Australia Organic Cotton Market Size, Share, Trends and Forecast by Type, Quality Type, Application, and Region, 2026-2034

Australia Organic Cotton Market Summary:

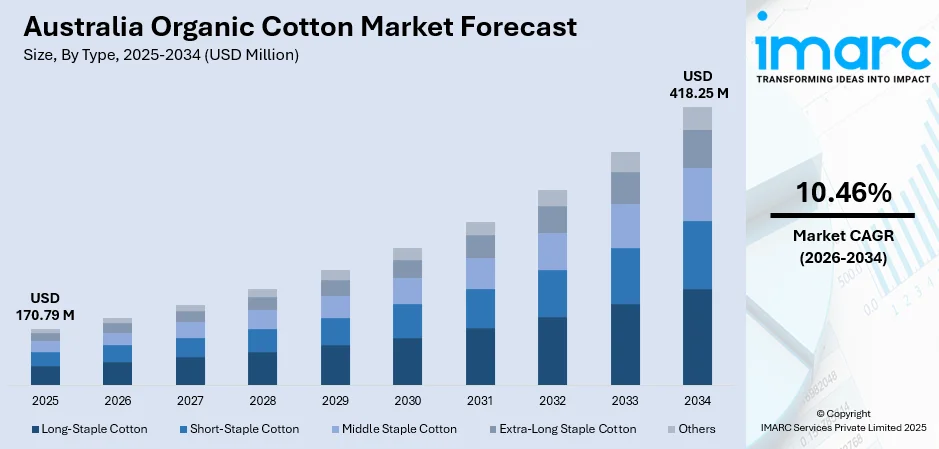

The Australia organic cotton market size was valued at USD 170.79 Million in 2025 and is projected to reach USD 418.25 Million by 2034, growing at a compound annual growth rate of 10.46% from 2026-2034.

The market expansion is propelled by increasing consumer preference for sustainable and ethically produced textiles, growing awareness of environmental impacts associated with conventional cotton farming, and rising adoption of eco-friendly fashion among Australian consumers. The strengthening regulatory framework supporting circular economy initiatives, expanding e-commerce channels providing wider product accessibility, and strong domestic fashion brand commitments to sustainable sourcing practices are collectively contributing to the Australia organic cotton market share.

Key Takeaways and Insights:

- By Type: Middle staple cotton dominates the market with approximately 35% revenue share in 2025, driven by its optimal fiber length that balances softness with durability, making it ideal for everyday apparel manufacturing, and its cost-effective production suited to Australian climate conditions.

- By Quality Type: Upland leads the market with approximately 55% revenue share in 2025, owing to its adaptability to diverse growing conditions across Australian cotton regions, high yield potential, and suitability for the broadest range of textile applications from casual wear to home furnishings.

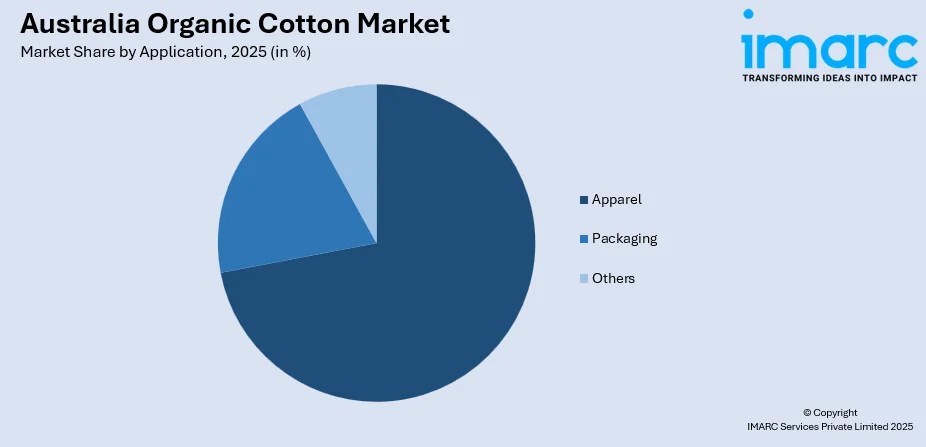

- By Application: Apparel accounts for the largest revenue share of approximately 72% in 2025. This dominance is driven by robust consumer demand for sustainable fashion, proliferation of eco-conscious clothing brands, and increasing preference for chemical-free fabrics in everyday wear and baby clothing categories.

