Australia Paint Market Size, Share, Trends and Forecast by Technology, Type of Paint, Resin, End User, and Region, 2025-2033

Australia Paint Market Overview:

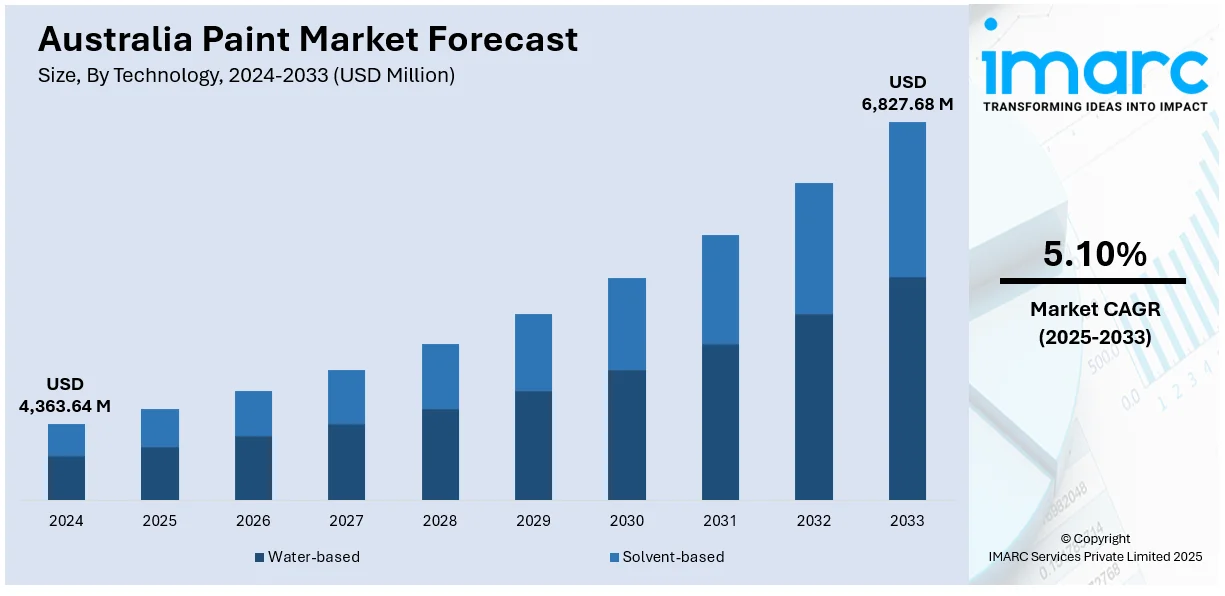

The Australia paint market size reached USD 4,363.64 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 6,827.68 Million by 2033, exhibiting a growth rate (CAGR) of 5.10% during 2025-2033. The market is witnessing steady growth driven by rising construction activity, home renovation trends, and increased infrastructure investments. Demand for eco-friendly and low-VOC paints is also growing due to environmental regulations and consumer awareness. Decorative and industrial segments are both contributing to volume expansion, supported by urbanization and commercial development. Technological innovation in coatings is further enhancing product appeal, strengthening the Australia paint market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4,363.64 Million |

| Market Forecast in 2033 | USD 6,827.68 Million |

| Market Growth Rate 2025-2033 | 5.10% |

Australia Paint Market Trends:

Expansion of Infrastructure Projects

The Australia paint market is witnessing strong momentum from the expansion of large-scale infrastructure and commercial construction projects across the country. Government investments in transportation, energy, healthcare, and urban development are fueling the need for high-performance industrial coatings. For instance, in March 2025, the Federal Government announced $54 million in funding to expedite home construction, including $4.7 million for a streamlined off-site construction certification process. The UDIA urges an additional $5 billion for enabling infrastructure to address housing supply constraints, as 33% of residential land in capital cities faces such limitations. These paints are essential for protecting structural surfaces such as bridges, tunnels, pipelines, and public buildings from corrosion, extreme weather, and heavy usage. Industrial coatings not only extend the lifespan of assets but also improve safety and compliance with building standards. With increased focus on long-term durability and maintenance efficiency, project developers are prioritizing quality coatings that meet strict environmental and performance criteria. This surge in infrastructure development is creating consistent demand for protective and functional paints, making industrial applications a major contributor to overall volume and value growth in the Australia paint market.

To get more information on this market, Request Sample

Increased Use of Powder Coatings

The growth of the Australia paint market is increasingly being driven by the rising adoption of powder coatings. Known for their superior durability, powder coatings offer resistance to chipping, scratching, and fading, making them ideal for the country’s demanding climate conditions. Additionally, their efficiency in application such as faster curing times and minimal waste makes them a cost-effective choice for manufacturers. A key factor behind this shift is their eco-friendly profile, as powder coatings contain no solvents and emit little to no volatile organic compounds (VOCs). This aligns with Australia’s stringent environmental standards and the growing focus on sustainable construction and manufacturing practices. For instance, in January 2025, AkzoNobel launched the Interpon D Futura Collection 2024-2025 in Australia and New Zealand, offering sustainable powder coatings for architects. Featuring three color palettes Merging Worlds, Healing Nature, and Soft Abstraction the collection emphasizes beauty, durability, and eco-friendliness, with a 25-year warranty and an Environmental Product Declaration. As industries like automotive, appliances, furniture, and construction seek high-performance coatings with lower environmental impact, powder coatings are becoming a preferred alternative, contributing significantly to the Australia paint market growth.

