Australia Particle Board Market Size, Share, Trends and Forecast by Application, Sector, and Region, 2025-2033

Australia Particle Board Market Overview:

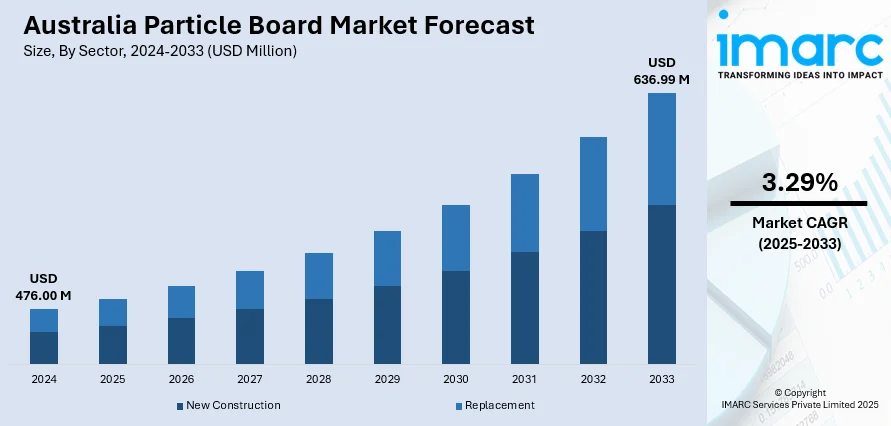

The Australia particle board market size reached USD 476.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 636.99 Million by 2033, exhibiting a growth rate (CAGR) of 3.29% during 2025-2033. The market is driven by rising residential construction, increased demand for cost-effective furniture solutions, and government emphasis on sustainable materials. Technological advancements in manufacturing and expanding renovation activities further contribute to the expansion of the Australia particle board market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 476.00 Million |

| Market Forecast in 2033 | USD 636.99 Million |

| Market Growth Rate 2025-2033 | 3.29% |

Australia Particle Board Market Trends:

Rising Demand for Sustainable Construction Materials

The trend toward eco-friendly construction practices is significantly driving the Australia particle board market development. Contractors and developers increasingly use recycled wood particle board as a resource-efficient, low-emission material substitute for traditional products. This complies with national sustainability standards and building ratings like Green Star, which promote the use of low-impact materials. Local manufacturers are also modifying production processes to reduce carbon emissions and enhance recyclability. These green changes not only address regulatory requirements but are also attractive to green-conscious consumers, promoting a demand surge in both the residential and commercial markets. With sustainability emerging as the core pillar of the Australian building sector, combining recycled and low-emission particle boards will still define the market trend. The latest manufacturing technologies are propelling the qualitative shift of the Australia particle board market. For instance, in September 2024, the Engineered Wood Products Association of Australasia (EWPAA) unveiled its newly constructed mezzanine office, showcasing the innovative use of renewable engineered wood products (EWPs) supplied by member companies. The interior features a range of EWP applications, including laminated hardwood, Austral Plywood strips, timber framing, and Australian Panels’ particleboard STRUCTAflor.

To get more information on this market, Request Sample

Technological Advancements in Manufacturing

Modern manufacturing innovations are driving the qualitative transformation of the Australia particle board market growth. Automation and digital process controls have enabled manufacturers to produce boards with improved density, moisture resistance, and dimensional stability. Enhanced bonding technologies and precision layering techniques are extending the product's lifecycle and application range. Additionally, the integration of smart monitoring systems into production lines has allowed real-time quality control and energy optimization. These improvements are meeting the evolving expectations of architects and builders for performance-based materials. As manufacturers continue to invest in state-of-the-art production facilities, such advancements are expected to accelerate Australia particle board market growth by enabling premium-grade outputs suitable for high-end residential and commercial interiors. For instance, in February 2024, Australian Panels, a Borg Group company, commissioned Siempelkamp to develop one of the longest MDF press, measuring 8' x 78.6 m, for its Mount Gambier facility. This marks the sixth collaboration between the two companies, reinforcing Australian Panels' exclusive use of Siempelkamp equipment across its wood-based panel production sites in Mount Gambier and Oberon. The new line, designed for heavy-duty applications, will utilize light Pinus Radiata wood and is scheduled for delivery in May 2025, with production commencing in early 2026.

Australia Particle Board Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on application and sector.

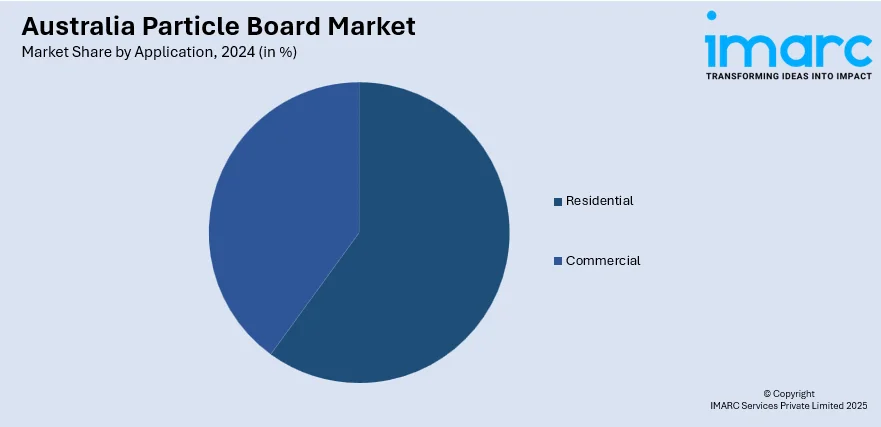

Application Insights:

- Residential

- Commercial

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential and commercial.

Sector Insights:

- New Construction

- Replacement

A detailed breakup and analysis of the market based on the sector have also been provided in the report. This includes new construction and replacement.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Particle Board Market News:

- In April 2025, the Australian Forest Products Association (AFPA) welcomed the Federal Labor Government’s new ‘ReMade in Australia’ brand as a strong step towards highlighting the forest sector’s recycling leadership. With manufacturers already using significant recycled materials in products like particleboard and composite decking, the initiative aligns with AFPA’s vision to boost sustainable, locally made timber and fibre products. The move supports national capability and promotes innovative recycling, reinforcing the sector’s key role in climate-positive practices.

- In April 2025, Laminex Australia took over the former Carter Holt Harvey particleboard plant in Gympie, securing 42 local jobs and expanding its Southeast Queensland manufacturing footprint. Now operating as the Gympie Monkland site, it will produce particleboard flooring to meet rising demand. The move supports regional economic growth and sustainable timber processing, backed by Queensland Government support.

Australia Particle Board Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Residential, Commercial |

| Sectors Covered | New Construction, Replacement |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia particle board market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia particle board market on the basis of application?

- What is the breakup of the Australia particle board market on the basis of sector?

- What is the breakup of the Australia particle board market on the basis of region?

- What are the various stages in the value chain of the Australia particle board market?

- What are the key driving factors and challenges in the Australia particle board market?

- What is the structure of the Australia particle board market and who are the key players?

- What is the degree of competition in the Australia particle board market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia particle board market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia particle board market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia particle board industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)