Australia On-the-go Healthy Snacks Market Size, Share, Trends and Forecast by on Product Type, Nutritional Content, Packaging Type, Distribution Channel, and Region, 2025-2033

Australia On-the-go Healthy Snacks Market Overview:

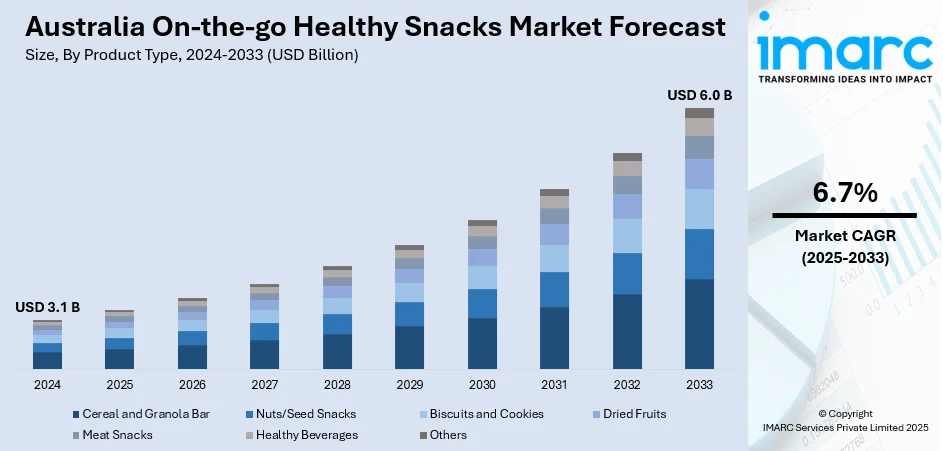

The Australia on-the-go healthy snacks market size reached USD 3.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.0 Billion by 2033, exhibiting a growth rate (CAGR) of 6.7% during 2025-2033. The market is experiencing significant growth mainly due to rising health consciousness, busy urban lifestyles, and demand for clean-label, functional foods. Furthermore, growth is supported by plant-based innovation, diverse retail channels, and increasing preference for portable, nutrient-rich snack options.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3.1 Billion |

| Market Forecast in 2033 | USD 6.0 Billion |

| Market Growth Rate 2025-2033 | 6.7% |

Australia On-the-go Healthy Snacks Market Trends:

Rising Health and Wellness Awareness

Rising health and wellness awareness is driving a noticeable shift in snacking preferences across Australia. This trend is a major contributor to Australia on-the-go healthy snacks market growth, as consumers increasingly seek out options that support active, balanced lifestyles without compromising convenience. Products boasting high protein, low sugar, gluten-free, or vitamin-enriched formulations are gaining traction among fitness enthusiasts, office workers, and busy parents alike. For instance, In November 2024, FULFIL Vitamin & Protein Bars launched in Australia, available exclusively at Woolworths. With flavors like Chocolate Peanut Butter and Chocolate Salted Caramel, each bar contains 9 added vitamins and is low in sugar, perfect for busy lifestyles and on-the-go snacking. The trend is especially strong among Millennials and Gen Z, who value transparency, clean labels, and functional nutrition in their daily diets. As health becomes more deeply integrated into everyday choices, traditional processed snacks are being replaced by nutrient-dense bars, seed mixes, and yogurt-based packs. Retailers and brands are responding with expanded product lines and strategic placement across both physical and digital channels. This continued shift toward wellness-focused consumption supports the Australia on-the-go healthy snacks market outlook.

To get more information on this market, Request Sample

Rising Demand for Plant-Based Snacks

The rise of plant-based and vegan lifestyles in Australia is significantly influencing snack choices, especially in the on-the-go segment. Consumers ranging from dedicated vegans to flexitarians are increasingly gravitating toward plant-powered options that align with ethical, environmental, and health-conscious values. Products such as nut-based bites, protein-rich seed bars, chickpea crisps, and fruit-and-nut trail mixes are becoming mainstream in retail aisles and convenience channels. These snacks offer a clean label appeal with natural ingredients, no animal-derived additives, and often feature functional benefits like fiber, protein, and antioxidants. Reflecting this trend, brands are innovating with vegetables and legumes as core ingredients. For instance, in June 2023, Australian brand Health Guru announced the launch of ‘Health Guru Cauliflower Puffs,’ a new line of plant-based snacks. Available in five flavors, these low-carb, gluten-free puffs are made from freeze-fried cauliflower and baked for a healthier option. The brand aims to meet the rising demand for nutritious on-the-go snacks. Brands are innovating with ingredients like lentils, quinoa, hemp, and coconut to meet rising demand for variety and flavor without compromising on nutrition. Supermarkets, gyms, cafes, and online stores are expanding shelf space for these items, further boosting accessibility. This sustained consumer shift is contributing to the growing Australia on-the-go healthy snacks market share.