- Key Players: The Australia organic cotton market exhibits moderate competitive intensity, with sustainable fashion brands, textile manufacturers, and organic fiber suppliers competing across premium and mainstream segments through ethical sourcing certifications and supply chain transparency initiatives.

To get more information on this market Request Sample

The Australia organic cotton market is experiencing growth as eco-consciousness reshapes consumer purchasing patterns across the fashion and textile sectors. Leading Australian sustainable fashion brands are driving organic cotton adoption through locally manufactured, ethically sourced apparel collections. Innovative companies have secured significant funding to scale made-to-order organic cotton apparel platforms and invest in technology for custom garment production, reflecting strong investor confidence in sustainable fashion ventures. The Government's introduction of the Seamless circular textile scheme, attracting widespread participation from brands, retailers, and industry stakeholders, demonstrates strengthening policy support for sustainable fiber adoption and responsible textile production practices. These developments collectively underscore the momentum building across Australia's organic cotton value chain.

Australia Organic Cotton Market Trends:

Rising Sustainable and Ethical Fashion Demand

Consumer preference for environmentally responsible textiles is accelerating organic cotton adoption across Australian fashion retail. Brands are increasingly incorporating transparent supply chains and sustainability certifications into their value propositions. In 2024, KITX became B Corp certified following a rigorous two-year assessment process, underscoring its commitment to measurable sustainability impact through regenerative and circular fashion initiatives. This certification trend reflects broader industry movement toward verified ethical practices that resonate with environmentally conscious Australian consumers.

Expanding E-Commerce and Digital Retail Channels

Online retail platforms are significantly enhancing organic cotton product accessibility for Australian consumers. Digital channels enable comprehensive product information sharing, certification verification, and comparison shopping for sustainable textiles. According to IAB Australia and Pureprofile's 2024 Australian and New Zealand Ecommerce Report, approximately 83% of Australian online shoppers purchase monthly through digital channels, creating substantial distribution opportunities for organic cotton brands reaching eco-conscious buyers across urban and regional areas.

Supply Chain Traceability and Certification Adoption

Blockchain-based traceability solutions and certification frameworks are strengthening organic cotton supply chain integrity in Australia. Enhanced tracking capabilities from farm to finished product build consumer trust through verified sourcing claims. In May 2025, Better Cotton launched Physical Better Cotton from Australia with 156 Australian myBMP/Better Cotton farm businesses participating in traceability programs, with over 2 Million bales expected to be available through the Better Cotton Platform. It allows brands and retailers to source verified sustainable fiber while meeting evolving consumer expectations for ethical supply chain transparency.

Market Outlook 2026-2034:

The Australia organic cotton market revenue is projected to witness substantial growth, supported by sustained consumer demand for sustainable textiles and strengthening regulatory frameworks promoting circular economy principles. The market generated a revenue of USD 170.79 Million in 2025 and is projected to reach a revenue of USD 418.25 Million by 2034, growing at a compound annual growth rate of 10.46% from 2026-2034. Expanding applications across baby apparel, home textiles, and eco-friendly packaging segments, combined with increasing brand commitments to sustainable sourcing, position organic cotton as a growth category within Australia's evolving textile landscape.

Australia Organic Cotton Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Middle Staple Cotton | 35% |

| Quality Type | Upland | 55% |

| Application | Apparel | 72% |

Type Insights:

- Long-Staple Cotton

- Short-Staple Cotton

- Middle Staple Cotton

- Extra-Long Staple Cotton

- Others

Middle staple cotton dominates the Australia organic cotton market with approximately 35% revenue share in 2025.

