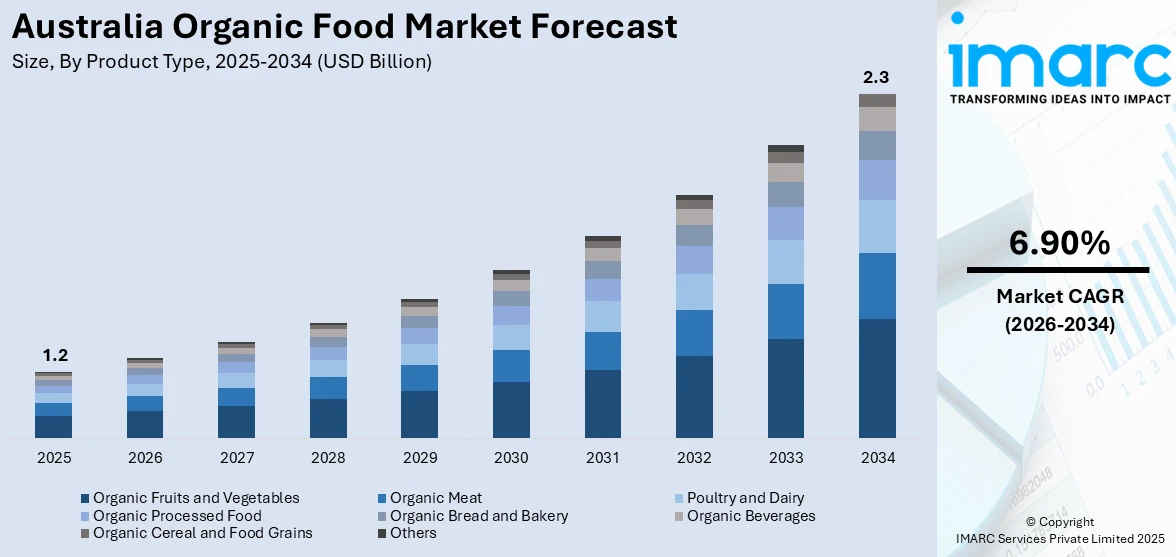

Australia Organic Food Market Report by Product Type (Organic Fruits and Vegetables, Organic Meat, Poultry and Dairy, Organic Processed Food, Organic Bread and Bakery, Organic Beverages, Organic Cereal and Food Grains, and Others), Distribution Channel (Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, Online Stores, and Others), and Region 2026-2034

Australia Organic Food Market Overview:

The Australia organic food market size reached USD 1.2 Billion in 2025. Looking forward, the market is projected to reach USD 2.3 Billion by 2034, exhibiting a growth rate (CAGR) of 6.90% during 2026-2034. The market is primarily driven by increasing consumer demand, rising health awareness, easy accessibility in supermarkets like Woolworths and Coles, and significant expansion of the retail sector.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1.2 Billion |

| Market Forecast in 2034 | USD 2.3 Billion |

| Market Growth Rate 2026-2034 | 6.90% |

Key Trends of Australia Organic Food Market:

Increasing Consumer Demand

Consumer interest in organic products in Australia has increased, as evidenced by consistent growth in spending on these goods which highlighted a marked increase in consumer expenditures on certified organic products from one year to the next. This trend is backed by data from industry reports by the Australian Organic Ltd., the Australian organic sector is continually evolving, boasting a market value exceeding $2 Billion from domestic and international sales in 2020. According to the report on organic farming in Australia from 2020, this industry was expected to see a revenue increase of 7.9% during the 2020-20221 period and is projected to grow at an annual rate of 14.9% over the next five years, reaching an estimated $3.9 Billion by 2025-2026. Besides, the sector comprises over 3,200 certified entities, including farmers, manufacturers, wholesalers, and retailers nationwide. Notably, farmers make up 41% of these certified entities, often managing diversified operations that produce a variety of products such as fruits, vegetables, dairy, cattle, sheep, fodder, and grain. Furthermore, growing awareness of the long-term effects of dietary choices on health is a major contributor to the public's developing health consciousness. Along with this, Australians are choosing more organic products as a result of environmental concerns becoming increasingly prominent in consumer decisions that emphasize soil protection and renewable resources.

To get more information on this market Request Sample

Significant Retail Expansion

The Australian organic food market is experiencing robust growth, driven by significant retail expansion. According to the Australia Retail Association (ARA), in May 2024, Australian retail sales experienced a slight uptick, with a year-on-year increase of 1.7%. Moreover, data from the Australian Bureau of Statistics (ABS) indicated that retail spending across the country reached $35.9 Billion in May. Besides, food sales also increased by 3%. Meanwhile, cafes, restaurants, and takeaways saw a modest increase of 0.9%. This surge is largely due to major supermarket chains like Woolworths and Coles expanding their organic product offerings. Furthermore, by increasing the availability of organic foods, these retailers have made it easier for a wider range of consumers to purchase these products. This accessibility is crucial as it taps into the growing consumer awareness and demand for health-conscious and environmentally friendly products. As more consumers opt for organic foods due to their perceived health and environmental benefits, retailers are responding by stocking more of these items. This strategic expansion by major retailers is meeting current consumer needs while driving the overall growth of the organic food sector in Australia.

