Australia Overhead Cranes Market Size, Share, Trends and Forecast by Type, Lifting Capacity, End Use, and Region, 2026-2034

Australia Overhead Cranes Market Summary:

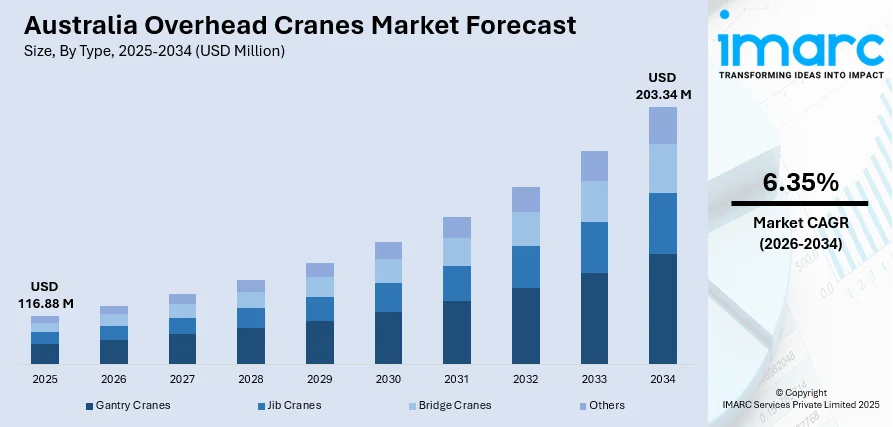

The Australia overhead cranes market size reached USD 116.88 Million in 2025 and is projected to reach USD 203.34 Million by 2034, growing at a compound annual growth rate of 6.35% from 2026-2034.

The Australia overhead cranes market is expanding steadily as key industrial sectors modernize their material handling capabilities to meet rising operational demands. The development in infrastructure, mining, and manufacturing processes is also increasing the pressure on the need to have an efficient lifting solution. The growth of the market is also being facilitated by the rising investments in warehouse automation, renewable energy installations, and sophisticated logistics networks. Stringent workplace safety regulations and the need for precision in heavy-load handling are encouraging industries to adopt technologically advanced crane systems, strengthening the Australia overhead cranes market share.

Key Takeaways and Insights:

- By Type: Bridge cranes dominate the market with a share of 48% in 2025, driven by their versatility in handling heavy loads across manufacturing floors, warehouses, and industrial facilities requiring extensive horizontal coverage.

- By Lifting Capacity: The 11-50 ton segment leads the market with a share of 30% in 2025, reflecting strong demand from mining operations, heavy manufacturing, and infrastructure projects requiring medium to heavy lifting capabilities.

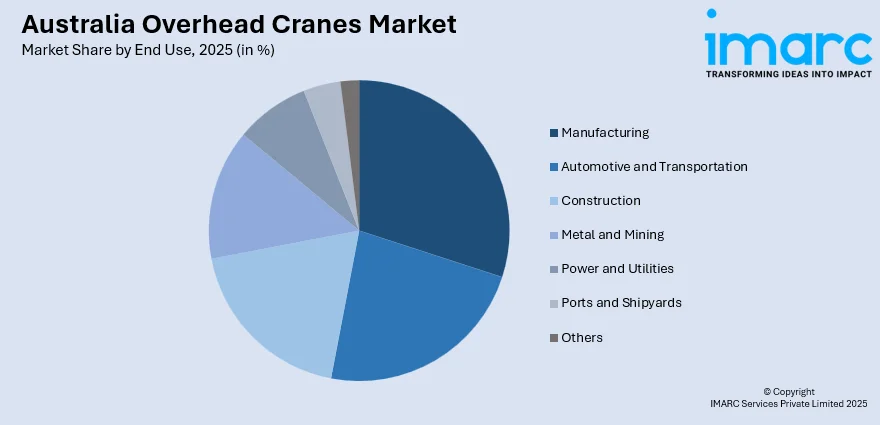

- By End Use: Manufacturing dominates the market share at 23% in 2025, supported by ongoing industrial modernization, automation initiatives, and the need for efficient material handling across production facilities.

- Key Players: The Australia overhead cranes market features a competitive landscape with established manufacturers focusing on product innovation, safety enhancements, and comprehensive after-sales services to strengthen market positioning and meet evolving industrial requirements.

