Australia Online Furniture Market Size, Share, Trends and Forecast by Raw Material, Product, Application, and Region, 2026-2034

Australia Online Furniture Market Summary:

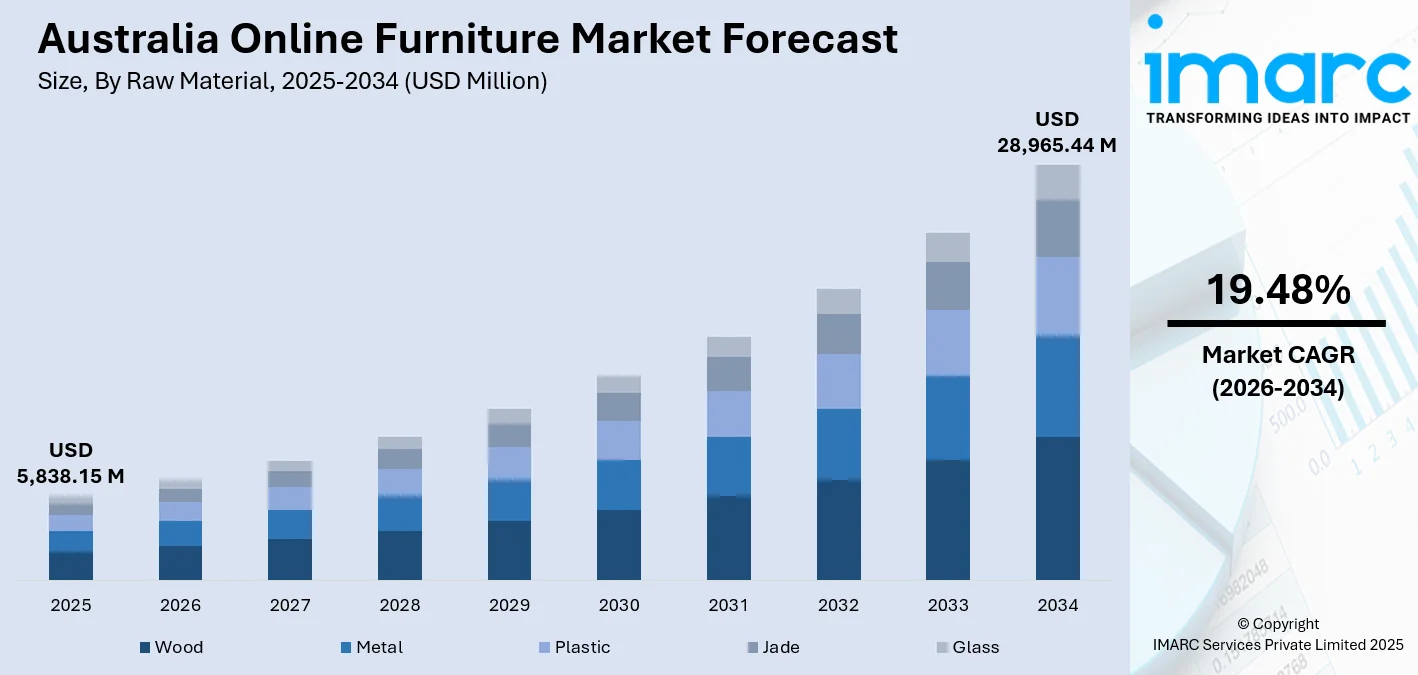

The Australia online furniture market size was valued at USD 5,838.15 Million in 2025 and is projected to reach USD 28,965.44 Million by 2034, growing at a compound annual growth rate of 19.48% from 2026-2034.

The Australia online furniture market is experiencing robust expansion driven by rising internet penetration, smartphone adoption, and evolving consumer preferences toward convenient home shopping experiences. Digital platforms offer extensive product catalogues, competitive pricing, and doorstep delivery services that eliminate traditional retail constraints. Urbanization patterns, smaller living spaces, and demand for space-efficient furniture solutions further accelerate online channel adoption across metropolitan and regional areas.

Key Takeaways and Insights:

- By Raw Material: Wood dominates the market with a share of 46.12% in 2025, owing to its aesthetic appeal, durability, structural versatility, and consumer perception as a premium material for long-term furniture investments.

- By Product: Living room furniture leads the market with a share of 33.06% in 2025, driven by continuous home renovation cycles, entertainment space prioritization, and demand for modular seating configurations that adapt to evolving lifestyle requirements.

