Australia Online Education Market Size, Share, Trends and Forecast by Type, Provider, Technology, End User, and Region, 2026-2034

Australia Online Education Market Overview:

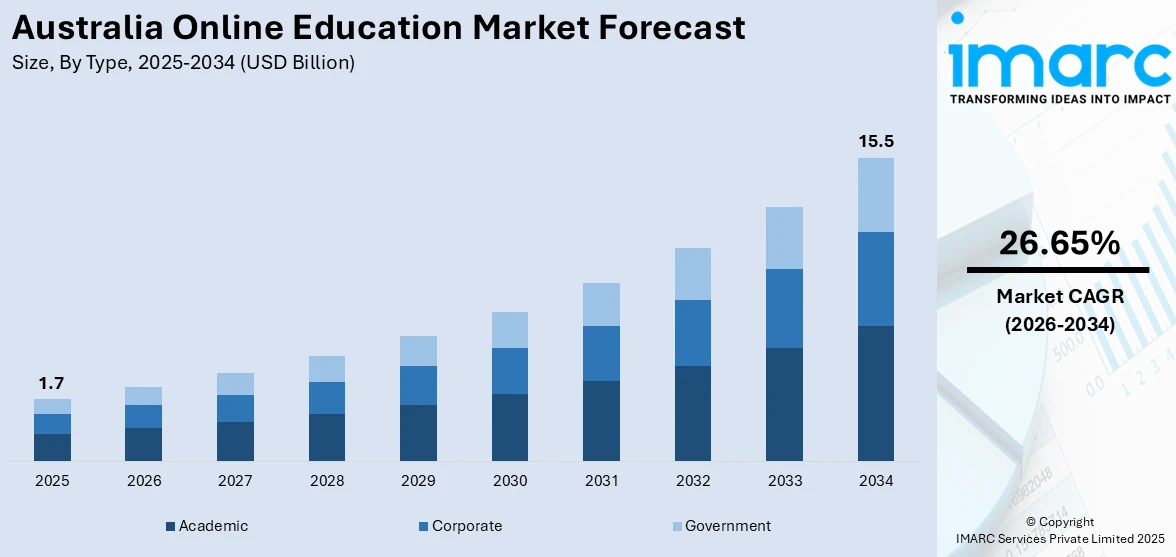

The Australia online education market size reached USD 1.7 Billion in 2025. Looking forward, the market is expected to reach USD 15.5 Billion by 2034, exhibiting a growth rate (CAGR) of 26.65% during 2026-2034. The market is witnessing significant growth, driven by increased internet penetration, flexible learning preferences, and rising demand for upskilling and professional certification programs. Universities, vocational institutes, and private platforms are investing in interactive content, AI-based learning tools, and hybrid models. Government support for digital education and corporate training initiatives further supports growth, contributing to a steadily rising Australia online education market share across academic and non-academic segments.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.7 Billion |

| Market Forecast in 2034 | USD 15.5 Billion |

| Market Growth Rate 2026-2034 | 26.65% |

Key Trends of Australia Online Education Market:

Expansion in Corporate E-Learning

The corporate sector in Australia is playing a major role in driving the expansion of online learning through greater investment in digital training solutions. Companies across sectors are focusing on ongoing learning and professional development to stay ahead of changing technologies, regulatory requirements, and competitive forces. Online platforms providing customizable training modules in compliance, technical skills, leadership, and soft skills are being widely adopted. For instance, in October 2024, Laing O'Rourke Australia launched LOR Learn, a new learning platform for its 2,500 employees, in collaboration with SAP. The platform offers personalized, role-specific training and has increased resource accessibility, with 700 employees benefiting monthly. The initiative aims to enhance career development, employee engagement, and retention within the company. The scalability and flexibility of such solutions enable organizations to train big, dispersed workforces cost-effectively while saving on travel and infrastructure expenses. Several companies are also combining learning management systems (LMS) with employee performance monitoring to tie training to business results. With remote and hybrid work arrangements now the norm, digital upskilling is crucial to workforce productivity. This trend is likely to continue, reinforcing the position of corporate e-learning in the overall growth of Australia's online education system.

To get more information on this market Request Sample

Growing Adoption of Hybrid Learning Models

Hybrid models of learning are becoming a central strategy for Australian schools as they attempt to reconcile the advantages of online and classroom-based teaching. By combining online modules with face-to-face classroom sessions, universities, vocational colleges, and training providers are providing students with more flexibility to learn at their own pace while still having access to collaborative and practical experiences. For instance, in May 2024, the Australian Institute of Higher Education announced plans to launch Hybrid-1. This course brings together one day of on-campus study with variable online access to lectures. This new model gives students a complete education and latest technology with the flexibility required in today's workplace. It keeps students ready for future employment within a hybrid work environment. This method responds to different needs of learners, such as working professionals, students in rural settings, and overseas students. The hybrid models also allow institutions to make better utilization of campus assets and extend courses beyond geographical barriers. Application of technology in forms like video courses, interactive simulation, and online labs is adding depth to learning, whereas onsite sessions provide peer-to-peer communication and feedback. This seamless integration of learning formats is attracting wider participation and contributing significantly to Australia online education market growth across both academic and professional education sectors.