To get more information on this market Request Sample

The Australia overhead cranes market is gaining momentum as industries across construction, mining, and manufacturing sectors prioritize efficient material handling solutions. Government infrastructure investments, including major transport and civil engineering projects, are creating substantial demand for high-capacity lifting systems. The integration of advanced technologies such as IoT connectivity, remote diagnostics, and predictive maintenance features is transforming crane operations, enabling real-time performance monitoring and reduced downtime. The demand for integrated lifting solutions in Australia is being driven by the growth of warehouse automation and expanding infrastructure projects. The need for efficient, heavy-duty lifting equipment is increasing as ports, logistics hubs, and industrial facilities modernize to support rising operational requirements. This trend reflects a broader push toward mechanization and advanced material handling solutions in the country’s construction and logistics sectors.

Australia Overhead Cranes Market Trends:

Expansion of Heavy-Lift Systems in Infrastructure Projects

Australia is witnessing increased deployment of large-capacity overhead cranes in civil and transport construction projects. These systems are becoming essential for handling massive prefabricated components, structural beams, and heavy equipment in bridge and highway developments. The ability to perform precise, high-load lifts supports tighter project timelines and safer on-site execution. In December 2024, one of South Australia's largest overhead cranes was deployed to install 12 super-T beams at the Aldinga Interchange as part of the Main South Road duplication project, marking heightened reliance on heavy-lift equipment in major infrastructure works and contributing to the Australia overhead cranes market growth.

Integration of Smart and IoT-Enabled Crane Technologies

Australian industrial facilities are increasingly adopting smart overhead crane systems equipped with IoT connectivity, remote monitoring capabilities, and real-time performance analytics. The Australia internet of things (IoT) market size reached USD 30.5 Billion in 2024. Looking forward, the market is projected to reach USD 92.6 Billion by 2033, exhibiting a growth rate (CAGR) of 13.15% during 2025-2033. These intelligent solutions enable predictive maintenance, automatic load tracking, and enhanced operator safety through built-in alerts and remote-control functions. The shift aligns with broader Industry 4.0 adoption across manufacturing, logistics, and mining sectors. Warehouses and industrial sites are trialing systems with usage data tracking and IoT diagnostics to reduce downtime and improve operational efficiency.

Adoption of Standardized and FEM-Compliant Equipment

Manufacturing and industrial facilities across Australia are increasingly adopting overhead cranes built to FEM standards, highlighting a broader emphasis on precision, safety, and operational efficiency. These systems are chosen not only for their load-handling capabilities but also for their role in streamlining workflows and minimizing reliance on manual labor. This aligns with the growing trend of integrating advanced, safety-oriented lifting solutions across industrial operations to enhance productivity and workforce protection.

Market Outlook 2026-2034:

The Australia overhead cranes market is poised for sustained growth through the forecast period, supported by robust infrastructure investments, expanding mining activities, and ongoing industrial modernization. Government stimulus packages targeting transport, energy, and manufacturing sectors are expected to drive substantial demand for advanced lifting solutions. The integration of automation, smart technologies, and renewable energy project expansions will further accelerate market development. The market generated a revenue of USD 116.88 Million in 2025 and is projected to reach a revenue of USD 203.34 Million by 2034, growing at a compound annual growth rate of 6.35% from 2026-2034.

Australia Overhead Cranes Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Bridge Cranes | 48% |

| Lifting Capacity | 11-50 Ton | 30% |

| End Use | Manufacturing | 23% |

Type Insights:

- Gantry Cranes

- Jib Cranes

- Bridge Cranes

- Others

Bridge cranes dominate the market with a 48% share of the total Australia overhead cranes market in 2025.

Bridge cranes, also known as overhead travelling cranes, represent the largest type segment in Australia's overhead cranes market due to their exceptional versatility and ability to provide maximum coverage across factory floors and industrial facilities. These systems, available in single or double girder configurations, are extensively deployed across manufacturing plants, warehouses, and heavy industrial operations where horizontal load movement is critical. Their capacity to handle substantial weights while maintaining precise positioning makes them indispensable for production workflows.

The dominance of bridge cranes is reinforced by their widespread application in mining maintenance facilities, automotive workshops, and steel processing plants, where continuous, high-frequency lifting operations are standard. In August 2025, Modular Cranes completed delivery of three overhead cranes to Queensland's Fraser Coast region for a new government manufacturing facility, featuring advanced capabilities including crane-to-crane synchronization and LED lighting, demonstrating the ongoing demand for sophisticated bridge crane solutions in Australian industrial settings.

Lifting Capacity Insights:

- Up to 5 Ton

- 6-10 Ton

- 11-50 Ton

- More Than 50 Ton

The 11-50 ton segment leads the market with a 30% share of the total Australia overhead cranes market in 2025.

The 11-50 ton lifting capacity segment holds the largest market share, driven by strong demand from mining operations, manufacturing facilities, and infrastructure projects requiring medium to heavy lifting capabilities. This capacity range offers the optimal balance between lifting power and operational flexibility, making it suitable for diverse industrial applications including equipment maintenance, material handling, and component assembly across multiple sectors.

