Australia Packaging Machinery Market Size, Share, Trends and Forecast by Machine Type, Technology, End-Use, and Region, 2026-2034

Australia Packaging Machinery Market Summary:

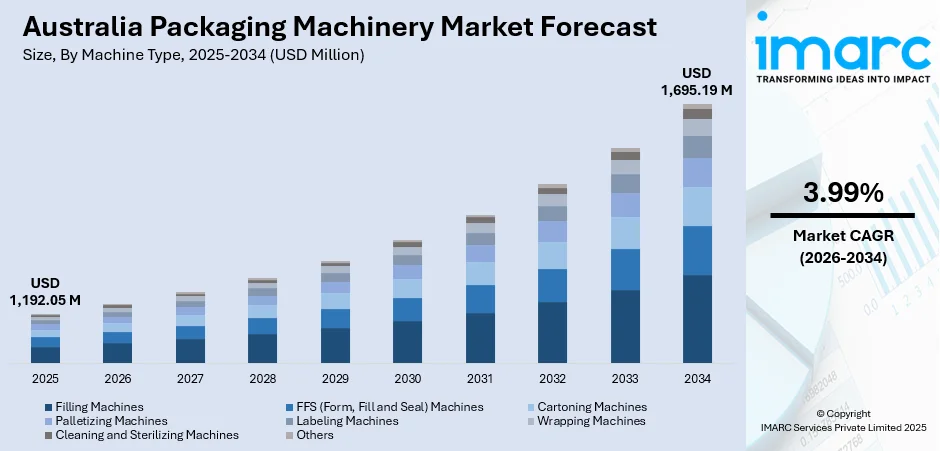

The Australia packaging machinery market size was valued at USD 1,192.05 Million in 2025 and is projected to reach USD 1,695.19 Million by 2034, growing at a compound annual growth rate of 3.99% from 2026-2034.

The market is driven by rising demand for automated packaging solutions across food and beverage processing, growing emphasis on sustainable and recyclable packaging materials, stringent regulatory standards promoting environmentally responsible practices, and expanding e-commerce and retail sectors requiring efficient packaging operations. Technological advancements enhancing production efficiency, customization capabilities, and compliance with environmental standards further contribute to the Australia packaging machinery market share.

Key Takeaways and Insights:

-

By Machine Type: Filing machines dominates the market with a share of 24.3% in 2025, driven by their precision in liquid and semi-liquid packaging, versatility across industries, and ability to minimize product wastage while increasing production efficiency.

- By Technology: General packaging leads the market with a share of 65.8% in 2025, owing to its broad applicability across industries, cost-effectiveness, and flexibility, while providing reliable solutions for standard packaging requirements and high-volume operations.

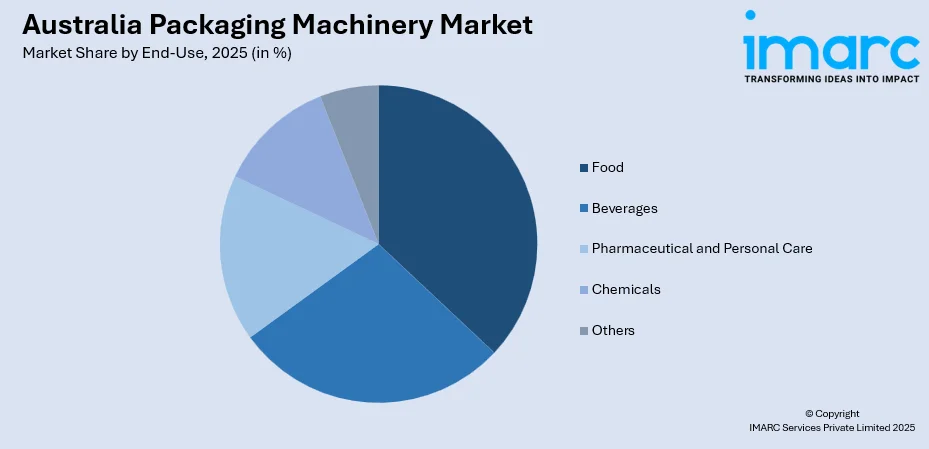

- By End-Use: Food represents the largest segment with a market share of 37.8% in 2025, driven by Australia’s growing processed food industry, rising convenience food demand, stringent safety regulations, and the need for extended shelf-life packaging solutions.

