Australia Over-The-Counter Pharmaceutical Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, Formulation, and Region, 2025-2033

Australia Over-The-Counter Pharmaceutical Market Overview:

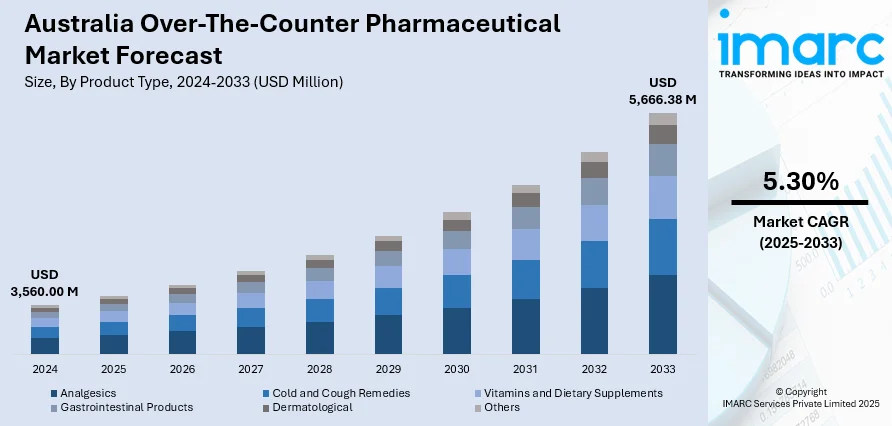

The Australia over-the-counter pharmaceutical market size reached USD 3,560.00 Million in 2024. Looking forward, the market is expected to reach USD 5,666.38 Million by 2033, exhibiting a growth rate (CAGR) of 5.30% during 2025-2033. The market is growing due to increasing consumer preference for self-medication and easy access to non-prescription medications. The demand for pain relief, cold and flu treatments, and digestive health products is driving market expansion. With more Australians seeking convenient and affordable healthcare solutions, the OTC pharmaceutical market is contributing positively to the Australia over-the-counter pharmaceutical market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3,560.00 Million |

| Market Forecast in 2033 | USD 5,666.38 Million |

| Market Growth Rate 2025-2033 | 5.30% |

Key Trends of Australia Over-The-Counter Pharmaceutical Market:

Rising Self-Medication

There is an increasing trend of self-medication in Australia with greater consumers using over-the-counter (OTC) drugs for convenience and cost. Easy access to a variety of OTC products including painkillers, cold remedies, and digestive supplements from pharmacies and the Internet drives the trend towards self-diagnosis and self-treatment. As prescription prices grow and waiting periods for medicines expand more Australians are turning to OTC remedies to treat everyday illnesses on their own. Increased health awareness also fosters this trend as consumers increasingly turn to OTC items to treat minor health ailments without the requirement of a doctor's consultation. As a result, the demand for OTC pharmaceuticals in Australia continues to grow, contributing significantly to Australia over-the-counter pharmaceutical market growth.

To get more information on this market, Request Sample

Growing Health Consciousness

In Australia increased health awareness is leading to a transition towards preventive care with consumers increasingly looking towards natural remedies and over-the-counter products to support their well-being. With increasing awareness of the need for nutrition, physical fitness, and overall well-being demand for vitamins, dietary supplements, and herbal remedies has grown significantly. Consumers increasingly rely on OTC products as part of a preventive strategy to avoid illness rather than using them solely as treatments once symptoms are present. This move towards preventive and natural products is changing the OTC pharmaceutical market with products providing immune system support, energy, and overall well-being increasingly popular. Consequently, the Australian market for vitamins and supplements continues to see strong growth, mirroring a wider cultural movement towards healthier living in Australia.

Expansion of Online Sales

The expansion of online shopping websites is substantially transforming the Australian over-the-counter pharmaceutical market as more consumers seek the convenience of buying over-the-counter medicines from internet retailers. Consumers are able to make access to a wider selection of OTC drugs, vitamins, and supplements through e-commerce with the additional convenience of home delivery. Such a shift is especially attractive for convenience-seekers because it lessens the necessity to go to brick-and-mortar establishments and offers the ease of comparing prices. Sales over the internet are also booming as a result of private buying options for delicate health merchandise, like feminine hygiene products or digestive supplements. With the growing usage of digital platforms, online retailing of OTC products is likely to keep increasing, contributing further to the growth of the market in Australia.