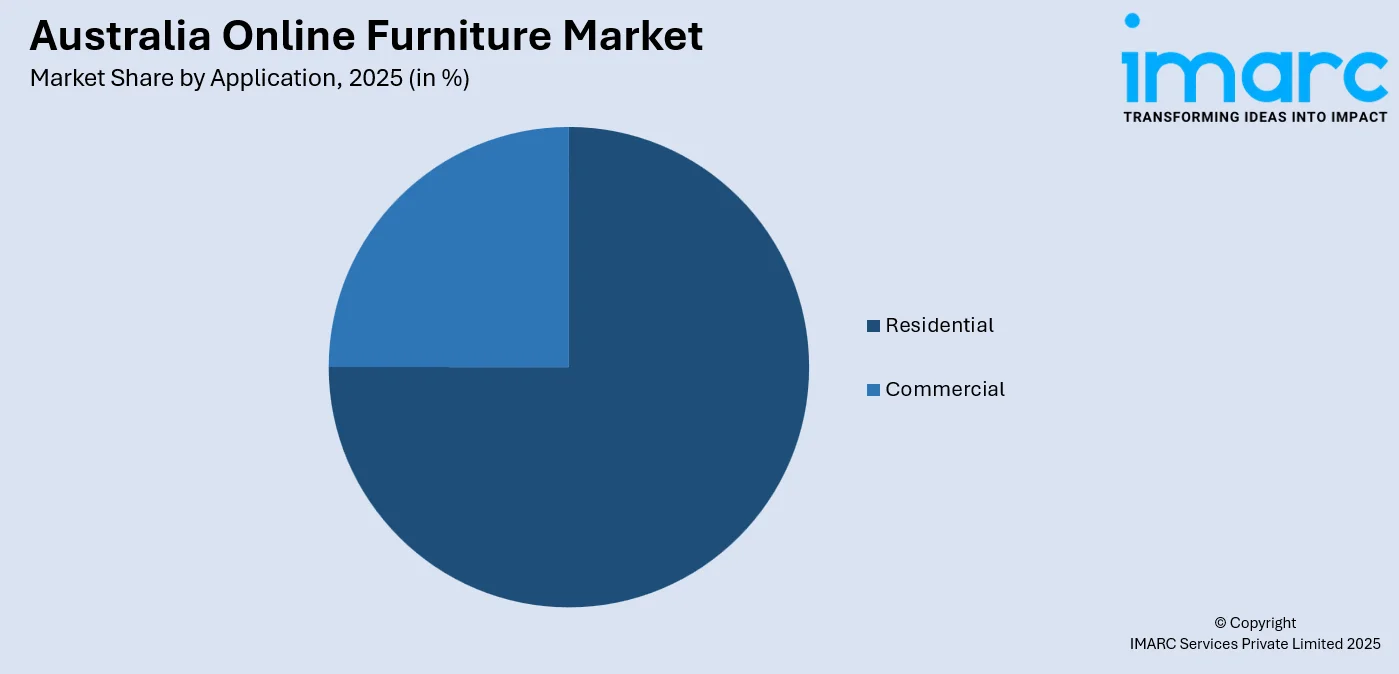

- By Application: Residential dominates the market with a share of 75.06% in 2025, reflecting homeowner preferences for personalized interior design, remote work infrastructure needs, and increasing household furniture replacement frequencies.

- Key Players: The Australia online furniture market demonstrates moderate competitive intensity, with established e-commerce platforms competing alongside specialized furniture retailers and direct-to-consumer brands across price segments, product categories, and evolving consumer preferences. Some of the key players operating in the market include, Brosa, Castlery, Eva, Fantastic Furniture, Freedom, Inter IKEA Systems B.V., Luxo Living, and Mocka.

The Australia online furniture market leverages advanced logistics infrastructure, secure digital payment systems, and augmented reality technologies that strengthen consumer confidence in remote purchasing decisions. In July 2025, Singapore‑based furniture retailer Castlery expanded its Australian presence by opening a new showroom in Brisbane’s Fortitude Valley after strong online sales performance, reflecting how digital‑first brands are blending online and offline strategies to enhance customer reach. Platform integration of comprehensive product specifications verified customer 'reviews, virtual visualization tools, and accommodating return policies progressively reduces traditional online shopping barriers. Market participants effectively serve heterogeneous demographic segments spanning budget-oriented consumers, mid-range household shoppers, and affluent buyers seeking premium designer furniture collections through differentiated product portfolios, pricing strategies, and customer service approaches tailored to distinct purchasing behaviors and lifestyle requirements.

