Australia Orthopedic Braces and Supports Market Size, Share, Trends and Forecast by Product, Type, Application, End User, and Region, 2025-2033

Australia Orthopedic Braces and Supports Market Overview:

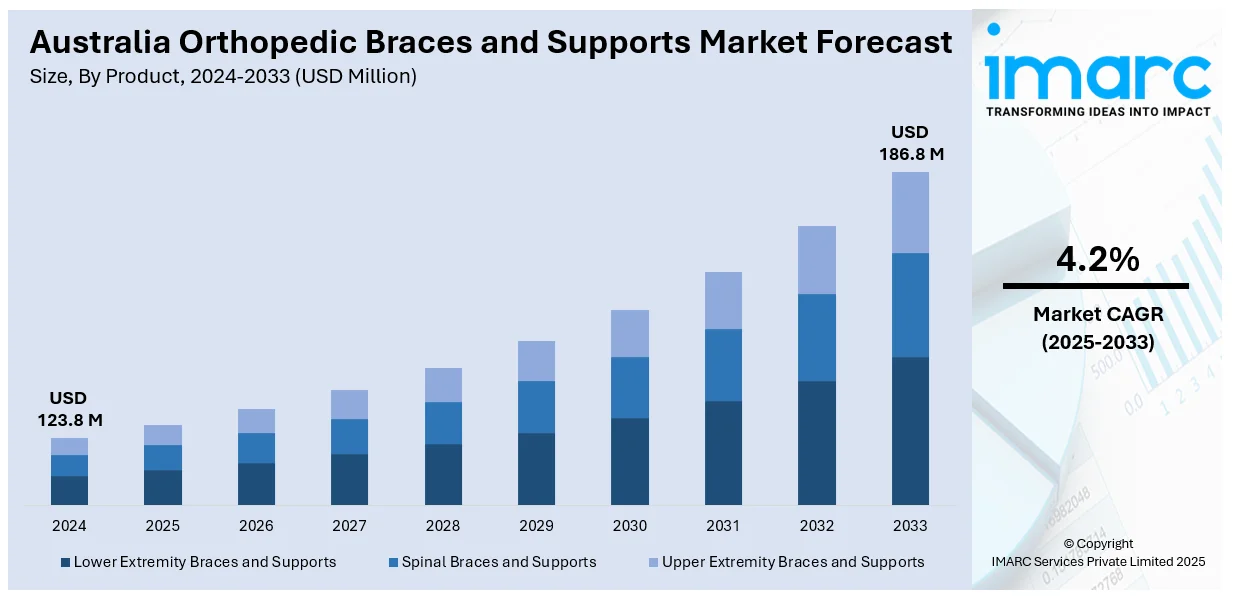

The Australia orthopedic braces and supports market size reached USD 123.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 186.8 Million by 2033, exhibiting a growth rate (CAGR) of 4.2% during 2025-2033. The aging population-driven growth of the market has resulted in a greater prevalence of musculoskeletal disorders, thereby increasing the demand for supportive devices. Sports culture in the country results in a rise in sports injuries, further pushing the demand for orthopedic supports higher.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 123.8 Million |

| Market Forecast in 2033 | USD 186.8 Million |

| Market Growth Rate 2025-2033 | 4.2% |

Australia Orthopedic Braces and Supports Market Trends:

Integration of Smart Technology

One of the most important orthopedic brace trends is the incorporation of smart technology. Wearable sensors are being integrated into braces more and more to track movement, muscle activity, joint angles, and healing in real-time. These smart braces allow for remote monitoring and customized treatment regimens by sending data to medical specialists via mobile applications. Better patient compliance, earlier problem discovery, and more accurate rehabilitation are made possible by this technology. Intelligent orthopedic supports are increasingly being utilized in sports injury rehabilitation, chronic disease management, and postoperative recovery as the demand for home and telehealth treatment rises. The data collected through these devices not only enhances individual patient outcomes but also contributes to broader clinical research and advancements in orthopedic care.

To get more information on this market, Request Sample

Focus on Preventative Use and Active Lifestyles

Orthopedic braces are increasingly recognized not only for rehabilitation but also for injury prevention, particularly among athletes and active individuals. These braces provide targeted compression, stability, and motion control to reduce the risk of sprains, tendonitis, and overuse injuries during both training and daily activities. Lightweight, low-profile designs make them discreet and comfortable for prolonged use. Additionally, manufacturers focus on ergonomics and stylish designs to encourage long-term adoption. This preventative approach is especially relevant given that, in 2021–22, around 56,000 Australians were hospitalized due to sports-related injuries, highlighting the prevalence of such injuries. The increasing use of orthopedic braces mirrors this trend since they are useful in preventing injury and encouraging movement. The change towards preventive care is a part of the wider healthcare trend in favor of preventing rather than curing further increasing the Australia orthopedic braces and supports market share.

Customization and 3D Printing

Customization via three-dimensional (3D) printing is redefining orthopedic braces and supports. Off-the-shelf braces traditionally have an imprecise fit that results in discomfort or compromised function. Using 3D scanning and printing technologies, braces can now be custom-fit to each patient's individual anatomy, providing a comfortable, close fit that enhances support and mobility. Additionally, the braces are more aesthetically pleasing, lighter, and better ventilated, all of which improve user pleasure and adherence. Additionally, rapid prototyping and changes are made possible by 3D printing, which makes it ideal for post-operative, pediatric, and athletic application scenarios where anatomical requirements may change rapidly. This movement is a movement towards personalized medicine, where treatment devices are custom-fit to the patient and not mass-produced thus aiding the Australia orthopedic braces and supports market growth.

