Australia Pasta Market Size, Share, Trends and Forecast by Product Type, Raw Material, Distribution Channel, and Region, 2025-2033

Australia Pasta Market Overview:

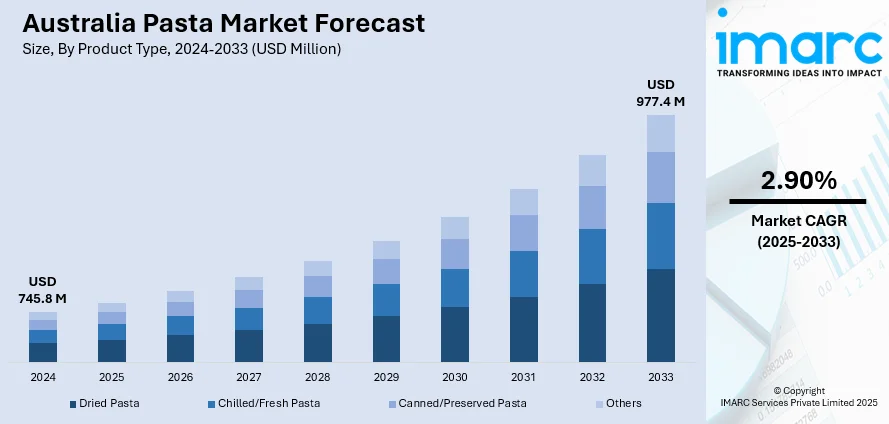

The Australia pasta market size reached USD 745.8 Million in 2024. Looking forward, the market is projected to reach USD 977.4 Million by 2033, exhibiting a growth rate (CAGR) of 2.90% during 2025-2033. The market is growing steadily, driven by rising demand for diverse noodle types, premium products, and convenient meal options. Cultural influences, online retail expansion, and interest in specialty and health-focused pasta varieties are shaping consumer choices and encouraging product innovation across the category.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 745.8 Million |

| Market Forecast in 2033 | USD 977.4 Million |

| Market Growth Rate 2025-2033 | 2.90% |

Key Trends of Australia Pasta Market:

Rising Demand for Regional Varieties

Australia’s pasta market is witnessing a growing appetite for culturally diverse and region-specific noodle dishes. As consumer preferences evolve beyond traditional wheat-based pasta, there is rising interest in rice noodles and other specialty offerings influenced by Asian cuisines. This trend is driven by both the multicultural demographic makeup of urban centers and a broader acceptance of global food experiences in mainstream dining. Restaurants and food brands are responding by introducing products that cater to this shift in palate, blending authenticity with modern presentation. In November 2024, Tam Jai International launched its first Australian franchised restaurant, “TamJai Mixian,” in Melbourne. The debut introduced Hong Kong-style mixian rice noodles to the local market, offering diners a distinctive noodle experience rooted in Yunnan cuisine. The restaurant’s focus on customizable spice levels and flavor profiles added an interactive element, making it popular among younger, adventurous consumers. Such developments reflect the market’s openness to alternative pasta formats and show how global culinary trends are shaping domestic consumption. The integration of Asian noodles into Australia’s broader pasta category signals strong potential for category expansion through innovation, authenticity, and experiential dining formats that connect with diverse consumer segments.

To get more information on this market, Request Sample

Tech-Driven Expansion of Premium Access

Convenience and efficiency are playing a major role in the evolution of Australia’s pasta market, especially as online grocery platforms become more sophisticated. Consumers now expect broader product choices, fresher inventory, and faster delivery when shopping for food essentials, including pasta. This shift is pushing major retailers to enhance their digital and logistics infrastructure to meet rising service expectations. It is also enabling smaller brands and premium producers to reach wider audiences through curated online offerings. In September 2024, Coles launched its first automated Customer Fulfilment Centre (CFC) in Truganina, Melbourne. The center introduced Australian-first technologies and AI systems to streamline order processing and deliveries. Notably, the CFC featured a range of specialty items, including artisan products from Lello Pasta. By integrating premium pasta into its expanded online range, Coles improved access to high-quality offerings that were previously limited to select retailers or foodservice channels. This advancement supports the growth of premium pasta consumption by increasing availability across larger geographic regions. It also demonstrates how technology-driven retail infrastructure can positively influence product visibility, reduce supply chain barriers, and encourage consumers to explore higher-end pasta alternatives from the comfort of their homes.

