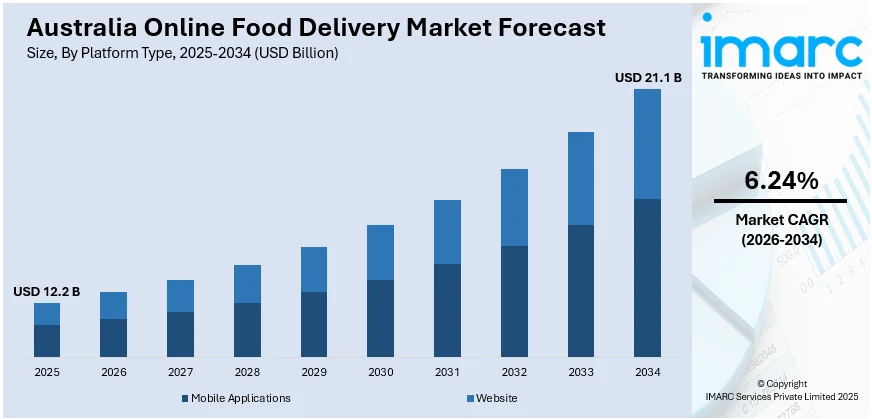

Australia Online Food Delivery Market Report by Platform Type (Mobile Applications, Website), Business Model (Order Focused Food Delivery System, Logistics Based Food Delivery System, Full-Service Food Delivery System), Payment Method (Online Payment, Cash on Delivery), and Region 2026-2034

Australia Online Food Delivery Market Size:

Australia online food delivery market size reached USD 12.2 Billion in 2025. Looking forward, the market is projected to reach USD 21.1 Billion by 2034, exhibiting a growth rate (CAGR) of 6.24% during 2026-2034. The market in Australia is being driven by increasing urbanization, changing consumer preferences, rising disposable incomes of individuals, convenience and time-saving benefits, the availability of diverse cuisines, the growing smartphone penetration, and promotions and discounts offered by these platforms.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 12.2 Billion |

|

Market Forecast in 2034

|

USD 21.1 Billion |

| Market Growth Rate 2026-2034 | 6.24% |

Australia Online Food Delivery Market Analysis:

- Major Market Drivers: The Australia online food delivery market size is primarily driven by increasing urbanization and changing consumer lifestyles, which prioritize convenience and time-saving solutions in dining habits.

- Key Market Trends: Significant trends include the rise of virtual kitchens and dark stores catering exclusively to delivery orders, and the integration of technology such as AI and machine learning to enhance customer experience and operational efficiency.

- Challenges and Opportunities: Challenges include high competition leading to thin profit margins and regulatory scrutiny. However, opportunities lie in expanding into suburban and regional areas, and leveraging data analytics to personalize customer experiences and optimize delivery routes.

To get more information on this market Request Sample

Key Trends of Australia Online Food Delivery Market:

Emergence of cloud kitchen

The emergence of cloud kitchens is bolstering the market. Cloud kitchens have inexpensive set-up costs and assist reduce operational expenses such as employment taxes, service workers, furnishing, utilities, and insurance, making them an appealing investment opportunity. To keep up with changing market trends, numerous restaurants have turned to cloud kitchens. The growth can be attributed to the expanding number of restaurants in Australia, as well as the widespread use of cloud-based technology and increased acceptance of Quick Service Restaurant (QSR) services. Due to COVID-19, several packaged food services and restaurants turned to internet sales platforms to meet consumer demand. As a result, the extra benefit of implementing POS systems to accurately determine client preferences and sales trends is likely to boost market growth, as per Australia online food delivery market report.

Rapid technological advancements

Innovations such as the integration of IoT and voice commands are making the delivery process even more convenient for customers, who can now order food using voice commands on devices such as Amazon Alexa and Google Home and follow their orders in real time. These advancements expedite processes and also increase client loyalty by providing consistent and efficient service. Furthermore, businesses may collect useful data using IoT devices, allowing them to optimize logistics, improve inventory management, and personalize consumer interactions. As technology advances, the potential for further innovations in delivery services remains high, delivering increased convenience and efficiency for both businesses and customers.

