Australia Patient Handling Equipment Market Size, Share, Trends and Forecast by Product, Type of Care, End User, and Region, 2026-2034

Australia Patient Handling Equipment Market Summary:

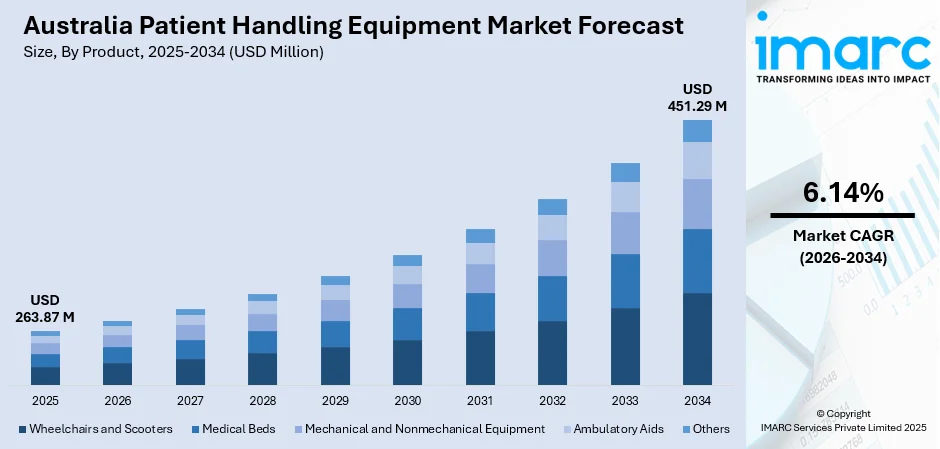

The Australia patient handling equipment market size was valued at USD 263.87 Million in 2025 and is projected to reach USD 451.29 Million by 2034, growing at a compound annual growth rate of 6.14% from 2026-2034.

The Australia patient handling equipment market is experiencing robust expansion driven by an aging population, requiring specialized mobility assistance and care solutions. The increasing focus on safety regulations within healthcare environments, along with public sector funding aimed at upgrading aged-care facilities, is encouraging hospitals and residential centers to expand their acquisition of patient handling equipment. Technological innovations in patient transfer systems and smart mobility aids are reshaping care delivery approaches, while continued awareness of caregiver injury prevention is driving the Australia patient handling equipment market share.

Key Takeaways and Insights:

- By Product: Medical Beds dominate the market with a share of 28% in 2025, driven by extensive demand across acute care hospitals, aged care facilities, and rehabilitation centers requiring specialized patient support systems.

- By Type of Care: Critical Care leads the market with a share of 25% in 2025, reflecting the high-dependency requirements of intensive care units and specialized treatment facilities across Australian healthcare networks.

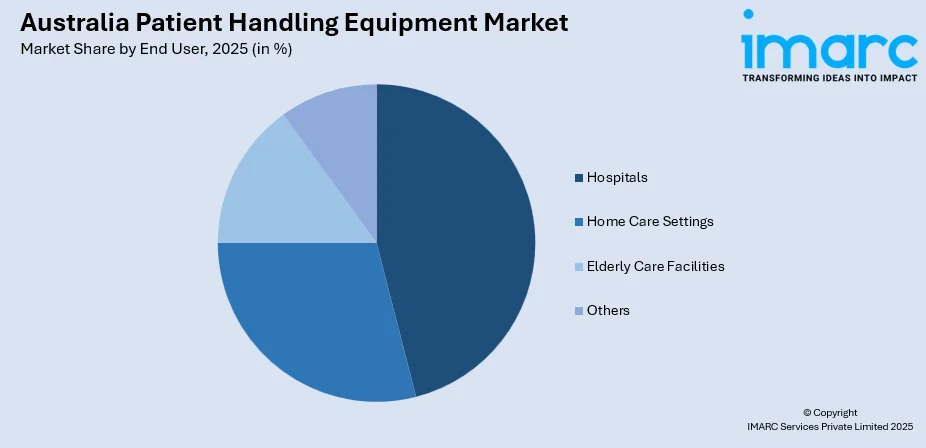

- By End User: Hospitals represent the largest segment with a market share of 46% in 2025, attributed to high patient volumes, frequent transfer requirements, and mandatory compliance with safe patient handling protocols.