- By Region: Australia Capital Territory & New South Wales dominates the market with a share of 35.2% in 2025, owing to major manufacturing concentration, superior logistics infrastructure, and proximity to consumer markets, while benefiting from strong local technical support.

- Key Players: The market exhibits a moderately consolidated competitive landscape, with established international manufacturers competing alongside specialized domestic suppliers across various price and technology segments. Market participants differentiate through technological innovation, after-sales service quality, and customization capabilities.

To get more information on this market Request Sample

The Australia packaging machinery market is experiencing sustained growth driven by fundamental shifts in consumer behavior, industrial modernization, and regulatory evolution. The nation's food and beverage processing sector continues to expand, necessitating sophisticated packaging equipment capable of meeting stringent quality and safety standards. In June 2024, APPMA partnered with Hannover Fairs Australia to launch a Processing & Packaging Pavilion, showcasing advanced machinery across food, beverage, pharma, and e-commerce sectors. Moreover, rising consumer preference for convenience foods, ready-to-eat meals, and portion-controlled products has intensified demand for automated packaging solutions that ensure consistency and hygiene. Simultaneously, the pharmaceutical and personal care industries are investing in advanced machinery to comply with serialization requirements and tamper-evident packaging mandates. The accelerating growth of e-commerce has created new packaging challenges, requiring durable yet sustainable solutions for shipping and handling. Environmental consciousness among Australian consumers and businesses is driving adoption of machinery compatible with recyclable and biodegradable materials, prompting manufacturers to upgrade their equipment portfolios.

Australia Packaging Machinery Market Trends:

Integration of Smart Manufacturing Technologies

The Australian packaging machinery sector is witnessing accelerated adoption of Industry 4.0 technologies, fundamentally transforming production operations. Manufacturers are increasingly implementing Internet of Things (IoT) enabled sensors and connectivity solutions that facilitate real-time monitoring of equipment performance, predictive maintenance scheduling, and remote diagnostics capabilities. In July 2025, Australian packaging machinery company Packserv launched its PLC-controlled twin-head filler, an Industry 4.0-ready solution for SMEs, offering real-time monitoring, automation, and scalable production capabilities. This digital transformation enables packaging facilities to minimize unplanned downtime, optimize energy consumption, and enhance overall equipment effectiveness. Advanced human-machine interfaces with intuitive touchscreen controls are streamlining operator interactions, reducing training requirements and human error potential. The integration of artificial intelligence algorithms for quality inspection and process optimization is becoming more prevalent, allowing manufacturers to maintain consistent output quality while reducing waste and rework.

Flexible and Modular Packaging Solutions

Australian manufacturers are prioritizing packaging machinery that offers enhanced flexibility and rapid changeover capabilities to address evolving market demands. The trend toward smaller batch sizes, personalized packaging, and frequent product variations requires equipment designed for quick format changes with minimal downtime. Modular machinery architectures are gaining prominence, enabling manufacturers to reconfigure production lines efficiently and scale capacity according to demand fluctuations. In November 2025, Packserv won the Best Small Business Award at the Australian Manufacturing Awards, recognised for its local production, Industry 4.0-enabled packaging machinery, and commitment to innovation and sustainability. Furthermore, this flexibility extends to accommodating diverse packaging formats, materials, and container sizes within unified systems. The emphasis on versatility is particularly pronounced in industries serving fragmented consumer preferences, where the ability to switch between packaging configurations rapidly provides significant competitive advantages in responding to market trends.

Sustainable Packaging Equipment Innovation

Environmental sustainability is reshaping packaging machinery specifications and capabilities across the Australian market. Equipment manufacturers are developing solutions specifically designed to process recyclable, compostable, and bio-based packaging materials without compromising production efficiency or package integrity. In July 2025, Pacmatix launched the FP 100 HP BOX MOTION 520 Paper Flow Wrapper in Australia, enabling manufacturers to wrap recyclable paper-based films efficiently while maintaining seal quality and line speed. Furthermore, machinery innovations focus on reducing material consumption through precision dosing, lighter-weight packaging designs, and optimized sealing technologies that maintain product protection while minimizing environmental footprint. Energy-efficient drives, regenerative braking systems, and intelligent power management features are becoming standard specifications as manufacturers seek to reduce operational carbon emissions. The transition toward mono-material packaging structures, which enhance recyclability, is driving demand for specialized equipment capable of maintaining barrier properties and functionality within single-material constraints.

