Australia Optical Transceiver Market Size, Share, Trends and Forecast by Form Factor, Fiber Type, Data Rate, Connector Type, Application, and Region, 2025-2033

Australia Optical Transceiver Market Overview:

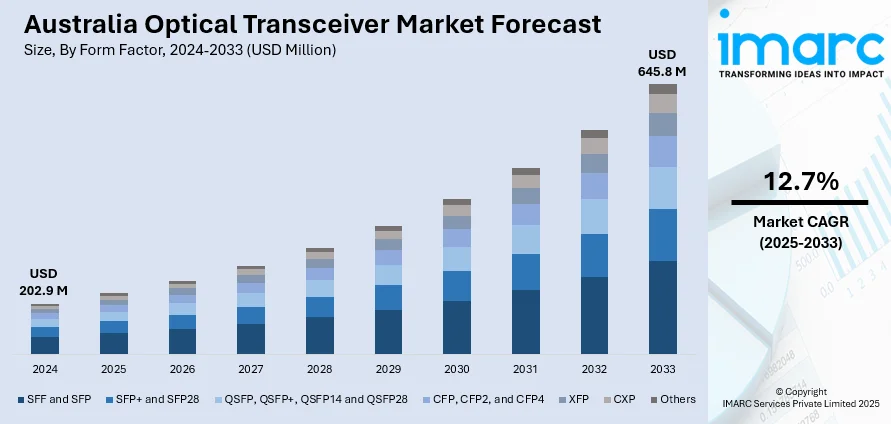

The Australia optical transceiver market size reached USD 202.9 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 645.8 Million by 2033, exhibiting a growth rate (CAGR) of 12.7% during 2025-2033. The growth is fueled by the rollout of fifth generation (5G) networks, demand for data centers and cloud computing, and government efforts to increase fiber infrastructure. Moreover, the demand for low-latency, high-speed communication, which has made optical transceivers indispensable for contemporary digital connectivity across all industries is impelling the Australia optical transceiver market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 202.9 Million |

| Market Forecast in 2033 | USD 645.8 Million |

| Market Growth Rate 2025-2033 | 12.7% |

Australia Optical Transceiver Market Trends:

Expansion of 5G Networks

The rollout of 5G technology in Australia is a key force behind the demand for optical transceivers. As 5G requires significantly higher data speeds and lower latency, telecom companies are upgrading their infrastructure to meet these technical needs. Optical transceivers enable rapid and efficient data transmission between cell towers, base stations, and core networks. With more devices and services relying on real-time connectivity like smart cities, autonomous systems, and IoT this technology becomes even more critical. The transition to 5G is not just about mobile phones; it impacts the entire digital ecosystem, encouraging the deployment of high-capacity optical networks that are faster, more reliable, and scalable to future demands.

To get more information on this market, Request Sample

Government Support for Fiber Infrastructure

Government efforts to support national digital infrastructure are a significant driver of Australia's optical transceiver market. Recent pledges, such as another AUD 3 billion from the government and AUD 800 million from NBN Co, are intended to upgrade the broadband network and provide high-speed internet access to an additional 622,000 premises by 2030. The upgrades will be capable of supporting more than 94% of fixed-line network customers with up to 1 Gbps speeds. These advances are speeding up the installation of fiber optic technologies, where optical transceivers are critical in supporting high-speed long-distance communication with little signal degradation. By enhancing connectivity within both urban and rural areas, such projects aid ambitions of digital inclusivity, economic development, and innovation. As infrastructure continues to evolve, calls for high-performance optical components only increase, bolstering Australia optical transceiver market growth.

Growth of Data Centers and Cloud Services

Australia’s digital economy is increasingly reliant on cloud computing and large-scale data centers, which demand high-bandwidth, low-latency network solutions. Optical transceivers are crucial for the internal and external connectivity of these centers, supporting massive data exchange and continuous service availability. As more businesses adopt remote work, digital platforms, and data-heavy applications, the need for strong data infrastructure intensifies. Cloud providers and data center operators are expanding capacity and looking to improve performance, both of which require dependable optical communication systems. Optical transceivers ensure data moves quickly and securely between servers, users, and storage systems, making them a backbone component of digital transformation across sectors.

Australia Optical Transceiver Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on form factor, fiber type, data rate, connector type, and application.

Form Factor Insights:

- SFF and SFP

- SFP+ and SFP28

- QSFP, QSFP+, QSFP14 and QSFP28

- CFP, CFP2, and CFP4

- XFP

- CXP

- Others

A detailed breakup and analysis of the market based on the form factor have also been provided in the report. This includes SFF and SFP, SFP+ and SFP28, QSFP, QSFP+, QSFP14 and QSFP28, CFP, CFP2, and CFP4, XFP, CXP, and others.