Growth Drivers of Australia Over-The-Counter Pharmaceutical Market:

Increasing Prevalence of Minor Ailments

Australia continues to experience frequent cases of common health issues such as seasonal allergies, headaches, digestive problems, and mild colds, encouraging consumers to seek fast and convenient over-the-counter (OTC) remedies. These products offer immediate relief from medical appointments, saving time for individuals and families and effectively reducing healthcare costs. Therefore, OTC medicines are now the preferred first response to typical diseases in urban and rural areas. Treatments that are accessible and dependable are always needed, so the market growth is quite steady. Because of this, manufacturers expand product ranges as well as improve formulations. This ongoing demand for quick, effective solutions reinforces the crucial role of OTC products in everyday healthcare while supporting the Australia over-the-counter pharmaceutical market demand.

Broad Retail and Pharmacy Accessibility

The widespread network of pharmacies, supermarkets, and convenience stores across Australia ensures exceptional accessibility to OTC pharmaceuticals. Strategic placement in both high-traffic urban areas and rural regions, combined with extended operating hours, makes these products readily available to consumers seeking immediate solutions. Dedicated health aisles and prominent displays further enhance product visibility and encourage repeat purchases. This expansive distribution framework not only simplifies the buying process but also supports strong and consistent sales growth. Reliable supply chains and strong partnerships between manufacturers and retailers maintain steady inventory levels and timely restocking, guaranteeing consumers have easy access to trusted OTC medications. Such extensive retail and pharmacy availability significantly contributes to market expansion and reinforces consumer reliance on OTC treatments.

Rising Demand for Natural and Preventive Remedies

Australian consumers are increasingly drawn to natural, plant-based OTC solutions such as herbal supplements, vitamins, and nutritional products that promote wellness and preventive care. According to the Australia over-the-counter pharmaceutical market analysis, this trend reflects growing health consciousness and a desire for clean-label, eco-friendly options that align with sustainable lifestyles. Manufacturers are responding by developing innovative, chemical-free formulations and expanding product lines to meet these evolving preferences. The focus on natural ingredients supports holistic health practices and encourages long-term self-care habits. By offering a wider range of herbal and preventive treatments, companies appeal to environmentally aware and health-focused customers, diversifying their consumer base. This shift toward natural and preventive remedies is steadily transforming the OTC pharmaceutical market, fostering innovation and creating new opportunities for growth across Australia.

Government Regulation of Australia Over-The-Counter Pharmaceutical Market:

Rigorous Safety and Quality Standards

The Therapeutic Goods Administration (TGA) enforces strict safety and quality regulations to ensure that all over-the-counter (OTC) pharmaceutical products sold in Australia are both effective and reliable. Each product undergoes thorough testing, and evaluators detail efficacy and dose properly and manufacture consistently before approving it. To maintain each of these high standards, manufacturers must comply with Good Manufacturing Practices (GMP), which include regular inspections and audits. Close monitoring safeguards consumers from medicines of low quality or fake medicines. It also builds long-term public trust in the market. These regulations encourage responsible industry growth via fostering a dependable plus transparent environment, and the regulations ensure that only safe, high-quality OTC products are available to the public, thereby supporting sustainable expansion across the Australian pharmaceutical landscape.

Mandatory Transparent Labeling

Australian law requires all OTC pharmaceutical products to feature clear, comprehensive labeling that includes precise dosage instructions, a complete list of active and inactive ingredients, potential side effects, and expiration dates. This mandatory transparency empowers consumers to make informed choices, reducing the risk of accidental misuse or overdose. Easy-to-read labels and accompanying patient information leaflets support responsible self-care practices by helping individuals manage minor ailments without professional supervision. Clear labeling also reinforces consumer confidence and encourages repeat purchases by promoting trust in product safety and quality. By prioritizing accessible and accurate information, regulatory authorities strengthen the credibility of OTC medicines and foster a market environment where safe, informed self-medication is both possible and widely practiced.

