Australia Online Alcohol Delivery Market Size, Share, Trends and Forecast by Type, Delivery Place, and Region, 2025-2033

Australia Online Alcohol Delivery Market Size and Growth Overview:

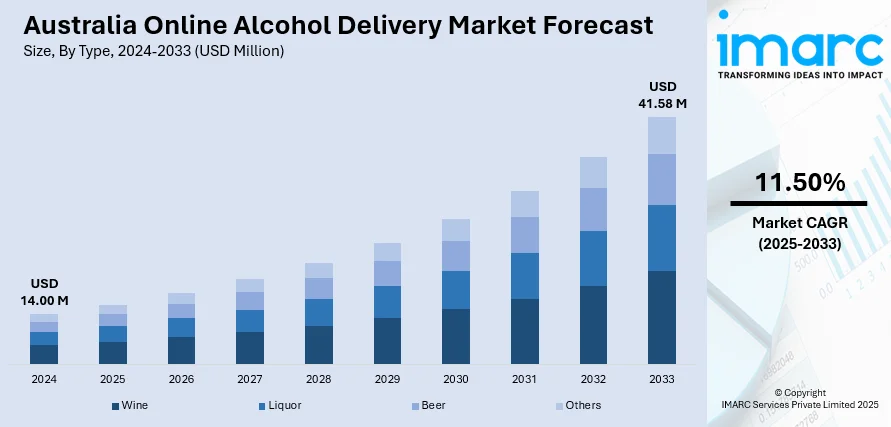

The Australia online alcohol delivery market size reached USD 14.00 Million in 2024. Looking forward, the market is expected to reach USD 41.58 Million by 2033, exhibiting a growth rate (CAGR) of 11.50% during 2025-2033. The market is driven by the growing consumer demand for convenience and rapid delivery through integrated digital platforms. The rise of premium and craft alcohol preferences is encouraging retailers to offer curated, high-quality selections. Additionally, evolving regulations are prompting responsible service practices, such as age verification and limited delivery hours, shaping safer and more compliant operations. These trends collectively enhance customer experience, promote trust, and support the sustainable growth of alcohol e-commerce across the country further impelling the Australia online alcohol delivery market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 14.00 Million |

| Market Forecast in 2033 | USD 41.58 Million |

| Market Growth Rate 2025-2033 | 11.50% |

Key Trends of Australia Online Alcohol Delivery Market:

Rise of Quick Commerce and Integrated Delivery Platforms

The growth of quick commerce is reshaping how Australians buy alcohol online. Consumers now expect faster delivery options, often within minutes or just over half an hour. This shift is being fueled by digital platforms that integrate alcohol offerings with broader grocery delivery services. Customers value the convenience of ordering alcohol alongside their everyday items, all from a single app or website. These platforms are improving user experience through features like real-time tracking, easy reordering, and curated recommendations. The appeal of speed and simplicity has become a key driver, especially among younger, tech-savvy demographics. As delivery services evolve, speed and integration are no longer luxuries they’re becoming baseline expectations. Australia online alcohol delivery market trends reflect this transformation, highlighting how retailers that fail to adapt may lose out to more agile competitors that focus on convenience and seamless digital experiences.

To get more information on this market, Request Sample

Growing Digital Adoption and Changing Consumer Behavior

The exponential development of digital technology usage in Australia is a key enabler of the online liquor delivery business. Internet penetration hit 94.9% in 2024, with more than 25 million Australians spending close to six hours a day online. Such extensive connectivity, supported by high smartphone penetration, has revolutionized shopping. Increasingly, consumers particularly younger generations find it preferable to browse and buy liquor online due to convenience, choice, and time saved. The COVID-19 pandemic also boosted this trend, with most adhering to online delivery services. Merchants take advantage of these trends via digital marketing, real-time personal recommendations, and frictionless payment solutions. With increasing digital literacy and e-commerce infrastructure, the Australia online alcohol delivery market demand is poised for long-term growth, fueled by changing consumer habits and a need for frictionless convenient shopping.".