Growth Drivers of Australia Online Education Market:

Rising Demand for Lifelong Learning and Upskilling

As the Australian workforce adapts to rapid technological changes, more individuals are seeking continuous education to remain employable and future-ready. Traditional degrees are no longer sufficient to meet the pace of industry transformation. Australians—across age groups and professions—are enrolling in online platforms offering vocational certifications, short-term specializations, and professional development courses. These digital programs provide flexibility and relevance, allowing learners to study on their terms while directly applying new skills in real-time work environments. The rise of the gig economy, remote work, and cross-functional roles has further accelerated this shift. Unlike conventional institutions, online platforms cater to dynamic career paths, enabling on-demand learning that aligns with real-world job requirements, thus solidifying their role as a primary upskilling channel.

Advancements in Digital Infrastructure and Connectivity

Australia’s substantial improvements in digital infrastructure have significantly strengthened the foundation for online education. Nationwide expansion of the National Broadband Network (NBN), growing 5G coverage, and greater affordability of digital devices have enabled seamless access to learning platforms across both urban and rural communities. According to the Australia online education market analysis, these advancements support high-quality content delivery, such as interactive lectures, live sessions, and multimedia-rich materials. Even in previously underserved areas, learners can now access the same resources as those in major cities, reducing educational inequality. Additionally, more schools and institutions are integrating cloud-based systems and virtual classrooms, enhancing collaboration and accessibility. This growing digital ecosystem continues to fuel the reach, effectiveness, and inclusivity of online education across Australia’s diverse geography.

Increased Student Demand for Flexible and Personalized Learning

Today’s learners, especially Gen Z, millennials, and working adults, are no longer satisfied with rigid academic structures. Instead, they seek education that adapts to their schedules, learning speeds, and career goals. Online platforms offering personalized learning paths, AI-driven suggestions, and real-time performance analytics are gaining momentum. These features allow students to focus on strengths, close knowledge gaps efficiently, and build confidence in specific areas of interest. Personalization not only improves engagement but also reduces dropout rates and boosts long-term learning outcomes. This shift away from standardized teaching toward learner-centric models is reshaping expectations across the education sector. As personalization continues to evolve, online education providers are becoming preferred choices for those demanding flexible, effective, and tailored academic experiences.

Government Support of Australia Online Education Market:

Federal Funding for EdTech and Digital Transformation

The Australian government continues to play a central role in strengthening the country’s online education infrastructure through strategic funding initiatives. Programs such as the Digital Education Revolution and sustained investment in the National Broadband Network (NBN) have laid the foundation for reliable digital access across both urban and regional areas. These efforts aim to reduce the digital divide and ensure equitable learning opportunities for all Australians. Beyond infrastructure, the government has introduced grants and financial incentives to encourage collaboration between educational institutions and EdTech companies. These partnerships are fostering innovation in content delivery, platform design, and learning analytics. By improving access and digital capability, federal support is enabling more institutions, particularly in underserved communities, to expand their online education offerings and reach broader learner demographics.

Policy Frameworks Encouraging Online Learning Integration

Government policy in Australia has increasingly evolved to support the mainstream adoption of online and blended education across both public and private institutions, which is further driving the Australia online education market demand. Regulatory bodies now recognize online qualifications as equal in credibility to traditional, campus-based degrees, helping to build trust among students, employers, and educators alike. This shift has led universities, TAFEs, and independent training providers to formally incorporate digital programs into their core curricula. Updated guidelines from national education authorities also allow for quality assurance and compliance specific to virtual learning models. As a result, educational institutions are more confident in investing in long-term digital strategies. These supportive policy frameworks are not only modernizing Australia’s education system but also accelerating the adoption of online education as a viable and respected pathway.

Skills Recognition and Micro-Credentialing Initiatives

In response to the fast-changing labor market, the Australian government has launched several initiatives to promote micro-credentials and skills-based certification. These short, targeted learning modules allow individuals to quickly gain practical knowledge in high-demand fields such as digital technology, healthcare, and renewable energy. Through partnerships with TAFE institutions and industry groups, these programs ensure that training remains relevant and directly aligned with workforce needs. National frameworks have also been introduced to formalize the recognition of micro-credentials, allowing them to be stacked toward larger qualifications or professional pathways. This skills-first approach enables learners to remain competitive and agile without the time or cost commitment of full degrees. Government support for such initiatives is helping position online education as a key driver of national workforce development.