Market Outlook 2026-2034:

The Australia packaging machinery market demonstrates promising growth prospects throughout the forecast period, with market revenue projected to expand steadily from its current valuation to reach significantly higher levels by the end of the decade. Continued investment in food processing capacity, pharmaceutical manufacturing expansion, and e-commerce fulfillment infrastructure will sustain equipment demand across all segments. Technological advancement in automation, sustainability-focused innovations, and smart manufacturing integration will drive equipment replacement cycles and new installations, positioning the market for consistent revenue growth through sustained industrial modernization initiatives. The market generated a revenue of USD 1,192.05 Million in 2025 and is projected to reach a revenue of USD 1,695.19 Million by 2034, growing at a compound annual growth rate of 3.99% from 2026-2034.

Australia Packaging Machinery Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Machine Type | Filing Machines | 24.3% |

| Technology | General packaging | 65.8% |

| End-Use | Food | 37.8% |

| Region | Australia Capital Territory & New South Wales | 35.2% |

Machine Type Insights:

- Filling Machines

- FFS (Form, Fill and Seal) Machines

- Cartoning Machines

- Palletizing Machines

- Labeling Machines

- Wrapping Machines

- Cleaning and Sterilizing Machines

- Others

Filing machines dominate with a market share of 24.3% of the total Australia packaging machinery market in 2025.

Filling machines represent the leading segment within Australia's packaging machinery market, serving as critical components across virtually every industry requiring liquid, semi-liquid, paste, or powder product packaging. These machines encompass diverse technologies including volumetric, gravimetric, piston, pump, and auger-based systems, each optimized for specific product characteristics and production requirements. The food and beverage sector relies extensively on filling equipment for dairy products, sauces, beverages, edible oils, and processed foods, while pharmaceutical applications demand precision filling with stringent accuracy and hygiene compliance.

The continued dominance of filling machines reflects their indispensable role in production workflows where accurate product dosing directly impacts profitability, regulatory compliance, and consumer satisfaction. Manufacturers are investing in servo-driven filling technologies that enhance precision while reducing product giveaway and waste. Clean-in-place systems and hygienic designs facilitate rapid product changeovers and maintain sanitary conditions essential for food safety certification. The versatility of modern filling equipment in handling increasingly diverse container formats and sustainable packaging materials reinforces their position as foundational investments for packaging operations.

Technology Insights:

- General Packaging

- Modified Atmosphere Packaging

- Vacuum Packaging

General packaging leads with a share of 65.8% of the total Australia packaging machinery market in 2025.

General packaging technology maintains its dominant position within the Australian market, encompassing conventional packaging methodologies that serve broad applications across multiple industries. This technology segment includes standard sealing, wrapping, cartoning, and case packing operations that form the backbone of most packaging facilities. The widespread adoption of general packaging technology reflects its proven reliability, lower capital investment requirements, and compatibility with established production practices across food, beverage, pharmaceutical, and consumer goods manufacturing.

The enduring leadership of general packaging technology stems from its applicability to products without specialized atmospheric or preservation requirements, representing the majority of packaged goods in retail and industrial channels. Manufacturers continue upgrading general packaging equipment with enhanced automation features, improved throughput capabilities, and better material handling efficiency while maintaining cost-effectiveness. In March 2024, Automation & Packaging showcased Baumer wrap-around case packers, Ronchi modular bottle unscramblers, and Zilli & Bellini fillers at APPEX 2024, highlighting versatile, high-throughput packaging machinery. The flexibility of general packaging machinery in accommodating various product types and packaging formats makes it essential for manufacturers serving diverse product portfolios requiring reliable, high-volume packaging operations.

End-Use Insights:

Access the comprehensive market breakdown Request Sample

- Food

- Beverages

- Pharmaceutical and Personal Care

- Chemicals

- Others

Food exhibits a clear dominance with a 37.8% share of the total Australia packaging machinery market in 2025.

The food industry represents the largest end-use segment for packaging machinery in Australia, driven by the nation's substantial food processing sector serving both domestic consumption and significant export markets. Food manufacturers require diverse packaging equipment for applications spanning fresh produce, dairy products, bakery items, confectionery, snacks, frozen foods, and prepared meals. Stringent food safety regulations and quality assurance requirements mandate sophisticated packaging solutions that ensure product integrity, extend shelf life, and provide tamper-evident consumer protection throughout distribution channels.

