Australia Pain Management Drugs Market Size, Share, Trends and Forecast by Drug Class, Indication, Distribution Channel, and Region, 2025-2033

Australia Pain Management Drugs Market Overview:

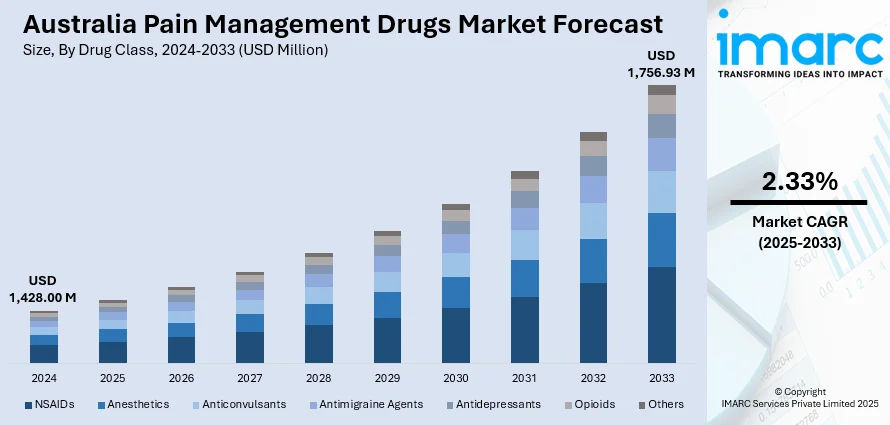

The Australia pain management drugs market size reached USD 1,428.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,756.93 Million by 2033, exhibiting a growth rate (CAGR) of 2.33% during 2025-2033. The surging ageing population, escalating surgical volumes, improved urban healthcare access, pharmaceutical innovation, rising chronic illness cases, government regulation on opioid safety, digital health adoption, insurance coverage expansion, and burgeoning investment in palliative care are some of the factors propelling the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,428.00 Million |

| Market Forecast in 2033 | USD 1,756.93 Million |

| Market Growth Rate 2025-2033 | 2.33% |

Australia Pain Management Drugs Market Trends:

Ageing Population and Rising Chronic Pain Burden

Australia’s ageing population plays a major role in shaping the market for pain management drugs. In 2023, Australians aged 65 years and above made up for 17.38% of the total population. As the population continues to age, the incidence of age-related chronic pain conditions, such as osteoarthritis, spinal degeneration, and neuropathic pain, are witnessing a considerable rise. This demographic transition is fueling growth in the demand of both over-the-counter (OTC) and prescription pain relievers. Additionally, elderly patients require consistent chronic pain management, leading to persistent pharmaceutical consumption over a longer period of time. Apart from this, policies supporting the care of the elderly and better access to palliative medicine in geriatric settings further increases the commercial opportunity for chronic pain drugs, which is creating a positive Australia pain management drugs market outlook.

To get more information on this market, Request Sample

Increased Volume of Surgical Procedures and Post-Operative Care

The escalating level of elective and emergent surgical procedures has created a sustained need for effective post-surgical pain control. Inpatient and outpatient surgical centers rely on analgesics, such as opioids, non-steroidal anti-inflammatory drugs (NSAIDs), and local anesthetics, to manage patient recovery and minimize complications associated with pain. With changing surgical practice, including a rise in minimally invasive surgery, there is greater interest in rapid recovery, which is another factor boosting the Australia pain management drugs market growth. Moreover, the application of Enhanced Recovery After Surgery (ERAS) protocols also supports the need for personalized pharmaceutical interventions to enhance early discharge and better outcomes, which is supporting the market growth. Postoperative pain is one of the primary drivers of patient satisfaction and functional recovery, and it has made clinicians adopt the use of multimodal analgesia techniques. This trend not only advantages the sales of conventional painkillers but also encourages the use of newer ones with extended duration of action and reduced side effects. Post-operative pain is a primary determinant of patient satisfaction and functional recovery, prompting medical professionals to adopt multimodal analgesia approaches. This trend not only supports the sales of conventional pain medications but also encourages the uptake of newer formulations with longer duration of action and reduced side effects.

Pharmaceutical Innovation and Product Diversification

Continuous innovation in pain management pharmaceuticals is boosting the Australia pain management drugs market share. Key manufacturers are actively investing in the development of safer and more effective analgesics, including extended-release opioids, transdermal delivery systems, and abuse-deterrent formulations. These innovations aim to balance efficacy with risk minimization, particularly in light of increasing regulatory scrutiny around opioid misuse. Additionally, there is a growing emphasis on non-opioid alternatives targeting neuropathic and inflammatory pain pathways, such as sodium channel blockers, cyclooxygenase-2 (COX-2) inhibitors, and cannabinoid-based treatments. Product diversification also includes fixed-dose combinations and personalized medicine approaches that cater to patient-specific pain profiles. As a result, physicians now have a broader therapeutic arsenal to tailor pain management plans, improving clinical outcomes and patient adherence. The introduction of new drugs into the Australian market, supported by expedited regulatory reviews and pharmaceutical benefits scheme (PBS) listings, further enhances accessibility.

