Australia Organic Beverages Market Report by Product Type (Organic Coffee and Tea, Organic Non-Dairy Beverages, Organic Alcoholic Beverages, Organic Soft Drinks, and Others), Distribution Channel (Supermarkets and Hypermarkets, Grocery Stores, Pharmacies, Online, and Others), and Region 2025-2033

Market Overview:

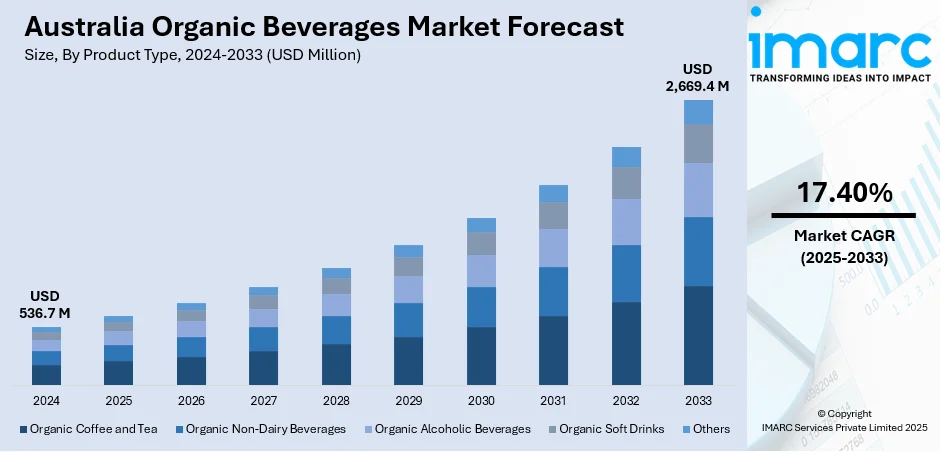

The Australia organic beverages market size reached USD 536.7 Million in 2024. Looking forward, the market is expected to reach USD 2,669.4 Million by 2033, exhibiting a growth rate (CAGR) of 17.40% during 2025-2033. The market is primarily fueled by growing consumer health and environmental awareness and a considerable demand for nature-derived options, particularly those that include native botanicals such as lemon myrtle and finger lime. With consumers adopting functional wellness—pursuing immunity, gut well-being, and stress reduction—organic teas, kombuchas, and cold-pressed juices are becoming popular. This intersection of health, sustainability, and convenience further propels the Australia organic beverages market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 536.7 Million |

|

Market Forecast in 2033

|

USD 2,669.4 Million |

| Market Growth Rate 2025-2033 | 17.40% |

Organic beverages refer to drinks that are free from chemical-based additives, including synthetic preservatives, GMOs, artificial flavors, etc. Some of the common product variants include organic tea and coffee, organic non-dairy beverages, organic alcoholic drinks, organic carbonated beverages, etc. These beverages aid in mitigating the risk of numerous diseases, such as gastrointestinal ailments, cancer, neurological disorders, etc., that can be caused due to synthetic additives present in conventional drinks. Furthermore, organic beverages also offer numerous benefits in boosting immunity, enhancing metabolism, improving gut health, balancing blood sugar levels, etc.

To get more information on this market, Request Sample

In Australia, the growing consumer concerns towards the negative health impact of synthetic additives, GMOs, preservatives, etc., are augmenting the demand for organic beverages. Additionally, the elevating levels of urbanization and improving consumer living standards have increased the per capita expenditures on high-quality, organic drinks in the country. Moreover, the rising popularity of ready-to-drink and portable product variants, particularly among the consumers with hectic lifestyles, is further propelling the market growth in Australia. Besides this, the emergence of e-commerce platforms is also catalyzing the demand for organic beverages supported with numerous advantages, such as wide product range, hassle-free shopping experience, doorstep delivery, etc. Additionally, several regional manufacturers are focusing on the development of clean-label products with prolonged shelf life and easy storage benefits. In line with this, the introduction of various gluten-free, lactose-free, and vegan product variants is also bolstering the market growth. Moreover, the growing influence of social media trends and numerous celebrity endorsements promoting the benefits of organic beverages will continue to drive the product demand in Australia over the forecast period.

Growth Drivers of Australia Organic Beverages Market:

Rising Health Consciousness and Lifestyle Shifts

The Australian organic beverages sector is thriving due to expanding health consciousness and shifting consumer lifestyles. Australians are increasingly taking charge of their well-being, by opting for organic products to escape synthetic additives, pesticides, and artificial components typical of standard beverages. This has triggered growing demand for organic juices, teas, coffees, and kombuchas that fit clean-label tendencies. Specifically in metropolitan areas such as Sydney, Melbourne, and Perth, consumers are looking for products that promote holistic well-being, like organic herbal teas used for relaxation or detoxification. Additionally, numerous Australians are embracing dietary styles that focus on natural, whole foods, including plant-based, paleo, and low-tox diets, which enhance the attractiveness of organic drinks.

