Australia Paper Packaging Products Market Size, Share, Trends and Forecast by Product Type, Material Type, End-Use Industry, and Region, 2025-2033

Australia Paper Packaging Products Market Overview:

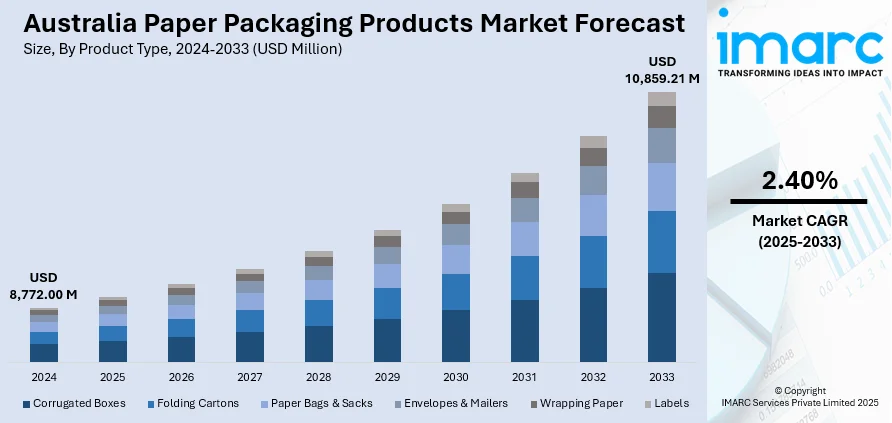

The Australia paper packaging products market size reached USD 8,772.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 10,859.21 Million by 2033, exhibiting a growth rate (CAGR) of 2.40% during 2025-2033. The market is primarily driven by stringent environmental regulations promoting sustainable alternatives to plastic, alongside the rapid progress of e-commerce, which demands lightweight, recyclable, and durable packaging solutions to support efficient logistics, reduce carbon footprints, and meet rising consumer expectations for eco-friendly and functional packaging.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 8,772.00 Million |

| Market Forecast in 2033 | USD 10,859.21 Million |

| Market Growth Rate 2025-2033 | 2.40% |

Australia Paper Packaging Products Market Trends:

Rising Environmental Regulations and Consumer Demand for Sustainable Packaging

One of the strongest drivers for expansion in Australia's paper packaging products market is the country's increasing environmental regulations and the broader cultural shift towards sustainability. Australia has been gradually moving towards eliminating single-use plastics under both state and federal policy. For instance, major states such as New South Wales, Queensland, and Western Australia have enacted legislation restricting various plastic packaging products, such as plastic bags, straws, and polystyrene containers. Such regulatory changes have created a legislative gap that sustainable alternatives, such as paper packaging, have rapidly bridged. Additionally, environmentally conscious Australian consumers are becoming increasingly aware of their environmental impact. An increasing number of Australian consumers are opting for sustainable packaging and even are even prepared to pay extra for eco-friendly alternatives. This demand has led retailers, manufacturers, and food service operators to rethink their packaging strategies. Retailers such as Coles and Woolworths have already moved a considerable proportion of their product range to recyclable or compostable paper packaging, which affects supply chain dynamics.

To get more information on this market, Request Sample

Growth of E-commerce and Last-Mile Delivery Networks

Another driver of the Australian paper packaging products market is the substantial growth of the e-commerce industry. Online shopping in Australia has experienced exponential growth, particularly since the COVID-19 pandemic, which significantly altered consumer buying habits. This surge in online shopping has fueled the need for protective, long-lasting, and affordable packaging materials that are also lightweight, thereby minimizing transportation costs. Paper packaging items, such as corrugated boxes, mailers, and paper fillers, have become the preferred option among e-retailers. They offer the protective strength needed to safeguard products but are more eco-friendly than plastic or Styrofoam materials. Furthermore, the expanding last-mile delivery segment, ranging from logistics operators to gig economy couriers to automated fulfillment warehouses, has also led to a rise in demand for optimized packaging.

Australia Paper Packaging Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on product type, material type, and end-use industry.

