Australia Organic Farming Market Size, Share, Trends and Forecast by Type, Product, Method, End User, and Region, 2025-2033

Australia Organic Farming Market Size and Share:

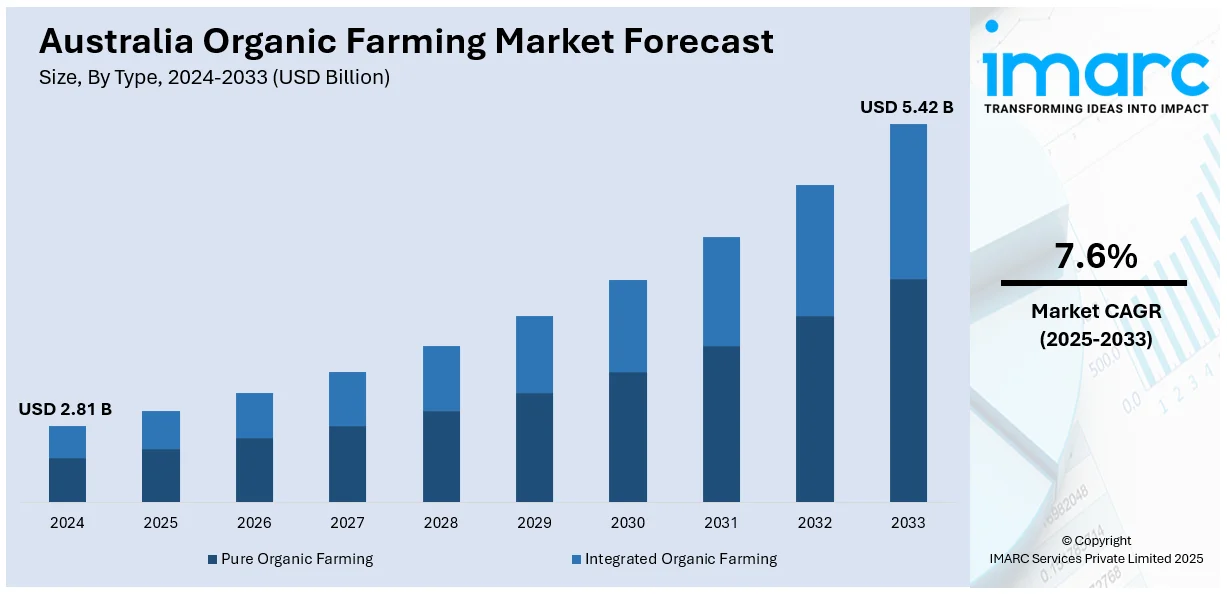

The Australia organic farming market size was valued at USD 2.81 Billion in 2024. Looking forward, the market is projected to reach USD 5.42 Billion by 2033, exhibiting a CAGR of 7.6% from 2025-2033. The Australia organic farming market share is expanding, driven by the rising usage of organic farming methods like cover cropping that help to maintain soil health and improve water retention, making farms more resilient, along with the expansion of supermarkets, specialty stores, and online platforms, which are broadening their organic sections and increasing the accessibility of fresh items to meet the high demand.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2.81 Billion |

|

Market Forecast in 2033

|

USD 5.42 Billion |

| Market Growth Rate (2025-2033) | 7.6% |

At present, innovations in organic fertilizers and biopesticides are positively influencing the market in Australia. They offer safer and more effective alternatives to synthetic chemicals. Farmers use bio-based fertilizers made from compost, seaweed extracts, and beneficial microbes to support soil health and increase crop yields. Biopesticides, obtained from natural origins, such as bacteria, fungi, and plant extracts, assist in managing pests without harming the environment. These improvements make organic farming more efficient and sustainable while meeting user demand for chemical-free food items. Additionally, researchers and agritech companies work on developing new solutions that enhance plant growth and disease resistance naturally. With better organic inputs available, more farmers are transitioning to organic methods, minimizing their environmental impact while maintaining productivity.