Growth in this segment is supported by expanding mining activities and infrastructure developments that require reliable lifting solutions for handling substantial loads. The Australian mining industry's contribution of approximately A$59.4 billion in tax and royalty revenues during fiscal year 2024 underscores the sector's scale and its corresponding demand for medium-capacity crane systems. Infrastructure projects involving precast concrete elements and structural steel components further reinforce demand within this lifting capacity range.

End Use Insights:

Access the comprehensive market breakdown Request Sample

- Manufacturing

- Automotive and Transportation

- Construction

- Metal and Mining

- Power and Utilities

- Ports and Shipyards

- Others

Manufacturing holds the largest share at 23% of the total Australia overhead cranes market in 2025.

The manufacturing sector represents the largest end-use segment for overhead cranes in Australia, driven by ongoing industrial modernization, automation initiatives, and the critical need for efficient material handling across production facilities. Manufacturing operations rely heavily on overhead crane systems for moving raw materials, work-in-progress components, and finished products throughout production floors, enabling streamlined workflows and enhanced productivity.

Australia's manufacturing sector continues to expand, maintaining its role as a vital contributor to the national economy despite wider challenges. Increasing adoption of advanced technologies such as automation, robotics, and digital manufacturing is driving the need for more sophisticated crane systems capable of integrating smoothly with modern production processes. Expectations of long-term industry growth also point to ongoing demand for efficient, reliable material handling solutions across diverse manufacturing environments.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Growth in the Australia Capital Territory & New South Wales is supported by expanding construction activity, modernization of manufacturing facilities, and ongoing infrastructure upgrades. Rising investment in logistics hubs and warehousing increases demand for efficient lifting systems. Government-backed development projects further stimulate requirements for reliable material handling equipment, while the shift toward automation drives interest in advanced, integrated overhead crane solutions.

Victoria & Tasmania see strong demand driven by a robust manufacturing base, growth in food processing, and continuous upgrades across transport and logistics facilities. Emphasis on productivity improvement encourages industries to adopt automated lifting solutions. Infrastructure renewal, including ports and industrial estates, further accelerates crane requirements, supported by regional initiatives aimed at enhancing operational efficiency and workplace safety.

Queensland’s overhead crane market is influenced by mining activity, energy projects, and expansion of heavy engineering and fabrication facilities. Strong logistics and port development support additional demand for high-capacity lifting systems. Increased investment in construction and industrial automation encourages companies to modernize material handling operations, while growth in renewable energy projects creates new opportunities for advanced overhead crane installations.

The demand in Northern Territory & Southern Australia is driven by major resource sector operations, including mining, oil, and gas activities requiring durable and high-performance lifting equipment. Defense infrastructure upgrades strengthen market growth, while manufacturing modernization drives the adoption of automated cranes. Continued development of transport, logistics, and industrial facilities also supports the need for reliable material handling systems across varied operational environments.

Western Australia’s market is propelled by its strong mining, mineral processing, and energy sectors, all of which require heavy-duty lifting solutions. Ongoing development of port infrastructure and expansion of fabrication and engineering operations further drive demand. Companies are increasingly adopting advanced, automated cranes to enhance safety and productivity, aligning with the region’s focus on efficiency and large-scale industrial operations.

Market Dynamics:

Growth Drivers:

Why is the Australia Overhead Cranes Market Growing?

Government Infrastructure Investment and Stimulus Programs

Australia’s federal and state governments are rolling out large-scale infrastructure programs designed to stimulate economic activity and strengthen essential public and industrial assets. These initiatives focus on expanding and modernizing seaports, airports, freight hubs, and manufacturing precincts, all of which rely heavily on overhead cranes for efficient movement of heavy materials. Ongoing funding commitments toward national priority projects signal long-term support for construction and industrial development, generating a steady pipeline of opportunities for crane installations, upgrades, and lifecycle maintenance services.

Expansion of Mining and Resource Sector Activities

Australia’s mining industry remains a major driver of demand for overhead crane systems, playing a crucial role in supporting national economic activity and export performance. Mining operations rely on heavy-duty lifting equipment to manage mineral processing machinery, assist extraction workflows, and maintain large-scale assets. Ongoing investment in critical minerals such as lithium, copper, and rare earth elements continues to spur equipment needs, while the sector’s growing focus on automation expands opportunities for advanced, integrated crane solutions tailored to modern mining environments.