Product Type Insights:

- Corrugated Boxes

- Folding Cartons

- Paper Bags & Sacks

- Envelopes & Mailers

- Wrapping Paper

- Labels

The report has provided a detailed breakup and analysis of the market based on the product type. This includes corrugated boxes, folding cartons, paper bags & sacks, envelopes & mailers, wrapping paper, and labels.

Material Type Insights:

- Virgin Paper

- Recycled Paper

- Kraft Paper

- Coated Paper

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes virgin paper, recycled paper, kraft paper, and coated paper.

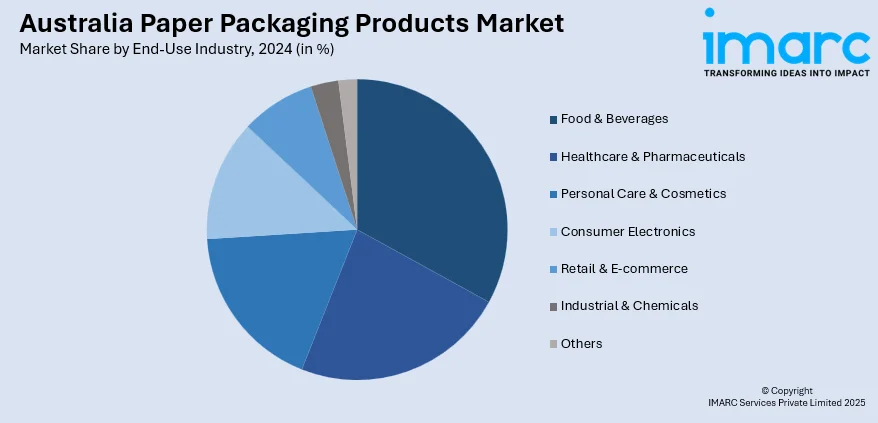

End-Use Industry Insights:

- Food & Beverages

- Healthcare & Pharmaceuticals

- Personal Care & Cosmetics

- Consumer Electronics

- Retail & E-commerce

- Industrial & Chemicals

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use industry. This includes food & beverages, healthcare & pharmaceuticals, personal care & cosmetics, consumer electronics, retail & e-commerce, industrial & chemicals, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Paper Packaging Products Market News:

- July 2024: Coles partnered with VektroPack to introduce kerbside-recyclable, paper-based packaging for its Bake & Create and Simply baking chocolate ranges. The new High Barrier Paper Flex film offers performance comparable to traditional plastic films, including moisture and oxygen resistance, and has been independently verified for recyclability by Opal.

- March 2023: Mars Wrigley Australia introduced recyclable paper-based packaging for its Mars, Snickers, and Milky Way bars, marking a significant shift from plastic to sustainable materials. Developed with Amcor's AmFiber Performance Paper, the new wrappers are made from FSC-certified paper and are curbside recyclable in Australia. This initiative aims to eliminate over 360 tons of plastic annually.

Australia Paper Packaging Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Corrugated Boxes, Folding Cartons, Paper Bags & Sacks, Envelopes & Mailers, Wrapping Paper, Labels |

| Material Types Covered | Virgin Paper, Recycled Paper, Kraft Paper, Coated Paper |

| End-Use Industries Covered | Food & Beverages, Healthcare & Pharmaceuticals, Personal Care & Cosmetics, Consumer Electronics, Retail & E-commerce, Industrial & Chemicals, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia paper packaging products market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia paper packaging products market on the basis of product type?

- What is the breakup of the Australia paper packaging products market on the basis of material type?

- What is the breakup of the Australia paper packaging products market on the basis of end-use industry?

- What is the breakup of the Australia paper packaging products market on the basis of region?

- What are the various stages in the value chain of the Australia paper packaging products market?

- What are the key driving factors and challenges in the Australia paper packaging products market?

- What is the structure of the Australia paper packaging products market and who are the key players?

- What is the degree of competition in the Australia paper packaging products market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia paper packaging products market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia paper packaging products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia paper packaging products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)