Increasing emphasis on consumer convenience

Consumer convenience is a key driver of the online food delivery sector. Individuals are always juggling several duties, ranging from job obligations to social gatherings, leaving little time for traditional meal preparation, grocery shopping, and cooking. Online food delivery services address these issues immediately by providing a quick and easy option to have meals delivered straight to one's door. Most online food delivery businesses operate around the clock, catering to a range of client needs, such as a late-night snack or an early morning.

Growth Drivers of Australia Online Food Delivery Market:

Rising Smartphone and Internet Penetration

The rapid increase in the use of smartphones and the availability of cheap internet have substantially contributed to the growth of the food delivery market online in Australia. With an increasing number of consumers going digital, the trend of placing food orders via mobile apps and websites has turned into a usual practice. Easy-to-use interfaces, hassle-free payment facilities, and live tracking have also contributed to this trend. This digital revolution is particularly visible among younger generations and urban populations who prefer the convenience provided by technology. With continued advances in connectivity in various segments, online food ordering services are penetrating beyond large cities, making digital penetration an imperative factor in the industry's continued growth.

Expansion of Restaurant Partnerships

One of the strongest contributors to Australia online food delivery market demand is the increasing involvement of restaurants, cafes, and quick-service outlets on delivery platforms. By collaborating with online aggregators, food businesses can access a much larger customer base without the constraints of their physical locations. This trend is particularly beneficial for small and mid-sized establishments, as they gain enhanced visibility and increased sales volumes. For customers, these partnerships broaden menu choices and provide convenient access to a range of premium and budget-friendly dining options. The growth of restaurant partnerships is reinforcing the online food delivery ecosystem, delivering advantages for service providers, eateries, and customers alike.

Variety and Customization

A significant factor propelling consumer interest in Australia’s online food delivery market is the extensive selection of cuisines and customization opportunities available on delivery platforms. Users can discover a range of diverse menus, from international favorites to local specialties, with just a few clicks. In addition to variety, the option to customize meals—such as choosing portion sizes, adding toppings, or selecting healthier alternatives—adds considerable value for customers seeking personalized dining experiences. This adaptability appeals to various consumer segments, including health-conscious individuals and those with specific dietary preferences. By providing an array of options and customization, platforms enhance customer satisfaction, foster repeat orders, and strengthen their competitive position in the evolving food delivery landscape.

Opportunities of Australia Online Food Delivery Market:

Expansion into Regional Areas

The online food delivery market in Australia holds considerable untapped potential in suburban and rural areas, where service availability is often limited. Most delivery services primarily cater to metropolitan regions, leaving smaller towns without adequate options. By expanding into these underserved locations, platforms can tap into new customer segments, particularly as digital connectivity and smartphone use increase beyond urban areas. With improvements in infrastructure and growing familiarity with online services, regional markets offer promising long-term growth opportunities. Providing localized food choices, implementing affordable delivery models, and forming partnerships with regional businesses could enhance outreach further. By filling accessibility gaps, companies can broaden their customer base and gain a significant competitive edge across wider regions.

Health and Wellness Offerings

According to Australia online food delivery market analysis, consumer preferences are increasingly influenced by health-conscious eating. Rising awareness about nutrition, active lifestyles, and preventive health measures is driving the demand for organic, vegan, gluten-free, and low-calorie meal options. This trend creates a strong opportunity for platforms to collaborate with health-focused restaurants, dieticians, and fitness brands to provide specialized meals. Subscription-based healthy meal plans and customizable dietary choices can appeal to urban professionals, young families, and fitness enthusiasts. Addressing this segment diversifies offerings and fosters brand loyalty by catering to changing lifestyle preferences. As wellness becomes a priority for consumers, health-oriented menus might serve as a significant differentiator in the competitive food delivery market.