The food sector's packaging machinery demand reflects evolving consumer preferences toward convenience, portability, and sustainable packaging formats. In June 2025, FoodTech Qld showcased sustainable packaging innovations for Australia’s food industry, including paper-based pallet wrapping and automated vacuum packing systems, highlighting efficiency, food safety, and reduced environmental impact. Moreover, growing popularity of ready-to-eat meals, single-serve portions, and on-the-go snacking products drives investment in flexible packaging equipment capable of producing pouch formats, stand-up bags, and reclosable packaging solutions. Export-oriented food manufacturers require machinery meeting international packaging standards and capable of accommodating diverse regulatory requirements across destination markets, further stimulating equipment investment and modernization across the processing sector.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales dominates with a market share of 35.2% of the total Australia packaging machinery market in 2025.

The Australia Capital Territory and New South Wales region drives the largest share of packaging machinery installations, reflecting the concentration of major manufacturing facilities, population centers, and logistics infrastructure. New South Wales hosts significant food and beverage processing operations, pharmaceutical manufacturing sites, and consumer goods production facilities requiring advanced packaging capabilities. Sydney's position as Australia's largest metropolitan area creates substantial local demand while providing efficient access to domestic distribution networks and international export channels through major port facilities.

Regional dominance extends from the established industrial base, skilled workforce availability, and proximity to technical support services essential for sophisticated packaging equipment operation and maintenance. Major packaging machinery suppliers maintain regional offices, demonstration facilities, and spare parts inventories within New South Wales, reducing equipment downtime and enabling rapid response to service requirements. The continued expansion of food processing capacity in regional New South Wales, particularly in emerging agricultural processing zones, sustains demand for packaging equipment installations across diverse production scales and specializations. According to sources, in October 2025, the NSW Government launched the Plant-Based Protein Manufacturing Prospectus, promoting regional NSW as a hub for sustainable food production and advanced packaging machinery adoption.

Market Dynamics:

Growth Drivers:

Why is the Australia Packaging Machinery Market Growing?

Expansion of Processed Food and Beverage Manufacturing

Australia's processed food and beverage sector continues expanding in response to evolving consumer lifestyles, dietary preferences, and demand for convenient meal solutions. The shift toward ready-to-consume products, packaged snacks, dairy alternatives, and functional beverages drives substantial investment in packaging infrastructure capable of maintaining product quality and extending shelf life. Manufacturers are establishing new production facilities and expanding existing operations to capture growing domestic consumption while positioning for export market opportunities across Asia-Pacific regions. This industrial expansion translates directly into packaging machinery demand across filling, sealing, labeling, and case packing applications. In May 2025, Coca-Cola Europacific Partners completed a new high-speed canning line in Richlands, Queensland, processing 120,000 cans per hour, enhancing production capacity and supporting sustainability goals. Furthermore, the premiumization trend in food and beverage categories further stimulates investment in sophisticated packaging equipment capable of delivering enhanced aesthetic appeal and differentiated consumer experiences.

Stringent Regulatory and Food Safety Requirements

Regulatory frameworks governing food safety, pharmaceutical packaging, and product traceability are becoming increasingly rigorous across Australian markets, compelling manufacturers to invest in compliant packaging equipment. Food safety standards mandate specific packaging integrity requirements, contamination prevention measures, and traceability capabilities throughout supply chains. Pharmaceutical serialization requirements drive adoption of sophisticated labeling and verification systems integrated within packaging lines. Environmental regulations targeting packaging waste reduction and recyclability encourage equipment investments enabling transition to sustainable materials and formats. As per sources, in October 2025, the Australian Government advanced packaging regulation reforms, introducing the Design for Kerbside Recyclability Grading Framework to enhance recyclability, reduce waste, and support a circular packaging economy. Further, these regulatory pressures create sustained demand for packaging machinery incorporating advanced hygiene features, quality inspection systems, and documentation capabilities essential for compliance demonstration and audit requirements across regulated industries.

E-commerce and Retail Distribution Evolution

The continued growth of e-commerce channels and evolving retail distribution models are reshaping packaging requirements across Australian markets. Products destined for direct-to-consumer delivery require packaging solutions optimized for shipping durability, presentation appeal, and easy opening functionality that differs significantly from traditional retail formats. Fulfillment operations demand flexible packaging equipment capable of handling diverse product assortments with rapid changeover capabilities. The expansion of omnichannel retail strategies requires manufacturers to support multiple packaging configurations within unified production environments. Rising consumer expectations regarding unboxing experiences and sustainable shipping materials drive innovation in protective packaging solutions and right-sized packaging systems that minimize void fill requirements while ensuring product protection throughout extended distribution networks. In March 2025, The Packaging People in Melbourne expanded its sustainable e-commerce packaging range, offering custom solutions with recycled, recyclable, and compostable materials to meet rising Australian retail demand.

