Australia Online Car Buying Market Size, Share, Trends and Forecast by Vehicle Type, Propulsion Type, Category, and Region, 2025-2033

Australia Online Car Buying Market Overview:

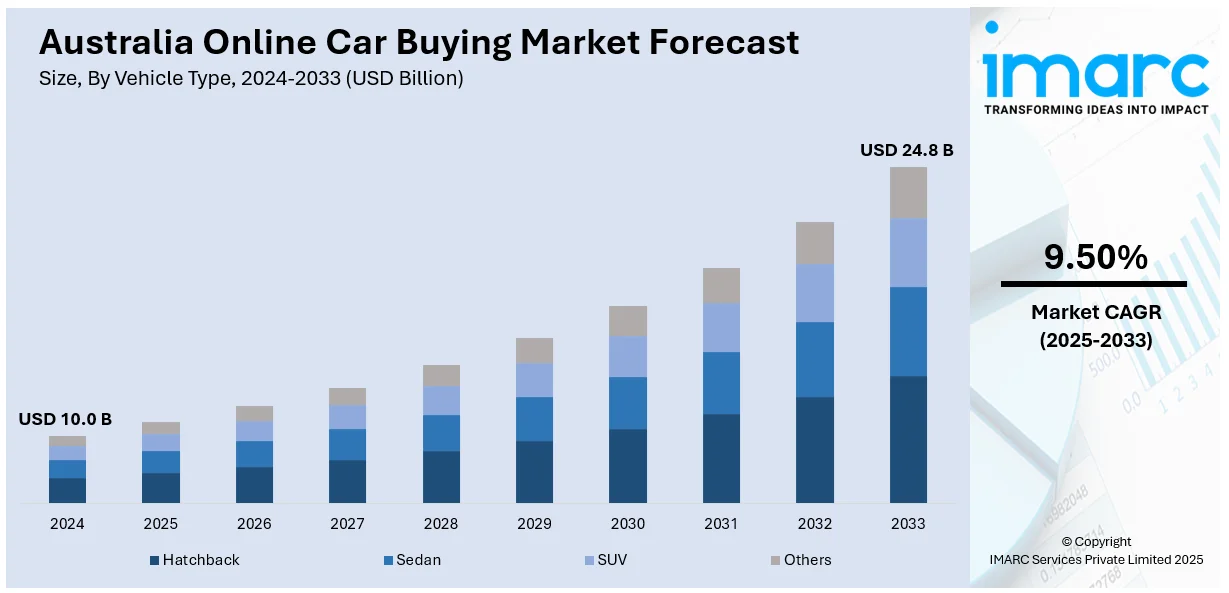

The Australia online car buying market size reached USD 10.0 Billion in 2024. Looking forward, the market is projected to reach USD 24.8 Billion by 2033, exhibiting a growth rate (CAGR) of 9.50% during 2025-2033. The market is growing, fueled by such trends as growing digital adoption, convenience demand, and contactless payments. Moreover, virtual showrooms, convenient price comparison, digital financing, and improved consumer confidence in secure online channels are positively impacting the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10.0 Billion |

| Market Forecast in 2033 | USD 24.8 Billion |

| Market Growth Rate 2025-2033 | 9.50% |

Key Trends of Australia Online Car Buying Market:

Digital Transformation in Used Vehicle Sales

The Australian used car market for online buying has seen tremendous growth fueled by technology improvements in digital platforms. Among the trends witnessed is the increase in rethought-used vehicle sites that improve customer experience and enhance conversion rates. Consumers are demanding more seamless, intuitive online experiences when buying cars, which creates increased expectations for digital platforms. This trend follows the general call for convenience, personalization, and efficiency in the online buying experience. For example, in March 2023, Toyota Australia launched its revamped used vehicle website powered by Sitecore XM Headless. This strategic development focused on improving website performance and user engagement. The new platform led to a remarkable 25% increase in conversion rates, a 35% reduction in bounce rates, and a 70% boost in time spent on the site. These enhancements show that an optimally optimized online presence can have a strong impact on consumer behavior, fueling growth in the competitive Australian online car market. The trend emphasizes the need for ongoing digital innovation to address changing consumer needs. As competition grows, automotive retailers are investing in cutting-edge technologies to improve website functionality, simplify the buying process, and develop compelling digital experiences that appeal to today's car buyers.

