Australia Oleochemicals Market Size, Share, Trends and Forecast by Type, Form, Application, Feedstock, and Region, 2025-2033

Australia Oleochemicals Market Overview:

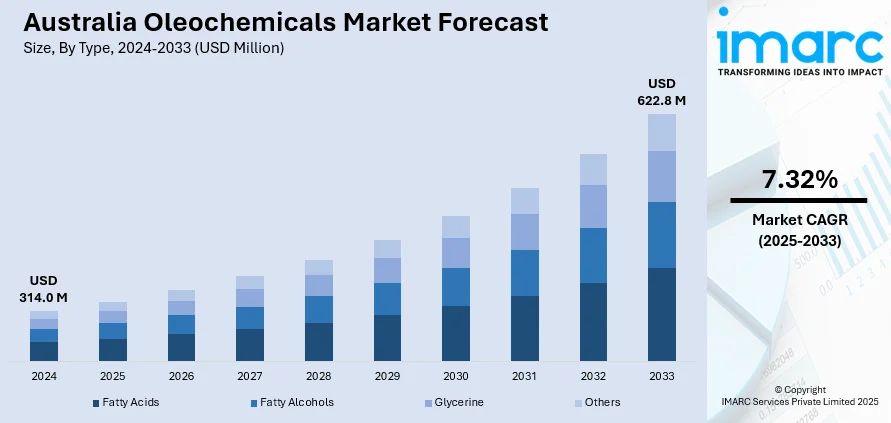

The Australia oleochemicals market size reached USD 314.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 622.8 Million by 2033, exhibiting a growth rate (CAGR) of 7.32% during 2025-2033. Rising demand for biodegradable and sustainable chemicals, increasing usage in personal care and household products, supportive government regulations, expanding applications in lubricants and polymers, and the growing preference for bio-based raw materials are expanding the Australia oleochemicals market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 314.0 Million |

| Market Forecast in 2033 | USD 622.8 Million |

| Market Growth Rate 2025-2033 | 7.32% |

Australia Oleochemicals Market Trends:

Rising Demand for Sustainable Alternatives Boosts Oleochemicals Market

The Australia oleochemicals market growth is primarily driven by the increasing demand for sustainable, biodegradable, and plant-based alternatives to petrochemicals. Oleochemicals—derived primarily from natural fats and oils—are being increasingly adopted across industries such as food and beverage, pharmaceuticals, personal care, and household products. This growth is propelled by rising environmental awareness and stringent regulations on synthetic chemicals. For instance, Global public health and safety organization NSF announced on March 28, 2025, the introduction of NSF Certification Guideline 537 in Australia to confirm that products are free of per- and polyfluoroalkyl substances (PFAS), also referred to as "forever chemicals." As a result, manufacturers are innovating product lines using fatty acids, fatty alcohols, and glycerine to meet consumer demand for eco-conscious goods. Moreover, the integration of circular economy principles and cleaner production technologies are further driving the market. The industry also benefits from Australia's access to abundant feedstocks such as tallow and palm oil derivatives. The growing consumer preference for green labels and Australia’s broader climate goals are reinforcing this transition. With increasing R&D and government backing for bio-based initiatives, oleochemicals are set to replace traditional chemicals across multiple sectors.

