Australia Orthopedic Implants Market Size, Share, Trends and Forecast by Product, Type, Biomaterial, End User, and Region, 2025-2033

Australia Orthopedic Implants Market Overview:

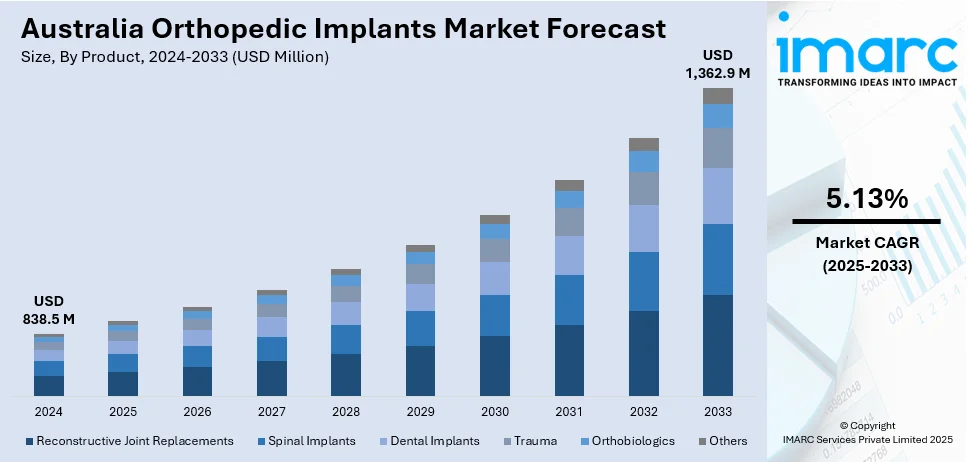

The Australia orthopedic implants market size reached USD 838.5 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,362.9 Million by 2033, exhibiting a growth rate (CAGR) of 5.13% during 2025-2033. The market is driven by an aging population, rising cases of osteoarthritis, osteoporosis and sports related injuries, and increased government and private sectors investments on hospital infrastructure. Moreover, growing demand for minimally invasive procedures and the development of new materials like titanium alloys and highly cross-linked polyethylene that enhance implant durability, longevity, and biocompatibility further boost the Australia orthopedic implants market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 838.5 Million |

| Market Forecast in 2033 | USD 1,362.9 Million |

| Market Growth Rate 2025-2033 | 5.13% |

Australia Orthopedic Implants Market Trends:

Rising Prevalence of Orthopedic Conditions

The increasing prevalence of orthopedic conditions, including arthritis, osteoarthritis, and traumatic injuries, is significantly boosting the demand for orthopedic implants in Australia. Osteoarthritis alone affects millions and is one of the leading causes of disability among adults. Sports-related injuries and work-related musculoskeletal disorders are also common, especially among younger and middle-aged populations. These issues often necessitate surgical intervention involving implants, such as spinal, knee, or shoulder replacements. The emphasis on early intervention and pain management through surgical procedures further reinforces demand. In addition, higher rates of obesity, a known risk factor for joint degeneration, are contributing to increased orthopedic complications. These clinical needs ensure sustained growth in implant use within hospitals and specialist orthopedic clinics nationwide.

To get more information on this market, Request Sample

Technological Advancements

Rapid technological innovation is a major growth factor in Australia’s orthopedic implants market. New materials like titanium alloys and highly cross-linked polyethylene enhance implant durability, longevity, and biocompatibility. Robotic-assisted surgeries and computer navigation systems enable precise implant placement, reducing complications and improving recovery times. Customized 3D-printed implants are also gaining traction for complex cases. These technologies offer better outcomes, fewer revision surgeries, and shorter hospital stays, which appeal to both patients and healthcare providers. Furthermore, minimally invasive surgical techniques are increasing in popularity, contributing to quicker rehabilitation and lower overall healthcare costs. As these technologies become more widely adopted in Australia’s healthcare system, the demand for advanced implants is expected to rise significantly, especially among tech-savvy patients and leading orthopedic centers. For instance, in July 2024, THINK Surgical, Inc., a pioneer in orthopedic surgical robotics, revealed that it had concluded a Collaboration Agreement with Signature Orthopaedics (SignatureOrtho™), an Australia-based orthopedic device manufacturer that emphasizes design. Using this partnership, THINK Surgical will incorporate a sophisticated knee design from SignatureOrtho into THINK Surgical's ID-HUB™, which is a proprietary database of implant modules intended for use with its TMINI Miniature Robotic System.

Increased Healthcare Spending and Patient Awareness

Growing healthcare expenditure and heightened patient awareness are contributing significantly to the Australia orthopedic implants market growth. The government and private sectors are investing in hospital infrastructure, surgical facilities, and advanced diagnostic tools, making orthopedic care more accessible. Public campaigns and online resources have improved understanding of musculoskeletal health, encouraging patients to seek earlier medical intervention. More Australians are now aware of the benefits of orthopedic surgeries in improving mobility and quality of life. Additionally, the availability of health insurance and medical financing options supports patient access to elective procedures like joint replacements. This combination of financial investment and consumer empowerment continues to drive market growth across both metropolitan and regional healthcare systems.