- Key Players: The Australia patient handling equipment market exhibits moderate competitive intensity, with multinational medical technology corporations maintaining strong distribution networks. Major players are focused on product innovation, ergonomic design improvements, and strategic partnerships with healthcare providers to strengthen market positioning and expand regional coverage.

To get more information on this market, Request Sample

The Australia patient handling equipment market is advancing as healthcare facilities prioritize safer, more efficient patient mobility solutions amid rising operational demands. Government initiatives supporting aged care modernization, including the 2024-25 Federal Budget allocation of AUD 2.2 billion for aged care reforms, are accelerating equipment procurement cycles. Healthcare facilities are progressively integrating powered lifting devices, intelligent hospital beds, and sophisticated patient transfer technologies to curb musculoskeletal strain among caregivers, a major contributor to compensation claims within the sector. For instance, Safe Work Australia reported that healthcare and social assistance accounted for 19.9% of all serious workers' compensation claims in 2024, underscoring the critical need for advanced patient handling solutions. The integration of IoT-enabled monitoring capabilities and ergonomic design principles is transforming equipment functionality, positioning the market for sustained Australia patient handling equipment market growth through the forecast period.

Australia Patient Handling Equipment Market Trends:

Integration of Smart Technology and IoT-Enabled Solutions

Australian healthcare facilities are increasingly adopting smart hospital beds and IoT-enabled patient handling systems that provide real-time monitoring capabilities and enhanced operational efficiency. These advanced solutions integrate sensors for fall detection, pressure ulcer prevention, and patient positioning alerts, enabling proactive care interventions. For instance, Hill-Rom's Centrella Smart+ bed platform has been deployed across Australian hospitals to help prevent patient falls and pressure injuries while easing caregiver workload. The NSW Smart Sensing Network's Ageing Forum in October 2025 highlighted how wearable technology, artificial intelligence, and smart sensors can transform care delivery under the new Aged Care Act 2024.

Expansion of Specialized Care Facility Infrastructure

The growing emphasis on high-dependency and intensive care facilities is emerging as a significant trend driving patient handling equipment demand. The development of high-end healthcare facilities, along with the addition of dedicated treatment areas and increased bed availability, is amplifying the need for updated patient handling technologies, including lift systems, adjustable beds, and integrated monitoring devices. South Australia's state government announced 150 newly built beds opening in 2024 across multiple hospitals, including the Queen Elizabeth Hospital's AUD 314 million redevelopment and the Flinders Medical Centre's AUD 498 million expansion featuring over AUD 20 million in new major medical equipment.

Rising Adoption of Ergonomic and Automated Transfer Systems

Healthcare providers are transitioning toward automated and ergonomically designed patient transfer equipment to minimize manual handling risks and improve operational workflows. Motorized patient lifts, air-assisted lateral transfer systems, and ceiling-mounted hoist installations are gaining traction as facilities prioritize both patient safety and caregiver protection. In March 2025, the Iris AirShuttle patient transfer platform was recognized at the Women in Innovation Award Showcase for its innovation in improving hospital workflow and reducing staff injuries. This development reflects the market's continued demand for advanced, ergonomic solutions that enable safer and more efficient patient transfers across clinical settings.

Market Outlook 2026-2034:

The Australia patient handling equipment market outlook remains positive as healthcare infrastructure investments accelerate and demographic trends drive sustained demand for mobility assistance solutions. Government commitment to aged care reform, evidenced by the 2025-26 Federal Budget investing AUD 2.6 Billion in the aged care sector, will continue supporting equipment modernization initiatives. The introduction of the Support at Home program and new Assistive Technology and Home Modifications Scheme from November 2025, providing funding up to AUD 15,000 for technologies and equipment, including walkers and wheelchairs, will expand accessibility to patient handling solutions. The market generated a revenue of USD 263.87 Million in 2025 and is projected to reach a revenue of USD 451.29 Million by 2034, growing at a compound annual growth rate of 6.14% from 2026-2034.

