Australia Oxygen Cylinders Market Size, Share, Trends and Forecast by Type, Material Type, Source, Sales Channel, and Region, 2026-2034

Australia Oxygen Cylinders Market Summary:

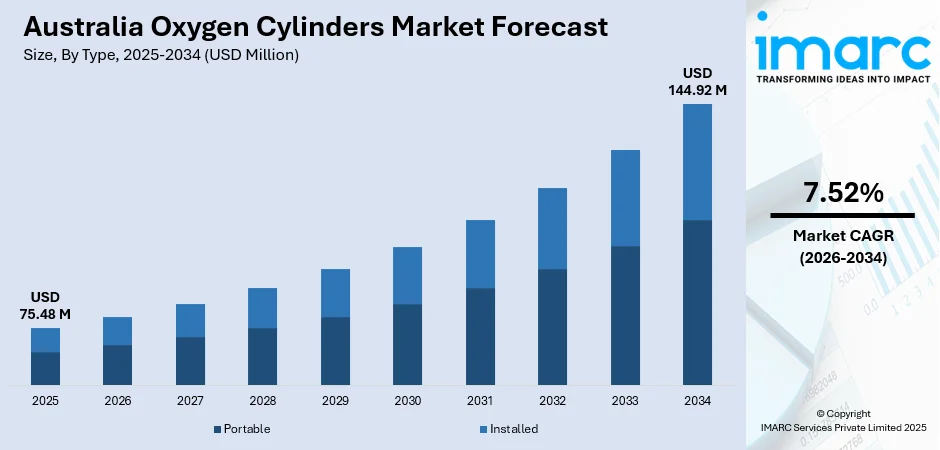

The Australia oxygen cylinders market size was valued at USD 75.48 Million in 2025 and is projected to reach USD 144.92 Million by 2034, growing at a compound annual growth rate of 7.52% from 2026-2034.

The Australia oxygen cylinders market is experiencing steady demand as healthcare providers expand emergency care capacity and home-based respiratory support adoption rises. Growth is supported by increasing prevalence of chronic respiratory conditions and the need for reliable medical oxygen supply across hospitals, clinics, and aged-care facilities. Industrial usage in manufacturing and welding applications further contributes to market stability, while suppliers focus on lightweight materials and improved safety features to enhance operational efficiency.

Key Takeaways and Insights:

- By Type: Portable dominates the market with a share of 65% in 2025, driven by increasing home healthcare adoption and patient preference for mobility and independence in managing respiratory conditions.

- By Material Type: Stainless steel leads the market with a share of 55% in 2025, owing to its superior durability, corrosion resistance, and ability to safely contain high-pressure medical gases for extended periods.

- By Source: Import represents the largest segment with a market share of 70% in 2025, reflecting Australia's reliance on international suppliers for specialized medical-grade cylinders and advanced cylinder technologies.

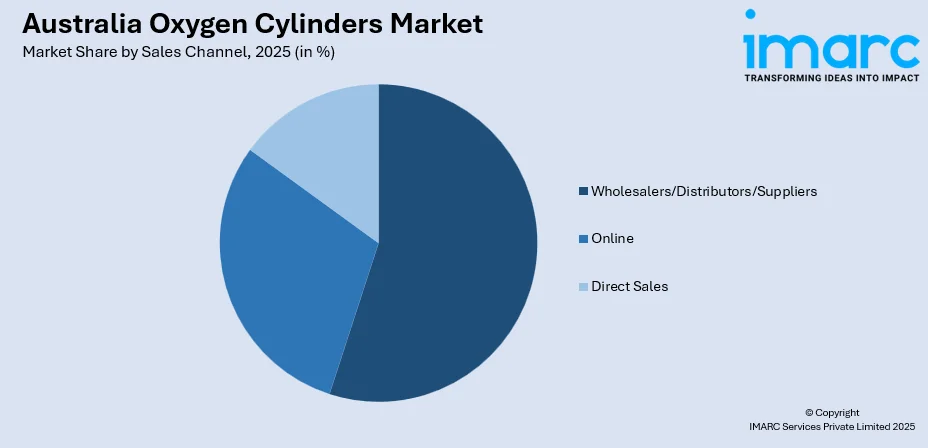

- By Sales Channel: Wholesalers/Distributors/Suppliers hold the largest share at 50% in 2025, supported by established distribution networks that ensure reliable supply to healthcare facilities, home care providers, and industrial users.