Rise of Packaged Organic Convenience Foods

The demand for organic food in Australia has expanded beyond raw produce. Packaged organic convenience foods like ready-to-eat meals, cereals, nut bars, and soups are increasingly becoming go-to options for busy consumers. Shoppers seeking quick yet healthy alternatives are attracted to organic branding that promises minimal chemicals, no synthetic additives, and cleaner ingredients. This trend is evident across supermarket shelves, with more space dedicated to organic snacks, frozen goods, and heat-and-serve meals. It signals a blend of health consciousness with convenience in lifestyle choices. Brands that provide organic-certified packaging along with transparent ingredient lists are distinguishing themselves in a competitive market. These products are helping to boost the Australia organic food market share across various retail sectors.

Growth Drivers of Australia Organic Food Market:

Health and Wellness Awareness

Australian consumers are more discerning about their food choices, driven by increasing concerns regarding pesticide exposure, food allergies, and long-term health implications. Organic food is increasingly viewed as a cleaner, safer option, free from synthetic chemicals, antibiotics, and artificial additives. This notion of purity resonates with individuals managing chronic conditions or food sensitivities, as well as those looking to enhance their diets. Health-conscious shoppers are particularly interested in organic fruits, vegetables, dairy, and pantry staples. As understanding of the relationship between food and health continues to grow, the demand for organic options is predicted to rise. These health-focused trends are central to boosting Australia organic food market demand across retail and food service.

Certification Trust Fueling Consumer Confidence

Certifications significantly influence organic food selections in Australia. Clear labelling, endorsed by accredited organisations, gives consumers confidence that products adhere to rigorous standards regarding chemical usage, animal welfare, and production methods. Shoppers are more inclined to trust and repeatedly purchase from brands that showcase recognised logos and transparent supply chain details. As skepticism grows regarding vague “natural” claims, certified organic labelling becomes a hallmark of quality and authenticity. This credibility is particularly crucial for higher-priced items, where consumers anticipate a clear rationale for the premium. The establishment of robust certification frameworks has bolstered buyer confidence and advanced the formalisation of the organic category, according to Australia organic food market analysis.

Growing Environmental Concerns

Concerns about the environment are increasingly shaping food choices in Australia. Organic farming methods free from synthetic fertilisers, pesticides, and genetic modification—are generally perceived as more beneficial for the soil, water systems, and biodiversity. Environmentally aware consumers are on the lookout for food produced with minimal ecological impact and greater focus on natural resource conservation. This preference is especially prominent among younger shoppers and families who prioritise sustainability in their everyday purchases. The connection between organic farming and reduced chemical runoff also attracts those who support clean waterways and pollinator health. As environmental consciousness continues to influence shopping behaviours, these values are contributing to the overall Australia organic food market growth, particularly in fresh produce and packaged categories.

Government Support of Australia Organic Food Market:

Funding and Grants for Organic Certification

One significant obstacle for small-scale farmers entering the organic market is the expense and complexity involved in certification. To alleviate this challenge, various government programs offer targeted financial support to help cover costs associated with audits, paperwork, and compliance processes. These grants enhance accessibility for producers who might otherwise be unable to afford certification. As more growers achieve certification, the overall supply of organic products rises, meeting the increasing consumer demand. These funding initiatives assist new entrants and motivate existing farms to adopt organic practices. Over time, this broadens the organic supply chain, bolsters rural economies, and contributes to a more diverse and resilient agricultural sector across Australia.

Research and Development Support for Organic Agriculture

Government-supported research is vital for advancing organic farming in Australia. Investments in research and development focus on creating non-chemical solutions for pest control, improving soil fertility with natural inputs, and refining crop rotation techniques. These innovations enable organic farmers to sustain productivity and sustainability without relying on synthetic fertilizers or pesticides. Public research organizations frequently collaborate with universities, industry groups, and growers to test organic-specific methods tailored to local conditions. The insights gained benefit certified organic farms and enhance broader sustainable agriculture. Continuous R&D funding ensures that the organic sector keeps evolving, addressing production challenges and strengthening long-term market viability.

Clear Regulatory Frameworks and Organic Standards

A solid regulatory framework is crucial for the credibility and expansion of Australia’s organic food market. Government agencies establish and enforce standards that clarify what qualifies as organic, ensuring consistency in production methods, labeling, and certification processes. These frameworks protect consumers from misleading claims and instill confidence in the authenticity of organic products. For producers, clear regulations minimize uncertainty and support efficient certification and export processes. Regulators also work with international bodies to align Australian standards with global organic benchmarks, facilitating cross-border trade. This organized approach enhances both domestic trust and international competitiveness, laying a strong foundation for market expansion.