Australia Patient Handling Equipment Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product | Medical Beds | 28% |

| Type of Care | Critical Care | 25% |

| End User | Hospitals | 46% |

Product Insights:

- Wheelchairs and Scooters

- Medical Beds

- Mechanical and Nonmechanical Equipment

- Ambulatory Aids

- Others

The medical beds segment dominates with a market share of 28% of the total Australia patient handling equipment market in 2025.

Medical beds represent the largest product segment due to their essential role in acute care hospitals, aged care facilities, and long-term care settings across Australia. The demand encompasses various bed types, including acute care beds, long-term care beds, bariatric beds, and specialty models with advanced positioning and pressure relief capabilities. Australian hospitals recorded approximately 12.1 million hospitalizations in 2022-23, creating substantial ongoing requirements for bed procurement, replacement, and technology upgrades. The segment benefits from regulatory requirements mandating safe patient handling protocols and infection control standards that drive periodic equipment renewal cycles.

Technological advancement is accelerating within the medical beds category, with electric beds featuring remote-controlled operations, integrated monitoring systems, and pressure ulcer prevention capabilities gaining widespread adoption. Healthcare authorities have allocated funding under the National Hospital Infrastructure Plan to replace outdated beds across metropolitan and regional hospitals, supporting the segment's sustained growth trajectory through the forecast period.

Type of Care Insights:

- Bariatric Care

- Fall Prevention

- Critical Care

- Wound Care

- Others

The critical care segment leads the market with a share of 25% of the total Australia patient handling equipment market in 2025.

Critical care applications demand specialized patient handling equipment designed for intensive care units, high-dependency units, and emergency departments where patient acuity levels require sophisticated mobility and transfer solutions. These settings necessitate equipment capable of supporting patients with complex medical conditions, multiple monitoring connections, and limited mobility. The Australian Government funded the establishment of a 14-bed High Dependency Unit at the National Referral Hospital in July 2023, exemplifying the ongoing infrastructure investments driving critical care equipment demand.

The segment's prominence reflects the essential nature of patient handling equipment in critical care environments where frequent repositioning, transfers between diagnostic areas, and emergency mobilization requirements create intensive equipment utilization patterns. Facilities are increasingly investing in advanced lifting systems, specialized transfer devices, and monitoring-integrated beds to enhance patient safety during vulnerable care episodes while protecting clinical staff from handling-related injuries. The integration of smart technology enabling predictive fall detection and automated positioning adjustments is transforming critical care equipment capabilities.

End User Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Hospitals

- Home Care Settings

- Elderly Care Facilities

- Others

The Hospitals segment holds the largest share at 46% of the total Australia patient handling equipment market in 2025.

Hospitals constitute the dominant end-user segment, reflecting their position as primary healthcare delivery centers with the highest patient volumes and most frequent transfer and repositioning requirements. In 2023–24, Australian hospitals managed a high volume of emergency department visits, creating continuous patient movement requirements that drive steady investment in equipment such as hoists, slings, hospital beds, and stretchers.

The hospital segment benefits from substantial government investment in healthcare infrastructure expansion and modernization. The 2024-25 Commonwealth Budget earmarked AUD 1.7 Billion for hospital expansion and equipment modernization across priority states, channeling fresh demand into advanced patient handling solutions. Major hospital redevelopment projects across Australian states, including the Queen Elizabeth Hospital's AUD 314 Million redevelopment in South Australia and Western Australia's AUD 24 Million investment in Joondalup Health Campus to deliver 60 additional beds, are creating significant procurement opportunities for patient handling equipment manufacturers and distributors.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The patient handling equipment market in ACT and New South Wales is driven by the strong presence of advanced healthcare facilities, high patient admission rates, and rapid adoption of safe patient mobility practices. Increasing workplace safety regulations, an ageing population, and investments in hospital infrastructure upgrades are accelerating demand for lifts, transfer aids, and mobility devices. The region’s focus on reducing caregiver injuries further strengthens equipment adoption across public and private hospitals.

