and industry collaboration further accelerate development, positioning Australia as a key player in offshore wind energy.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)