To get more information on this market, Request Sample

Expanding Industrial Applications Drive Oleochemicals Adoption

Another major trend shaping Australia’s oleochemicals market is the rising demand across industrial applications including lubricants, plastics, coatings, and resins. With industries increasingly moving towards renewable and low-toxicity inputs, oleochemicals are becoming preferred raw materials. For instance, the Clean Energy Council started the 'Clean Energy Works for Australia' campaign on February 26, 2025, in an effort to combat false information in the country's energy discussion. Nearly 70% of Australians, according to research, are in favor of expanding renewable energy projects. The initiative seeks to provide correct information and promote knowledgeable conversations on the nation's clean energy future. Applications in bio-lubricants, for instance, are seeing traction due to their superior performance and low environmental impact compared to petroleum-based counterparts. Similarly, in the plastic and rubber sectors, fatty acids and esters are replacing traditional additives to create biodegradable and recyclable products. Regulatory frameworks supporting the use of environmentally friendly substances, coupled with advances in oleochemical processing, are making these inputs cost-competitive and technically efficient, which is positively impacting Australia oleochemicals market outlook. Additionally, Australia's participation in sustainable palm oil sourcing and its growing soy and canola sectors provide a robust foundation for oleochemical feedstock. As the market matures, collaborations between local producers and international players are expected to accelerate innovation and reinforce Australia's position in the global oleochemicals landscape.

Australia Oleochemicals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, form, application, and feedstock.

Type Insights:

- Fatty Acids

- Fatty Alcohols

- Glycerine

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes fatty acids, fatty alcohols, glycerine, and others.

Form Insights:

- Liquid

- Solid

- Flakes

- Pellets

- Beads

- Others

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes liquid and solid (flakes, pellets, beads, and others).

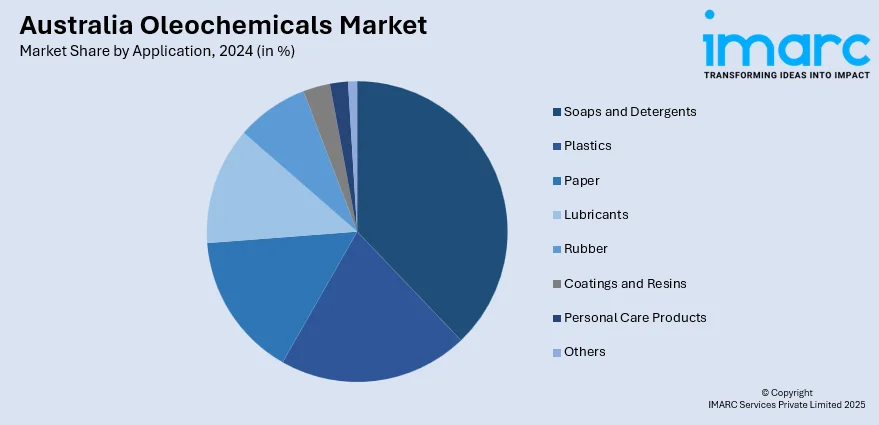

Application Insights:

- Soaps and Detergents

- Plastics

- Paper

- Lubricants

- Rubber

- Coatings and Resins

- Personal Care Products

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes soaps and detergents, plastics, paper, lubricants, rubber, coatings and resins, personal care products, and others.

Feedstock Insights:

- Palm

- Soy

- Rapeseed

- Sunflower

- Tallow

- Palm Kernel

- Coconut

- Others

A detailed breakup and analysis of the market based on the feedstock have also been provided in the report. This includes palm, soy, rapeseed, sunflower, tallow, palm kernel, coconut, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Oleochemicals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Fatty Acids, Fatty Alcohols, Glycerine, Others |

| Forms Covered |

|

| Applications Covered | Soaps and Detergents, Plastics, Paper, Lubricants, Rubber, Coatings and Resins, Personal Care Products, Others |

| Feedstocks Covered | Palm, Soy, Rapeseed, Sunflower, Tallow, Palm Kernel, Coconut, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia oleochemicals market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia oleochemicals market on the basis of type?

- What is the breakup of the Australia oleochemicals market on the basis of form?

- What is the breakup of the Australia oleochemicals market on the basis of application?

- What is the breakup of the Australia oleochemicals market on the basis of feedstock?

- What is the breakup of the Australia oleochemicals market on the basis of region?

- What are the various stages in the value chain of the Australia oleochemicals market?

- What are the key driving factors and challenges in the Australia oleochemicals?

- What is the structure of the Australia oleochemicals market and who are the key players?

- What is the degree of competition in the Australia oleochemicals market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia oleochemicals market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia oleochemicals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia oleochemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)