In Victoria and Tasmania, rising chronic disease prevalence, growing aged-care populations, and expanding home healthcare services are key growth drivers for patient handling equipment. Government-funded healthcare modernisation programs and emphasis on patient safety are boosting procurement of hoists, slings, and transfer systems. Increasing training initiatives for caregivers and the region’s strong network of rehabilitation centres also contribute to consistent market demand for advanced mobility and lifting solutions.

Queensland’s demand for patient handling equipment is supported by rapid population growth, expanding healthcare infrastructure, and rising hospital admissions across metropolitan and regional areas. The state’s strong aged-care sector and high incidence of mobility-related conditions are prompting greater investment in lifts, beds, and transfer devices. Growing workplace safety standards and increased focus on injury prevention for nurses and caregivers further stimulate adoption of ergonomic patient handling solutions.

In the Northern Territory and South Australia, demand is influenced by the need to support remote healthcare facilities and ageing populations. Expanding regional hospitals, increasing disability-care services, and government initiatives to improve rural healthcare access are driving procurement of essential lifting and transfer equipment. Rising awareness of safe patient handling protocols and the need to reduce manual handling injuries are also contributing to steady market growth in both regions.

Western Australia’s market growth is driven by strong investments in hospital expansions, a rising elderly population, and increasing demand for specialised rehabilitation services. The region’s vast geography encourages greater adoption of advanced patient handling equipment to support remote and rural facilities. Emphasis on improving caregiver safety, alongside growing home-care and assisted-living services, is accelerating demand for hoists, slings, adjustable beds, and related mobility-assistance devices.

Market Dynamics:

Growth Drivers:

Why is the Australia Patient Handling Equipment Market Growing?

Government Investment in Healthcare and Aged Care Infrastructure

Federal and state government commitments to healthcare infrastructure expansion and aged care reform are creating substantial demand for patient handling equipment across Australia. The 2025-26 Federal Budget invested AUD 2.2 billion in the aged care sector to deliver safe, high-quality care, building on the 2024-25 Budget allocation of AUD 2.2 billion for aged care reforms. The AUD 4.3 billion investment in the Support at Home program, commencing in November 2025, will help approximately 1.4 million people stay in their homes by 2035, driving demand for home-based patient handling solutions. State-level hospital expansion projects, including South Australia's commitment to over 600 new hospital beds and Western Australia's healthcare infrastructure investments, are generating significant equipment procurement opportunities across acute care, rehabilitation, and long-term care settings.

Rising Aging Population and Chronic Disease Prevalence

Australia's demographic transition toward an older population is fundamentally driving patient handling equipment demand as mobility limitations and chronic health conditions increase among elderly individuals. Projections indicate that more than 22% of Australians will be aged 65 years and above by 2026, up from 16% in 2020 and approximately double the 8.3% recorded in the early 1970s. The Stroke Foundation reported over 45,785 stroke cases in Australia in 2023, with projections indicating continued increases that will drive demand for specialized mobility assistance and rehabilitation equipment. Rising prevalence of conditions affecting mobility, including obesity, arthritis, and cardiovascular diseases, is creating sustained requirements for wheelchairs, patient lifts, medical beds, and transfer systems across healthcare settings.

Workplace Safety Regulations and Caregiver Injury Prevention Focus

Growing emphasis on healthcare worker safety and injury prevention is accelerating the adoption of mechanical patient handling equipment that reduces manual lifting requirements. Safe Work Australia's Key Work Health and Safety Statistics 2024 revealed that healthcare and social assistance accounted for 19.9% of all serious workers' compensation claims, the highest among all industries. Body stressing injuries, particularly those caused by manual handling tasks, remain the most significant contributor to serious workplace claims in the healthcare sector. Rising concerns over musculoskeletal injuries have prompted hospitals and aged-care facilities to prioritise safer handling practices. As a result, organisations are increasingly adopting mechanical lifting devices, ceiling-mounted hoists, and ergonomic transfer systems to safeguard staff wellbeing and meet occupational health and safety standards.

Market Restraints:

What Challenges the Australia Patient Handling Equipment Market is Facing?