Fiber Type Insights:

- Single Mode Fiber

- Multimode Fiber

The report has provided a detailed breakup and analysis of the market based on the fiber type. This includes single mode fiber and multimode fiber.

Data Rate Insights:

- Less Than 10 Gbps

- 10 Gbps to 40 Gbps

- 40 Gbps to 100 Gbps

- More Than 100 Gbps

A detailed breakup and analysis of the market based on the data rate have also been provided in the report. This includes Less Than 10 Gbps, 10 Gbps to 40 Gbps, 40 Gbps to 100 Gbps, and More Than 100 Gbps.

Connector Type Insights:

- LC Connector

- SC Connector

- MPO Connector

- RJ-45

The report has provided a detailed breakup and analysis of the market based on the connector type. This includes LC connector, SC connector, MPO connector, and RJ-45.

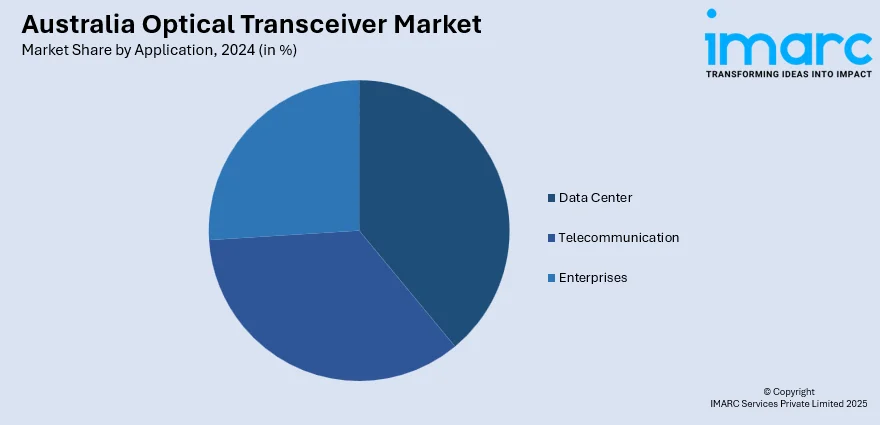

Application Insights:

- Data Center

- Telecommunication

- Enterprises

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes data center, telecommunication, and enterprises.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Optical Transceiver Market News:

- In January 2025, Jabil Inc. introduced its 1.6T OSFP optical transceiver, designed to meet rising demand for high-speed data center and AI/ML connectivity. Built with Intel® Silicon Photonics, it supports 200 Gb/s per lane and dual 800G or single 1.6T connections. Offering low power consumption and high reliability, the transceiver boosts bandwidth without major infrastructure changes. Jabil will showcase the solution at OFC 2025 alongside its broader photonics portfolio.

- In November 2024, Coherent Corp. introduced high-speed indium phosphide (InP) photodiodes optimized for next-generation 800G and 1.6T transceivers with 200 Gb/s PAM4 lanes. Available in singlet and 1x4 array packages, they have more than 50 GHz bandwidth, low capacitance, and wide optical response. Optimal for data center use, they provide high reliability and performance. Samples are already available, with full availability projected in Q1 2025.

Australia Optical Transceiver Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Form Factors Covered | SFF and SFP, SFP+ and SFP28, QSFP, QSFP+, QSFP14 and QSFP28, CFP, CFP2, and CFP4, XFP, CXP, Others |

| Fiber Types Covered | Single Mode Fiber, Multimode Fiber |

| Data Rates Covered | Less Than 10 Gbps, 10 Gbps to 40 Gbps, 40 Gbps to 100 Gbps, More Than 100 Gbps |

| Connector Types Covered | LC Connector, SC Connector, MPO Connector, RJ-45 |

| Applications Covered | Data Center, Telecommunication, Enterprises |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia optical transceiver market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia optical transceiver market on the basis of form factor?

- What is the breakup of the Australia optical transceiver market on the basis of fiber type?

- What is the breakup of the Australia optical transceiver market on the basis of data rate?

- What is the breakup of the Australia optical transceiver market on the basis of connector type?

- What is the breakup of the Australia optical transceiver market on the basis of application?

- What is the breakup of the Australia optical transceiver market on the basis of region?

- What are the various stages in the value chain of the Australia optical transceiver market?

- What are the key driving factors and challenges in the Australia optical transceiver market?

- What is the structure of the Australia optical transceiver market and who are the key players?

- What is the degree of competition in the Australia optical transceiver market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia optical transceiver market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia optical transceiver market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia optical transceiver industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)