Middle staple cotton leads Australia's organic cotton market owing to its versatile fiber characteristics that deliver excellent balance between softness, strength, and manufacturing efficiency for apparel production. The fiber length range provides optimal spinning properties for everyday clothing applications while maintaining cost competitiveness against premium extra-long staple varieties. Australian sustainable fashion brands are increasingly utilizing middle staple organic cotton for their core collections, emphasizing comfort and durability in made-to-order and ethical basics ranges manufactured in Sydney and Melbourne facilities with Ethical Clothing Australia certification.

Quality Type Insights:

- Supima/Pima

- Upland

- Giza

- Others

Upland leads the Australia organic cotton market with approximately 55% revenue share in 2025.

Upland holds the largest market share driven by its exceptional adaptability to Australian growing conditions and high yield potential that supports commercial-scale organic production. The variety's fiber characteristics suit diverse textile applications from casual apparel to home furnishings while offering cost advantages over premium long-staple alternatives. Australia's cotton industry is internationally recognized for producing yields significantly above global averages while maintaining superior upland cotton quality characteristics. Production is concentrated in the Murray-Darling Basin, where favorable climatic conditions and established agricultural infrastructure support sustainable cultivation practices across New South Wales and Queensland growing regions.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Apparel

- Packaging

- Others

Apparel accounts for the highest revenue of 72% Australia organic cotton market share in 2025.

Apparel dominates organic cotton consumption as Australian consumers increasingly prioritize sustainable fashion choices across casual wear, activewear, and specialty categories including baby clothing. The baby apparel segment demonstrates particularly strong demand. In 2024, Isla and Mimi launched its 'Gingham Blooms' collection featuring 100% organic cotton, GOTS-certified clothing for infants ages 0-3 years, highlighting Indigenous heritage through designs influenced by Aboriginal campsite paintings while meeting parental demand for chemical-free baby wear.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales serves as Australia's primary organic cotton market hub, combining Sydney's major fashion retail centers with extensive cotton production infrastructure across the state's northern and central valleys. The concentration of sustainable fashion brands, ethical manufacturing facilities, and organic certification bodies strengthens regional market positioning.

Victoria & Tasmania represents a significant organic cotton consumption center, with Melbourne hosting numerous sustainable fashion designers, ethical clothing manufacturers, and eco-conscious retail outlets. Tasmania's emerging artisanal textile sector contributes to regional demand for premium organic cotton in boutique fashion and sustainable home furnishing applications.

Queensland combines substantial cotton cultivation capacity in its central and southern regions with growing urban demand for sustainable textiles in Brisbane and coastal communities. The state's expanding organic farming initiatives and proximity to established ginning infrastructure support regional organic cotton supply chain development.

Northern Territory & Southern Australia represents an emerging cotton production frontier with significant rain-fed cultivation expansion potential, while South Australia contributes through Adelaide's sustainable fashion retail sector and government-led circular textile initiatives promoting organic fiber adoption across institutional and consumer applications.

Western Australia's organic cotton market is driven by Perth's environmentally conscious consumer base and expanding sustainable fashion retail presence. The Ord River Irrigation Scheme region offers emerging cultivation opportunities, with planned ginning infrastructure development supporting potential growth in regional organic cotton production.

Market Dynamics:

Growth Drivers:

Why is the Australia Organic Cotton Market Growing?

Escalating Consumer Eco-Consciousness and Green Consumerism

Heightened environmental awareness among Australian consumers represents a primary driver for organic cotton market expansion. Concerns regarding land degradation, water scarcity, and textile waste are motivating conscious purchasing decisions favoring products meeting ethical and sustainable standards. Environmentally aware consumers, particularly in metropolitan centers including Sydney, Melbourne, and Brisbane, actively seek clothing and home textiles produced from certified organic cotton to minimize pesticide exposure and chemical runoff. Australian sustainable fashion brands are responding through organic cotton collections manufactured locally with transparent supply chain practices and Ethical Clothing Australia certification, building consumer trust through verified sustainability credentials.