High Capital Investment Requirements

The substantial upfront costs associated with advanced patient handling equipment, particularly ceiling-mounted lift systems and smart hospital beds, present financial barriers for smaller healthcare facilities and aged care providers. Installation expenses for comprehensive lifting infrastructure, combined with ongoing maintenance and staff training requirements, create total cost of ownership considerations that can delay procurement decisions. Budget-constrained regional and rural facilities often face challenges allocating sufficient capital for equipment modernization.

Workforce Training and Adoption Challenges

Effective utilization of patient handling equipment requires comprehensive staff training programs that represent additional operational investments for healthcare providers. Research published in 2024 suggests that current patient handling training approaches may not effectively prevent injuries, indicating a need for refined education methodologies alongside equipment deployment. High staff turnover rates in aged care settings create ongoing training requirements that can affect equipment utilization consistency and return on investment realization.

Infrastructure Limitations in Existing Facilities

Many older healthcare buildings and residential aged care facilities were not designed to accommodate modern patient handling infrastructure such as ceiling-mounted lift systems. Structural modifications required for equipment installation can be expensive and disruptive to ongoing care operations. Space constraints in existing facilities may limit the deployment of floor-based lifts and other equipment requiring adequate maneuvering clearance, creating implementation challenges, particularly in metropolitan facilities with fixed footprints.

Competitive Landscape:

The Australia patient handling equipment market exhibits moderate competitive intensity characterized by the presence of established multinational medical technology corporations alongside specialized regional distributors. Several major players maintain significant market presence through comprehensive product portfolios and established distribution networks. Companies are focusing on product innovation, emphasizing smart technology integration, ergonomic design improvements, and IoT-enabled monitoring capabilities. Strategic partnerships with healthcare providers, group purchasing organizations, and aged care networks are enabling market penetration and customer retention. The competitive landscape is also shaped by regulatory compliance requirements, with the Therapeutic Goods Administration overseeing medical device registrations and ensuring product safety standards.

Recent Developments:

- April 2025: Arjo launched the Maxi Move 5, a next-generation mobile floor lift featuring touch sensor-activated motion assist and advanced positioning capabilities. The device is designed to minimize caregiver effort and enhance patient transfer safety through intuitive controls and improved ergonomic design.

- February 2025: Stryker introduced the ProCeed hospital bed to global markets, offering an ultra-low profile to help minimize fall hazards, improved maneuverability through a central fifth wheel, and customizable headboard options. The bed is designed for durability and ease of use, supporting patient safety and staff efficiency across acute care settings.

- February 2025: Agiliti Health, Inc. launched Essentia, a next-generation hospital bed built to improve patient protection and promote faster mobility. Equipped with sophisticated safety features and user-friendly controls, the bed aims to minimize fall incidents and enhance caregiver productivity across multiple clinical environments.

Australia Patient Handling Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Wheelchairs and Scooters, Medical Beds, Mechanical and Nonmechanical Equipment, Ambulatory Aids, Others |

| Types of Care Covered | Bariatric Care, Fall Prevention, Critical Care, Wound Care, Others |

| End Users Covered | Hospitals, Home Care Settings, Elderly Care Facilities, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia patient handling equipment market size was valued at USD 263.87 Million in 2025.

The Australia patient handling equipment market is expected to grow at a compound annual growth rate of 6.14% from 2026-2034 to reach USD 451.29 Million by 2034.

Medical Beds held the largest product share at 28%, driven by extensive demand across acute care hospitals, aged care facilities, and rehabilitation centers requiring specialized patient support systems with advanced monitoring and positioning capabilities.

Key factors driving the Australia patient handling equipment market include government investment in healthcare and aged care infrastructure, rising aging population requiring mobility assistance, workplace safety regulations promoting mechanical handling solutions, and technological innovations in smart hospital beds and patient transfer systems.

Major challenges include high capital investment requirements for advanced equipment, workforce training and adoption difficulties, infrastructure limitations in existing healthcare facilities, and budget constraints affecting equipment modernization in regional and rural healthcare settings.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)