Premiumization and Demand for Craft & Local Selections

Australian drinkers are more frequently opting for quality over quantity when making liquor buys. There's a definite shift towards premium, craft, and locally made drinks with unique taste and narratives. Consumers are attracted to products with artisanal values, such as small-batch liquors, organic wines, and small-batch craft beers. The demand is about flavor along with a desire to support local makers and to have a more intimate experience. Digital platforms are capitalizing on the trend by promoting one-of-a-kind offerings, providing curated boxes, and providing the history of each product. This premiumization trend aids delivery services in standing out in an oversaturated marketplace. Consumers will continue to venture beyond the standard brands, and companies that highlight variety and authenticity are most likely to gain customer loyalty. This trend provides room for innovation and creativity in packaging, flavor profiles, and presentation thereby bolstering the Australia online alcohol delivery market growth.

Growth Drivers of Australia Online Alcohol Delivery Market:

Urban Lifestyle and Convenience-Driven Demand

One of the most significant drivers of Australia online alcohol market is the urban lifestyle that is increasingly convenience- and time-efficient-oriented. As more Australians reside in cities and live busy lifestyles, the attractiveness of direct door delivery of alcohol has grown stronger. Most consumers now opt to order online instead of buying from in-store inventory, particularly at social events, dinner parties, or lazy weekends spent at home. Such convenience is further appealing in concentrated cities such as Sydney, Melbourne, and Brisbane, where connectivity to the many on-demand delivery options is extremely convenient. The allure of last-minute entertaining, coupled with the growing incorporation of alcohol delivery into popular food and grocery apps, has institutionalized the practice across several age cohorts. Furthermore, after-hours and weekend usage further charges sales, as customers use digital platforms to preserve social spontaneity without the inconvenience of physical travel. Such changing lifestyle practices greatly compound the uptake and frequency of online alcohol shopping.

Integration with Hospitality and Event-Based Consumption

According to the Australia online alcohol delivery market analysis, another prime driver of the industry is its deepening alignment with hospitality and event-driven consumption patterns. With several Australians choosing to host private parties at home or mark special occasions with close friends and family, the demand for trustworthy alcohol delivery has risen in tandem. Online sites are responding to this trend by providing customized party packages, mixology kits, and group discounts for bulk orders. Some even partner with local brewers or sommeliers to create tasting flights that can be brought right to your doorstep, erasing the boundary between hospitality and retail. Where outdoor socializing and house-party etiquette are culturally sanctioned, like a backyard barbecue or beach party, the convenience of being able to easily obtain quality drinks without having to go out to a shop increases. By serving Australia's event-driven lifestyle, online alcohol delivery businesses are accessing repeat-use situations, enhancing order frequency and customer loyalty.

Regulatory Evolution, Responsible Service, and Delivery Innovation

Australia's online alcohol delivery market is influenced by changing regulatory environments that weigh innovation against consumer protection. Companies need to navigate intricate licensing procedures, such as holding packaged liquor licences, adopting strict age verification practices, and guaranteeing compliance with responsible service obligations. Emerging drivers also involve required training (such as RSA certification), ID verification in real-time using digital means, and controlled delivery practices intended to stop underage or drunk person deliveries. Tightening rules on late-night ordering and rapid-delivery windows is occurring in some areas to respond to issues surrounding alcohol-related harms. Operationally, delivery models have expanded, from rapid 30-minute fulfilment to same-day and appointment-based delivery options, providing flexibility while retaining compliance with responsible service protocols. Players are putting their money into AI-powered logistics, digital compliance solutions, and safe delivery protocols, which build customer confidence and defend a safety focus. This careful combination of regulative responsiveness and service innovation is the secret to continued sustainable, scalable growth in Australia's online alcohol delivery market.

Australia Online Alcohol Delivery Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and delivery place.

Type Insights:

- Wine

- Liquor

- Beer

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes wine, liquor, beer, and others.

