Australia Pathology Lab Services Market Size, Share, Trends and Forecast by Type, Testing Service, End Use, and Region, 2025-2033

Australia Pathology Lab Services Market Overview:

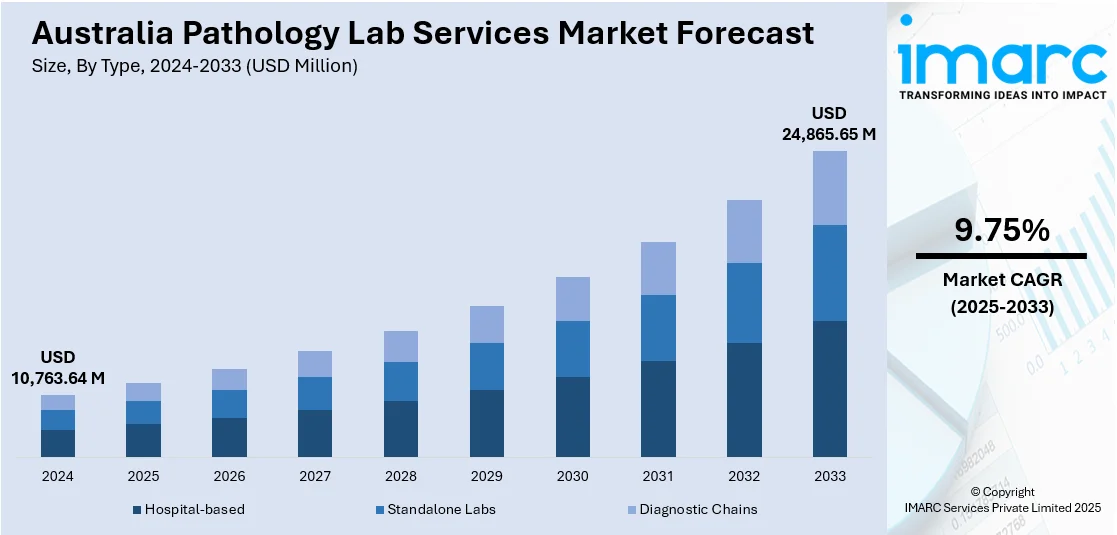

The Australia pathology lab services market size reached USD 10,763.64 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 24,865.65 Million by 2033, exhibiting a growth rate (CAGR) of 9.75% during 2025-2033. The market is driven by the growing demand for precision diagnostics, supported by advancements in genomic testing, government-funded rebates, and rising clinician adoption of personalized medicine. Increased investment in AI-driven automation and digital pathology is enhancing operational efficiency, reducing diagnostic errors, and enabling scalable solutions. Strategic collaborations between labs, biotech firms, and research institutions are accelerating innovation, further augmenting the Australia pathology lab services market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10,763.64 Million |

| Market Forecast in 2033 | USD 24,865.65 Million |

| Market Growth Rate 2025-2033 | 9.75% |

Australia Pathology Lab Services Market Trends:

Increasing Demand for Personalized Medicine and Genomic Testing

The market is experiencing significant growth due to the rising demand for personalized medicine and genomic testing. Advances in genetic research and biomarker discovery have enabled labs to offer tailored diagnostic solutions, particularly in oncology, rare diseases, and pharmacogenomics. With the Australian government and private sector investing in precision medicine initiatives, pathology labs are expanding their capabilities in liquid biopsy technologies and next-generation sequencing (NGS). Australia is facing a severe shortage of genomic health workers. It has only two Indigenous genetic counsellors, and no Indigenous clinical geneticists to serve a population in which 51% live in remote communities. Organizations such as SING Australia are working to bridge this gap by advocating for culturally safe research and educating Indigenous individuals in genomic diagnosis. This transition aims to enhance pathology laboratory service equity, especially for the disadvantaged Aboriginal and Torres Strait Islander population that suffer from delayed rare disease diagnosis and inadequate access to clinical genetics. Additionally, increased awareness among patients and clinicians about the benefits of genetic testing for early disease detection and treatment optimization is driving market expansion. The Medicare Benefits Schedule (MBS) has also introduced new rebates for genomic tests, further supporting adoption. As a result, pathology providers are forming strategic partnerships with biotech firms and research institutions to enhance their service offerings, positioning Australia as a leader in precision diagnostics.

To get more information on this market, Request Sample

Digital Transformation and Automation in Pathology Services

The escalating need for efficiency, accuracy, and scalability is also supporting the Australia pathology lab services market growth. The integration of automation, artificial intelligence (AI), and machine learning into laboratory workflows is becoming more prevalent, aimed at decreasing turnaround times and reducing human error. Digital pathology platforms, including whole-slide imaging and cloud-based data management, are improving diagnostic accuracy and enabling remote consultations. The adoption of laboratory information management systems (LIMS) and electronic health records (EHR) integration is streamlining data sharing between labs and healthcare providers. A cross-country survey of 120 Australian community pharmacists reported that 67% experienced usability issues with electronic health records (EHRs), 58% delays, and 42% data inaccuracies within e-prescribing systems. Despite such system deficiencies, 79% acknowledged the removal of illegible prescription issues through e-prescribing, and 40% noticed a reduction in their workload, underlining the operational benefits of digitized health processes. These findings underscore the imperative need for more integrated digital solutions in pharmacy and pathology laboratories to ensure accuracy and efficiency in patient diagnosis and care delivery. Furthermore, the COVID-19 pandemic accelerated the transition to digital solutions, with telehealth and remote testing gaining traction. Major pathology providers are investing in AI-driven diagnostic tools to enhance cancer detection and chronic disease monitoring. As technology continues to transform, Australian pathology labs are expected to further embrace automation, improving cost-efficiency and patient outcomes while maintaining regulatory compliance.