To get more information on this market, Request Sample

The implementation of labeling regulations and stronger organic certification is impelling the Australia organic farming market growth. Clear labeling helps shoppers to easily identify genuine organic items, reducing confusion and preventing misleading claims. Stringent regulations ensure that farmers and producers follow proper organic standards, improving overall product quality. This encourages more farmers to adopt organic methods, knowing their efforts are recognized and valued. Export markets also benefit, as international buyers prefer certified organic products with strict compliance. Besides this, government agencies and certification bodies work to standardize these regulations, making organic farming more credible and profitable. With stronger labeling and certification, users feel more confident in their purchases.

Key Trends of Australia Organic Farming Market:

Rising demand for organic products

The increasing need for organic products is fueling the market growth in the country. More people choose organic fruits, vegetables, and grains because they want healthier and synthetic-free food items. With a rise in the number of diseases linked to poor diet and chemical exposure, people have become more aware about what they eat. As per the data published on the official website of the Australian Institute of Health and Welfare, in 2024, cardiovascular disease represented nearly 12% of the overall disease burden (14% for males, 10% for females), placing it fourth among disease categories, following cancer, mental and substance use disorders, and musculoskeletal conditions. Besides this, supermarkets, specialty stores, and online platforms are expanding their organic sections to meet this high demand. Restaurants and cafes also prefer organic ingredients to attract health-conscious people. This trend encourages more farmers to employ organic methods, increasing the overall supply.

Growing need for climate-resilient crop production

The rising requirement for climate-resilient crop production is offering a favorable Australia organic farming market outlook. Farmers face challenges, such as droughts, unpredictable weather, and soil degradation, making climate-adaptive practices more important. Government initiatives also support climate-smart agriculture through grants, research, and education programs. According to the information given on the official website of the Department of Agriculture, Fisheries, and Forestry, the Australian Government launched the USD 302.1 Million Climate-Smart Agriculture Program via the Natural Heritage Trust (NHT) for a duration of five years starting from 2023-24. It included the 'Partnerships and Innovation grant', which accepted applications from 22 February 2024 to 8 April 2024. This was a competitive grant program with a total of USD 45 Million accessible over four years (2024-25 to 2027-28) for medium to large projects aimed at promoting the development, testing, usage, and implementation of innovative and climate-smart tools and practical farming methods that enhance productivity. Apart from this, organic farming methods like cover cropping help to improve soil health and water retention, making farms more resilient.

Increasing adoption of sustainable and regenerative farming practices

The growing adoption of sustainable and regenerative farming practices in Australia assists in improving soil health and increasing biodiversity. Farmers use methods like no-till farming, crop rotation, and composting to restore soil fertility and reduce reliance on synthetic inputs. Besides this, government policies and investments support turning organic waste into compost and natural fertilizers, helping farms to stay sustainable. As per the information given on the official website of the Queensland government, in 2024, an investment of USD 291 Million was designated for the Scenic Rim Agricultural Industrial Precinct (SRAIP) initiative to establish a future innovation zone in Queensland, Australia. Expanding the activities of Queensland-based vegetable farming and marketing firm Kalfresh, the facility was anticipated to generate 641 direct jobs throughout the 10-year construction phase and an extra 475 direct jobs each year during operation. It intended to transform organic agricultural waste into renewable energy and offer a fresh source of fertilizers for the local farming community to employ in crop cultivation.

Growth Drivers of Australia Organic Farming Market:

Growing Awareness about Health and Wellness

The increasing focus on health and wellness among Australian consumers has notably impacted food selections, leading to a shift towards organically grown items. Shoppers are progressively steering clear of products that involve synthetic pesticides, fertilizers, and genetically modified organisms. Instead, they prefer foods that are seen as safer, fresher, and more nutritious. This heightened interest in clean-label and chemical-free options is evident in fruits and vegetables and also in dairy, meat, and packaged organic products. The COVID-19 pandemic has further accelerated this trend, prompting consumers to emphasize immune-boosting and natural dietary choices. Consequently, retailers are broadening their organic product offerings to align with consumer demands, greatly enhancing Australia organic farming market demand.