- Key Players: The Australia oxygen cylinders market exhibits a moderately consolidated competitive landscape, with multinational gas companies and regional suppliers competing across healthcare and industrial segments. Market participants are focusing on product innovation, service excellence, and distribution network expansion to strengthen their market positions.

To get more information on this market, Request Sample

The Australia oxygen cylinders market is witnessing sustained growth as healthcare systems prioritize reliable medical oxygen delivery for both acute and chronic care needs. Rising incidence of respiratory illnesses, an ageing population, and increasing adoption of home-based oxygen therapy are strengthening long-term demand. According to the report published by the Australian Institute of Health and Welfare (AIHW), Australia's population is projected 31.3 Million by 2035. Aging demographics are notable, with those aged 65 and over increasing from 12% to 17%, projected to reach 24% by 2065, driven by longer life expectancies and declining birth rates. Hospitals and emergency care providers continue to modernize their oxygen infrastructure, creating opportunities for advanced, lightweight cylinder designs that enhance mobility and patient comfort. Beyond healthcare, industries such as manufacturing, mining, and metal fabrication rely on oxygen for cutting, welding, and processing, supporting stable demand across non-medical sectors. Market participants are also focusing on improved valve technology, better safety compliance, and efficient refilling networks to ensure uninterrupted supply. Growing emphasis on disaster preparedness and regional healthcare upgrades further reinforces the market’s outlook, positioning oxygen cylinders as an essential component of Australia’s broader medical and industrial ecosystem.

Australia Oxygen Cylinders Market Trends:

Increasing Demand for Home-Based Oxygen Therapy

The demand for home-based oxygen therapy is rising as an increasing number of patients are managing chronic respiratory issues outside of hospital environments. An ageing population with higher incidences of COPD, asthma, and post-operative respiratory needs is driving consistent demand. Healthcare providers are recommending home oxygen solutions to reduce hospital load, improve quality of life, and support long-term care, making residential oxygen cylinders a critical part of patient management. The Australian government is now offering an oxygen supplement to assist registered Support at Home and residential aged care providers with the costs of supplying continuous oxygen therapy to eligible participants.

Shift Toward Lightweight and Portable Cylinders

Manufacturers are increasingly developing lightweight and portable oxygen cylinders to support better patient mobility and independence. These compact designs reduce physical strain, making them easier for elderly patients and caregivers to handle during daily activities and travel. Improved materials such as aluminum composites are gaining preference, enabling greater convenience without compromising cylinder capacity or safety, thereby reshaping user expectations for modern oxygen delivery solutions.

Growing Adoption of Advanced Valve and Safety Technologies

Hospitals and clinics are prioritizing advanced valve systems and enhanced safety features to ensure consistent, controlled oxygen flow and reduce operational risks. Innovations include pressure-relief mechanisms, integrated regulators, and tamper-resistant components that enhance reliability during intensive medical use. These upgraded technologies also support faster emergency response, easier maintenance, and improved compliance with evolving healthcare safety standards, strengthening trust in oxygen cylinder performance.

Market Outlook 2026-2034:

The Australia oxygen cylinders market outlook remains positive as healthcare providers, aged-care facilities, and home-care settings continue to prioritise reliable oxygen delivery systems. Demand is supported by rising respiratory care needs, growing emphasis on emergency preparedness, and ongoing upgrades to medical infrastructure. Manufacturers are expected to focus on lightweight materials, enhanced safety mechanisms, and efficient distribution networks to meet shifting user expectations. Industrial applications in welding and processing further contribute to market stability, reinforcing the sector’s long-term growth potential. The market generated a revenue of USD 75.48 Million in 2025 and is projected to reach a revenue of USD 144.92 Million by 2034, growing at a compound annual growth rate of 7.52% from 2026-2034.

Australia Oxygen Cylinders Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Portable | 65% |

| Material Type | Stainless Steel | 55% |

| Source | Import | 70% |

| Sales Channel | Wholesalers/Distributors/Suppliers | 50% |

Type Insights:

- Portable

- Installed

The portable segment dominates with a market share of 65% of the total Australia oxygen cylinders market in 2025.

The portable segment remains the leading category due to its strong adoption in oxygen therapy and emergency medical use. Its lightweight design, easy handling, and compatibility with modern safety valves make it suitable for elderly patients and individuals requiring continuous mobility. Healthcare facilities also prefer portable units for short-stay and outpatient care, supporting broader usage across the medical landscape. The Australia government Integrated Care and Commissioning initiative, which is trialing innovative care models across several rural and First Nations communities, further elevates the need for portable solutions that can function reliably in underserved regions.