To get more information on this market, Request Sample

Rising Demand for Hassle-Free Car Buying

The Australian online car buying market is expanding rapidly, fueled by the increasing demand for hassle-free car purchasing experiences. Consumers are increasingly seeking the convenience of browsing, comparing, and purchasing vehicles online without the need to visit multiple dealerships. This shift is driven by the desire for time efficiency, as online platforms allow users to explore a wide range of models, check prices, and read reviews from the comfort of their homes. Technological advancements, such as virtual showrooms, 360-degree car views, and AI-powered recommendation engines, have made the process more interactive and user-friendly. The COVID-19 pandemic further accelerated this trend, as restrictions and safety concerns pushed many buyers toward digital solutions. Even as the situation improved, the convenience of online car buying remained attractive. Additionally, the availability of digital financing options, online vehicle inspections, and secure payment methods has increased consumer confidence in making purchases without physical interactions. As digital literacy grows and e-commerce continues to thrive, the online car-buying market in Australia is set to grow, driven by the demand for seamless, transparent, and efficient car shopping experiences.

Virtual Showrooms and Digital Retailing

The emergence of virtual showrooms and digital retailing technologies is changing the landscape of vehicle purchases in Australia. Consumers can now engage with immersive 3D settings, embark on virtual tours, and utilize online configurators to tailor vehicles from their homes. This advancement reduces the necessity for numerous visits to dealerships, thus simplifying the decision-making process and enhancing convenience. These innovations particularly attract tech-savvy consumers who prioritize speed, transparency, and digital independence. Automotive brands and online platforms are focusing on creating user-friendly interfaces and augmented reality experiences to mimic real-life interactions. As a consequence, customer involvement is increasing, and conversion rates are on the rise. This transition toward digital retailing is crucial for broadening the Australia online car buying market share, making it a significant trend influencing the industry's future.

Growth Drivers of Australia Online Car Buying Market:

Digital Literacy and Internet Penetration

Australia's growing digital proficiency is fundamentally transforming the car-buying process. With a significant portion of the population comfortable using digital platforms for significant transactions, trust in buying high-value items like vehicles online has expanded remarkably. Consumers are now capable of researching, comparing models, and completing purchases through websites and apps, bypassing dealership visits entirely. This digital assurance is bolstered by dependable internet access across urban and regional locations, enhancing the reach of online car-buying platforms. As automotive brands and marketplaces enhance their digital offerings, user confidence continues to rise. This trend is particularly evident among younger buyers who seek speed, transparency, and self-directed experiences. This shift significantly contributes to the expanding according to Australia online car buying market analysis.

Contactless Transactions Reshaping Buyer Preferences

Following the COVID-19 pandemic, consumer behavior has notably shifted toward prioritizing safety, convenience, and minimal physical interaction. These changes have intensified the preference for contactless transactions, even for high-value purchases such as vehicles. Online car-buying platforms are now addressing this demand by providing services like digital documentation, virtual vehicle tours, and home test drives. Customers can manage the entire purchasing process from selection to delivery without visiting a dealership. This smooth, low-contact experience appeals to health-conscious consumers and those wanting to avoid lengthy in-person visits. Consequently, many buyers now perceive digital-first platforms as safer and more efficient alternatives, further boosting Australia online car buying market demand.

End-to-End Online Services Enhancing Buyer Experience

The rise of comprehensive digital solutions is revolutionizing the online car-buying experience in Australia. Platforms are advancing beyond basic vehicle listings to include integrated services such as immediate financing, trade-in assessments, insurance options, warranty offerings, and home delivery. This holistic approach streamlines the buying process and minimizes the need for multiple third-party interactions. Buyers enjoy increased transparency, expedited decision-making, and less paperwork, all from a single platform. These all-in-one solutions are particularly appealing to first-time car buyers and busy professionals looking for efficiency and convenience. The ease of end-to-end digital transactions improves customer satisfaction and fosters long-term trust in online channels. This integrated approach is playing a vital role in driving Australia online car buying market growth.