Environmental Awareness and Sustainable Consumption

Environmental issues are becoming a significant factor affecting consumer decisions and is hence closely related to the Australia organic beverages market demand. Consumers are choosing organic beverages for their health advantages, as they are environmentally friendly. The use of organic farming methods that eschew chemical fertilizers and encourage soil replenishment appeals to Australians concerned with biodiversity, conserving water, and minimizing the use of chemicals. Areas with rich agricultural heritage—like Tasmania, Victoria, and Southern South Australia—are also championing organic beverage manufacturing as part of a broader sustainability commitment to environmentally friendly agriculture. Even organic beverage brands that use recyclable packaging, carbon-neutral operations, and fair sourcing gain more appeal to buyers who care about sustainability. This congruence between the values of consumers and product identity is especially clear in farmers' markets, health food shops, and independent coffee houses, where organic drinks frequently are marketed as an integral part of a lifestyle that honors the body and the planet.

Supportive Retail Infrastructure and Local Innovation

Australia's distribution and retail networks have developed to accommodate the organic drinks market, generating further momentum for growth. Large supermarket chains and special health food stores have increased their organic product offerings, facilitating consumers in both metropolitan and regional areas to have easier access to organic beverages. E-commerce and subscription models have also allowed smaller organic beverage manufacturers to distribute wider, particularly in Queensland and Western Australia where regional demand is increasing. In the meantime, Australian businesspeople are proactively innovating in the organic arena, developing beverages that combine ancient knowledge with contemporary wellness trends. These are such as kombucha infused with native botanicals, organic cold brews, and herbal infusions utilizing locally based ingredients. Government support and organic certification schemes also help enhance industry optimism and consumer confidence. As clean, traceable sourcing and transparency increasingly become the focus, domestic brands are positioned to out-differentiate against imported players and satisfy changing domestic demand with quality and authenticity.

Opportunities of Australia Organic Beverages Market:

Expansion in Regional and Underserved Markets

The biggest potential for the Australian organic beverage market is selling more widely into rural and remote areas. While capital cities such as Sydney, Melbourne, and Brisbane have a strong presence of organic products, smaller towns and regional areas are increasingly looking for access to healthier, more sustainable food and beverages. As better logistics and an expansion of health-oriented retail stores in these regions become a reality, brands have an excellent opportunity to break into new markets. Australians residing in regional areas have strong agricultural roots and are more likely to favor local and organic suppliers. Organic drinks brands can foster strong loyalty from rural consumers by adapting marketing initiatives to emphasize local sourcing, environmental responsibility, and community engagement. Moreover, alliances with local grocers, co-ops, and farmers' markets can promote visibility and trust, enabling smaller organic producers to increase their presence beyond metropolitan areas.

Innovation with Native Ingredients and Functional Benefits

According to the Australia organic beverages market analysis, the region’s biodiversity is rich with offerings for organic beverage innovation using native ingredients and functional health benefits. Plants like lemon myrtle, Kakadu plum, finger lime, and wattleseed are becoming more and more prominent in teas, juices, and health beverages. While they provide distinctive flavor and nutrition, these ingredients also appeal to consumers seeking genuine Australian products that enhance biodiversity and Indigenous Australians. Functional drinks—those promoting digestive health, vitality, sleep, or immunity—are also gaining momentum among Australians increasingly interested in active health management. When blended with organic certification and these functional and indigenous ingredients, products are placed as premium, purpose-driven options. This niche, but fast-emerging, market enables Australian brands to stand out not only at home but also on the international stage, where there is increasing demand for innovative, natural health drinks. Partnerships with Indigenous-owned businesses can also provide ethical value and help drive reconciliation initiatives.

Export Potential and Tourism-Driven Exposure

Australia's image of clean, high-quality food and beverage products makes it an excellent platform for international expansion of organic drink brands. As there is increasing global demand for organically grown and sustainably sourced products, particularly in the Middle East and Asia-Pacific regions, Australian drinks highlighting organic credentials, ethical supply, and environmental stewardship can command the attention of selective international customers. Moreover, Australia's tourism sector provides a natural platform for an organic display to the world. Visitors to Australia's café culture, wineries, and health retreats regularly find locally produced organic drinks, which can generate global interest and word-of-mouth promotion. Byron Bay, Margaret River, and the Sunshine Coast are already popular with their organic and health-based lifestyle communities, thus providing the perfect springboards for organic beverage exposure. These tourist destinations raise local consciousness and provide quality feedback and testing grounds for emerging product innovations, enabling brands to hone offerings prior to exporting with confidence and attraction.

Challenges of Australia Organic Beverages Market:

High Cost of Production and Pricing Constraints

One of the key issues for the organic beverages industry in Australia is the high cost of production, which has a direct influence on pricing and affordability. Organic farming calls for more labor-intensive practices, rigid adherence to certification requirements, and natural methods of controlling pests, all of which result in greater input costs than in conventional farming. These costs are translated into the end retail prices of organic drinks, pricing them out of reach for price-sensitive consumers, particularly in regions facing financial hard times or cost of living pressures driven by inflation. A wide range of Australians who reside in suburban and rural communities might consider that organic beverages fall outside their regular purchase budget, limiting regular shopping to specialist segments and not the general population. Moreover, the price of acquiring and sustaining organic certification in Australia can be prohibitive for small producers, who may find it difficult to compete with bigger, heavily funded brands. Without wider affordability or industry assistance to reduce entry costs, the market may price out many potential consumers and constrain growth overall.

