Australia Pedestal Fan Market Size, Share, Trends and Forecast by Type, Application, Distribution Channel, and Region, 2026-2034

Australia Pedestal Fan Market Summary:

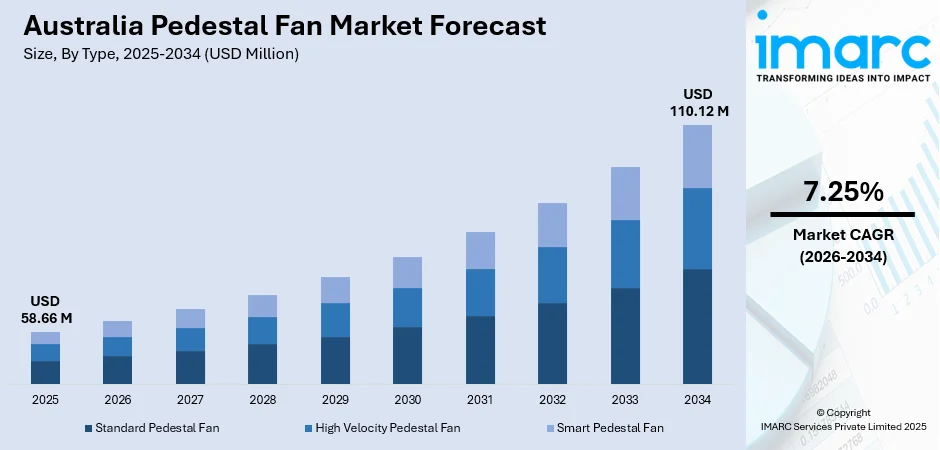

The Australia pedestal fan market size was valued at USD 58.66 Million in 2025 and is projected to reach USD 110.12 Million by 2034, growing at a compound annual growth rate of 7.25% from 2026-2034.

The Australian pedestal fan market is experiencing robust expansion driven by escalating heatwave frequency and intensity across the continent. Rising residential electricity costs are prompting households to seek cost-effective cooling alternatives to air conditioning systems. Increasing urbanization and compact living arrangements in metropolitan areas create strong demand for portable, space-efficient ventilation solutions. Growing consumer awareness regarding energy-efficient appliances and the integration of smart home technologies are further reshaping purchasing preferences in the Australia pedestal fan market share.

Key Takeaways and Insights:

- By Type: Standard pedestal fan dominates the market with a share of 68% in 2025, attributed to its affordability, widespread availability, and proven reliability for everyday residential cooling needs.

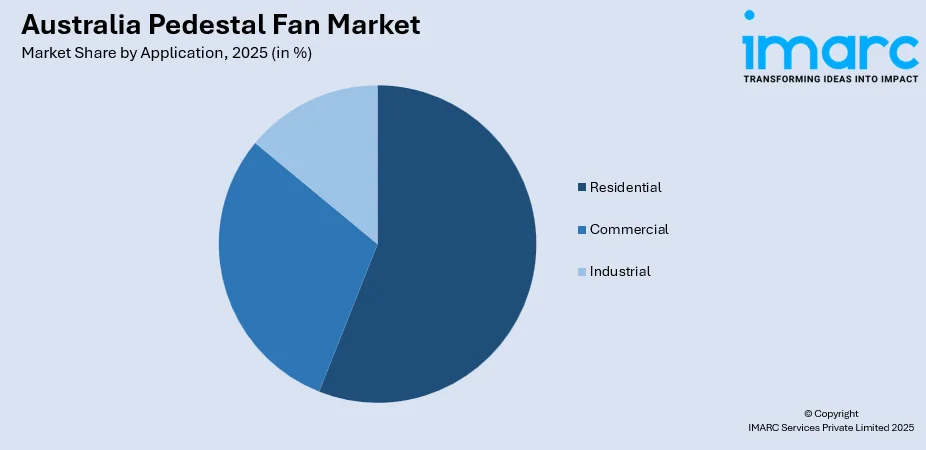

- By Application: Residential segment leads the market with a share of 56% in 2025, driven by increasing household formation and consumer preference for economical cooling alternatives.

- By Distribution Channel: Offline channels represent the largest segment with a market share of 62% in 2025, owing to consumer preference for in-store product evaluation before purchase.

- Key Players: The Australia pedestal fan market exhibits moderate competitive intensity, with established domestic retailers competing alongside international brands across multiple price segments.