Opportunities of Australia Online Car Buying Market:

Expansion into Regional and Remote Areas

Australia's vast landscape offers a significant opportunity for online car-buying platforms to cater to consumers in regional and remote locations who face limited access to conventional dealerships. By providing a larger selection of vehicles online and enabling remote test drives or home delivery options, these platforms can address the mobility needs of buyers beyond major urban centers. Features like digital listings, 360° vehicle views, and virtual consultation tools enhance accessibility and instill confidence in rural customers. This approach narrows the urban-rural gap in vehicle availability and positions online retailers as convenient and inclusive alternatives to traditional dealerships. With improvements in digital infrastructure in rural regions, this market segment holds substantial growth potential for expanding the Australia online car-buying market reach.

Integration of Financing and Insurance

Online car-buying platforms are increasingly combining vehicle financing and insurance options to create a more cohesive purchasing experience. This integration removes the necessity for buyers to visit various institutions for loan approvals or insurance coverage, thus saving time and minimizing hassle. Tools like instant loan calculators, pre-approvals, EMI plans, and on-platform insurance quotes provide users with transparency and control. Such financial resources also make online platforms more comprehensive, motivating customers to complete their purchasing journey within the digital environment. For first-time buyers or those looking for convenience, this consolidated approach delivers exceptional value. As consumer expectations for all-in-one solutions grow, integrated financing and insurance services are becoming vital competitive advantages in the Australia online car-buying market.

AI and Data-Driven Personalization

Artificial intelligence and data analytics are paving the way for customized shopping experiences on car-buying platforms. By examining browsing habits, preferences, budget ranges, and location details, these platforms can suggest appropriate vehicles, recommend financing choices, and offer time-sensitive deals. This targeted strategy enhances the relevance of offerings, boosts engagement, and increases conversion rates. Personalization also extends to follow-up services, such as reminders for test drives, price reductions, and service schedules. Furthermore, predictive analytics assists platforms in anticipating demand and managing inventory more effectively. In a competitive landscape, these tailored digital interactions can help differentiate a platform and elevate customer satisfaction. As AI technologies advance, data-driven personalization will play a central role in boosting efficiency and driving growth in the Australia online car-buying market.

Challenges of Australia Online Car Buying Market:

Lack of Physical Inspection

Despite increasing trust in digital platforms, many Australian car buyers remain reluctant to finalize purchases without physically inspecting the vehicle. The inability to test drive, examine interiors, or assess condition in person continues to be a significant obstacle for online-only transactions. This concern is especially evident with used vehicles, where physical wear and previous usage are more difficult to evaluate digitally. Although features like 360° videos, comprehensive listings, and inspection reports assist, they may not entirely replace the tangible experience. To mitigate this issue, some platforms have introduced return policies or hybrid models that include optional in-person appointments. However, until a larger number of consumers feel comfortable with remote evaluations, this challenge will persist in limiting the full potential of the Australia online car-buying market.

Trust and Transparency Concerns

Trust remains a major challenge within the online car-buying experience. Buyers frequently harbor doubts regarding the accuracy of vehicle descriptions, hidden fees, service histories, and overall transparency. Concerns surrounding post-sale service, warranty support, and dispute resolution further deter high-value online transactions. New users particularly require reassurance that the online representation accurately reflects the product they will receive. To tackle this, platforms must adopt transparent pricing, third-party inspections, verified listings, and dependable customer support. Establishing trust also involves supplying detailed documentation, secure payment systems, and visible customer reviews. In the absence of these measures, online platforms risk losing credibility and buyer confidence, making trust-building essential for sustainable success in the Australia online car-buying market.

Logistics and Delivery Complexities

Effective vehicle delivery is crucial for online car-buying platforms, particularly when serving remote or interstate customers. However, moving cars over long distances necessitates strong logistical coordination, secure handling, and real-time tracking challenges that many platforms continue to face. Delays, vehicle damage during transport, or unclear delivery timelines can severely affect customer satisfaction. Furthermore, some buyers may be hesitant to proceed without knowing precisely when or how their vehicle will arrive. To address this, companies must invest in reliable logistics solutions and streamlined processes to improve delivery efficiency and customer satisfaction. Streamlining fulfillment is vital for operational efficiency and for building trust and scaling the Australia online car-buying market.

Australia Online Car Buying Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on vehicle type, propulsion type, and category.

Vehicle Type Insights:

- Hatchback

- Sedan

- SUV

- Others

The report has provided a detailed breakup and analysis of the market based on the vehicle type. This includes hatchback, sedan, SUV, and others.