Ethical Marketing and Advertising Oversight

Australia maintains strict oversight of marketing and advertising for OTC pharmaceuticals to ensure all promotional content remains accurate, ethical, and evidence based. Regulatory agencies review advertising materials across digital, print, and broadcast channels to ensure the prevention of misleading information or exaggerated health claims. Every campaign must focus on usage guidelines that are correct, and the benefits verified for products. These rules keep pharmaceutical brands competing fairly as well as protecting consumers against false ads plus against possible health hazards. The regulators work to maintain transparency as well as full accountability regarding all promotional practices. This encourages responsible marketing along with product safety standards. This balanced approach supports sustainable market growth, builds consumer trust, and safeguards public health while upholding the integrity and credibility of the OTC pharmaceutical sector nationwide.

Australia Over-The-Counter Pharmaceutical Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, distribution channel, and formulation.

Product Type Insights:

- Analgesics

- Cold and Cough Remedies

- Vitamins and Dietary Supplements

- Gastrointestinal Products

- Dermatological

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes analgesics, cold and cough remedies, vitamins and dietary supplements, gastrointestinal products, dermatological, and others.

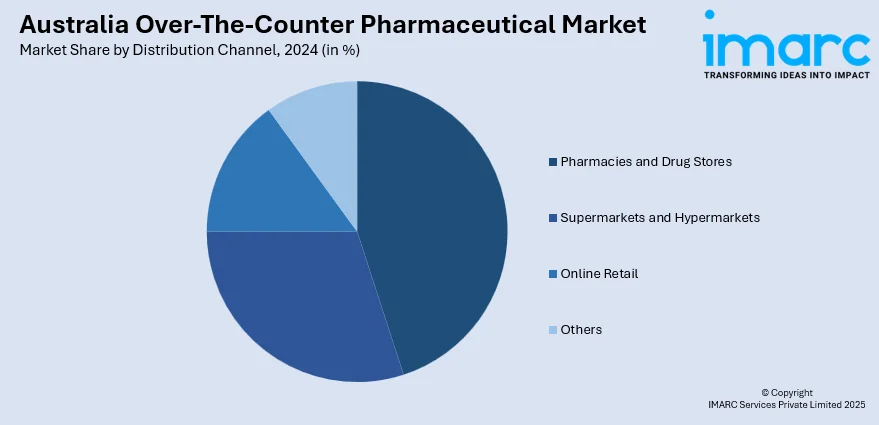

Distribution Channel Insights:

- Pharmacies and Drug Stores

- Supermarkets and Hypermarkets

- Online Retail

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes pharmacies and drug stores, supermarkets and hypermarkets, online retail, and others.

Formulation Insights:

- Tablets and Capsules

- Liquids and Syrups

- Topicals

- Creams

- Ointments

- Others

A detailed breakup and analysis of the market based on the formulation have also been provided in the report. This includes tablets and capsules, liquids and syrups, topicals (creams and ointments), and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Over-The-Counter Pharmaceutical Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Analgesics, Cold and Cough Remedies, Vitamins and Dietary Supplements, Gastrointestinal Products, Dermatological, Others |

| Distribution Channels Covered | Pharmacies and Drug Stores, Supermarkets and Hypermarkets, Online Retail, Others |

| Formulations Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia over-the-counter pharmaceutical market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia over-the-counter pharmaceutical market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia over-the-counter pharmaceutical industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia over-the-counter pharmaceutical market was valued at USD 3,560.00 Million in 2024.

The Australia over-the-counter pharmaceutical market is projected to exhibit a CAGR of 5.30% during 2025-2033.

The Australia over-the-counter pharmaceutical market is projected to reach a value of USD 5,666.38 Million by 2033.

The Australia over-the-counter pharmaceutical market is marked by growing preference for self-care, expansion of online and pharmacy retail channels, rising use of digital health platforms, increasing demand for natural and herbal remedies, and broader deregulation enabling easier consumer access to medicines without prescriptions.

Growth in Australia’s over-the-counter pharmaceutical market is supported by rising healthcare expenditure, an aging population with recurring ailments, lifestyle-related health issues, increasing focus on preventive care, higher consumer awareness through marketing campaigns, expanding rural penetration, convenience-driven purchases, and ongoing product innovations addressing diverse therapeutic needs across pain relief, digestive health, and respiratory care.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)