Australia Online Test Preparation Market Size, Share, Trends and Forecast by Exam/Test, Device Preferences, Payment Period, Payment Mode, and Region, 2025-2033

Australia Online Test Preparation Market Overview:

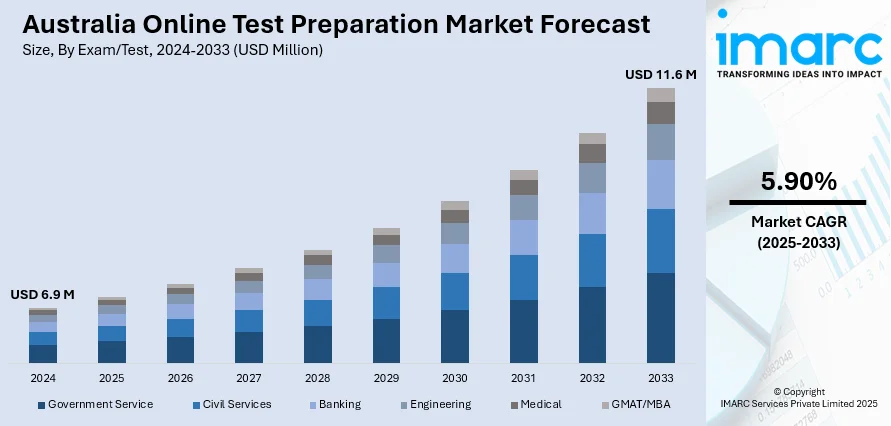

The Australia online test preparation market size reached USD 6.9 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 11.6 Million by 2033, exhibiting a growth rate (CAGR) of 5.90% during 2025-2033. At present, students, parents, and professionals are increasingly opting for online platforms for test preparation owing to their customized study schedules. Moreover, the heightened intensity of competition in academic and professional entrance examinations is contributing to the market growth. Apart from this, the rising international student enrollment is expanding the Australia online test preparation market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6.9 Million |

|

Market Forecast in 2033

|

USD 11.6 Million |

| Market Growth Rate 2025-2033 | 5.90% |

Australia Online Test Preparation Market Trends:

Increasing Preference for Digital Learning Platforms

The market for online test preparation in Australia is experiencing robust growth since students, parents, and professionals are increasingly opting for online platforms for test preparation. This is being propelled by the extensive reach of high-speed internet and the increased usage of smartphones, tablets, and laptops by people of all ages. Students are consuming adaptive, on-demand content that is aligned to their academic objectives or professional tests. Institutions and Edtech companies are reacting by creating interactive online platforms with customized study schedules, performance reports, and artificial intelligence (AI)-based content suggestions. Teachers are also moving toward digital delivery models that support scalable and low-cost test preparation. Moreover, remote learning practices are further influencing learning aspirations in the long term. Consequently, the online mode is considered a time-saving, efficient, and interactive substitute for conventional classroom-based mentoring. The IMARC Group predicts that the Australia Edtech market size will increase to USD 7.4 Billion by 2033.

To get more information on this market, Request Sample

Increasing Competition for Academic and Professional Exams

The increasing intensity of competition in academic and professional entrance examinations is contributing to the Australia online test preparation market growth. Students looking for higher education chances at premier universities both in Australia and overseas are intensively preparing for exams and English language proficiency tests. Similarly, skilled migrants and professionals are constantly preparing for qualification and certification tests to elevate their professional opportunities. Online platforms are offering integrated mock tests, adaptive learning modules, and expert virtual coaching sessions to address these changing needs. Parents and students are spending more money on high-quality prep tools to be competitive, which is encouraging test prep providers to innovate and expand their offerings. The availability of quality guidance by renowned instructors, in addition to ongoing performance monitoring, is equipping students with the aid they need to score maximally and better perform in the increasingly challenging testing conditions. In 2025, EdTech company RM plc prolonged its collaboration with the South Australian Certificate of Education Board (SACE), pledging to provide digital assessments for secondary subjects until 2032. The renewal is based on a collaboration that started in 2018, when RM initially assisted SACE in transitioning from paper examinations to on-screen formats. RM delivers digital learning and assessment solutions worldwide, collaborating with governments, examination awarding agencies, and educational organizations. Its technology facilitates the entire assessment lifecycle, encompassing secure administration, digital test creation, grading, and scrutiny.