Health-Focused Pasta Options Driving Demand

The growing health and wellness consciousness is deeply impacting consumer behavior in the Australian pasta segment. More consumers are moving away from conventional refined pasta to healthier options, such as whole grain, gluten-free, and high-protein pasta. These options are attracting those with dietary restrictions, fitness goals, or just healthy meal habits. Pasta made from quinoa, brown rice, and legumes is gaining traction because of its increased fiber and protein content. Furthermore, health-aware consumers are increasingly adding protein-enriched pasta to their diets. The increased availability of these items through supermarkets, specialist health stores, and online shopping is increasing consumer exposure and encouraging experimentation with healthier foods. This shift in preferences serves as a crucial factor impacting Australia pasta market share.

Growth Drivers of Australia Pasta Market:

Cultural Diversity in Food Habits

Australia’s multicultural landscape has significantly influenced food consumption trends making pasta a staple in numerous households. The strong footprint of Italian cuisine alongside the integration of global flavors has inspired consumers to try various pasta types and recipes. Beyond classic Italian preparations pasta is being reimagined within different culinary traditions catering to a broad audience. Both restaurants and home cooks are opting for high-quality and gourmet pasta indicative of shifting taste trends. The cultural acceptance of international foods also fosters a desire for healthier and more innovative pasta options such as organic and plant-based varieties. This phenomenon underscores how cultural diversity is consistently driving Australia pasta market demand positioning it as a crucial factor for long-term consumption.

Convenience and Busy Lifestyles

The rapid pace of life in Australia is significantly increasing the need for convenient meal solutions, with pasta becoming a favored option. Quick-cooking and ready-to-eat pasta products resonate with working professionals, students, and busy families looking for efficient meal options that do not sacrifice flavor. Packaged pasta dishes, instant pasta cups, and frozen varieties provide both convenience and cost-effectiveness, aligning well with contemporary consumer preferences. Furthermore, innovations in packaging and serving sizes are improving product availability, especially for those consuming on the move. The growing preference for convenience-focused foods is expected to remain a key driver of Australia pasta market growth in the years ahead.

Expansion of Retail and E-Commerce

The extensive distribution of pasta through supermarkets, specialty shops, and online platforms has greatly improved accessibility for Australian consumers. Major retailers are expanding their pasta selections, offering a blend of mainstream, gourmet, and health-oriented products. Simultaneously, e-commerce is becoming more popular, enabling consumers to explore a wide range of pasta brands and types from the comfort of their homes. Subscription services and online-exclusive promotions are further expanding product availability and encouraging repeat purchases. This expansion in distribution supports established brands and opens doors for niche and artisanal pasta makers to reach larger markets. According to Australia pasta market analysis, the synergy of traditional and digital retail channels is crucial in shaping the overall industry landscape.

Australia Pasta Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, raw material, and distribution channel.

Breakup by Product Type:

- Dried Pasta

- Chilled/Fresh Pasta

- Canned/Preserved Pasta

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes dried pasta, chilled/fresh pasta, canned/preserved pasta, and others.

Breakup by Raw Material:

- Durum Wheat Semolina

- Wheat

- Mix

- Barley

- Rice

- Maize

- Others

A detailed breakup and analysis of the market based on the raw material have also been provided in the report. This includes durum wheat semolina, wheat, mix, barley, rice, maize, and others.

