Australia Paper Chemicals Market Size, Share, Trends and Forecast by Type, Form, and Region, 2025-2033

Australia Paper Chemicals Market Growth Overview:

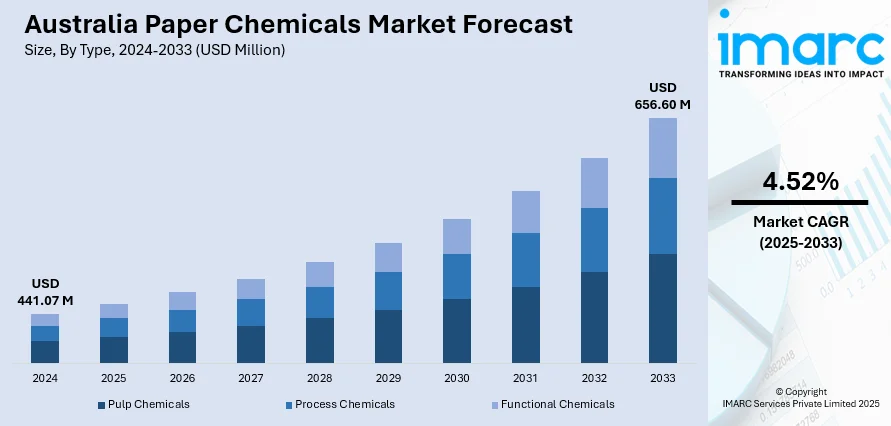

The Australia paper chemicals market size reached USD 441.07 Million in 2024. Looking forward, the market is expected to reach USD 656.60 Million by 2033, exhibiting a growth rate (CAGR) of 4.52% during 2025-2033. The market is driven by increasing demand from the construction, automotive, and agriculture sectors, all of which rely heavily on specialty and commodity paper chemicals. Along with this, government initiatives supporting sustainable packaging and recycling are accelerating the adoption of eco-friendly additives. Additionally, domestic manufacturing growth and rising exports of pulp and paper products are reinforcing the need for consistent chemical supply and innovations, further augmenting the Australia paper chemicals market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 441.07 Million |

| Market Forecast in 2033 | USD 656.60 Million |

| Market Growth Rate 2025-2033 | 4.52% |

Key Trends of Australia Paper Chemicals Market:

Shift Toward Sustainable and Bio-Based Chemicals

The market is seeing a decisive movement toward sustainable and bio-based alternatives, primarily in response to regulatory pressures and environmental expectations from both industry stakeholders and end consumers. Traditional paper chemicals, particularly those derived from petrochemicals, are being phased out or minimized in favor of biodegradable and non-toxic substitutes. This is especially evident in the adoption of bio-based sizing agents, starch-derived surface treatments, and natural binders that reduce ecological harm and improve recyclability. Pulp and paper manufacturers are revisiting formulations to ensure compliance with Australian Packaging Covenant Organisation (APCO) guidelines and broader emissions goals under the country’s national sustainability strategy. Moreover, research institutions and industry partnerships are driving localized innovation, enabling substitutes to match the performance of conventional agents without sacrificing productivity or printability. There is also increased investment in enzymes and other biotech-derived inputs, which not only enhance paper properties but reduce energy and water consumption in the production process. These developments are positively impacting the Australia paper chemicals market growth.

To get more information on this market, Request Sample

Growing Demand for Functional Paper Products Across End-Use Sectors

There is a rise in demand for functional paper products that require advanced chemical formulations. This includes grease-resistant wrappers, moisture-barrier packaging, antimicrobial tissues, and ink-receptive printing grades. As industries such as food service, e-commerce, and healthcare evolve, they are placing more stringent requirements on the physical and chemical properties of paper substrates. Chemical suppliers are responding by tailoring their offerings, developing fluorine-free barrier coatings, improving wet-strength resins for hygienic applications, and optimizing pigments for enhanced print contrast and durability. In particular, the food packaging segment is driving innovation in barrier chemistry, with increasing scrutiny around food-contact safety and recyclability. Meanwhile, logistics firms are demanding higher tear resistance and surface stability in e-commerce mailers. The resulting market environment favors suppliers with application-specific knowledge, localized technical support, and the ability to rapidly prototype new formulations in response to shifting end-user expectations.