Rising Warehouse Automation and E-commerce Logistics Growth

The rapid evolution of Australia's logistics and warehousing industry, driven by e-commerce growth and changing consumer expectations, is fueling demand for automated material handling systems. Overhead cranes are increasingly integrated into automated and semi-automated warehouses to manage inventory movement efficiently, reduce manual labor requirements, and improve operational safety. Institutional participation in industrial assets continues to grow, with investment decisions increasingly shaped by the level of automation and the presence of specialized operational capabilities. Facilities that integrate advanced technologies and efficient material handling systems are becoming more attractive, as investors prioritize modern, scalable infrastructure that supports higher productivity and long-term operational resilience. The Australia warehousing and storage market size was valued at USD 18.40 Billion in 2024. Looking forward, the market is expected to reach USD 35.20 Billion by 2033, exhibiting a CAGR of 7.50% from 2025-2033, with e-commerce and retail capturing significant market share and driving demand for advanced lifting solutions.

Market Restraints:

What Challenges the Australia Overhead Cranes Market is Facing?

High Initial Investment and Extended ROI Cycles

Implementing overhead crane systems requires significant upfront capital investment, including costs associated with design, customization, installation, and structural reinforcement. For small and medium-sized enterprises, this financial burden can be prohibitive, with return on investment typically materializing over extended periods depending on utilization rates and operational scale. This long payback cycle poses financial risks and can slow adoption outside capital-intensive sectors.

Shortage of Skilled Crane Operators and Technicians

A persistent shortage of trained crane operators, maintenance technicians, and certified inspectors remains a critical challenge in Australia's overhead cranes market. Attracting and retaining talent is increasingly difficult, particularly in regional and remote areas where industrial activity is expanding. Labour shortages in the logistics sector are increasingly straining crane operations, limiting workforce availability and impacting daily productivity. These constraints are prompting companies and industry bodies to focus more heavily on skills development, training programs, and operational efficiencies to ensure that material handling activities can continue smoothly despite staffing challenges.

Stringent Regulatory Compliance and Safety Standards

Australia enforces rigorous occupational health and safety regulations for material handling equipment, requiring compliance with evolving standards covering installation, routine inspections, and maintenance documentation. Businesses are required to follow the relevant Australian standards governing crane design, operation, and maintenance, and failure to comply can lead to serious consequences, including enforcement actions and interruptions to normal operations. The complexity and cost of maintaining compliance present ongoing challenges for market participants.

Competitive Landscape:

The Australia overhead cranes market exhibits moderate concentration, with established manufacturers commanding significant market presence through integrated equipment portfolios and comprehensive service networks. Competition is driven by investments in product innovation, safety enhancements, and after-sales support capabilities. Major players focus on diversifying model offerings, improving operational efficiency, and enhancing affordability to attract wider customer segments. Strategic partnerships and localized production initiatives are fostering innovation and accelerating product development cycles. Companies are increasingly emphasizing lifecycle services, including retrofitting, modernization, and predictive maintenance solutions, to generate recurring revenue and strengthen customer relationships.

Recent Developments:

- February 2025: Family-owned Towne Lifting & Testing celebrated its 80th anniversary with the launch of a cutting-edge digital crane solution in the UK. The company joined forces with Australian smart lifting innovator Sole Digital to unveil the “Crane of the Future,” aimed at enhancing safety, increasing operational efficiency, and providing advanced insights for businesses across the region.

Australia Overhead Cranes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Gantry Cranes, Jib Cranes, Bridge Cranes, Others |

| Lifting Capacities Covered | Up to 5 Ton, 6-10 Ton, 11-50 Ton, More Than 50 Ton |

| End Uses Covered | Manufacturing, Automotive and Transportation, Construction, Metal and Mining, Power and Utilities, Ports and Shipyards, Others |

| Regions Covered | Australia Capital Territory and New South Wales, Victoria and Tasmania, Queensland, Northern Territory and Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia overhead cranes market size was valued at USD 116.88 Million in 2025.

The Australia overhead cranes market is expected to grow at a compound annual growth rate of 6.35% from 2026-2034 to reach USD 203.34 Million by 2034.

Bridge cranes dominated the market with a 48% share in 2025, driven by their versatility in handling heavy loads across manufacturing floors, warehouses, and industrial facilities requiring extensive horizontal coverage and precise load positioning.

Key factors driving the Australia overhead cranes market include government infrastructure investments, expanding mining and manufacturing activities, growing warehouse automation, increasing adoption of smart crane technologies, and stringent workplace safety regulations.

Major challenges include high initial investment costs and extended ROI cycles, persistent shortage of skilled crane operators and technicians, stringent regulatory compliance requirements, and competition from imported equipment affecting local manufacturers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)