Australia Organic Honey Market Size, Share, Trends and Forecast by Product Type, Application, Packaging, and Region, 2025-2033

Australia Organic Honey Market Overview:

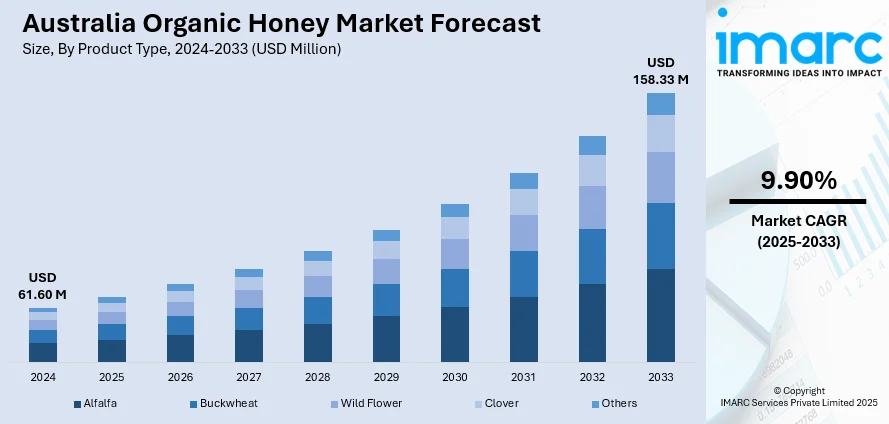

The Australia organic honey market size reached USD 61.60 Million in 2024. Looking forward, the market is expected to reach USD 158.33 Million by 2033, exhibiting a growth rate (CAGR) of 9.90% during 2025-2033. At present, people in Australia are looking for clean-label beauty products, and brands are responding by creating items with organic and chemical-free ingredients, such as certified organic honey. Besides this, the broadening of retail outlets is increasing item visibility, accessibility, and user trust and thus contributing to the expansion of the Australia organic honey market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 61.60 Million |

| Market Forecast in 2033 | USD 158.33 Million |

| Market Growth Rate 2025-2033 | 9.90% |

Key Trends of Australia Organic Honey Market:

Increasing popularity in skincare and cosmetics

Rising popularity of organic honey in skincare and cosmetics is positively influencing the market in Australia. Organic honey is gaining traction among the masses for its natural antibacterial, moisturizing, and healing properties, making it a preferred ingredient in creams, face masks, lip balms, and shampoos. Australian users are seeking clean-label beauty products, and brands are responding by formulating items with organic and chemical-free components, including certified organic honey. Local cosmetic companies highlight the purity, sustainability, and skin-friendly benefits of organic honey, aligning with the growing trends in natural skincare. This demand extends to do-it-yourself (DIY) skincare routines, where individuals purchase organic honey directly for personal use. Spas and wellness centers are also employing organic honey-based treatments, further boosting their visibility and desirability. Social media influencers and beauty bloggers are promoting organic honey for its glow-enhancing and soothing effects, encouraging trial among wider audiences. Additionally, rising awareness about the environmental and ethical aspects of organic production is adding value to honey sourced from responsible beekeeping. Export potential is increasing as international brands continue to seek premium Australian organic honey for natural cosmetic lines. This growing synergy between skincare trends and clean ingredients is strengthening the role of organic honey in the market and supporting steady growth across the wellness and personal care industries in Australia. According to the IMARC Group, the Australia skincare market is set to attain USD 4.22 Billion by 2033, exhibiting a growth rate (CAGR) of 4.44% during 2025-2033.

To get more information on this market, Request Sample

Expansion of retail outlets

The broadening of retail channels is impelling the Australia organic honey market growth. According to the Australian Bureau of Statistics, the retail market estimate for April 2025 increased by 3.8% in comparison to April 2024. As supermarkets, health food stores, and specialty organic outlets are expanding across urban and regional areas, they continue to offer more shelf space and dedicated sections for organic products, including honey. Retailers are actively promoting organic honey through attractive packaging, clear labeling, and promotional displays that highlight its purity and health benefits. The presence of organic honey in mainstream retail chains builds user confidence and encourages trial among shoppers who may not otherwise seek it out. Retail expansion also supports local producers by providing platforms to reach a broader customer base, both in-store and through online channels. Supermarkets and wellness retailers are collaborating with Australian beekeepers to ensure consistent supply and traceability, enhancing transparency. Private label organic honey is also gaining traction, offering affordability and choice. As people are becoming more health-conscious and willing to spend on natural alternatives, retail availability plays a significant role in converting interest into purchase. The expanding retail network is ultimately helping normalize organic honey as an everyday product and stimulating the Australia honey market demand.