Limited Consumer Awareness and Misinformation

As interest in sustainability and health increases, however, the majority of Australian consumers remain unclear on what makes a drink organic. Ambiguity surrounding terms such as "natural," "organic," and "eco-friendly" can confuse individuals into making uneducated choices. Such confusion is compounded by inconsistent labelling and marketing that might deceive or overstate the organic status of products. In rural and remote areas of the nation, educational outreach and access to reliable information regarding organic farming and certification are still in short supply. Consequently, potential consumers may underappreciate or even be skeptical about the advantage of organic drinks. This raises a communication issue for the brands, who need to make an investment in consumer education to gain people's trust in the product. The bridging of these knowledge gaps is necessary for the growth of the organic beverage market and involves concerted action by producers, retailers, and industry organizations to increase awareness and transparency among all populations.

Supply Chain Constraints and Climate Issues

The organic beverage sector in Australia largely relies on the stability of local agricultural supply chains, which are constantly marred by climate issues. Droughts, floods, bushfires, and shifting seasons have a significant impact on the yield and quality of organic crops like fruits, herbs, and grains utilized in drinks. The majority of organic agriculture is found in South Australia, Victoria, and parts of New South Wales, where the changing climate has a greater impact. Organic agriculture, not allowing the use of synthetic additives, makes it more costly and time-consuming to recover from hostile weather conditions. Furthermore, organic manufacturers tend to use smaller, decentralized supply chains, which lack the infrastructure and support they need to expand production and meet accelerating demand. These weaknesses place a challenge for organic drink companies to ensure consistent availability, particularly for products reliant upon fresh, seasonal ingredients. Absent investment in climate resilience and supply chain coordination, the business could experience continued disruption that impacts product quality and customer confidence.

Key Market Segmentation:

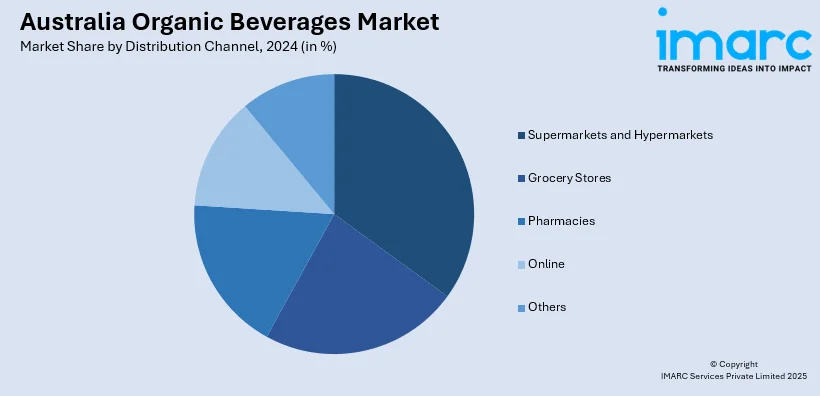

IMARC Group provides an analysis of the key trends in each sub-segment of the Australia organic beverages market report, along with forecasts at the country and regional level from 2025-2033. Our report has categorized the market based on product type and distribution channel.

Breakup by Product Type:

- Organic Coffee and Tea

- Organic Non-Dairy Beverages

- Organic Alcoholic Beverages

- Organic Soft Drinks

- Others

Breakup by Distribution Channel:

- Supermarkets and Hypermarkets

- Grocery Stores

- Pharmacies

- Online

- Others

Breakup by Region:

- Australia Capital Territory and New South Wales

- Victoria and Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Competitive Landscape:

The competitive landscape of the industry has also been examined with some of the key players, including:

- Byron Bay Coffee Company

- Montville Coffee

- Ovvio Organics

- Planet Organic

- República Organic

- Tea Gardens Kombucha

- Tea Tonic

Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Segment Coverage | Product Type, Distribution Channel, Region |

| Region Covered | Australia Capital Territory and New South Wales, Victoria and Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Byron Bay Coffee Company, Montville Coffee, Ovvio Organics, Planet Organic, República Organic, Tea Gardens Kombucha, Tea Tonic, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia organic beverages market was valued at USD 536.7 Million in 2024.

The Australia organic beverages market is projected to exhibit a CAGR of 17.40% during 22025-2033

The Australia organic beverages market is expected to reach a value of USD 2,669.4 Million by 2033.

The Australia organic drinks market is fueled by clean-label, health-conscious consumer demand for products such as botanical teas, organic juices, and functional kombuchas. As mainstream retail, cafés, and wellness brands move toward organic products, market acceptability and visibility keep growing.

The Australia organic drinks market is fueled by increased health consciousness and a need for chemical-free, sustainably sourced beverages. Domestic sourcing, organic certification, and functional health properties make products appealing to consumers, thereby escalating their demand across the country. Increased availability through retail chains and cafés is further fueling growth, as well as a nationwide change in direction toward responsible, wellness-driven consumption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)