Government Support and Certification Initiatives

The Australian government has been actively involved in bolstering the organic farming sector through various financial and policy-driven incentives. Grants, low-interest loans, and subsidies are being provided to facilitate the transition from conventional to organic farming practices. Furthermore, clearer and more accessible certification standards have been developed to simplify the accreditation process for farmers aiming for organic certification. These streamlined procedures have lessened compliance burdens, encouraging participation from more small- and medium-sized farmers. Additionally, educational programs and advisory services have assisted producers in aligning with global organic standards, enhancing Australia's standing in the international organic supply chain. These collective efforts are fueling dynamic growth in the country's organic farming sector.

Expanding Export Opportunities

Australia’s reputation for providing clean, safe, and high-quality agricultural products has created significant export opportunities for its organic farming industry. Nations throughout Asia, such as China, Japan, and Singapore, are increasingly importing organic food products from Australia due to rising health consciousness and insufficient domestic supplies. Similarly, markets in North America, especially the United States and Canada, continue to express strong interest in Australian organic meat, grains, and packaged goods. Trade agreements, along with Australia's rigorous food safety and organic standards, have further enhanced its global competitiveness. According to Australia organic farming market analysis, the growing international demand is encouraging local producers to expand their operations and diversify their offerings, leading to substantial export-driven growth.

Opportunities of Australia Organic Farming Market:

Expansion into Untapped Regional Markets

The increasing focus on healthy living and sustainability is no longer confined to urban areas in Australia. Rural and regional communities are increasingly looking for organic food options, creating new opportunities for organic producers. These areas, which have been inadequately served by organic supply chains, offer substantial potential for market growth. Building robust distribution networks, collaborating with local retailers, and providing competitively priced organic products can help satisfy this demand. Furthermore, sourcing locally can lower transportation expenses and reinforce community-based farming ecosystems. By exploring these up-and-coming domestic markets, organic producers can cultivate brand loyalty and ensure long-term growth, while also supporting economic development in rural areas. This approach to regional market penetration is becoming a crucial strategy for expanding the organic farming sector in Australia.

Development of Value-Added Organic Products

As consumer tastes shift, there is a rising demand for raw organic produce and convenient, ready-to-eat organic choices. This trend opens up a lucrative avenue for creating value-added organic products like snacks, beverages, cereals, and frozen meals. These products cater to health-conscious consumers seeking quick yet nutritious food options. The surge in popularity of plant-based diets further aligns with the growing demand for organic offerings, presenting opportunities for innovation. By prioritizing product development, packaging, and branding, producers can set themselves apart in a competitive market. These value-added products can generate higher profit margins and diversify revenue streams, making them a vital growth driver in the organic farming market in Australia.

Growth in Organic Livestock Farming

There is an increasing consumer preference for ethically sourced and hormone-free animal products, creating a significant opportunity in organic livestock farming. Consumers are opting for organic meat, dairy, and eggs due to perceived health advantages and environmental benefits. Australia’s expansive grazing lands and robust regulatory frameworks make it ideally suited for organic animal farming practices. Farmers who transition to organic livestock methods can benefit from premium pricing and escalating international demand, especially in export markets. Moreover, organic livestock products are gaining popularity across retail, food service, and e-commerce platforms. This sector complements the crop-based organic market and boosts Australia's overall organic profile, significantly contributing to the long-term sustainability of the organic farming market in Australia.

Challenges of Australia Organic Farming Market:

High Production Costs Limiting Scalability

A key challenge in the organic farming sector in Australia is the notably higher production costs compared to conventional farming. Organic practices often depend on manual labor for weeding, crop rotation, and natural pest control, leading to increased labor expenses. Additionally, natural fertilizers and organic inputs are usually more expensive and less readily available than their synthetic counterparts. The transitional phase from conventional to organic farming can also result in temporary reductions in yields, which places financial pressure on farmers. These high costs can hinder competitiveness, particularly when consumers remain sensitive to prices. Without adequate price premiums or government assistance, many producers struggle to become profitable, making elevated production costs a significant obstacle to broader adoption and scalability of organic farming in Australia.

Limited Access to Organic Inputs Hindering Productivity

A consistent challenge faced by organic farmers in Australia is the restricted availability of certified organic inputs. It can be difficult to obtain high-quality organic seeds, approved fertilizers, and natural pest management solutions, especially in remote or rural areas. The absence of local suppliers often forces farmers to depend on imports, which can raise costs and delay planting or treatment schedules. Inconsistent access to these essential inputs can impact farm productivity and curtail the adoption of organic methods. Additionally, the lack of standardized input quality and supply chains can lead organic farmers to face compromised yields and challenges in maintaining certification standards. This limitation directly affects the efficiency and sustainability of farming operations, representing a significant hurdle to the expansion of the organic farming market in Australia.