Growth Factors of Australia Organic Honey Market:

Increasing Consumer Interest in Natural Sweeteners and Health Attributes

In Australia, increasing consumer interest in wellness and health is fueling high growth in the market for organic honey. Most Australian consumers, especially in urban cities such as Melbourne and Sydney, are looking for natural sweeteners to substitute refined sugar and artificial syrups. Organic honey is valued for its raw nature, lack of additives, and perceived nutritional benefits. Organic honey is treasured for its taste and functional role in local breweries, bakeries, or home recipes in European and Middle Eastern multicultural settings. In addition, consumers are becoming more conscious of how raw and organic honey may alleviate seasonal allergies and help digestive health. With an increasing culture of wellness and a transition to ingredient-smarter food shopping, there is increasing demand for organic Australian honey products from a variety of floral sources, such as regional pollens from Western Australia's jarrah or Tasmania's leatherwood, each with its own compelling attractions to discerning customers.

Distinct Regional Flora and Native Botanical Diversity

Australia's unparalleled floral diversity presents singular opportunities within the organic honey market, yielding region-specific products that have strong local identity. Fruit types such as jarrah, bush, leatherwood, and yellow box honey are harvested from isolated locales like Tasmania, the Darling Ranges, and the eastern woodlands. These infrequent floral sources confer unique flavor profiles and health-related characteristics, which find favour among local and export customers looking for exotic, premium honeys. Small-scale artisan producers in places such as Western Australia and Far North Queensland produce small batches of organic honey through sustainable beekeeping practices native to indigenous flora. This botanical diversity enables brands to storytelling authenticity and terroir differentiation. The connection with untapped environments and rigorous certification levels further endorses customer belief in purity and origin, solidifying Australia as an upscale specialty honey supplier on the national and international fronts.

Growth in Certified Retail Channels and Value-Added Products

According to the Australia honey market analysis, the region’s organic honey sector enjoys increasing supermarket and specialty food store support, complemented by value-added product format innovation. Large food retailers and natural-food stores increasingly allocate shelf space to certified organic honey, plain and blended, supplemented by accompaniments such as honeycomb, creamed honey, and infused types (e.g. infused with indigenous lemon myrtle or eucalyptus). These varied formats appeal to convenience-oriented shoppers and foodies alike. Organic honey farmers are also working with kitchenware companies, gift packers, and hospitality establishments to provide attractively packaged jars and tasting boxes of varietal honeys. Suppliers are also looking at product line extension opportunities such as skin care containing honey, lip balms, and wellness preparations using known Australian ingredients such as kakadu plum and sandalwood. This product and retail innovation invites trial and premium positioning, hence organic honey is a staple in the pantry and a lifestyle purchase, which is gaining broader market share among urban consumers and gourmet export markets.

Opportunities of Australia Organic Honey Market:

Regional and Artisanal Honey Branding Opportunities

Australia's varied climates and distinctive floral ecosystems, like the pristine wilderness of Tasmania, Western Australia's jarrah forests, and Queensland's eucalyptus woodlands, provide an organic opportunity for producers to create artisanal, regionally branded organic honey. Brands can differentiate themselves based on designated varietals, local origins, and native floral inputs, offering consumers genuine tastes linked to place. Places such as Far North Queensland, the Darling Ranges, and the Sheep Station Creek Reserve provide unique nectar profiles. Through targeted packaging, origin narrative, and conservation marketing (e.g., protecting wildflower corridors or funding native bee habitat), producers can create premium product lines. This positioning resonates with environmentally conscious urban consumers and international customers who appreciate terroir, traceability, and Australian biodiversity.

Product Diversification and Value‑Added Innovation

The Australian organic honey market offers scope for diversification into premium and complementary markets. Manufacturers can move beyond standard jars to honeycomb blocks, creamed honey, nutrient–enriched blends with indigenous botanicals (such as lemon myrtle or cinnamon bark), and varietal specials for wellness extra uses. Furthermore, tapping honey's natural antibacterial and antioxidant properties creates entry points into skincare lines, lip balms, and bee-based health products infused with local flower extracts. Partnerships with local chefs, gourmet food companies, and artisan chocolatiers provide opportunities for honey-infused foods and recipe kits to develop. This range extension builds onshore appeal in gourmet retail, farmers' markets, and hospitality markets, particularly in areas such as the Barossa Valley and Byron Bay, where consumers are looking for local, quality food experiences and craft packaging.