Government Sustainability Initiatives and Regulatory Support

Strengthening policy frameworks promoting circular economy principles and sustainable textile production are catalyzing organic cotton market growth. Government-backed initiatives addressing Australia's textile waste challenge create favorable conditions for sustainable fiber adoption. In 2024, the Australian government introduced the Seamless scheme establishing a clothing product stewardship framework with a 4-cent levy per garment, targeting circular textile industry development by 2030. The scheme has enrolled foundation members like Cotton On Group, David Jones, and THE ICONIC, collectively committing to reduced waste and enhanced sustainability across fashion value chains.

Fashion Innovation and Ethical Brand Partnerships

Australia's fashion innovation ecosystem is creating organic cotton market opportunities through collaborations between designers, manufacturers, and sustainable fiber suppliers. Fashion brands in cities including Melbourne and Byron Bay are partnering with organic cotton sources to develop limited-edition ranges and artisanal clothing collections emphasizing ethical storytelling. The increasing preference for slow fashion and minimalism supports premium positioning for quality organic cotton products. Additionally, textile research programs at institutions investigate fiber innovations to enhance organic cotton performance and durability for Australian conditions, supporting market development through technology advancement and product differentiation capabilities.

Market Restraints:

What Challenges the Australia Organic Cotton Market is Facing?

Weather-Associated Risks and Climatic Unpredictability

Australia's organic cotton supply faces significant challenges from weather variability and climatic unpredictability affecting cotton growing regions. Droughts, heatwaves, and irregular rainfall patterns disrupt planting schedules, reduce yields, and intensify pest pressure, with organic production particularly vulnerable given restrictions on synthetic pesticides.

Infrastructure Deficits and Processing Constraints

Limited specialized organic processing infrastructure constrains market expansion, with most existing cotton ginning facilities optimized for conventional production methods requiring strict separation protocols for organic certification maintenance. Insufficient nearby processing capacity increases logistics costs and carbon footprint for organic fiber transportation.

Market Scale and Competitive Pricing Pressures

Australia's organic cotton industry faces challenges from relatively small domestic production scale compared to global competitors, limiting economies of scale and resulting in higher per-unit costs. Imported organic cotton from established suppliers in countries including India offers price advantages, creating competitive pressure for Australian producers and brands.

Competitive Landscape:

The Australia organic cotton market features a moderately competitive landscape with participation spanning sustainable fashion brands, textile manufacturers, and organic fiber distributors. Market participants differentiate through sustainability certifications including GOTS and Better Cotton accreditation, supply chain transparency initiatives, and ethical manufacturing credentials. Competition intensifies around brand authenticity and verifiable environmental claims as consumer scrutiny increases. Strategic partnerships between fashion retailers and organic cotton suppliers support market development, while vertical integration among larger players enhances supply security and traceability capabilities across value chains.

Australia Organic Cotton Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Long-Staple Cotton, Short-Staple Cotton, Middle Staple Cotton, Extra-Long Staple Cotton, Others |

| Quality Types Covered | Supima/Pima, Upland, Giza, Others |

| Applications Covered | Apparel, Packaging, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia organic cotton market size was valued at USD 170.79 Million in 2025.

The Australia organic cotton market is expected to grow at a compound annual growth rate of 10.46% from 2026-2034 to reach USD 418.25 Million by 2034.

Middle staple cotton dominated the market with approximately 35% share in 2025, driven by its optimal fiber characteristics balancing softness and durability for diverse apparel manufacturing applications.

Key factors driving the Australia organic cotton market include rising consumer eco-consciousness favoring sustainable textiles, government circular economy initiatives, expanding e-commerce distribution channels, and increasing brand commitments to ethical sourcing practices.

Major challenges include weather-related production risks and climatic unpredictability, limited specialized organic processing infrastructure, competitive pricing pressures from larger global suppliers, and higher production costs constraining economies of scale.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)