Sustainable Packaging Solutions

Sustainability has become a critical concern for consumers, and eco-friendly packaging offers a significant opportunity for food delivery platforms in Australia. Traditional single-use plastics are increasingly criticized for their environmental impact, leading to a greater demand for biodegradable, recyclable, and reusable packaging options. By transitioning to greener alternatives, platforms can enhance their brand image, attract environmentally conscious customers, and align with broader sustainability initiatives. Collaborating with suppliers of eco-friendly packaging materials and implementing innovations like compostable containers can further distinguish businesses in the market. Additionally, promoting sustainable practices can draw partnerships with eco-focused restaurants and organizations. In a landscape where environmental responsibility is gaining traction, the adoption of sustainable packaging solutions can yield both reputational and competitive advantages.

Challenges of Australia Online Food Delivery Market:

High Operational Costs

One of the significant challenges in the Australian online food delivery market is the elevated cost structure associated with operations. Expenses tied to logistics, delivery fleets, commissions awarded to riders, and technology upkeep greatly impact profitability. Moreover, varying fuel prices, urban traffic congestion, and the necessity for efficient last-mile delivery further exacerbate operational difficulties. Platforms also need to maintain competitive pricing, which further compresses margins. To alleviate costs, companies are investigating automation, optimized route planning, and partnerships with cloud kitchens. Nonetheless, finding a balance between affordability for consumers and profitability for platforms remains a daunting challenge, making high operational costs a continuous hurdle in achieving long-term business growth.

Intense Market Competition

The Australian online food delivery sector is characterized by fierce competition, with numerous platforms competing for consumer interest and restaurant collaborations. This intense rivalry frequently results in aggressive pricing tactics, substantial discounts, and regular promotional efforts that affect profit margins. New entrants and growing local players further complicate the competitive landscape, compelling existing companies to innovate constantly. While this competition benefits consumers by providing more choices and better deals, it also introduces sustainability challenges for service providers. Maintaining differentiation through unique offerings like healthier menus, faster delivery, or loyalty programs is increasingly vital. In such a crowded market, achieving steady profitability while engaging in fierce competition remains a significant challenge for platforms.

Customer Retention Issues

Customer retention is another crucial challenge within the Australian online food delivery market. With regular promotions, discounts, and cash-back incentives available across platforms, consumers frequently switch providers based on price differences rather than loyalty. This behavior complicates the ability of companies to cultivate a stable and recurring customer base. Although strategies like loyalty programs, subscription models, and personalized recommendations are being implemented, their effectiveness is limited within such a highly competitive environment. Consumers demand seamless app experiences, dependable delivery, and an array of food options, meaning that any shortcoming in service can swiftly lead to customer churn. As customer acquisition costs continue to rise, platforms face pressure to devise sustainable strategies for enhancing retention while also ensuring profitability.

Australia Online Food Delivery Market Segmentation:

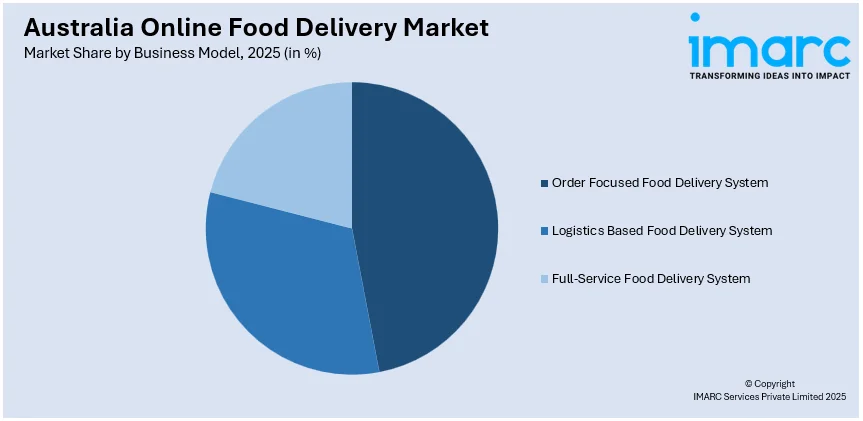

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2026-2034. Our report has categorized the market based on platform type, business model, and payment method.