Australia Paint Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on technology, type of paint, resin, and end user.

Technology Insights:

- Water-based

- Solvent-based

The report has provided a detailed breakup and analysis of the market based on the technology. This includes water-based and solvent-based.

Type of Paint Insights:

- Emulsion

- Enamel

- Distemper

- Textures

- Others

A detailed breakup and analysis of the market based on the type of paint have also been provided in the report. This includes emulsion, enamel, distemper, textures, and others.

Resin Insights:

- Acrylic

- Alkyd

- Polyurethane

- Epoxy

- Polyester

- Others

A detailed breakup and analysis of the market based on the resin have also been provided in the report. This includes acrylic, alkyd, polyurethane, epoxy, polyester, and others.

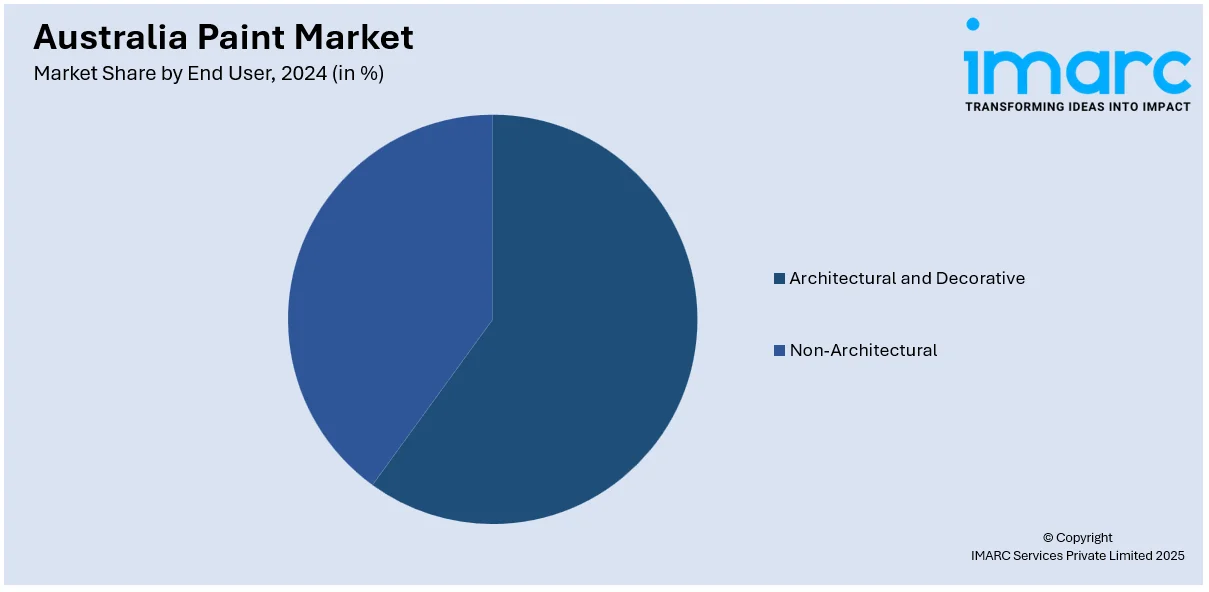

End User Insights:

- Architectural and Decorative

- Non-Architectural

- Automotive and Transportation

- Wood

- General Industrial

- Marine

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes architectural and decorative and non-architectural (automotive and transportation, wood, general industrial, marine, and others).

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & South Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & South Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Paint Market News:

- In March 2025, Inkmaker Australia was named the Primary Channel Partner for Fast & Fluid Management in Australia, enhancing access to advanced paint tinting technologies. This partnership promises improved service and technical support, providing Australian customers with precision dispensers, mixers, smart software, and comprehensive after-sales services for optimized performance and efficiency.

- In March 2025, Axalta Coating Systems announced the acquisition of U-POL Australia and New Zealand, enhancing its portfolio of automotive refinishing products, including paints and coatings. This acquisition aims to expand Axalta's market reach while maintaining U-POL’s commitment to innovation and service. Daniel Harper will lead U-POL Australia & New Zealand under Axalta’s management.

Australia Paint Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Technologies Covered | Water-based, Solvent-based |

| Types of Paint Covered | Emulsion, Enamel, Distemper, Textures, Others |

| Resins Covered | Acrylic, Alkyd, Polyurethane, Epoxy, Polyester, Others |

| End Users Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & South Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia paint market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia paint market on the basis of technology?

- What is the breakup of the Australia paint market on the basis of type of paint?

- What is the breakup of the Australia paint market on the basis of resin?

- What is the breakup of the Australia paint market on the basis of end user?

- What is the breakup of the Australia paint market on the basis of region?

- What are the various stages in the value chain of the Australia paint market?

- What are the key driving factors and challenges in the Australia paint market?

- What is the structure of the Australia paint market and who are the key players?

- What is the degree of competition in the Australia paint market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia paint market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia paint market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia paint industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)