Growing emphasis on community care and patient independence continues to strengthen demand for portable oxygen cylinders. Their versatility makes them ideal for use in ambulances, remote clinics, and home-care environments, especially as new trial sites such as Northern Tasmania and Whyalla/Port Augusta expand operations from July 2025. Manufacturers are improving cylinder materials and ergonomics to enhance comfort and transport convenience, reinforcing the segment’s solid position as healthcare delivery shifts toward flexible, decentralised models.

Material Type Insights:

- Stainless Steel

- Aluminum

- Others

The stainless steel segment leads with a share of 55% of the total Australia oxygen cylinders market in 2025.

Stainless steel cylinders lead the market as they offer superior durability, long service life, and strong resistance to corrosion. Healthcare institutions value their reliability during frequent refilling cycles and intensive use, making them suitable for both acute and chronic care needs. Their ability to maintain structural strength under demanding conditions enhances trust among users.

The segment also benefits from consistent safety performance, meeting strict medical and industrial handling requirements. Stainless steel cylinders are widely used in hospitals, emergency response units, and industrial operations where robust construction is essential. Ongoing refinements in design help balance weight and durability, ensuring steady demand across applications.

Source Insights:

- Import

- Domestic

The import segment holds the largest share at 70% of the total Australia oxygen cylinders market in 2025.

The import segment dominates as Australia relies on overseas manufacturers for advanced medical and industrial oxygen cylinders. Imported products often feature modern valve systems, high-quality materials, and enhanced safety standards that align well with diverse user requirements across healthcare and industry. This enables wider choice and easy access to specialized cylinder types.

The segment further benefits from strong global supply partnerships that ensure consistent availability. Import channels support efficient procurement of lightweight, high-capacity, and technologically upgraded cylinders that may not be produced locally. As demand for advanced respiratory equipment grows, international sourcing continues to play a central role in fulfilling market needs.

Sales Channel Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Wholesalers/Distributors/Suppliers

- Online

- Direct Sales

The wholesalers/distributors/suppliers segment prevails the market with the 50% share of the total Australia oxygen cylinders market in 2025.

Wholesalers, distributors, and suppliers remain the dominant sales channel because they provide broad market coverage and dependable supply to hospitals, clinics, home-care providers, and industrial users. Their extensive networks support timely cylinder delivery, refilling, and maintenance services, ensuring uninterrupted oxygen availability across regions.

These channels also offer a diverse product range sourced from both local and international manufacturers. Their logistical capabilities and bulk handling strengths help maintain stable pricing and reduce supply disruptions. As demand expands across healthcare and industrial sectors, their role in ensuring efficient distribution and customer support remains central.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales shows strong demand due to its large population base and advanced healthcare infrastructure. Hospitals, aged-care centres, and home-care providers drive steady consumption of medical oxygen cylinders, while industrial activity in fabrication and manufacturing supports additional requirements across non-medical sectors.

Victoria and Tasmania demonstrate consistent demand supported by established medical facilities, growing home-care adoption, and strong industrial operations. The region’s focus on healthcare upgrades, emergency preparedness, and community health services ensures ongoing need for both portable and installed oxygen cylinders across diverse applications.

Queensland’s expanding healthcare network, rising respiratory care needs, and significant mining and industrial activities contribute to sustained demand for oxygen cylinders. Remote and regional communities rely heavily on portable cylinders for emergency response and mobility-based care, supporting steady market engagement across the state.

Northern Territory & South Australia faces logistics challenges due to remote geography, increasing reliance on portable oxygen cylinders for medical emergencies and community healthcare. Industrial sectors, including mining and metal processing, also support demand. Improving distribution networks further enhances accessibility and supply reliability across these widely dispersed areas.

Western Australia’s strong mining, manufacturing, and processing industries drive substantial industrial oxygen usage. The region’s healthcare sector also requires reliable oxygen solutions for hospitals and remote clinics. Vast geographic spread increases reliance on well-coordinated supply chains, ensuring timely refilling and delivery of oxygen cylinders across urban and rural zones.

Market Dynamics:

Growth Drivers:

Why is the Australia Oxygen Cylinders Market Growing?