Australia Online Furniture Market Trends:

Augmented Reality Integration for Virtual Product Visualization

Digital furniture platforms increasingly deploy augmented reality tools enabling customers to visualize products within their actual living spaces before purchase. A 2025 industry survey found that 79% of leading furniture retailers reported that 3D and AR visualisation technologies are overtaking traditional photos as the preferred way to showcase products online, driving higher customer engagement and helping buyers assess fit and style before buying. These technologies address traditional online shopping barriers by allowing dimensional accuracy assessment, color matching with existing décor, and spatial compatibility verification. Enhanced visualization capabilities reduce product return rates while building consumer confidence in remote furniture purchasing decisions across residential applications.

Sustainable Material Sourcing and Eco-Conscious Manufacturing

Growing environmental awareness drives demand for furniture manufactured from responsibly sourced materials, recycled components, and low-emission production processes. For instance, Australian furniture rental and styling company Valiant launched a new sustainable range crafted from recycled plastics, turning ocean and landfill waste into high‑quality pieces and underscoring rising industry commitment to circular design. Online retailers highlight sustainability credentials through transparent supply chain disclosures, forest certification standards, and carbon footprint measurements. Consumers particularly in urban centers demonstrate willingness to pay premium prices for furniture demonstrating verifiable environmental benefits and ethical manufacturing practices.

Modular and Space-Efficient Furniture Design Innovation

Urban apartment living and smaller residential footprints stimulate demand for multifunctional furniture solutions offering storage optimization, convertible configurations, and minimalist aesthetics. Castlery’s Fall 2025 collection focused on modular, space‑saving designs such as storage sofas and customizable beds tailored for compact homes, reflecting how online‑first brands are responding to the needs of urban consumers seeking adaptable furniture without compromising style. Online platforms showcase innovative designs including transformable tables, wall-mounted systems, and compact seating arrangements. This trend particularly resonates with younger demographics, first-time homebuyers, and renters seeking furniture adaptable to changing living situations and spatial constraints.

Market Outlook 2026-2034:

The Australia online furniture market demonstrates strong growth momentum supported by continuing digital commerce adoption, logistics infrastructure enhancements, and consumer preference shifts toward convenient home shopping experiences. Rising disposable incomes, housing construction activity, and interior design awareness sustain furniture replacement cycles and discretionary spending patterns. Platform innovations in customer experience, payment flexibility, and delivery services maintain competitive differentiation across market participants. The market generated a revenue of USD 5,838.15 Million in 2025 and is projected to reach a revenue of USD 28,965.44 Million by 2034, growing at a compound annual growth rate of 19.48% from 2026-2034.

Australia Online Furniture Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Raw Material |

Wood |

46.12% |

|

Product |

Living Room Furniture |

33.06% |

|

Application |

Residential |

75.06% |

Raw Material Insights:

- Wood

- Metal

- Plastic

- Jade

- Glass

The wood dominates with a market share of 46.12% of the total Australia online furniture market in 2025.

Wood furniture commands substantial market preference reflecting its natural aesthetic qualities, structural durability, and perceived value retention across residential applications. In February 2025, Australian manufacturer Workspace Commercial Furniture expanded its facility and launched a new circular furniture program designed to repurpose and recycle used furniture at the end of its lifecycle, showcasing industry moves toward sustainable wooden product offerings that resonate with environmentally conscious consumers. Australian consumers associate wooden furniture with quality craftsmanship, timeless design appeal, and compatibility with diverse interior styles ranging from contemporary minimalism to traditional settings.

Online platforms effectively showcase wood furniture through high-resolution imagery, detailed grain pattern displays, and finish variation samples that compensate for inability to physically examine products. Wood's natural warmth, texture, and aging characteristics appeal particularly to homeowners seeking long-term furniture investments with potential heirloom value. Environmental sustainability concerns further support wood demand as consumers prioritize renewable materials over synthetic alternatives, provided appropriate forest management certifications accompany product offerings.

Product Insights:

- Living Room Furniture

- Bedroom Furniture

- Office Furniture

- Kitchen Furniture

- Others

The living room furniture leads with a share of 33.06% of the total Australia online furniture market in 2025.

Living room furniture dominates online sales reflecting this space's central role in residential entertainment, family gatherings, and daily activities requiring frequent furniture updates and style refreshes. Consumers prioritize sofas, coffee tables, entertainment units, and accent chairs that establish room ambiance while accommodating evolving lifestyle patterns including remote work arrangements and home entertainment system integration. The category benefits from high product visibility, regular replacement cycles, and strong influence from interior design trends disseminated through digital media channels.