Australia On-the-go Healthy Snacks Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on product type, nutritional content, packaging type, and distribution channel.

Product Type Insights:

- Cereal and Granola Bar

- Nuts/Seed Snacks

- Biscuits and Cookies

- Dried Fruits

- Meat Snacks

- Healthy Beverages

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes cereal and granola bar, nuts/seed snacks, biscuits and cookies, dried fruits, meat snacks, healthy beverages, and others.

Nutritional Content Insights:

- Gluten-Free

- Low-Fat

- Sugar-Free

- Others

A detailed breakup and analysis of the market based on the nutritional content have also been provided in the report. This includes gluten-free, low-fat, sugar-free, and others.

Packaging Type Insights:

- Boxes

- Pouches

- Wraps

- Others

A detailed breakup and analysis of the market based on the packaging type have also been provided in the report. This includes boxes, pouches, wraps, and others.

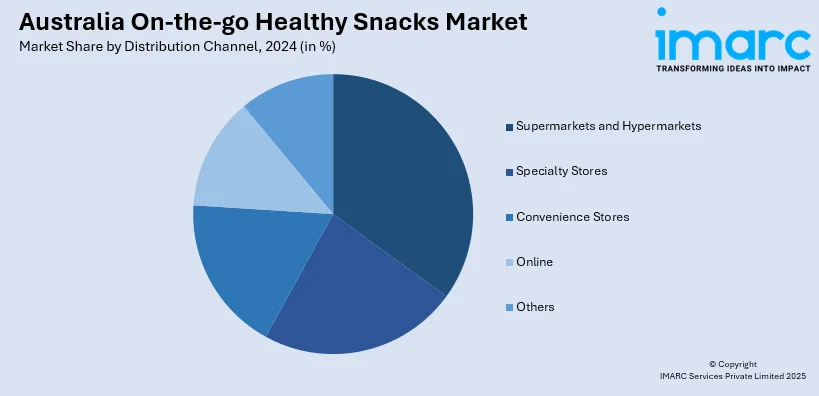

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, convenience stores, online, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia On-the-go Healthy Snacks Market News:

- In April 2025, Majans, an Australian company, announced a significant brand refresh for its Infuzions snack range, featuring new packaging and positioning aimed at health-conscious consumers. In collaboration with Asprey, the updated branding includes a new Veggie Straws flavour and a Salt & Balsamic Vinegar option, reaffirming Infuzions' commitment to innovative, better-for-you snacking options.

- In February 2025, Healthier Tastier Foods announced the launch of Frisp, a range of freeze-dried fruits catering to Australia’s growing demand for healthy snacks. With no added sugar and preserved nutrients, Frisp appeals to conscious consumers.

Australia On-the-go Healthy Snacks Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Cereal and Granola Bar, Nuts/Seed Snacks, Biscuits and Cookies, Dried Fruits, Meat Snacks, Healthy Beverages, Others |

| Nutritional Contents Covered | Gluten-Free, Low-Fat, Sugar-Free, Others |

| Packaging Types Covered | Boxes, Pouches, Wraps, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, Online, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia on-the-go healthy snacks market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia on-the-go healthy snacks market on the basis of product type?

- What is the breakup of the Australia on-the-go healthy snacks market on the basis of nutritional content?

- What is the breakup of the Australia on-the-go healthy snacks market on the basis of packaging type?

- What is the breakup of the Australia on-the-go healthy snacks market on the basis of distribution channel?

- What is the breakup of the Australia on-the-go healthy snacks market on the basis of region?

- What are the various stages in the value chain of the Australia on-the-go healthy snacks market?

- What are the key driving factors and challenges in the Australia on-the-go healthy snacks market?

- What is the structure of the Australia on-the-go healthy snacks market and who are the key players?

- What is the degree of competition in the Australia on-the-go healthy snacks market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia on-the-go healthy snacks market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia on-the-go healthy snacks market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia on-the-go healthy snacks industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)