Market Restraints:

What Challenges the Australia Packaging Machinery Market is Facing?

High Capital Investment Requirements

Advanced packaging machinery represents substantial capital expenditure that can challenge acquisition decisions for small and medium-sized manufacturers operating within constrained financial parameters. Sophisticated automation, Industry 4.0 integration, and specialized technologies command premium pricing that extends payback periods and complicates return-on-investment calculations. Equipment financing availability and terms influence purchasing timelines, potentially delaying modernization initiatives despite clear operational benefits. The total cost of ownership extending beyond initial purchase to include installation, commissioning, training, and ongoing maintenance further elevates investment thresholds.

Technical Skills and Workforce Availability

The increasing sophistication of modern packaging machinery creates challenges in recruiting and retaining technically qualified personnel capable of operating, maintaining, and optimizing complex automated systems. Programming expertise for servo-driven equipment, troubleshooting capabilities for integrated control systems, and understanding of Industry 4.0 technologies require specialized training that may not be readily available through conventional technical education pathways. Competition for qualified technicians across manufacturing sectors intensifies recruitment difficulties, particularly for operations located outside major metropolitan centers where talent pools are more limited.

Supply Chain and Lead Time Constraints

Global supply chain complexities affecting component availability, manufacturing lead times, and logistics costs create uncertainties for packaging machinery procurement planning. Extended delivery timelines for specialized equipment can delay production expansion projects and limit responsiveness to market opportunities. Dependency on international suppliers for critical components and replacement parts introduces vulnerability to shipping disruptions, currency fluctuations, and trade policy changes. These supply chain factors complicate capital planning cycles and may influence equipment selection decisions toward suppliers offering more reliable delivery performance and local technical support capabilities.

Competitive Landscape:

The Australia packaging machinery market features a competitive environment characterized by established international manufacturers competing alongside specialized regional suppliers across technology segments and price tiers. Market participants differentiate through technological innovation, comprehensive service networks, and application-specific expertise addressing diverse industry requirements. Competition intensifies around automation capabilities, energy efficiency, sustainability features, and digital integration offerings that enhance operational value propositions. Domestic suppliers leverage local presence advantages including rapid technical response, reduced lead times for service interventions, and understanding of regional regulatory requirements. International participants counter through global technology portfolios, extensive research and development investments, and established brand reputations built across decades of market presence. Strategic partnerships between equipment suppliers and packaging material manufacturers create integrated solution offerings addressing complete packaging line requirements.

Recent Developments:

-

In September 2025, Jet Technologies introduced the first high-speed Vertical Form Fill Seal (VFFS) machinery in Australia and New Zealand capable of producing and filling Block-Bottom Gusset Bags for coffee brands. This innovation allows in-house bag production, reduces costs compared to pre-made bags, and enhances product branding, shelf presence, and packaging efficiency.

Australia Packaging Machinery Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Machine Types Covered | Filling Machines, FFS (Form, Fill and Seal) Machines, Cartoning Machines, Palletizing Machines, Labeling Machines, Wrapping Machines, Cleaning and Sterilizing Machines, Others |

| Technologies Covered | General Packaging, Modified Atmosphere Packaging, Vacuum Packaging |

| End-Uses Covered | Food, Beverages, Pharmaceutical and Personal Care, Chemicals, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia packaging machinery market size was valued at USD 1,192.05 Million in 2025

The Australia packaging machinery market is expected to grow at a compound annual growth rate of 3.99% from 2026-2034 to reach USD 1,695.19 Million by 2034.

Filling machines held the largest market share, driven by their critical role in food, beverage, pharmaceutical, and personal care industries, while ensuring precise liquid and semi-liquid product packaging and minimizing production wastage.

Key factors driving the Australia packaging machinery market include rising demand for automated packaging solutions, growing emphasis on sustainable packaging materials, stringent food safety regulations, expanding e-commerce distribution channels, and technological advancements in production efficiency.

Major challenges include high capital investment requirements for advanced equipment, technical workforce availability constraints, extended procurement lead times, supply chain uncertainties for specialized components, and complexity in integrating new technologies with existing production infrastructure.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)