Australia Orthopedic Implants Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, type, biomaterial, and end user.

Product Insights:

- Reconstructive Joint Replacements

- Knee Replacement Implants

- Hip Replacement Implants

- Extremities

- Spinal Implants

- Spinal Fusion Implants

- Vertebral Compression Fracture (VCF) Devices

- Motion Preservation Devices/Non-Fusion Devices

- Dental Implants

- Root Form Dental Implants

- Plate Form Dental Implants

- Trauma

- Orthobiologics

- Demineralized Bone Matrix (DBM)

- Allograft

- Bone Morphogenetic Protein (BMP)

- Viscosupplementation Products

- Synthetic Bone Substitutes

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes reconstructive joint replacements (knee replacement implants, hip replacement implants, and extremities), spinal implants (spinal fusion implants, vertebral compression fracture (VCF) devices, and motion preservation devices/non-fusion devices), dental implants (root form dental implants and plate form dental implants), trauma, orthobiologics (demineralized bone matrix (DBM), allograft, bone morphogenetic protein (BMP), viscosupplementation products, synthetic bone substitutes, and others), and others.

Type Insights:

- Knee

- Hip

- Wrist and Shoulder

- Dental

- Spine

- Ankle

- Others

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes knee, hip, wrist and shoulder, dental, spine, ankle, and others.

Biomaterial Insights:

- Metallic Biomaterials

- Stainless Steel

- Titanium alloy

- Cobalt alloy

- Others

- Ceramic Biomaterials

- Polymers Biomaterials

- Others

A detailed breakup and analysis of the market based on the biomaterial have also been provided in the report. This includes metallic biomaterials (stainless steel, titanium alloy, cobalt alloy, and others), ceramic biomaterials, polymers biomaterials, and others.

End User Insights:

- Hospitals

- Orthopedic Clinic

- Ambulatory Surgical Centers

- Others

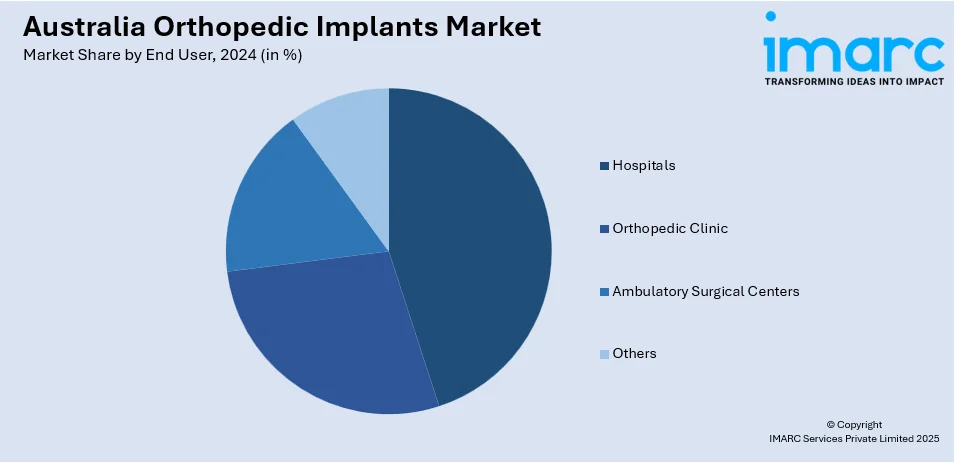

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals, orthopedic clinic, ambulatory surgical centers, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Orthopedic Implants Market News:

- In May 2024, Prominent MedTech researchers from the University of Melbourne and RMIT University collaborated with Signature Orthopaedics, Australia’s sole producer of implantable orthopaedic devices, to develop joint R&D initiatives in clinical and technological advancements aimed at producing new medical implants.

- In December 2023, Researchers from Australia and China achieved a significant advancement in providing enhanced knee and hip replacements. Scientists from Flinders University in South Australia and the Shandong First Medical University disclosed that their innovative orthopedic implant technology demonstrates a greater capacity to prevent infection and promote bone growth following surgery.

Australia Orthopedic Implants Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Types Covered | Knee, Hip, Wrist and Shoulder, Dental, Spine, Ankle, Others |

| Biomaterials Covered |

|

| End Users Covered | Hospitals, Orthopedic Clinic, Ambulatory Surgical Centers, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia orthopedic implants market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia orthopedic implants market on the basis of product?

- What is the breakup of the Australia orthopedic implants market on the basis of type?

- What is the breakup of the Australia orthopedic implants market on the basis of biomaterial?

- What is the breakup of the Australia orthopedic implants market on the basis of end user?

- What is the breakup of the Australia orthopedic implants market on the basis of region?

- What are the various stages in the value chain of the Australia orthopedic implants market?

- What are the key driving factors and challenges in the Australia orthopedic implants market?

- What is the structure of the Australia orthopedic implants market and who are the key players?

- What is the degree of competition in the Australia orthopedic implants market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia orthopedic implants market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia orthopedic implants market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia orthopedic implants industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)