Opportunities of Australia Online Education Market:

International Student Enrollment via Online Platforms

Australia's global reputation for academic excellence presents a strong opportunity to attract international students through online education. Many potential learners, particularly from developing countries, face challenges related to relocation costs, visa restrictions, or work commitments. Offering fully virtual programs allows Australian universities and EdTech platforms to tap into this untapped global demand without expanding physical infrastructure. These online degrees and certifications, when tailored to suit international learners—with flexible time zones, localized support, and culturally relevant content—can create new revenue streams while enhancing Australia's position in global education. Additionally, partnerships with overseas institutions or agencies can help facilitate enrollment and recognition of qualifications, further supporting this outreach. The scalability of online platforms allows education providers to grow their international footprint with minimal operational overhead.

Expansion into Niche and Specialized Learning Segments

Australia's online education sector holds vast potential in catering to niche and specialized learning areas that are often underserved in traditional academia. Subjects such as Indigenous knowledge, permaculture, marine conservation, agriculture technology, creative writing, and sustainability are gaining interest among both professionals and personal learners. Online modules focused on these areas allow institutions to diversify their course offerings and reach new student demographics. These programs are especially attractive to adult learners, hobbyists, and individuals seeking to explore specific areas of interest or transition into emerging industries. By tailoring content to smaller yet passionate audiences, providers can carve out loyal learner communities and enhance engagement. This strategic focus on niche segments also helps education brands differentiate themselves in a competitive digital market, unlocking long-term growth opportunities.

Integration with Career Placement and Job Matching Services

One of the most promising opportunities in Australia’s online education market lies in connecting learning outcomes directly to career pathways. By partnering with job portals, recruitment agencies, and corporate employers, online education platforms can offer integrated “learn-and-earn” ecosystems. These systems allow students to transition smoothly from acquiring skills to securing employment, particularly in high-demand industries like tech, healthcare, logistics, and digital marketing. Course completion can trigger access to interviews, internships, or job placement assistance, dramatically increasing the perceived value of education programs. Such partnerships not only boost learner confidence and satisfaction but also build a strong platform loyalty. For institutions and EdTech firms, aligning education with employment outcomes helps attract working professionals and job seekers looking for direct return on investment from their studies.

Challenges of Australia Online Education Market:

Digital Divide in Rural and Remote Regions

While Australia has made strides in digital infrastructure, a significant digital divide still exists, especially in rural and remote communities. Many learners in these areas struggle with unreliable internet connections, limited access to digital devices, and low digital literacy. These barriers hinder equitable access to online education and exclude a portion of the population from participating in modern learning experiences. Despite efforts like the National Broadband Network rollout, gaps remain in speed, reliability, and affordability. Additionally, without proper digital skills training, learners may find it difficult to navigate online platforms effectively. For the online education sector to achieve inclusive, nationwide growth, addressing these disparities through targeted infrastructure investment, device subsidies, and digital education programs is essential to ensure fair and widespread participation.

Concerns Over Course Quality and Accreditation

As online education rapidly expands across Australia, ensuring the quality and credibility of digital courses has become a growing concern. The market is increasingly populated with low-cost, non-accredited providers offering unverified or poorly designed content. This undermines consumer trust and deters prospective learners who are unsure of a course’s validity or long-term value. Without recognized credentials, learners may face difficulties in employment or further academic advancement. Maintaining consistent academic standards across digital platforms is critical, particularly when courses are offered outside traditional institutions. Regulatory bodies and education providers must work together to establish clearer frameworks, ensure transparent assessment methods, and promote accreditation standards. Strengthening these areas is vital for safeguarding the reputation and reliability of Australia’s online learning ecosystem.

High Dropout Rates and Learner Engagement Issues

A persistent challenge facing the online education sector in Australia is student retention. Without the physical presence of teachers or peers, many learners struggle with motivation and discipline, leading to high dropout rates. The absence of real-time interaction, accountability, and structured schedules can cause disengagement, especially for self-paced courses. Additionally, some students may feel isolated or overwhelmed without personalized guidance or community support. To counter this, providers must develop interactive learning models that promote active participation, including live classes, discussion forums, gamification, and AI-driven feedback. Building supportive digital communities and offering mentorship or academic coaching can also improve learner outcomes. Investing in engagement strategies is essential to improve course completion rates and ensure long-term success for both students and education platforms.

Australia Online Education Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, provider, technology, and end user.