Increasing Integration of Process Automation and Chemical Dosing System

Automation is increasingly influencing the way paper chemicals are applied in Australian mills. Advanced dosing systems, integrated with real-time monitoring tools, are now standard in modern facilities. These technologies ensure precision in chemical use, improving product consistency, reducing waste, and supporting cost optimization. Automated systems adjust chemical input based on process variables such as pH, temperature, retention levels, and fiber composition, significantly minimizing overuse or underdosing. This trend is gaining momentum due to labor shortages, operational efficiency demands, and the rising cost of raw materials. Along with this, Australian paper manufacturers, particularly those producing high-grade packaging or specialty paper, are investing in digital control systems that allow centralized management of multiple chemical inputs across stages like pulping, sizing, and coating. These integrations also support predictive maintenance, reducing unplanned downtime and extending equipment life. The convergence of chemical supply and operational intelligence is shifting the competitive landscape, pushing local suppliers to adapt quickly or risk obsolescence.

Growth Factors of the Australia Paper Chemicals Market:

Expansion of Packaging and Corrugated Paper Industries

Australia’s packaging sector is expanding rapidly, driven by strong growth in e-commerce, food delivery services, and retail logistics. As companies move toward eco-friendly alternatives to plastic, demand for paper-based packaging, particularly corrugated and flexible formats, is rising significantly. These products require high-performance paper chemicals, including strength enhancers, barrier coatings, and sizing agents, to meet durability, moisture resistance, and printability standards. The shift to sustainable packaging solutions is also prompting innovations in biodegradable and food-safe chemical treatments. This transformation in the packaging landscape is fueling higher consumption of paper chemicals, especially in large-scale production facilities. As both domestic brands and exporters seek packaging that balances functionality and environmental responsibility, the role of specialty paper chemicals becomes increasingly critical in ensuring competitive, high-quality packaging solutions.

Rising Paper Recycling and Reprocessing Activities

Australia’s commitment to sustainable resource use and waste reduction is leading to a notable increase in recycled paper production in the country, which is driving the Australia paper chemicals market demand. The use of recycled fibers, however, presents several challenges, such as reduced strength, poor brightness, and residual ink content, all of which require chemical treatment for improvement. To address these issues, paper mills are investing in advanced deinking agents, flocculants, and retention aids to improve fiber quality and process efficiency. As recycling processes become more advanced, the need for high-performance paper chemicals continues to grow. This creates a stable demand stream for chemical suppliers while supporting Australia’s broader circular economy goals. The consistent use of recycled content in packaging, newsprint, and printing paper ensures the paper chemicals market remains active across both virgin and recycled production lines.

Growth of the Education and Office Stationery Segment

Despite the increasing digitization of communication and learning, Australia’s education sector and office supply industry continue to rely heavily on high-quality paper products. Schools, universities, and government offices require large volumes of paper for books, exam materials, administrative documentation, and printed resources. To meet the high expectations for visual quality and performance, manufacturers depend on paper chemicals like optical brighteners, surface sizing agents, and pigments. These additives improve attributes such as print clarity, brightness, smoothness, and durability. Additionally, Australia’s export of educational materials, including textbooks and exam papers, further drives demand for top-grade paper. This sustained requirement for well-finished and reliable paper products keeps the stationery segment a stable consumer of paper chemicals, supporting market growth through consistent institutional and commercial demand.

Opportunities in the Australia Paper Chemicals Market

Development of Specialty Grades for Food Contact and Medical Use

As consumer awareness around hygiene and safety continues to grow, demand for specialized paper products in the food and healthcare sectors is rising significantly. These applications require highly engineered paper enhanced with chemical treatments for grease resistance, moisture barriers, and antimicrobial performance. In food packaging, for instance, paper must meet strict safety and durability requirements, while in healthcare, products such as surgical wraps, paper-based diagnostic tools, and disposable trays require both sterility and structural strength. This trend creates a strong opportunity for chemical manufacturers to innovate in developing formulations that meet increasingly rigorous regulatory standards. By focusing on safe, compliant, and high-performance additives, suppliers can access niche, high-margin market segments within Australia’s evolving paper chemicals landscape.