To get more information on this market Request Sample

Australia's pedestal fan market is undergoing significant transformation driven by climatic, economic, and technological factors. The Bureau of Meteorology has confirmed increasing frequency and intensity of heatwaves across the continent, intensifying demand for affordable and accessible cooling solutions. Rising residential electricity costs continue driving consumer preference toward energy-efficient fan options over power-intensive air conditioning systems. Increasing urbanization and compact living arrangements in metropolitan areas create strong demand for portable, space-efficient ventilation solutions that pedestal fans readily provide. Expanding residential construction activity and steady household formation rates are broadening the addressable market for cooling appliances. Growing consumer awareness regarding energy-efficient appliances and the integration of smart home technologies are further reshaping purchasing preferences within the Australia pedestal fan market.

Australia Pedestal Fan Market Trends:

Integration of Smart Technologies and IoT Connectivity

Australian consumers are increasingly embracing smart home technologies, driving demand for pedestal fans featuring Wi-Fi connectivity, voice assistant compatibility, and app-based controls. Industry data indicates that smart appliance sales in Australia doubled year-on-year during 2025, reflecting growing consumer appetite for connected home devices. Manufacturers are leveraging brushless DC motors and advanced sensor technologies to deliver energy-efficient, intelligent cooling solutions.

Growing Preference for Energy-Efficient Cooling Solutions

Rising household electricity costs are compelling Australian consumers to prioritize energy-efficient appliances, positioning pedestal fans as attractive alternatives to power-intensive air conditioning systems. The Australian Energy Market Commission projects residential electricity costs to fall by approximately 13% over the next decade under base case scenarios, though current high rates continue incentivizing efficient cooling options. Mandatory Energy Rating labels enable consumers to compare operating costs, with ceiling and pedestal fans operating for less than two cents per hour according to industry benchmarks. The 2024 expansion of the Equipment Energy Efficiency Program introduced stricter minimum performance standards, accelerating the transition toward energy-optimized products.

Expansion of E-Commerce and Omnichannel Retail Strategies

Online retail channels are gaining significant traction within Australia's home appliance market, reshaping consumer purchasing behaviors for cooling products. E-commerce platforms appeal to consumers through competitive pricing, comprehensive product reviews, and convenient home delivery options. Major retailers are enhancing their omnichannel capabilities, offering consumers flexible shopping experiences that combine online research with in-store product evaluation and rapid delivery services across metropolitan and regional areas.

Market Outlook 2026-2034:

The Australia pedestal fan market is positioned for sustained growth throughout the forecast period, supported by favorable demographic trends, climate dynamics, and evolving consumer preferences. Population growth and increasing household formation rates, particularly in metropolitan corridors of Sydney, Melbourne, and Brisbane, continue expanding the addressable consumer base for portable cooling solutions. The market generated a revenue of USD 58.66 Million in 2025 and is projected to reach a revenue of USD 110.12 Million by 2034, growing at a compound annual growth rate of 7.25% from 2026-2034.

Australia Pedestal Fan Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Standard Pedestal Fan | 68% |

| Application | Residential | 56% |

| Distribution Channel | Offline | 62% |

Type Insights:

- Standard Pedestal Fan

- High Velocity Pedestal Fan

- Smart Pedestal Fan

The standard pedestal fan dominates with a market share of 68% of the total Australia pedestal fan market in 2025.

Standard pedestal fans maintain market leadership due to their proven reliability, straightforward operation, and competitive pricing that appeals to cost-conscious Australian households. These conventional fans deliver effective air circulation without the complexity of advanced features, making them accessible to consumers across all demographic segments. The simplicity of mechanical controls and minimal maintenance requirements reinforces consumer confidence in standard pedestal fan models.

Australian consumers traditionally prioritize functional performance and durability when selecting cooling appliances, attributes that standard pedestal fans reliably deliver. The broad availability of standard models across brick-and-mortar retail networks and online platforms ensures convenient accessibility for replacement purchases. Established distribution relationships between domestic retailers and fan manufacturers support competitive pricing dynamics that benefit cost-conscious consumers. The segment's stability provides manufacturers with predictable demand patterns, enabling efficient inventory management and supply chain optimization throughout seasonal demand cycles.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Industrial

The residential segment leads with a share of 56% of the total Australia pedestal fan market in 2025.