Australia Organic Food Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product type, and distribution channel.

Product Type Insights:

- Organic Fruits and Vegetables

- Organic Meat, Poultry and Dairy

- Organic Processed Food

- Organic Bread and Bakery

- Organic Beverages

- Organic Cereal and Food Grains

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes organic fruits and vegetables, organic meat, poultry and dairy, organic processed food, organic bread and bakery, organic beverages, organic cereal and food grains, and others.

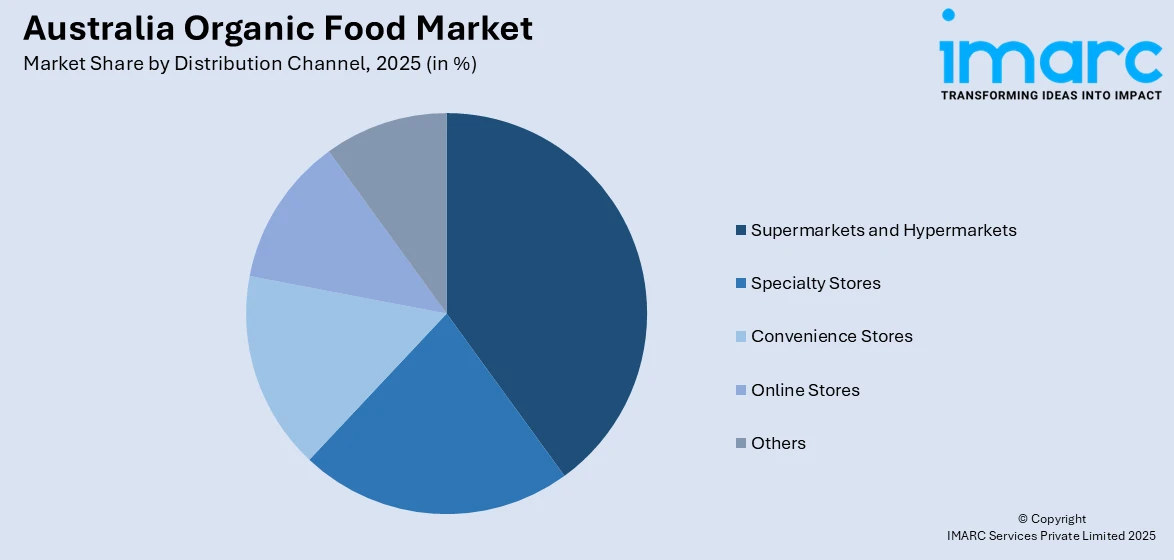

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, specialty stores, convenience stores, online stores, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Organic Food Market News:

- In March 2024, Hewitt, an Australian food producer, received two prestigious accolades at this year's Australian Organic Industry Awards, securing the Business of the Year and Brand of the Year awards for its Cleaver’s Organic brand. These awards celebrate high standards and exceptional contributions within the Australian organic sector, highlighting notable achievements of individuals, products, brands, and companies. Moreover, Hewitt earned the Business of the Year title, recognizing their significant contributions and innovations in the certified organic market. Additionally, the award acknowledges Hewitt's dedication to advancing employee skills in certified organic practices.

- In March 2024, Australian Oilseeds Holdings Limited, a company that is involved in the processing, manufacturing, and distribution of non-GMO oilseeds, and organic and conventional food-grade oils, has collaborated with EDOC Acquisition Corp., a publicly traded special purpose acquisition company. This strategic deal, which received approval from EDOC shareholders on March 5, 2024, represents a significant step forward for Australian Oilseeds, establishing it as the largest cold-pressing oil facility in Australia and the Asia Pacific region.

Australia Organic Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Organic Fruits and Vegetables, Organic Meat, Poultry and Dairy, Organic Processed Food, Organic Bread and Bakery, Organic Beverages, Organic Cereal and Food Grains, Others |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Convenience Stores, Online Stores, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia organic food market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia organic food market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia organic food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The organic food market in Australia was valued at USD 1.2 Billion in 2025.

The Australia organic food market is projected to exhibit a compound annual growth rate (CAGR) of 6.90% during 2026-2034.

The Australia organic food market is expected to reach a value of USD 2.3 Billion by 2034.

Increased health concerns, preference for chemical-free food, and support for local producers are fueling demand. Wider retail availability, rising food sensitivities, and alignment with sustainable lifestyles further boost adoption. Government-backed certification support and shifting consumer values toward natural nutrition also contribute to organic market expansion.

Australian consumers are embracing organic convenience foods, demanding clean-label products with minimal processing represent the primary key trend of the market. Certification transparency is gaining importance, while urban organic farming and local sourcing are expanding. Organic meat and baby food are also growing segments, supported by rising awareness around health and ethical consumption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)