Australia Pathology Lab Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, testing service, and end use.

Type Insights:

- Hospital-based

- Standalone Labs

- Diagnostic Chains

The report has provided a detailed breakup and analysis of the market based on the type. This includes hospital-based, standalone labs, and diagnostic chains.

Testing Service Insights:

- General Physiological and Clinical Tests

- Imaging and Radiology Tests

- Esoteric Tests

- COVID-19 Tests

A detailed breakup and analysis of the market based on the testing service have also been provided in the report. This includes general physiological and clinical tests, imaging and radiology tests, esoteric tests, and COVID-19 tests.

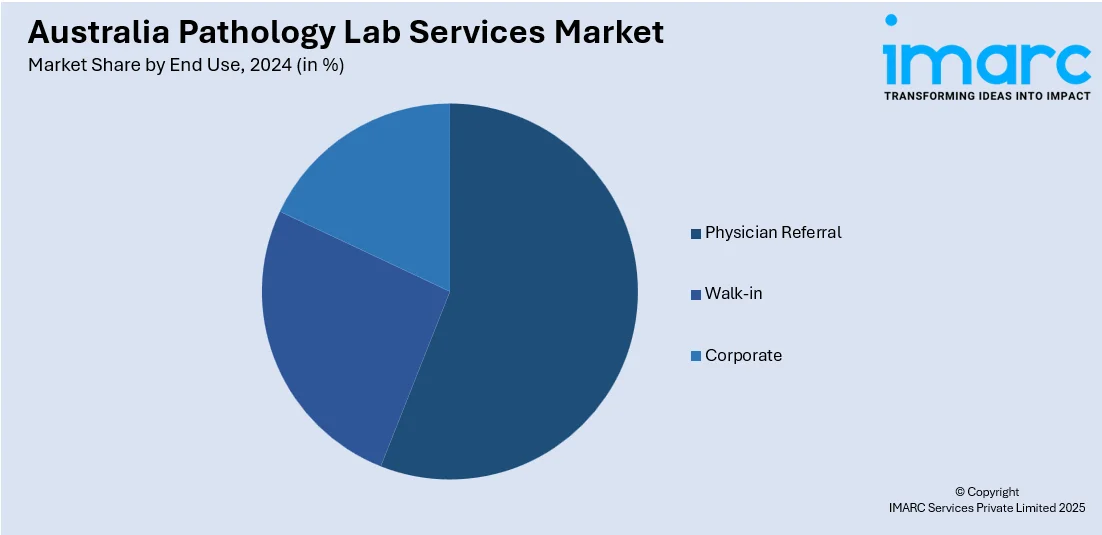

End Use Insights:

- Physician Referral

- Walk-in

- Corporate

The report has provided a detailed breakup and analysis of the market based on the end use. This includes physician referral, walk-in, and corporate.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Pathology Lab Services Market News:

- February 17, 2025: Abacus DX partnered with Inpeco to distribute its FlexLab X and ProTube automation systems across New Zealand and Australia, aiming to enhance traceability and reduce human error in clinical laboratories. With over 2,600 installations globally across 78 countries, Inpeco provides its independent Total Laboratory Automation (TLA) platform to local anatomical and clinical pathology services. This partnership also includes assistance with the upcoming FlexPath™ solution, which aims to streamline histopathology workflows and expedite tissue diagnoses in Australian pathology labs.

- December 01, 2024: Australian Clinical Labs and Geneseq Biosciences launched Melaseq™, a genomic melanoma test with 95% diagnostic accuracy utilizing microRNA profiling on routine biopsy tissue. With over 1.5 million skin biopsies and 17,000 invasive melanoma cases annually in Australia alone, Melaseq enables earlier and precise detection of malignancies within routine pathology laboratory workflows. The assay seamlessly aligns with existing histopathology practices and will be extended to liquid biopsy applications, transforming melanoma diagnosis in Australian clinical laboratories.

Australia Pathology Lab Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Hospital-based, Standalone Labs, Diagnostic Chains |

| Testing Services Covered | General Physiological and Clinical Tests, Imaging and Radiology Tests, Esoteric Tests, COVID-19 Tests |

| End Uses Covered | Physician Referral, Walk-in, Corporate |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia pathology lab services market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia pathology lab services market on the basis of type?

- What is the breakup of the Australia pathology lab services market on the basis of testing service?

- What is the breakup of the Australia pathology lab services market on the basis of end use?

- What is the breakup of the Australia pathology lab services market on the basis of region?

- What are the various stages in the value chain of the Australia pathology lab services market?

- What are the key driving factors and challenges in the Australia pathology lab services market?

- What is the structure of the Australia pathology lab services market and who are the key players?

- What is the degree of competition in the Australia pathology lab services market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia pathology lab services market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia pathology lab services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia pathology lab services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)