Australia Pallet Market Size, Share, Trends and Forecast by Type, Application, Structural Design, and Region, 2026-2034

Australia Pallet Market Overview:

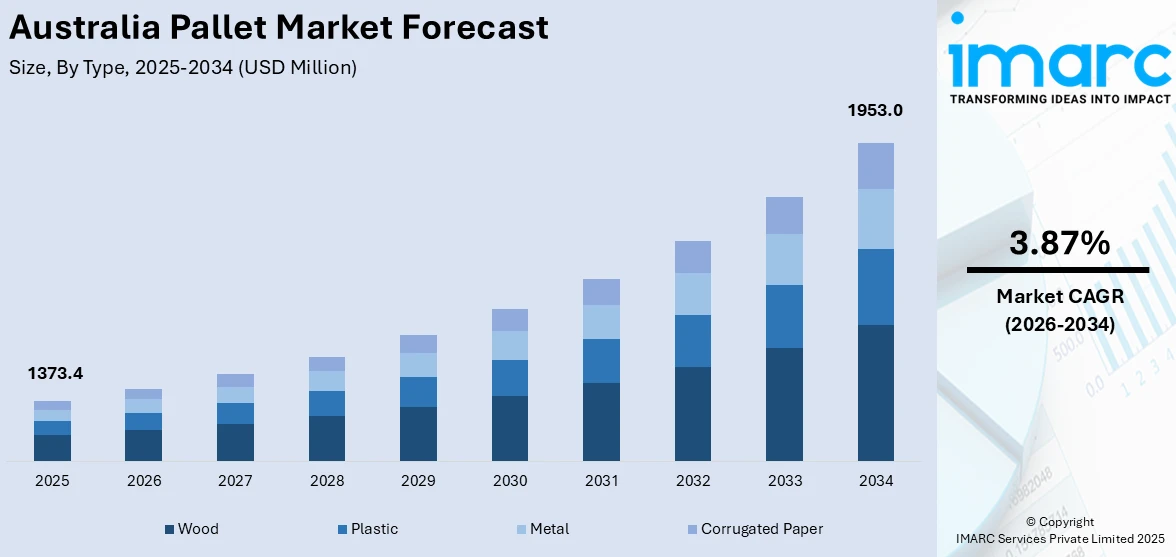

The Australia pallet market size reached USD 1,373.4 Million in 2025. Looking forward, the market is projected to reach USD 1,953.0 Million by 2034, exhibiting a growth rate (CAGR) of 3.87% during 2026-2034. The market is driven by growing e-commerce, expanding logistics and warehousing, rising infrastructure projects, increasing exports, sustainability trends, ongoing technological advancements in pallet tracking, and the surging demand for cost-efficient, durable, and reusable pallet solutions across various industries.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 1,373.4 Million |

| Market Forecast in 2034 | USD 1,953.0 Million |

| Market Growth Rate 2026-2034 | 3.87% |

Key Trends of Australia Pallet Market:

Growing Adoption of Sustainable and Recyclable Pallets

The Australia pallet market is experiencing a significant shift toward sustainable and eco-friendly solutions. Companies are increasingly adopting pallets constructed from recycled materials like plastic and wood composites because these options help them align with the government sustainability mandates and minimize their environmental impact. For instance, in March 2024, Hyne Group acquired Melbourne-based Rodpak Pty Ltd, expanding into pallet manufacturing to enhance sustainability and premium product offerings under the parent company James Jones & Sons Ltd. Moreover, reusable and repairable pallets are becoming more popular because businesses want to reduce their expenses while implementing circular economy methods. Besides this, the market evolution is also influenced by rising industry requirements for lightweight and biodegradable pallets, as it is highly demanded by the food and pharmaceutical industries. Furthermore, the rise of eco-conscious consumers and businesses has encouraged pallet manufacturers to invest in sustainable production methods and materials for pallet manufacturing. Apart from this, sustainable pallets are becoming a central focus for supply chain operations as Australian industries are accelerating their collaboration with sustainability targets, which is boosting the Australia pallet market share.

To get more information on this market Request Sample

Increased Use of Smart and RFID-Enabled Pallets

Ongoing technological advancements are significantly driving the adoption of smart pallets embedded with Radio Frequency Identification (RFID) and Internet of Things (IoT) capabilities and expanding the Australia pallet market growth. In line with this, Australian businesses in the retail and logistics sectors and manufacturing industries are integrating these advanced pallets to track inventory better, boost supply chain efficiency, and minimize losses from poor management and theft. Concurrently, smart pallets provide real-time tracking that enables users to monitor temperature along with location and product conditions, thus maintaining strict quality standards critical for perishable goods and pharmaceuticals. Additionally, advanced pallet systems offer automation and digital logistics solutions that enable them to improve operational efficiency while generating data-driven insights. For example, in October 2024, SMART Recycling launched a high-tech production line in Dandenong South, adding 700,000 recycled pallets annually using robotics and scanning software to enhance supply chain efficiency and sustainability. Furthermore, RFID-enabled pallets have become a strategic investment for companies as they expand their e-commerce and omnichannel operations to enhance warehouse management efficiency and achieve complete supply chain transparency. As a result, the Australia pallet market outlook is transforming into a data-based and technologically advanced sector, driven by projected market growth.