Online platforms particularly excel at presenting living room furniture through lifestyle imagery, room setting visualizations, and dimensional planning tools that facilitate confident purchasing decisions for high-value items. Modular sofa configurations, sectional flexibility, and customizable upholstery options translate effectively to digital presentation formats. The segment also experiences consistent demand from new homeowners, renters furnishing initial spaces, and established households seeking periodic style updates that align with contemporary design preferences and functional requirements.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

The residential dominates with a market share of 75.06% of the total Australia online furniture market in 2025.

Residential applications overwhelmingly dominate online furniture purchases as homeowners and renters seek convenient solutions for personal living space furnishing without traditional retail store visits. In 2025, Australian online furniture retailer Temple & Webster reported record sales exceeding A$601 million, driven largely by strong demand for home furniture categories across residential segments and enhanced digital customer experiences, underscoring how online platforms are meeting the needs of at‑home shoppers. Digital platforms effectively serve residential needs through extensive product catalogues spanning all room types, budget ranges, and style preferences while offering delivery scheduling that accommodates personal timeframes. Home furniture purchasing decisions benefit from private consideration periods, family consultation opportunities, and ability to compare options across multiple platforms without sales pressure.

The residential segment encompasses diverse consumer motivations including initial home furnishing, renovation projects, lifestyle changes, and periodic style updates that collectively sustain consistent purchase frequency. Online channels particularly appeal to younger demographics comfortable with digital transactions, busy professionals valuing time efficiency, and regional residents with limited local retail access. Enhanced delivery services including room placement, assembly assistance, and packaging removal further reduce residential consumer barriers to online furniture purchasing across metropolitan and remote locations.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The online furniture market in Australia Capital Territory and New South Wales is highly competitive, driven by urban demand in Canberra and Sydney. Consumers increasingly prefer e-commerce platforms for convenience, diverse styles, and competitive pricing. Established retailers and direct-to-consumer brands offer fast delivery and customization options, while local trends emphasize modern, space-saving, and sustainable furniture for apartments and offices.

Victoria and Tasmania show growing adoption of online furniture retail, with Melbourne and Hobart leading digital sales. Shoppers are attracted to flexible payment options, eco-friendly materials, and contemporary designs. Seasonal promotions and free shipping further boost e-commerce penetration. Small-scale Tasmanian retailers are leveraging online platforms to reach broader markets, making furniture shopping more accessible across urban and regional areas.

Queensland’s online furniture sector is expanding due to rising urbanization in Brisbane, Gold Coast, and Sunshine Coast. Consumers increasingly favor digital shopping for convenience, variety, and cost savings. Popular trends include multifunctional furniture, outdoor living sets, and sustainable products. Local brands and national e-commerce players are enhancing user experience with easy returns, quick delivery, and virtual room planning tools.

In Northern Territory and South Australia, online furniture sales are growing steadily, driven by demand in Darwin and Adelaide. Limited local retail options make e-commerce a practical solution for diverse furniture needs. Shoppers prefer products combining durability and design, particularly for climate resilience. Online platforms emphasize flexible shipping, installation services, and promotions to attract regional customers.

Western Australia’s online furniture market is evolving rapidly, with Perth as the main hub. Consumers are increasingly shopping online for convenience, range, and affordability, especially for home and office furniture. National and local retailers focus on fast delivery, eco-conscious materials, and customizable options. The market growth is supported by rising awareness of interior design trends and increasing digital adoption across metropolitan and regional areas.

Market Dynamics:

Growth Drivers:

Why is the Australia Online Furniture Market Growing?

Accelerating Digital Commerce Adoption and Mobile Shopping Convenience

Widespread smartphone penetration and improved mobile internet connectivity fundamentally transform furniture shopping behaviors across Australian demographics. In September 2025, Melbourne’s Artiss saw online sales surge after joining Temu, selling over 15,000 items from 1,200 products, showing digital channels boost reach and purchases. Mobile-optimized platforms enable browsing, comparison, and purchasing activities during commute times, lunch breaks, and evening leisure periods without physical store visits. Progressive web applications, one-click checkout systems, and saved payment credentials reduce transaction friction while push notifications alert consumers to promotional offers, new arrivals, and personalized product recommendations based on browsing history. Digital wallets, buy-now-pay-later services, and installment payment options further democratize furniture access across income segments.

Sophisticated Logistics Infrastructure and Last-Mile Delivery Innovations

Advanced warehousing networks, regional distribution centers, and specialized furniture delivery services enable reliable fulfillment across Australia's geographically dispersed population centers. According to reports, Toll Group invests AU$200 million to open its largest automated retail distribution centre in Kemps Creek, western Sydney. Spanning 67,626 sqm, the facility features AU$75 million in automation, supports omni-channel retail fulfilment, and aims for a 6-Star Green rating. Construction began August 2023, with operations expected in 2025, creating 240 jobs and boosting national retail logistics. Third-party logistics partnerships provide expertise in fragile item handling, assembly services, and precise delivery windows that match consumer availability.

