Australia OTT Platform Market Size, Share, Trends and Forecast by Revenue Model, Content Type, Streaming Device, User Type, Service Vertical, and Region, 2025-2033

Australia OTT Platform Market Overview:

The Australia OTT platform market size reached USD 4.70 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 18.91 Billion by 2033, exhibiting a growth rate (CAGR) of 16.73% during 2025-2033. The increasing internet penetration, rising demand for on-demand content, shifting consumer preferences towards digital streaming, strategic partnerships with local content producers, and advancements in 5G infrastructure enhancing streaming experiences are some of the key factors fueling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.70 Billion |

| Market Forecast in 2033 | USD 18.91 Billion |

| Market Growth Rate 2025-2033 | 16.73% |

Australia OTT Platform Market Trends:

Proliferation of Hybrid Monetization Models

Australia's OTT platform market is undergoing a significant transformation, with a shift towards hybrid monetization models that combine Subscription Video on Demand (SVOD), Advertising Video on Demand (AVOD), and Free Ad-supported Streaming TV (FAST) services. This evolution is driven by changing consumer preferences and the need for platforms to diversify their revenue streams. Netflix and Disney+ are among the key players. Both platforms have introduced ad-supported tiers to attract cost-conscious viewers while maintaining premium subscription offerings for exclusive content. Disney+ launched its ad-supported plan in late 2023, while Netflix rolled out its ad-tiered subscription in the same year. These moves reflect a broader industry trend toward hybrid models, aiming to expand reach and maximize revenue. The adoption of these models by both local and international platforms is reshaping the Australian OTT landscape, fostering a more inclusive and sustainable streaming ecosystem.

To get more information on this market, Request Sample

Strategic Consolidations and Content Localization

The Australian OTT market is undergoing significant strategic shifts, with consolidations and an increased focus on content localization as key players adapt to changing consumer demands and competitive pressures. A notable move in this direction is News Corp’s sale of its Australian cable TV unit, Foxtel, to British sports network DAZN for AUD 3.4 billion ($2 billion), including debt. This sale reflects the ongoing industry pivot toward streaming platforms, driven by evolving viewer preferences and the high costs of traditional broadcasting. DAZN’s acquisition aims to leverage Foxtel’s established market presence to strengthen its sports broadcasting offerings in Australia. In parallel, the emphasis on content localization is intensifying. Although investment in Australian feature films and television dramas saw a nearly 30% decline in the 2023-24 financial year, streaming platforms continue to invest in local content. Stan, a leading Australian streaming service, remains at the forefront, producing Australian-specific content to meet local audience tastes. These strategic initiatives highlight the industry's efforts to enhance operational efficiency and boost viewer engagement in the Australian OTT market.

Australia OTT Platform Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on revenue model, content type, streaming device, user type, and service vertical.

Revenue Model Insights:

- Subscription Based

- Advertising Based

- Transaction Based

- Others

The report has provided a detailed breakup and analysis of the market based on the revenue model. This includes subscription based, advertising based, transaction based, and others.