Expansion of E-commerce and Retail Logistics

The rapid growth of online shopping is significantly reshaping the logistics and supply chain industry in Australia, resulting in an increased reliance on pallets for storage, handling, and delivery operations. With consumer expectations for quicker deliveries on the rise, warehouses and distribution centers face mounting pressure to enhance efficiency, leading to a surge in pallet usage for both bulk storage and last-mile delivery. Pallets are essential for facilitating the movement of goods, minimizing handling times, and ensuring product safety during transit. The increase in retail and e-commerce activities has also boosted demand for standardized pallet systems that enable automation and smart logistics. Consequently, the growth of e-commerce is directly driving the surge in Australia pallet market demand, establishing pallets as vital assets for businesses striving to expand their operations and meet ever-changing consumer needs.

Growth Drivers of Australia Pallet Market:

Industrial and Agricultural Growth

Australia’s robust agricultural foundation and burgeoning manufacturing sector significantly enhance the demand for pallets. Agricultural exports like grains, dairy, and meat depend on pallets for secure and effective transport to both domestic and international markets. In the same vein, food processing and industrial production utilize pallets for the packing, storage, and shipping of goods. The capacity of pallets to manage bulk volumes while safeguarding product quality renders them essential across these sectors. Furthermore, the export-oriented nature of Australian agriculture necessitates pallets that meet international standards, further elevating demand. This trend highlights how the agricultural and industrial backbone of the economy continues to support the pallet market, establishing it as a vital element in supply chain operations.

Focus on Supply Chain Efficiency

Businesses in Australia are increasingly emphasizing efficiency within their supply chains, with pallets playing a pivotal role in this evolution. Utilizing standardized pallets reduces the time spent handling products, lowers damage risks, and facilitates seamless integration with automated warehouse and distribution systems. As e-commerce expands and the demand for rapid fulfillment rises, companies are exploring ways to improve operational efficiency. Pallets contribute to cost-effectiveness by enhancing load optimization during both storage and transport, which helps reduce overall logistics costs. Additionally, industries are embracing advanced pallet management solutions, such as pooling and tracking systems, to enhance utilization. As indicated in Australia pallet market analysis, the modernization of supply chains and operations focused on efficiency will continue to bolster pallet usage throughout the retail, logistics, and manufacturing sectors.

Growing Infrastructure and Trade Activities

The rise of infrastructure investments and increasing trade activities in Australia are significant factors driving the demand for pallets. The development of modern logistics hubs, ports, and warehouses facilitates growing international trade and domestic distribution, leading to a sustained need for pallets as an essential logistics tool. As Australia solidifies its position in global supply chains, the efficient handling of imports and exports becomes vital, with pallets ensuring standardized transportation across borders. The growth of intermodal transport and the increasing use of containerized shipping further promote pallet usage, as they guarantee compatibility and product safety throughout the shipping process. These advancements in infrastructure, alongside trade growth, establish pallets as a critical component of Australia’s logistics framework, propelling consistent market growth in alignment with changing trade dynamics.

Opportunities of Australia Pallet Market:

Growth in Cross-Border Trade

Australia’s strong position as an exporter of agricultural products, minerals, and manufactured goods presents considerable opportunities for pallet suppliers. International shipping necessitates pallets that adhere to global standards, such as ISPM-15, to prevent pest contamination and facilitate smooth customs clearance. As trade volumes rise, the demand for durable, standardized pallets significantly increases. Export-oriented sectors like meat, dairy, wine, and mining depend heavily on pallets for the safe and efficient transport of bulk items. This trend prompts pallet manufacturers to innovate and develop designs suitable for long-distance shipping while also broadening their offerings for various export markets. With the rapid pace of globalization, cross-border logistics continues to reinforce opportunities within Australia’s pallet market by generating a steady and large-scale demand for compliant pallets.

Customized Industry-Specific Solutions

Various sectors, including pharmaceuticals, food processing, automotive, and chemicals, have unique requirements regarding material handling. For instance, the pharmaceutical industry seeks hygienic, contamination-free pallets, while food and beverage manufacturers typically prefer pallets that resist moisture and pests. Additionally, automotive companies may need heavy-duty pallets for transporting parts and machinery. This scenario creates a profitable opportunity for pallet suppliers to provide tailored solutions that align with the operational standards of each sector. Offering customized designs can enhance efficiency, minimize product damage, and ensure compliance with regulatory standards. As more industries adopt digitized and streamlined supply chains, the demand for niche, industry-specific pallet innovations will persist, driving opportunities in the Australian pallet market for specialized solutions.