Australia Pain Management Drugs Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on drug class, indication, and distribution channel.

Drug Class Insights:

- NSAIDs

- Anesthetics

- Anticonvulsants

- Antimigraine Agents

- Antidepressants

- Opioids

- Others

The report has provided a detailed breakup and analysis of the market based on the drug class. This includes NSAIDS, anesthetics, anticonvulsants, antimigraine agents, antidepressants, opioids, and others.

Indication Insights:

- Musculoskeletal Pain

- Surgical and Trauma Pain

- Cancer Pain

- Neuropathic Pain

- Migraine Pain

- Obstetrical Pain

- Fibromyalgia Pain

- Burn Pain

- Dental/Facial Pain

- Pediatric Pain

- Others

A detailed breakup and analysis of the market based on the indication have also been provided in the report. This includes musculoskeletal pain, surgical and trauma pain, cancer pain, neuropathic pain, migraine pain, obstetrical pain, fibromyalgia pain, burn pain, dental/facial pain, pediatric pain, and others.

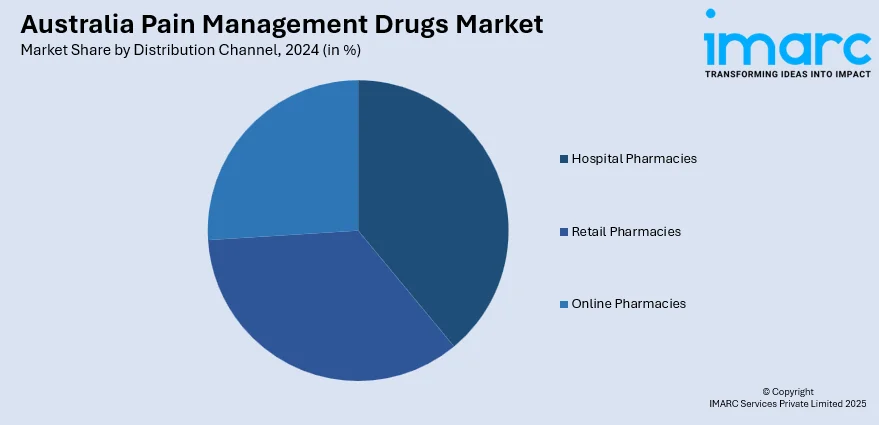

Distribution Channel Insights:

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes hospital pharmacies, retail pharmacies, and online pharmacies.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Pain Management Drugs Market News:

- In 2024, Pfizer announced an upgrade to its plant in Melbourne, aiming to make it one of the most advanced pharmaceutical production facilities in Australia. This move is part of Pfizer's commitment to enhancing local manufacturing capabilities and ensuring a steady supply of essential medicines, including pain management drugs.

- In 2024, the Australian Government announced USD 53.6 million in funding through the Medical Research Future Fund to support research into women’s health and chronic pain. This investment aims to advance evidence-based treatments and improve outcomes, particularly for conditions like endometriosis and pelvic pain affecting Australian women.

Australia Pain Management Drugs Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | USD Million |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Drug Classes Covered | NSAIDs, Anesthetics, Anticonvulsants, Antimigraine Agents, Antidepressants, Opioids, Others |

| Indications Covered | Musculoskeletal Pain, Surgical and Trauma Pain, Cancer Pain, Neuropathic Pain, Migraine Pain, Obstetrical Pain, Fibromyalgia Pain, Burn Pain, Dental/Facial Pain, Pediatric Pain, Others |

| Distribution Channels Covered | Hospital Pharmacies, Retail Pharmacies, Online Pharmacies |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia pain management drugs market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia pain management drugs market on the basis of drug class?

- What is the breakup of the Australia pain management drugs market on the basis of indication?

- What is the breakup of the Australia pain management drugs market on the basis of distribution channel?

- What is the breakup of the Australia pain management drugs market on the basis of region?

- What are the various stages in the value chain of the Australia pain management drugs market?

- What are the key driving factors and challenges in the Australia pain management drugs?

- What is the structure of the Australia pain management drugs market and who are the key players?

- What is the degree of competition in the Australia pain management drugs market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia pain management drugs market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia pain management drugs market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia pain management drugs industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)