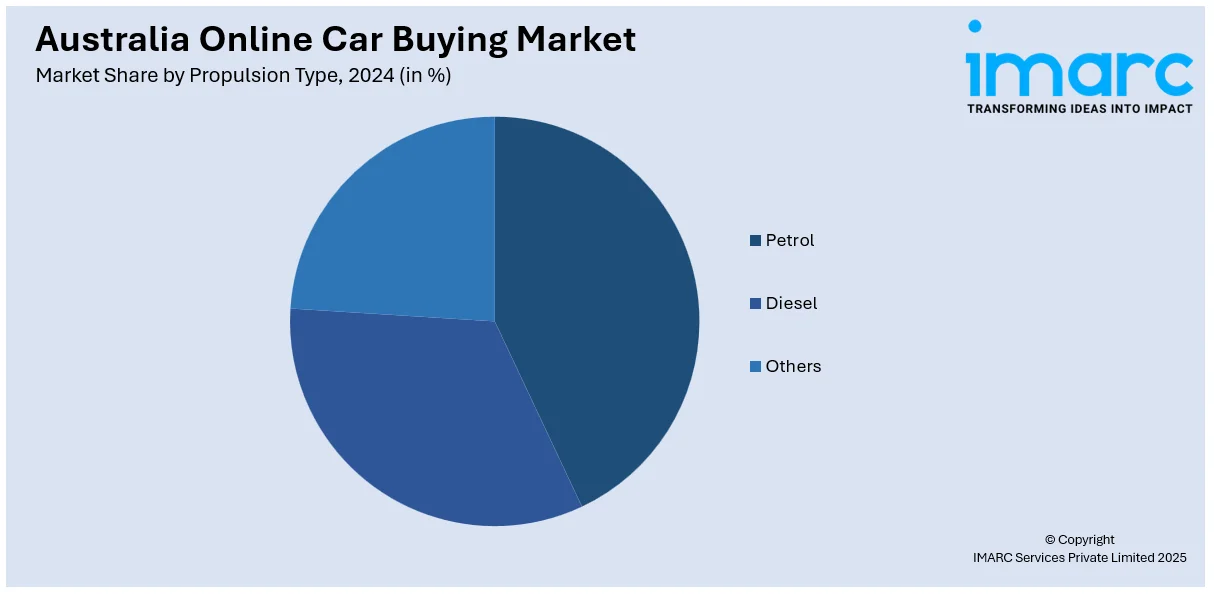

Propulsion Type Insights:

- Petrol

- Diesel

- Others

A detailed breakup and analysis of the market based on the propulsion type have also been provided in the report. This includes petrol, diesel, and others.

Category Insights:

- Pre-Owned Vehicle

- New Vehicle

A detailed breakup and analysis of the market based on the category have also been provided in the report. This includes pre-owned vehicle and new vehicle.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Online Car Buying Market News:

- October 2024: Carsales partnered with Monoova to launch a secure payments solution for online car buying in Australia. The platform enhanced buyer-seller trust, reduced fraud risks, and streamlined transactions, setting a new standard for safety and efficiency in the digital automotive marketplace.

- October 2024: Carma appointed Sling & Stone to boost its presence in the Australian online car buying market. The partnership aimed to enhance trust in pre-owned car purchases, driving Carma’s growth with innovative marketing strategies, reshaping the used car buying experience across Australia.

Australia Online Car Buying Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Vehicle Types Covered | Hatchback, Sedan, SUV, Others |

| Propulsion Types Covered | Petrol, Diesel, Others |

| Categories Covered | Pre-Owned Vehicle, New Vehicle |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia online car buying market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia online car buying market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia online car buying industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The online car buying market in Australia was valued at USD 10.0 Billion in 2024.

The Australia online car buying market is projected to exhibit a compound annual growth rate (CAGR)of 9.50% during 2025-2033.

The Australia online car buying market is expected to reach a value of USD 24.8 Billion by 2033.

The market is witnessing increased use of AI-powered recommendations, mobile-first browsing, and integration of subscription-based vehicle models. Enhanced digital experiences through 360° car views and seamless documentation processes are also gaining traction, as consumers prioritize speed, transparency, and convenience in their car-buying journey.

Rising consumer demand for flexible, contactless transactions and time-saving digital solutions is accelerating online car sales. The availability of bundled services like financing, trade-ins, and home delivery, along with growing internet penetration and evolving buyer behavior, are key factors propelling market expansion across both new and used car segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)