Certification Complexity Burdening Small Farmers

The organic certification process in Australia is often intricate, time-consuming, and financially burdensome, particularly for small- and medium-sized farms. It requires strict compliance with regulated farming practices, thorough documentation of inputs, regular inspections, and continuous adherence to national and international standards. Many farmers struggle with the paperwork and procedural demands without external consultancy or training, which adds to their costs and complexity. Additionally, the transition period required to convert conventional farms to certified organic status often spans several years, during which farmers cannot market their products as organic despite practicing organic methods. These hurdles discourage many potential entrants and limit the scalability of existing operations, making certification complexity a major bottleneck in the Australia organic farming market.

Australia Organic Farming Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Australia organic farming market, along with forecasts at the country and regional levels from 2025-2033. The market has been categorized based on type, product, method, and end user.

Analysis by Type:

- Pure Organic Farming

- Integrated Organic Farming

Pure organic farming represents the largest segment. It avoids synthetic chemicals, making it more appealing to health-conscious people and eco-friendly buyers. Farmers emphasize organic fertilizers, rotating crops, and biological pest management, enhancing soil quality and long-term sustainability. With increasing demand for clean and chemical-free food items, more farmers adopt pure organic methods to meet market expectations. Government support and certifications also encourage this approach, giving farmers better access to premium markets. Individuals trust pure organic products for their higher nutritional value and better taste, thereby increasing sales. Additionally, the growing awareness about environmental issues encourages both farmers and users towards sustainable farming. As Australia expands its organic exports, pure organic farming stands out for meeting strict worldwide standards. The benefits of pure organic farming practices in quality and profitability make them the top choice in the market.

Analysis by Product:

- Fruits

- Vegetables

- Cereals and Grains

- Others

Fruits hold the biggest market share. They are in high demand due to their health benefits, fresh taste, and chemical-free nature. People prefer organic fruits, as they are devoid of synthetic pesticides and fertilizers, rendering them a safer option. Australia’s climate supports diverse fruit production, including apples, berries, citrus, and tropical fruits, ensuring a steady supply throughout the year. Organic certification adds value, allowing farmers to sell at premium prices both locally and internationally. Supermarkets, farmers’ markets, and direct-to-consumer (D2C) sales drive the demand for organic fruits, encouraging more growers to shift towards organic methods. Additionally, the rising awareness about sustainable farming practices and environmental concerns encourages farmers to employ organic fruit production. With government support and expanding export opportunities, organic fruits dominate the market. Their nutritional benefits, strong user preference, and increasing availability make them the top product in the country.

Analysis by Method:

- Crop Rotation

- Polyculture

- Mulching

- Soil Management

- Weed Management

- Composting

- Others

Crop rotation is a key method in the market. Farmers grow different crops in the same field over different seasons to maintain soil fertility and reduce pests. This method helps to prevent soil depletion and minimizes the need for synthetic fertilizers. It also controls weeds and plant diseases by disrupting their life cycles. Legumes, for example, add nitrogen to the soil, benefiting future crops like wheat or vegetables. Many organic farms employ this practice to boost yields naturally while maintaining healthy soil and sustainable farming systems.

Polyculture is when multiple crops grow together in the same area instead of one. Organic farmers in Australia prefer this method because it mimics natural ecosystems, making farms more resilient. Different plants support each other by repelling pests, improving soil nutrients, and reducing water loss. This method also aids in risk management. If one crop fails, others still grow. Farmers often mix vegetables, herbs, and fruit trees, creating a balanced and productive farm that supports biodiversity and lowers reliance on chemical inputs.

Mulching involves covering the soil with organic materials like straw, leaves, or wood chips. Australian organic farmers employ mulch to keep moisture in the soil, reduce weeds, and enhance soil health. It also assists in managing soil temperature, shielding plant roots from excessive heat. Over time, mulch breaks down and enriches the soil with nutrients. Many organic farmers prefer natural mulch sources, such as compost or crop residues to avoid synthetic chemicals. This simple and effective method supports sustainable agriculture by improving soil structure and minimizing water evaporation.