Australia Orthopedic Braces and Supports Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product, type, application, and end user.

Product Insights:

- Lower Extremity Braces and Supports

- Spinal Braces and Supports

- Upper Extremity Braces and Supports

The report has provided a detailed breakup and analysis of the market based on the product. This includes lower extremity braces and supports, spinal braces and supports, and upper extremity braces and supports.

Type Insights:

- Soft and Elastic Braces and Supports

- Hinged Braces and Supports

- Hard and Rigid Braces and Supports

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes soft and elastic braces and supports, hinged braces and supports, and hard and rigid braces and supports.

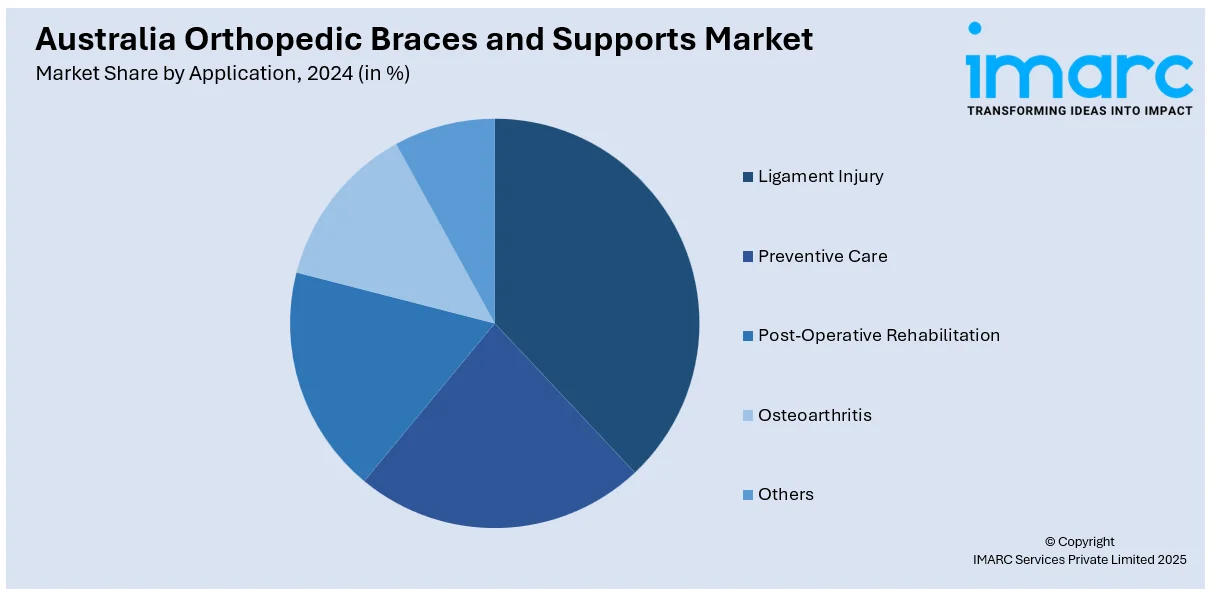

Application Insights:

- Ligament Injury

- Preventive Care

- Post-Operative Rehabilitation

- Osteoarthritis

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes ligament injury, preventive care, post-operative rehabilitation, osteoarthritis, and others.

End User Insights:

- Orthopedic Clinics

- Hospitals and Surgical Centers

- Over the Counter (OTC) Platforms

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes orthopedic clinics, hospitals and surgical centers, over the counter (OTC) platforms, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Orthopedic Braces and Supports Market News:

- In January 2024, Enovis introduced the DonJoy® ROAM™ OA Knee Brace, designed for patients with osteoarthritis or knee pain. This innovative unloader brace relieves pressure from the affected knee, improving stability and mobility. With features like magnetic clips for easy alignment, the BOA® Fit System for adjustable support, and a slim profile for discreet wear, the ROAM OA offers comfort and effectiveness. It's suitable for conservative care, pre-surgery preparation, and postoperative knee protection.

- In January 2024, UNFO Med launched a new corrective foot brace for babies that aims to correct conditions such as metatarsus adductus (MTA). The non-invasive, non-surgical device is an alternative to the conventional casting and surgical procedures, which can potentially revolutionize newborns' care with such conditions. MTA impacts about 7% of babies and 12% of siblings of children with such conditions, thus this development is a major milestone in pediatrics.

Australia Orthopedic Braces and Supports Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Lower Extremity Braces and Supports, Spinal Braces and Supports, Upper Extremity Braces and Supports |

| Types Covered | Soft and Elastic Braces and Supports, Hinged Braces and Supports, Hard and Rigid Braces and Supports |

| Applications Covered | Ligament Injury, Preventive Care, Post-Operative Rehabilitation, Osteoarthritis, Others |

| End Users Covered | Orthopedic Clinics, Hospitals and Surgical Centers, Over the Counter (OTC) Platforms, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia orthopedic braces and supports market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia orthopedic braces and supports market on the basis of product?

- What is the breakup of the Australia orthopedic braces and supports market on the basis of type?

- What is the breakup of the Australia orthopedic braces and supports market on the basis of application?

- What is the breakup of the Australia orthopedic braces and supports market on the basis of end user?

- What is the breakup of the Australia orthopedic braces and supports market on the basis of region?

- What are the various stages in the value chain of the Australia orthopedic braces and supports market?

- What are the key driving factors and challenges in the Australia orthopedic braces and supports?

- What is the structure of the Australia orthopedic braces and supports market and who are the key players?

- What is the degree of competition in the Australia orthopedic braces and supports market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia orthopedic braces and supports market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia orthopedic braces and supports market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia orthopedic braces and supports industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)