Export Expansion and Eco‑Premium Market Positioning

Australia's clean, well‑regulated image as an agricultural producer offers significant scope for export of organic honey to premium world markets. High-demand markets for organic, ethically produced food like Japan, South Korea, and regions of Europe appreciate Australian-origin honey for its certification intensity and connection to pristine terrain. Marketing flora-specific honeys (e.g., Tasmanian leatherwood or Jarrah Forest monofloral lots) allows producers to market products as upscale gourmet experiences. Partnerships with food companies focused on export and metropolitan city trade networks in cities such as Melbourne and Adelaide facilitate entry into global gourmet chains and ethical e-commerce markets. The opportunity is further strengthened by sustainability communications regarding the protection of native pollinators and sustainable harvesting. With global purchasers increasingly emphasizing provenance, purity, and environmental stewardship, Australian organic honey is well placed to reach eco-premium niche markets overseas.

Australia Organic Honey Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, application, and packaging.

Product Type Insights:

- Alfalfa

- Buckwheat

- Wild Flower

- Clover

- Others

The report has provided a detailed breakup and analysis of the market based on the product Type. This includes alfalfa, buckwheat, wild flower, clover, and others.

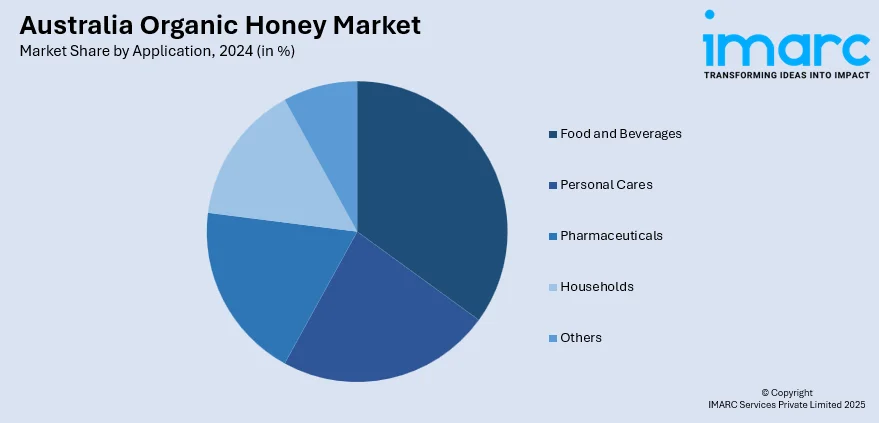

Application Insights:

- Food and Beverages

- Personal Cares

- Pharmaceuticals

- Households

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes food and beverages, personal cares, pharmaceuticals, households, and others.

Packaging Insights:

- Glass Jar

- Bottle

- Tub

- Others

The report has provided a detailed breakup and analysis of the market based on the packaging. This includes glass jar, bottle, tub, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Organic Honey Market News:

- In November 2024, S&W Seed Company declared that it completed the voluntary administration process for its subsidiary, S&W Seed Company Australia Pty Ltd (S&W Australia). To enable the fulfillment of specific conditions for the DOCA's effectiveness, S&W concluded a settlement agreement to release from the intercompany duties owed to S&W Australia. The company would transfer ownership of certain white clover and alfalfa (lucerne) intellectual property, provide the associated inventory, compensate insurance proceeds received for S&W Australia, and extend transitional assistance to S&W Australia necessary to aid the transition of business operations to an independent entity.

Australia Organic Honey Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Alfalfa, Buckwheat, Wild Flower, Clover, Others |

| Applications Covered | Food and Beverages, Personal Care, Pharmaceuticals, Households, Others |

| Packaging Covered | Glass Jar, Bottle, Tub, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia organic honey market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia organic honey market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia organic honey industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia organic honey market was valued at USD 61.60 Million in 2024.

The Australia organic honey market is projected to exhibit a CAGR of 9.90% during 2025-2033.

The Australia organic honey market is expected to reach a value of USD 158.33 Million by 2033.

The Australia organic honey market trends include increased demand for region-specific varietals like jarrah and leatherwood, growth in artisanal and small-batch production, and rising popularity of infused and raw honey products. Consumers are also favoring traceable, eco-friendly options, while exports target premium wellness markets with clean, sustainable, and botanically rich offerings.

The Australia organic honey market is driven by rising health consciousness, demand for natural sweeteners, and consumer preference for chemical-free products. Unique native floral sources and sustainable beekeeping practices enhance appeal. Support from eco-conscious retailers and growing interest in traceable, locally produced food further contribute to the market’s strong momentum.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)