Soil management is crucial for maintaining fertile and healthy soil. Farmers avoid synthetic fertilizers and use organic matter like compost and manure to improve soil structure. Techniques, such as cover cropping and minimal tilling help to retain nutrients and prevent erosion. Healthy soil promotes better crop growth and enhances the farm’s overall sustainability. By focusing on soil biology and natural fertility, organic farmers create a balanced ecosystem where plants grow strong without harming the environment. Good soil management is key to long-term productivity in organic farming.

Weed management in organic farming depends on natural techniques rather than chemical herbicides. Australian farmers employ hand weeding and mechanical tools to control weeds. Some also plant cover crops that suppress unwanted plant growth. Livestock grazing is another effective way to keep weeds under control. By preventing weed overgrowth naturally, organic farmers ensure that their crops get enough nutrients and space to grow. This method also helps to maintain biodiversity and soil health.

Composting is the process of recycling organic waste into nutrient-rich soil. In the country, organic farmers use compost made from food scraps, manure, and plant residues to improve soil fertility. It provides essential nutrients to crops while reducing reliance on synthetic fertilizers. Composting also enhances soil moisture retention and supports beneficial microorganisms. By turning waste into valuable resources, farmers create a more sustainable farming system. Many organic farms depend on composting to close the nutrient cycle, minimize environmental impact, and keep the soil healthy for future crops.

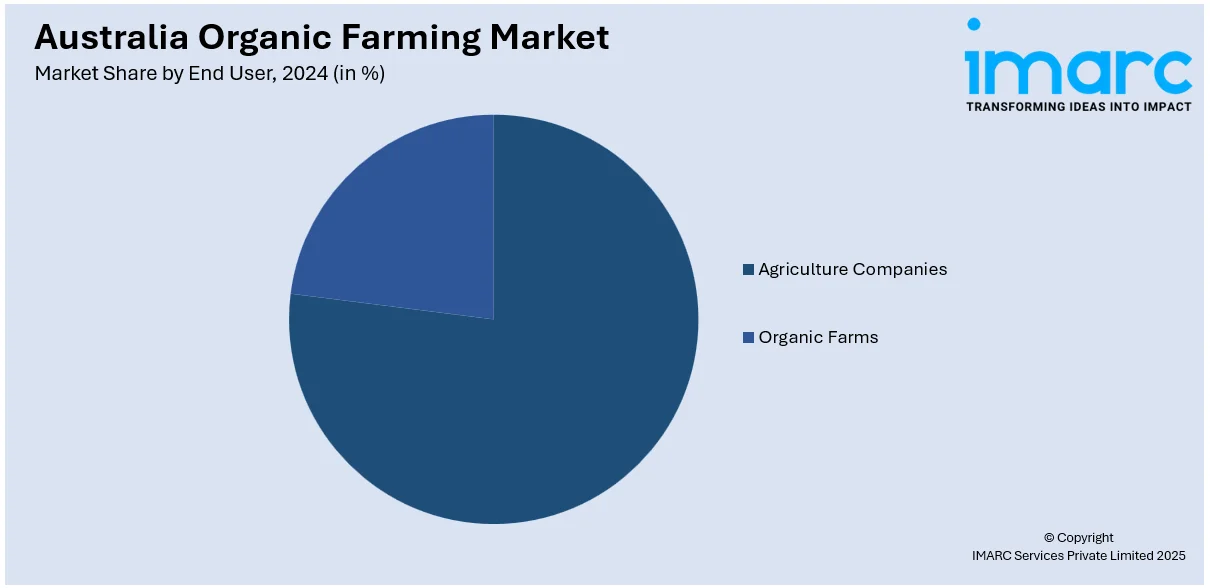

Analysis by End User:

- Agriculture Companies

- Organic Farms

Organic farms dominate the market. They are the backbone of production, supplying fresh and chemical-free food items to users, retailers, and exporters. With the rising need for natural products, more farms are adopting sustainable practices to meet the high Australia organic farming market demand. These farms focus on soil health, biodiversity, and natural pest control. Government support, certifications, and user trust help them to grow and expand. Many organic farms also supply directly to supermarkets, farmers' markets, and restaurants, strengthening their market presence. Additionally, export opportunities play an important role, as Australian organic yield is highly valued worldwide. As awareness about health and environmental benefits increases, organic farms continue to lead the way in cultivation and innovations. Their commitment to sustainability, quality, and meeting high requirements ensures their stronghold in the area.