Type Insights:

- Academic

- Higher Education

- Vocational Training

- K-12 Education

- Corporate

- Large Enterprises

- SMBs

- Government

The report has provided a detailed breakup and analysis of the market based on the type. This includes academic (higher education, vocational training, and K-12 education), corporate (large enterprises and SMBs), and government.

Provider Insights:

- Content

- Services

A detailed breakup and analysis of the market based on the provider have also been provided in the report. This includes content and services.

Technology Insights:

- Mobile E-Learning

- Rapid E-Learning

- Virtual Classroom

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes mobile e-learning, rapid e-learning, virtual classroom, and others.

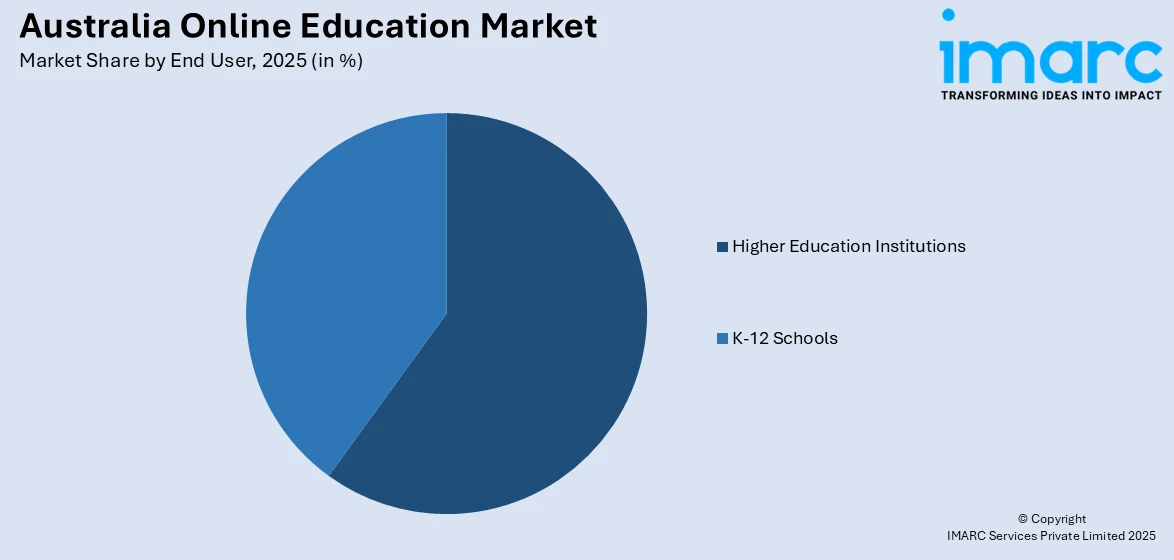

End User Insights:

Access the comprehensive market breakdown Request Sample

- Higher Education Institutions

- K-12 Schools

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes higher education institutions and K-12 schools.

Regional Insights:

- Australian Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & South Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australian Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & South Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Online Education Market News:

- In December 2024, Microsoft announced the launch of a new AI Skills Initiative aimed at upskilling 1 Million people in Australia and New Zealand by 2026. The program provides free resources and training through various platforms to meet workforce needs, particularly targeting underrepresented groups. The initiative builds on prior commitments to enhance digital skills in the region.

- In April 2024, OpenLearning announced the acquisition of three Australian online education marketplaces PostGradAustralia.com.au, TheUniGuide.com.au, and StudyNewZealand.nz, enhancing its student acquisition capabilities. The move aims to broaden OpenLearning's reach and provide additional cross-selling opportunities.

Australia Online Education Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Providers Covered | Content, Services |

| Technologies Covered | Mobile E-Learning, Rapid E-Learning, Virtual Classroom, Others |

| End Users Covered | Higher Education Institutions, K-12 Schools |

| Regions Covered | Australian Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & South Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia online education market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia online education market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia online education industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The online education market in Australia was valued at USD 1.7 Billion in 2025.

The Australia online education market is projected to exhibit a CAGR of 26.65% during 2026-2034.

The Australia online education market is projected to reach a value of USD 15.5 Billion by 2034.

The Australia online education market trends include the adoption of hybrid models combining virtual and in-person learning, integration of AI-powered personalization, and expanding vocational training via micro-credentials. Massive Open Online Courses (MOOCs) and gamified learning are also gaining popularity, supported by government digital learning policies and mobile-accessible platforms.

The major growth drivers include the rising internet and smartphone access, demand for flexible and self-paced learning, corporate e-learning investment, and strong government support via digital infrastructure funding. Moreover, the need for ongoing upskilling and professional certification across academic and non-academic sectors is also accelerating market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)