Housing Market Activity and Renovation Investment Trends

Sustained residential construction activity, property transactions, and renovation expenditures generate continuous furniture demand across new homeowners, upgrading households, and investment property furnishing requirements. Rising property values encourage homeowners to invest in quality furniture that enhances living environments and protects property aesthetics. Renovation trends focusing on open-plan living, home office creation, and outdoor entertainment areas drive specific furniture category demand. Government incentives for home improvements, low interest rate environments, and accumulated household savings during pandemic periods support discretionary spending on furniture upgrades.

Market Restraints:

What Challenges the Australia Online Furniture Market is Facing?

Product Visualization Limitations and Tactile Assessment Concerns

Despite augmented reality advances, consumers remain hesitant purchasing furniture without physical examination of material quality, construction sturdiness, and comfort characteristics particularly for seating products. Color accuracy across different display screens, fabric texture representation, and dimensional perception challenges create post-delivery disappointment risks. Inability to test mattress firmness, assess cushion resilience, or verify wood grain patterns limits confidence in high-value purchases requiring long-term satisfaction.

Delivery Complexity and Associated Cost Implications

Large furniture items incur substantial shipping expenses across Australia's vast distances, particularly for regional and remote area deliveries where logistics costs escalate significantly. Delivery scheduling coordination, access restrictions in apartment buildings, and doorway dimension limitations complicate fulfillment processes. Assembly requirements, packaging waste disposal, and potential delivery damage claims create additional consumer burden compared to traditional retail immediate possession.

Return Process Complications and Associated Financial Risks

Furniture return logistics involve complicated processes including pickup coordination, repackaging challenges, and restocking fees that discourage initial purchases. Large item transportation costs, potential product damage during returns, and extended refund processing times create consumer anxiety around online furniture transactions. Subjective dissatisfaction with color, style, or comfort presents legitimate return reasons but complicates merchant policies balancing customer satisfaction against operational costs.

Competitive Landscape:

The Australia online furniture market exhibits moderate competitive intensity with established e-commerce platforms, specialized furniture retailers, and direct-to-consumer brands competing across price segments. Market participants differentiate through product curation excellence, delivery reliability, augmented reality integration, and sustainable sourcing credentials appealing to environmentally conscious consumers. Competitive advantages stem from efficient supply chain management, exclusive designer collaborations, content marketing investments, and influencer partnerships driving brand awareness. Strategic alliances with logistics providers, payment platforms, and technology vendors enable operational efficiency while maintaining service quality standards that influence customer retention, repeat purchase behavior, and lifetime value across diverse demographic segments seeking varied furniture solutions.

Some of the key players include:

- Brosa

- Castlery

- Eva

- Fantastic Furniture

- Freedom

- Inter IKEA Systems B.V.

- Luxo Living

- Mocka

Recent Developments:

- In March 2025, Freedom Furniture has integrated AI‑enhanced search and personalization via Coveo’s platform on its ecommerce site, driving a 15 % rise in customer engagement and a 5.5% uplift in average order value as shoppers find products more easily. The AI initiative reflects a broader omnichannel shift to tailor online experiences and bridge digital and in‑store behavior.

Australia Online Furniture Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Raw Materials Covered | Wood, Metal, Plastic, Jade, Glass |

| Products Covered | Living Room Furniture, Bedroom Furniture, Office Furniture, Kitchen Furniture, Others |

| Applications Covered | Residential, Commercial |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Brosa, Castlery, Eva, Fantastic Furniture, Freedom, Inter IKEA Systems B.V., Luxo Living, Mocka, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia online furniture market size was valued at USD 5,838.15 Million in 2025.

The Australia online furniture market is expected to grow at a compound annual growth rate of 19.48% from 2026-2034 to reach USD 28,965.44 Million by 2034.

Wood held the largest market share at 46.12%, driven by its aesthetic appeal, durability, and consumer perception as a premium material offering long-term value retention across diverse interior design styles and residential applications.

Key factors driving the Australia online furniture market include accelerating digital commerce adoption, sophisticated logistics infrastructure with reliable last-mile delivery services, sustained housing market activity, and technology innovations such as augmented reality visualization tools that enhance consumer purchasing confidence.

Major challenges include product visualization limitations preventing tactile quality assessment, delivery complexity and associated costs particularly for regional areas, return process complications involving logistics coordination, and consumer hesitancy purchasing high-value items without physical examination of materials and comfort characteristics.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)