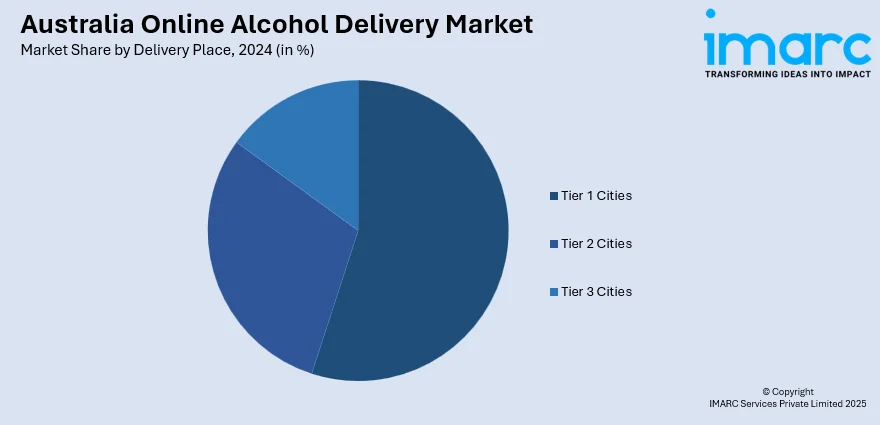

Delivery Place Insights:

- Tier 1 Cities

- Tier 2 Cities

- Tier 3 Cities

A detailed breakup and analysis of the market based on the delivery place have also been provided in the report. This includes tier 1 cities, tier 2 cities, and tier 3 cities.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Bottle Stop

- Dan Murphy's

- DoorDash

- Go Booze

- Liquor Loot

- Liquoroo Pty Ltd

- MILKRUN Delivery Pty Limited

- Paul's Liquor

- Tipple

Australia Online Alcohol Delivery Market News:

- In November 2024, Online bottle shop Jimmy Brings is partnering with delivery service MILKRUN, both linked to the Woolworths and Endeavour Groups. This collaboration will expand MILKRUN’s alcohol selection to over 2,000 products, alongside more than 10,000 grocery items. The partnership aims to offer customers a wider variety of alcohol options and more convenience, making it easier and potentially cheaper for shoppers to get their favorite drinks delivered quickly.

- In April 2024, Australian company Just Wines has acquired spirits retailer Liquor Loot for AU$1.2 million, following its recent purchase of alcohol-free brand Sans Drinks. Liquor Loot, known for its craft spirit subscription service, entered voluntary administration last month. Just Wines’ founder, Nitesh Bhatia, said the acquisition expands their portfolio into spirits, broadening market appeal and strengthening their competitive position in the liquor and beverage industry.

Australia Online Alcohol Delivery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Wine, Liquor, Beer, Others |

| Delivery Places Covered | Tier 1 Cities, Tier 2 Cities, Tier 3 Cities |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Bottle Stop, Dan Murphy's, DoorDash, Go Booze, Liquor Loot, Liquoroo Pty Ltd, MILKRUN Delivery Pty Limited, Paul's Liquor, Tipple, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia online alcohol delivery market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia online alcohol delivery market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia online alcohol delivery industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia online alcohol delivery market was valued at USD 14.00 Million in 2024.

The Australia online alcohol delivery market is projected to exhibit a CAGR of 11.50% during 2025-2033

The Australia online alcohol delivery market is expected to reach a value of USD 41.58 Million by 2033.

The Australia online alcohol delivery market is witnessing trends like rapid delivery services, curated beverage subscriptions, and growing demand for premium craft products. Integration with food delivery apps and increased mobile ordering enhance accessibility, while consumer preference for convenience and at-home socializing further continues to shape innovation and service diversification in the sector.

The Australia online alcohol delivery market is driven by urban lifestyle shifts, growing demand for convenience, and digital integration with food and event services. Enhanced logistics, personalized offerings, and evolving consumer habits continue to boost adoption. Regulatory compliance and responsible service frameworks also support sustainable market growth across key metropolitan regions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)