Value-Added Services

In addition to the conventional manufacture and sale of pallets, value-added services offer a significant growth opportunity. Companies are increasingly looking for cost-effective and sustainable models like pallet pooling, rental, repair, and refurbishment. Providing life-cycle management services prolongs the usability of pallets and supports corporate sustainability objectives and circular economy efforts. Providers that incorporate these services can create stronger long-term relationships with customers by lowering operational costs and minimizing environmental impact. Moreover, services such as on-site collection, maintenance, and real-time inventory tracking enhance efficiency in logistics operations. This shift from a product-centric approach to service-oriented offerings positions pallet suppliers as strategic partners in supply chain management, thereby expanding opportunities in the Australian pallet market and fostering recurring revenue streams.

Australia Pallet Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2026-2034. Our report has categorized the market based on type, application, and structural design.

Type Insights:

- Wood

- Plastic

- Metal

- Corrugated Paper

The report has provided a detailed breakup and analysis of the market based on the type. This includes wood, plastic, metal, and corrugated paper.

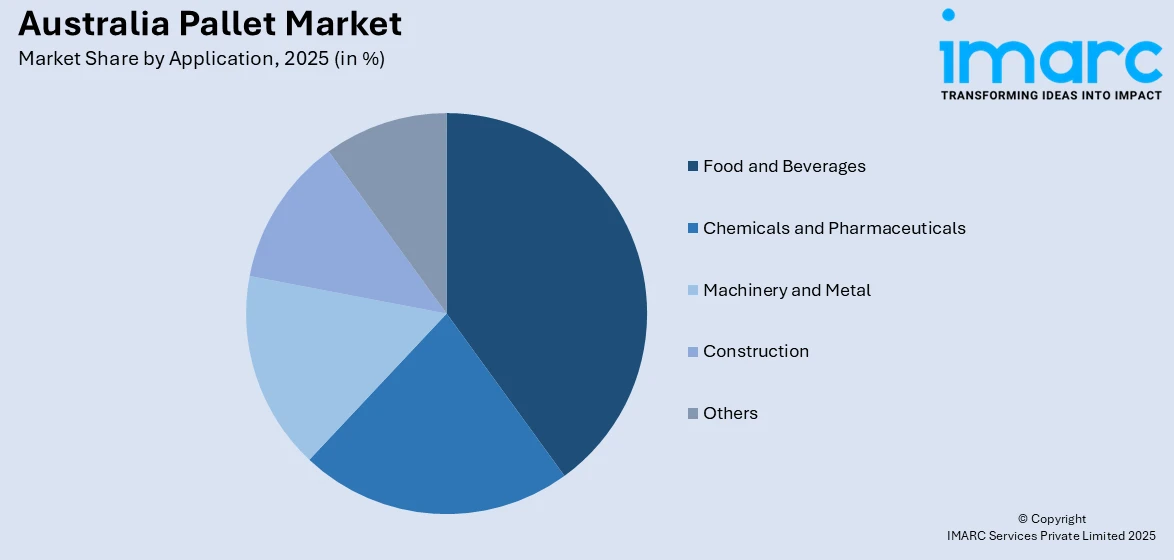

Application Insights:

Access the comprehensive market breakdown Request Sample

- Food and Beverages

- Chemicals and Pharmaceuticals

- Machinery and Metal

- Construction

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes food and beverages, chemicals, and pharmaceuticals, machinery and metal, construction, and others.

Structural Design Insights:

- Block

- Stringer

- Others

The report has provided a detailed breakup and analysis of the market based on the structural design. This includes block, stringer, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Pallet Market News:

- In October 2024, CMTP acquired Palletmasters, a strategic move that expanded its market presence and diversified its product offerings, thereby enhancing its competitive edge in the Australian pallet industry.

- In August 2024, FedEx implemented Dynamic Drive-through Pallet Dimensioning Systems across its Australian operations, enhancing processing efficiency and accuracy, which supports the growing e-commerce sector and boosts overall market growth.

Australia Pallet Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Wood, Plastic, Metal, Corrugated Paper |

| Applications Covered | Food and Beverages, Chemicals and Pharmaceuticals, Machinery and Metal, Construction, Others |

| Structural Designs Covered | Block, Stringer, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia pallet market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia pallet market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia pallet industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pallet market in Australia was valued at USD 1,373.4 Million in 2025.

The Australia pallet market is projected to exhibit a compound annual growth rate (CAGR) of 3.87% during 2026-2034.

The Australia pallet market is expected to reach a value of USD 1,953.0 Million by 2034.

Sustainability and innovation are shaping the Australia pallet market, with rising adoption of recyclable and lightweight materials. Increasing automation in warehouses and the integration of pallets with tracking technologies also stand out as trends, improving supply chain visibility and operational efficiency across industries.

Expanding e-commerce, agricultural exports, and manufacturing activity are major growth drivers. Strong logistics infrastructure, combined with growing focus on standardized handling and transport, is fueling demand. Rising trade activities and businesses’ need for cost-effective, durable pallets are pushing Australia pallet market growth steadily forward.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)