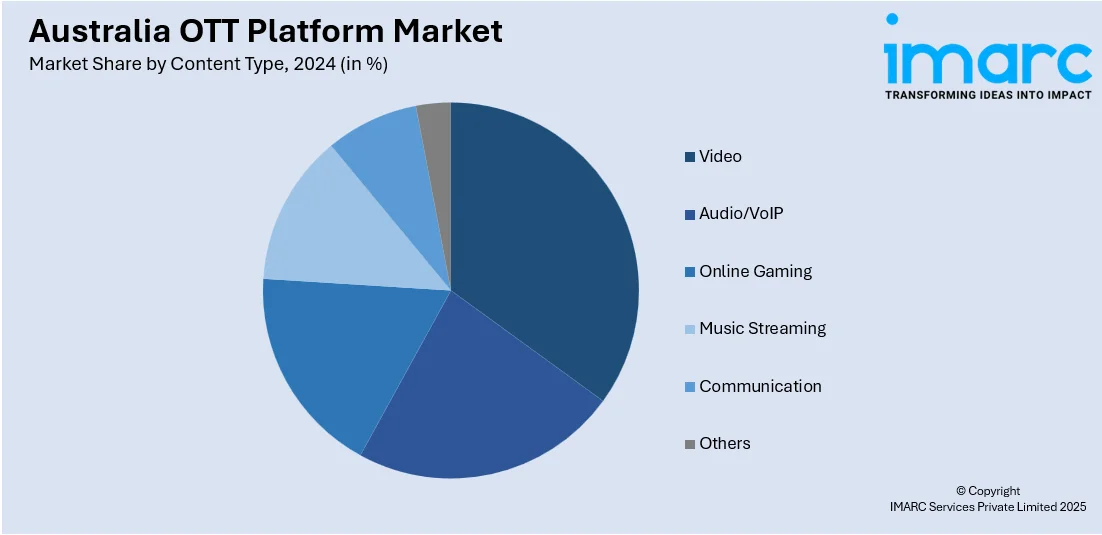

Content Type Insights:

- Video

- Entertainment and Infotainment

- Food, Travel and Fashion

- Sports Content

- Audio/VoIP

- Online Gaming

- Music Streaming

- Communication

- Others

A detailed breakup and analysis of the market based on the content type have also been provided in the report. This includes video (entertainment and infotainment, food, travel and fashion, and sports content), audio/VoIP, online gaming, music streaming, communication, and others.

Streaming Device Insights:

- Smartphones and Tablets

- Desktops and Laptops

- Smart TV’s and Set-Top Box

- Gaming Console

- Others

The report has provided a detailed breakup and analysis of the market based on the streaming device. This includes smartphones and tablets, desktops and laptops, smart TV's and set-top box, gaming console, and others.

User Type Insights:

- Personal

- Commercial

A detailed breakup and analysis of the market based on the user type have also been provided in the report. This includes personal and commercial.

Service Vertical Insights:

- Media and Entertainment

- Education and Learning

- Gaming

- Health and Fitness

- IT and Telecom

- E-commerce

- Others

A detailed breakup and analysis of the market based on the service vertical have also been provided in the report. This includes media and entertainment, education and learning, gaming, health and fitness, IT and telecom, e-commerce, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia OTT Platform Market News:

- February 2025: Disney+ announced that it would integrate ESPN content into its OTT platform for subscribers in Australia and New Zealand. This addition offers over 10,000 hours of live sports, including NBA, NHL, MLB, and UFC events, along with ESPN's studio shows and documentaries.

- March 2024: Planetcast Media Services, a media technology provider in India and Southeast Asia, acquired Australia's Switch Media, a white-label OTT platform provider operating across Asia-Pacific, Europe, and the U.S. This acquisition enables Planetcast to fully integrate Switch Media’s OTT solutions into its unified platform, NexC, enhancing its global OTT capabilities.

Australia OTT Platform Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Revenue Models Covered | Subscription Based, Advertising Based, Transaction Based, Others |

| Content Types Covered |

|

| Streaming Devices Covered | Smartphones and Tablets, Desktops and Laptops, Smart TV’s and Set-Top Box, Gaming Console, Others |

| User Types Covered | Personal, Commercial |

| Service Verticles Covered | Media and Entertainment, Education and Learning, Gaming, Health and Fitness, IT and Telecom, E-commerce, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia OTT platform market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia OTT platform market on the basis of revenue model?

- What is the breakup of the Australia OTT platform market on the basis of content type?

- What is the breakup of the Australia OTT platform market on the basis of streaming device?

- What is the breakup of the Australia OTT platform market on the basis of user type?

- What is the breakup of the Australia OTT platform market on the basis of service vertical?

- What is the breakup of the Australia OTT platform market on the basis of region?

- What are the various stages in the value chain of the Australia OTT platform market?

- What are the key driving factors and challenges in the Australia OTT platform market?

- What is the structure of the Australia OTT platform market and who are the key players?

- What is the degree of competition in the Australia OTT platform market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia OTT platform market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia OTT platform market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia OTT platform industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)