Regional Analysis:

- Western Australia

- New South Wales

- Queensland

- Victoria

- Rest of Australia

Queensland enjoys the leading position in the market. The region is noted for its vast agricultural land, favorable climate, and strong government support. The area’s warm weather and rich soil allow year-round organic farming, making it ideal for cultivating a wide range of crops, including vegetables, fruits, and grains. As per the data released by the Queensland Government’s Department of Agriculture and Fisheries, the Toowoomba Region upheld its reputation as the top agricultural area in Queensland, boasting a Gross Value of Production (GVP) of USD 1.27 Billion for 2023-24. It encompassed various agricultural products throughout the region, including egg production, livestock, cotton, horticulture, poultry, and cereal crops like sorghum, barley, and wheat. Queensland also has a large number of certified organic farms, ensuring a steady supply of high-quality products. Besides this, the state’s strong export network helps organic farmers to reach international markets, thereby enhancing profitability. Additionally, the increasing demand for chemical-free food items encourages more farmers to employ organic methods. Government initiatives, research programs, and financial incentives further support the expansion of organic farming in the region.

Competitive Landscape:

Key players in the region work on expanding organic product lines to meet the high demand. Large organic farms, food processors, and retailers ensure a steady supply of certified organic products, making them more accessible. Besides this, big companies focus on innovations, using eco-friendly farming techniques and improving packaging to attract health-conscious individuals. Exporters help to broaden Australia’s worldwide reach, increasing the demand for organic items. Additionally, government support and certification bodies maintain quality standards, emphasizing user trust. Supermarkets and online platforms promote organic options, making them easier to find. Moreover, farmers team up with researchers to enhance yields and sustainability. With a strong market presence and continuous improvements, these key players offer steady growth and long-term success across Australia. For instance, in October 2024, the Queensland Fruit & Vegetable Growers (QFVG) announced the recipients of the 'Grow Your Field' seed funding. It included Jah Farming Pty Ltd (Future Proofing Organic Farming in Tropical North Queensland), for which USD 19,000 was designated for investing in drone technology to enhance precision in protectant spraying and beneficial placement. This competitive funding initiative aimed to identify projects that align with the industry’s Future Fields strategy, outlining the vision for Queensland’s fresh produce industry for the upcoming decade.

The report provides a comprehensive analysis of the competitive landscape in the Australia organic farming market with detailed profiles of all major companies, including:

- Bauer's Organic Farm Pty Ltd

- Eco-Farms

- Eden Farmers Organics

- Manna Farms

- R&R Smith Pty Ltd

- Sustainable Farming Solutions Pty Ltd

- The Bio Organic Farm

- TOTALLY PURE FRUITS Pty Ltd

Latest News and Developments:

- October 2024: The Government of Queensland revealed the FOUR fertilizer project winners of the Backing Business in the Bush Fund (BBBF) and the Regional Economic Futures Fund (REFF). The BBBF provided financial support ranging from USD 500,000 to USD 2 Million for each project while grants through REFF varied from USD 50,000 to USD 12.75 Million. Mort & Co will obtain an undisclosed sum to enhance its current organic fertilizer output close to its Grassdale feedlot south of Dalby by adding more granulators and an automated batching system. Another recipient is the precision agriculture firm, DataFarming, which planned to utilize its funding to develop digital infrastructure that connects fertilizer manufacturers directly with farmers.

- October 2024: Flamingro, a superior certified organic chitin-based biostimulant for optimum plant growth & a healthier root system, was highlighted in Good Fruit & Vegetables magazine. The piece titled “Bio-Stimulant Ticks Aussie Organic Box” discussed its entry into the Australian market. It is accessible to farmers throughout Australia, having demonstrated a 26% rise in root mass in trials. With 70-80% of today’s wine grape vines rooted themselves, it aims to provide essential protection that could greatly diminish losses throughout the sector.