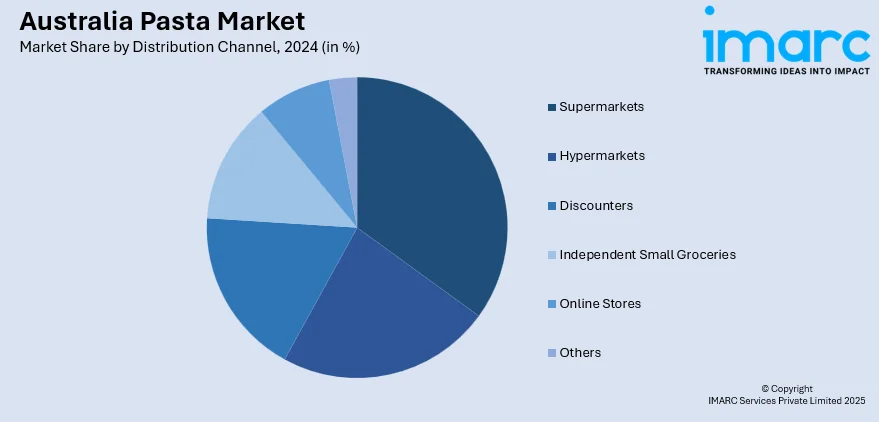

Breakup by Distribution Channel:

- Supermarkets

- Hypermarkets

- Discounters

- Independent Small Groceries

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets, hypermarkets, discounters, independent small groceries, online stores, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Barilla G. e R. F.lli S.p.A.

- F.lli De Cecco di Filippo S.p.A

- Giovanni Rana

- Just Pasta Australia Pty Ltd

- L'Abruzzese

- Pasta Di Porto

- Pastificio Lucio Garofalo S.p.A

- Pastificio Sandro

- Roma Food Products

- San Remo

- Vetta

Australia Pasta Market News:

- April 2025: Australian research by the George Institute highlighted that switching from creamy to tomato-based pasta sauces could cut household emissions by 270kg CO2 annually. This insight influenced consumer preferences, encouraging demand for lighter, sustainable pasta options across Australia's evolving packaged food market.

- February 2025: Barilla launched a limited-edition heart-shaped pasta for Valentine’s Day across Coles stores in Australia and New Zealand. Priced at USD 4.90, the product catered to seasonal demand and boosted consumer engagement, reinforcing pasta’s popularity in Australia’s evolving specialty food segment.

Australia Pasta Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Dried Pasta, Chilled/Fresh Pasta, Canned/Preserved Pasta, Others |

| Raw Materials Covered | Durum Wheat Semolina, Wheat, Mix, Barley, Rice, Maize, Others |

| Distribution Channels Covered | Supermarkets, Hypermarkets, Discounters, Independent Small Groceries, Online Stores, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Barilla G. e R. F.lli S.p.A., F.lli De Cecco di Filippo S.p.A, Giovanni Rana, Just Pasta Australia Pty Ltd, L'Abruzzese, Pasta Di Porto, Pastificio Lucio Garofalo S.p.A, Pastificio Sandro, Roma Food Products, San Remo, Vetta, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia pasta market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia pasta market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia pasta industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pasta market in Australia was valued at USD 745.8 Million in 2024.

The Australia pasta market is projected to exhibit a compound annual growth rate (CAGR) of 2.90% during 2025-2033.

The Australia pasta market is expected to reach a value of USD 977.4 Million by 2033.

The Australia pasta market is witnessing trends such as rising demand for organic and non-GMO products, growing popularity of gourmet pasta with unique textures and flavors, and increasing influence of plant-based diets. Sustainability-driven packaging and locally sourced ingredients are also shaping evolving consumer preferences.

Market growth is driven by increasing disposable incomes, rising popularity of premium food experiences, and greater exposure to global cuisines through travel and media. Expanding foodservice outlets, coupled with innovations in frozen and chilled pasta categories, are further fueling consumer interest and boosting overall market expansion in Australia.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)