Increasing International Student Enrollment and Immigration Ambitions

The rising international student enrollment is bolstering the market growth in Australia. Numerous international students and skilled migrants are taking test preparation courses for standardized entrance and language proficiency tests to become eligible for study and migration in Australia. At the same time, local students seeking to study overseas are also taking online courses aligned with international test patterns. The pro-immigration policies of the Australian government and the post-study work eligibility offered are motivating more candidates to apply, thus creating higher demand for systematic and effective prep platforms. Providers of online test prep are continually localizing and personalizing content appropriate to international tests as well as regional tastes. The capability of accessing quality education from anywhere, without physically being in a coaching center, is drawing users from different geographies, further driving the market.

Australia Online Test Preparation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on exam/test, device preferences, payment period, and payment mode.

Exam/Test Insights:

- Government Service

- Civil Services

- Banking

- Engineering

- Medical

- GMAT/MBA

The report has provided a detailed breakup and analysis of the market based on the exam/test. This includes government service, civil services, banking, engineering, medical, and GMAT/MBA.

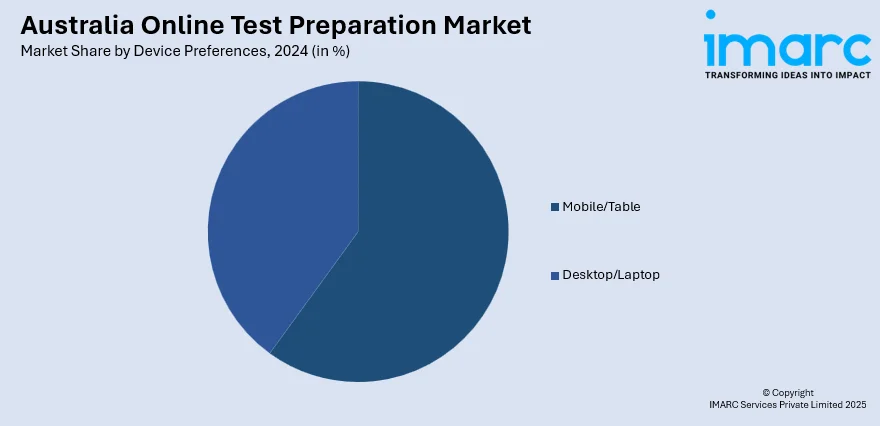

Device Preferences Insights:

- Mobile/Table

- Desktop/Laptop

The report has provided a detailed breakup and analysis of the market based on the device preferences. This includes mobile/table and desktop/laptop.

Payment Period Insights:

- One-Time Payment

- Installment

The report has provided a detailed breakup and analysis of the market based on the payment period. This includes one-time payment and installment.

Payment Mode Insights:

- Cash/Cheque

- Digital

A detailed breakup and analysis of the market based on the payment mode have also been provided in the report. This includes cash/cheque and digital.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Online Test Preparation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Exam/Tests Covered | Government Service, Civil Services, Banking, Engineering, Medical, GMAT/MBA |

| Device Preferences Covered | Mobile/Table, Desktop/Laptop |

| Payment Periods Covered | One-Time Payment, Installment |

| Payment Modes Covered | Cash/Cheque, Digital |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia online test preparation market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia online test preparation market on the basis of exam/test?

- What is the breakup of the Australia online test preparation market on the basis of device preferences?

- What is the breakup of the Australia online test preparation market on the basis of payment period?

- What is the breakup of the Australia online test preparation market on the basis of payment mode?

- What is the breakup of the Australia online test preparation market on the basis of region?

- What are the various stages in the value chain of the Australia online test preparation market?

- What are the key driving factors and challenges in the Australia online test preparation market?

- What is the structure of the Australia online test preparation market and who are the key players?

- What is the degree of competition in the Australia online test preparation market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia online test preparation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia online test preparation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia online test preparation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)