- March 2024: A group of 19 Vietnamese companies, the Vietnam Organic Agriculture Association (VOAA), and some organic farming educators were set to travel to Australia to promote different types of organic products from March 18-25. Tales of Vietnamese organic agriculture, along with the delightful flavors of organic products like coconut flower nectar juice, pepper, tea, coffee, and cashews, were to be showcased in Sydney, Bairnsdale, and Melbourne. The delegation intended to explore organic farming practices in Canberra, New South Wales’ Riverina area, and Victoria’s Gippsland area, and engage with various Australian organizations. The journey is designed to link the team with Australian importers and top organic farming instructors.

- September 2023: High Valley Dawn Permaculture at Rosslyn Bay, Queensland revealed the commencement of construction of a facility for processing and packaging to boost the output of its organic vegetables and fruits for local markets, businesses, and the farm's paddock-to-plate eatery, Beaches Rosslyn Bay. This farm was one of 24 enterprises chosen for the fifth cycle of the competitive RED grants program, which has a total funding of USD 3.9 Million. Overall, the fifth round of the RED Grants initiative was expected to create up to 215 direct permanent positions.

- April 2023: The Grains Research and Development Corporation (GRDC) teamed up with Australia’s national science agency CSIRO and industry partners, Kalyx Australia and Delta Agribusiness to make a five-year investment. This project sought to draw global interest by emphasizing the improvement of soil organic matter via effective nutrient management and implementing a comprehensive system strategy to enhance soil microbial activity. This spending reinforced GRDC’s commitment to supporting grain producers in comprehending and adopting sustainable agricultural practices through research, development, and extension (RD&E).

- March 2023: The Queensland Government declared 1.5 Million in funding to enhance Earthborn Australia's organics processing facility in Palmwoods on the Sunshine Coast. The initiative aims to generate 6 new jobs in construction and 6 new permanent roles. The finished facility will have the capacity to handle an extra 22,000 Tons of organic waste annually to produce high-quality soil amendments. This marks an initial step in cutting down waste and greenhouse gas emissions, while also generating employment and aiding agriculture in Queensland.

Australia Organic Farming Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Pure Organic Farming, Integrated Organic Farming |

| Products Covered | Fruits, Vegetables, Cereals and Grains, Others |

| Methods Covered | Crop Rotation, Polyculture, Mulching, Soil Management, Weed Management, Composting, Others |

| End Users Covered | Agriculture Companies, Organic Farms |

| Regions Covered | Western Australia, New South Wales, Queensland, Victoria, Rest of Australia |

| Companies Covered | Bauer's Organic Farm Pty Ltd, Eco-Farms, Eden Farmers Organics, Manna Farms, R&R Smith Pty Ltd, Sustainable Farming Solutions Pty Ltd, The Bio Organic Farm, TOTALLY PURE FRUITS Pty Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, the Australia organic farming market forecast, and dynamics from 2019-2033.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Australia organic farming market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia organic farming industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The organic farming market in Australia was valued at USD 2.81 Billion in 2024.

The increasing demand for chemical-free and healthy food items is encouraging more farmers to adopt organic practices. Besides this, government support through subsidies, certifications, and research programs is enabling organic farming expansion. Moreover, technological advancements in organic farming methods improve productivity, making it easier for farmers to make a transition from conventional farming.

The Australia organic farming market is projected to exhibit a CAGR of 7.6% during 2025-2033, reaching a value of USD 5.42 Billion by 2033.

Pure organic farming accounted for the largest Australia organic farming type market share because it avoids synthetic chemicals, meets user requirement for healthy food products, and supports sustainability. Farmers prefer it for better soil health, higher quality yield, and strong market demand.

Some of the major players in the Australia organic farming market include Bauer's Organic Farm Pty Ltd, Eco-Farms, Eden Farmers Organics, Manna Farms, R&R Smith Pty Ltd, Sustainable Farming Solutions Pty Ltd, The Bio Organic Farm, TOTALLY PURE FRUITS Pty Ltd, etc.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)