Rising Export Potential in the Asia-Pacific Region

Australia is strategically positioned to serve fast-growing Asia-Pacific economies with quality paper products that integrate performance-enhancing chemicals. Countries like Vietnam, the Philippines, and Indonesia are expanding their packaging and printing sectors, but often lack consistent access to premium paper grades. Australian manufacturers, known for quality and sustainability, are well placed to fill this gap. By incorporating specialty chemicals, such as strength additives, coating agents, and optical brighteners, into export-grade paper, producers can offer differentiated solutions that meet the quality standards of international clients. According to the Australia paper chemicals market demand, this export-oriented approach also creates strong demand for local chemical suppliers. As trade in paper products continues to rise in the region, Australia’s paper chemicals market stands to benefit significantly from increased cross-border collaboration and supply chain integration.

Digital Printing and High-Speed Press Compatibility

The growing use of digital and high-speed printing presses across Australia and globally has led to increased demand for paper that performs reliably under these conditions. Traditional paper may not offer adequate ink absorption, surface durability, or drying speed for modern printing needs. This shift opens opportunities for chemical suppliers to formulate specialized coatings and additives that enhance print clarity, color retention, and runnability on advanced press systems. The trend is especially pronounced in packaging, promotional, and short-run custom printing segments, where high-quality results are essential. As more businesses invest in variable data and on-demand print solutions, the need for compatible paper substrates grows. This drives innovation in the paper chemicals space, positioning suppliers as key enablers of print-grade performance improvements.

Australia Paper Chemicals Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and form.

Type Insights:

- Pulp Chemicals

- Process Chemicals

- Functional Chemicals

The report has provided a detailed breakup and analysis of the market based on the type. This includes pulp chemicals, process chemicals, and functional chemicals.

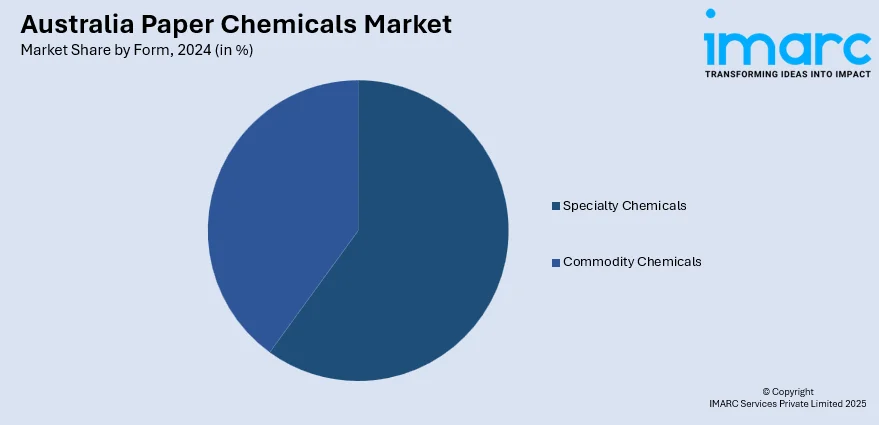

Form Insights:

- Specialty Chemicals

- Commodity Chemicals

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes specialty chemicals and commodity chemicals.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Paper Chemicals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Pulp Chemicals, Process Chemicals, Functional Chemicals |

| Forms Covered | Specialty Chemicals, Commodity Chemicals |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia paper chemicals market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia paper chemicals market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia paper chemicals industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The paper chemicals market in Australia was valued at USD 441.07 Million in 2024.

The Australia paper chemicals market is projected to exhibit a CAGR of 4.52% during 2025-2033.

The Australia paper chemicals market is projected to reach a value of USD 656.60 Million by 2033.

Key trends in the Australia paper chemicals market include increasing demand for eco-friendly and biodegradable additives, a shift toward sustainable paper production, and rising adoption of performance-enhancing chemicals. Technological advancements in specialty chemicals and growing recycling practices are also shaping the market’s evolution toward greener, more efficient manufacturing processes.

The Australia paper chemicals market is growing due to the rising need for sustainable and recyclable paper products, especially in the packaging and hygiene sectors. Increased paper recycling, advancements in eco-friendly chemical formulations, and expanding e-commerce activities are also fueling demand for high-performance, application-specific paper chemical solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)