Rising Prevalence of Respiratory Diseases

The growing incidence of chronic respiratory illnesses, coupled with Australia’s ageing population, is significantly boosting the need for dependable medical oxygen solutions. In Australia, acute respiratory disease mortality statistics for 2025 show that in August and September, influenza caused 434 deaths, surpassing COVID-19's 270. From January to September, COVID-19 led to 1,966 deaths compared to influenza's 1,326. Notably, more Aboriginal and Torres Strait Islander people died from influenza than from COVID-19 or RSV. Patients with COPD, asthma, and long-term respiratory impairments increasingly rely on oxygen cylinders for continuous therapy at home and in clinical settings. Healthcare providers are also expanding respiratory care programs to manage rising caseloads, reinforcing demand for safe, accessible, and portable oxygen supply systems across the country.

Growing Focus on Emergency Preparedness

Emergency readiness and disaster response planning are increasingly shaping oxygen cylinder demand, especially in remote and regional areas. Portable cylinders play a critical role in first-response efforts, rural medical services, and mobile healthcare units. Governments and healthcare providers are strengthening their preparedness strategies to ensure uninterrupted oxygen availability during natural disasters, medical emergencies, and public health crises. This heightened focus on resilience is driving broader adoption of compact, rapid-deployment oxygen solutions.

Sustained Industrial Usage Across Key Sectors

Industrial applications remain a major growth driver for the Australia oxygen cylinders market, particularly in manufacturing, mining, and metal fabrication. In December 2025, South Australian Mining Minister Tom Koutsantonis announced the release of over 11,000 square kilometers of land in the Northern Gawler Craton for mining exploration. This initiative follows a failed bill to extend miners' exploration rights. The land is believed to have significant copper and other mineral potential. Oxygen is essential for processes such as cutting, welding, heating, and refining, ensuring consistent demand from operational facilities nationwide. As industries modernise and adopt higher productivity standards, the need for reliable, high-capacity oxygen cylinders increases, supporting stable, long-term consumption beyond the healthcare ecosystem.

Market Restraints:

What Challenges the Australia Oxygen Cylinders Market is Facing?

High Costs of Advanced Cylinders and Equipment

Lightweight materials, precision valves, and upgraded safety technologies significantly increase production and procurement costs. Smaller healthcare facilities and home-care users often struggle with these expenses, slowing adoption of advanced oxygen solutions and creating a gap between basic and premium cylinder options in the market.

Logistics and Distribution Constraints in Remote Regions

Timely refilling and delivery of oxygen cylinders in remote locations remain difficult due to long distances, limited service points, and higher transportation expenses. These challenges can disrupt supply reliability, affecting both medical and industrial users who rely on consistent oxygen availability.

Regulatory Compliance and Safety Requirements

Strict regulatory standards require manufacturers and healthcare providers to regularly update equipment, documentation, and handling protocols. These compliance obligations increase operational complexity and costs, making it challenging for smaller suppliers and facilities to maintain stringent safety requirements across all oxygen storage and usage environments.

Competitive Landscape:

The competitive landscape of the Australia oxygen cylinders market is shaped by a mix of established manufacturers, specialized medical suppliers, and distributors focused on both healthcare and industrial applications. Competition is driven by product reliability, safety compliance, and the ability to provide efficient refilling and maintenance services across urban and remote regions. Companies are increasingly differentiating through lightweight materials, advanced valve technology, and portable designs tailored for home-based care. Strong after-sales support, nationwide distribution networks, and adherence to evolving regulatory standards play a crucial role in sustaining market presence, pushing players to prioritize innovation and operational efficiency.

Australia Oxygen Cylinders Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Portable, Installed |

| Material Types Covered | Stainless Steel, Aluminum, Others |

| Sources Covered | Import, Domestic |

| Sales Channels Covered | Wholesalers/Distributors/Suppliers, Online, Direct Sales |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia oxygen cylinders market size was valued at USD 75.48 Million in 2025.

The Australia oxygen cylinders market is expected to grow at a compound annual growth rate of 7.52% from 2026-2034 to reach USD 144.92 Million by 2034.

The portable segment held the largest share, supported by strong adoption in home-based care, emergency response, and outpatient treatment. Its lightweight design and ease of mobility make it the preferred choice across healthcare and community settings.

Key factors driving the Australia oxygen cylinders market include rising respiratory care needs, increased home-based oxygen therapy adoption, expanding healthcare infrastructure, and higher demand from emergency services, aged-care facilities, and industrial sectors requiring reliable oxygen supply.

Major challenges include high costs of advanced cylinder technologies, logistical difficulties in supplying remote and rural regions, and stringent regulatory requirements for cylinder safety, storage, and maintenance, which increase operational complexity for suppliers and healthcare providers.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)