Breakup by Platform Type:

- Mobile Applications

- Website

The report has provided a detailed breakup and analysis of the market based on the platform type. This includes mobile applications and website.

Breakup by Business Model:

Access the comprehensive market breakdown Request Sample

- Order Focused Food Delivery System

- Logistics Based Food Delivery System

- Full-Service Food Delivery System

A detailed breakup and analysis of the market based on the business model have also been provided in the report. This includes order focused food delivery system, logistics based food delivery system, and full-service food delivery system.

Breakup by Payment Method:

- Online Payment

- Cash on Delivery

The report has provided a detailed breakup and analysis of the market based on payment method. This includes online payment and cash on delivery.

Breakup by Region:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major markets in the region, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

- The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Detailed profiles of all major companies have been provided.

- Major online food delivery companies are investing in technology like real-time tracking, anticipated delivery times, and AI-powered personalized suggestions to improve the user interface and consumer experience. Furthermore, businesses use data to better analyze consumer behavior, optimize delivery routes, and adapt marketing strategies. To broaden their product offering, the market players use a variety of inorganic growth strategies, such as partnerships, regular mergers, and acquisitions. Other significant methods that companies use to strengthen their market domination include expansion, collaborations, and the consolidation and optimization of their offerings. In addition to expanding their business size and scope, corporations prioritize R&D in producing technologically enhanced and unique services to achieve a competitive advantage, thereby expanding Australia online food delivery market share.

Australia Online Food Delivery Market News:

- In April 2025, Menulog launched an AI Assistant in Australia to enhance the food ordering experience. This tool offers personalized meal recommendations, simplifies searches for dining options, and facilitates custom orders through a text-based interface. It aims to provide a more intuitive and convenient food delivery service while supporting local restaurants.

- In April 2025, Uber Eats Australia launched "Eats for Teens," allowing teens aged 13-17 to independently order food from over 50,000 restaurants. Parents can manage spending limits and track orders in real-time. This initiative aims to provide convenient meal solutions for busy families while ensuring safety by filtering out age-restricted items.

- In March 2025, Domino’s Pizza and Uber announced their plans to enhance their partnership in Australia and New Zealand, allowing extended trading hours through Uber’s delivery network. This initiative enables Domino's customers to order pizzas earlier and later and supports franchise growth by meeting increased demand during peak times and major events.

Australia Online Food Delivery Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Platform Types Covered | Mobile Applications, Website |

| Business Models Covered | Order Focused Food Delivery System, Logistics Based Food Delivery System, Full-Service Food Delivery System |

| Payment Methods Covered | Online Payment, Cash on Delivery |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia online food delivery market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia online food delivery market.

- Porter's five forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia online food delivery industry and its attractiveness.

- The competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The online food delivery market in Australia was valued at USD 12.2 Billion in 2025.

The Australia online food delivery market is projected to exhibit a compound annual growth rate (CAGR) of 6.24% during 2026-2034.

The Australia online food delivery market is expected to reach a value of USD 21.1 Billion by 2034.

The Australia online food delivery market is witnessing trends such as growing adoption of subscription-based meal plans, integration of AI for personalized recommendations, and rising popularity of contactless deliveries. Increasing demand for healthier food options and partnerships with cloud kitchens are also shaping market growth.

The Australia online food delivery market is driven by rising urban lifestyles, expanding smartphone and internet penetration, and greater reliance on digital payments. Strong consumer preference for convenience, coupled with promotional offers and expanding restaurant partnerships, is further fueling consistent growth across diverse customer segments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)