Residential applications dominate the Australian pedestal fan market, driven by the nation's substantial housing stock and favorable demographic trends supporting household formation. The Australian Bureau of Statistics reported that the number of residential dwellings increased by 53,800 to 11,410,700 in September 2025, representing a vast installed base for cooling appliances. Rising household energy costs are prompting homeowners to adopt pedestal fans as economical supplementary cooling options alongside air conditioning systems.

Urban apartment living and compact residential formats in metropolitan centers create ideal conditions for portable, space-efficient cooling solutions that pedestal fans provide. The flexibility to relocate fans between rooms and the absence of permanent installation requirements appeal to both homeowners and rental tenants. Increasing incidence of heatwaves documented by CSIRO's State of the Climate 2024 report reinforces residential demand for accessible cooling options during extreme temperature events. The growing presence of dual-income households with limited time for complex appliance maintenance favors straightforward, reliable pedestal fan models.

Distribution Channel Insights:

- Online

- Offline

The offline distribution channel holds the highest revenue share with 62% of the total Australia pedestal fan market in 2025.

Traditional brick-and-mortar retail channels maintain dominance within Australia's pedestal fan market, supported by consumer preference for in-person product evaluation before purchase. Major electronics and appliance retailers provide extensive showroom displays enabling customers to assess fan quality, noise levels, and airflow characteristics directly. The tactile experience of evaluating build quality and operating controls remains important for consumers investing in durable household appliances. In August 2024, JB Hi-Fi completed its acquisition of E&S Trading, demonstrating ongoing consolidation among offline appliance retailers seeking competitive scale.

Physical retail locations offer immediate product availability and instant gratification that online channels cannot fully replicate for urgent seasonal cooling needs. Knowledgeable sales staff provide personalized recommendations based on room size, usage requirements, and budget constraints, adding value to the in-store shopping experience. Offline retailers leverage seasonal promotional events and bundling strategies to drive foot traffic during peak summer demand periods. The established trust relationships between Australian consumers and major appliance retailers reinforce offline channel preferences across demographic segments.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory and New South Wales represent the largest market within Australia's pedestal fan landscape, driven by Sydney's substantial metropolitan population and high household density. New South Wales leads the consumer appliance market nationally, supported by elevated disposable incomes, strong retail infrastructure, and advanced distribution networks across urban and regional areas.

Victoria and Tasmania represent a significant market for pedestal fans, driven by Melbourne's large metropolitan population and variable climate conditions. The region demonstrates strong consumer preference for energy-efficient cooling solutions supported by state-level sustainability initiatives.

Queensland's subtropical and tropical climate zones create sustained year-round demand for effective cooling solutions across residential applications. Population growth in Brisbane's greater metropolitan area and coastal regions continues expanding the addressable market for portable cooling appliances.

Northern Territory & Southern Australia regions experience extreme temperature variations with Adelaide recording among Australia's highest summer temperatures, intensifying demand for reliable cooling options. The Northern Territory's tropical climate generates consistent cooling requirements throughout extended warm seasons.

Perth's Mediterranean climate with hot, dry summers creates strong seasonal demand patterns for cooling appliances. Western Australia regularly experiences significant heatwave conditions, with regions like Carnarvon recording extreme temperatures, highlighting the state's exposure to intense heat events that drive cooling appliance adoption.

Market Dynamics:

Growth Drivers:

Why is the Australia Pedestal Fan Market Growing?

Increasing Frequency and Intensity of Heatwaves Across Australia

Climate change is driving measurable increases in extreme heat events across Australia, creating fundamental demand growth for cooling solutions including pedestal fans. The Bureau of Meteorology's State of the Climate 2024 report documented that Australia has warmed by 1.51°C since 1910, with warming trends accelerating across recent decades. These documented climate trends establish sustained long-term demand growth for accessible, affordable cooling options.

Rising Electricity Costs Driving Demand for Energy-Efficient Alternatives

Australian household electricity costs remain elevated relative to historical averages, incentivizing consumers to adopt energy-efficient cooling alternatives to power-intensive air conditioning systems. The Australian Energy Market Commission projects household energy costs could be reduced by nearly $1,000 annually through electrification strategies, though immediate cost concerns continue favoring efficient appliance adoption. These economic dynamics create favorable conditions for pedestal fan market expansion as cost-conscious consumers seek budget-friendly cooling solutions.

Expanding Residential Construction and Household Formation

Australia's residential construction sector and population growth trajectory provide structural support for household appliance demand including pedestal fans. The Australian Bureau of Statistics reported building approvals increased 11.9% to 17,076 dwellings in June 2025, signaling sustained residential development activity. This has also created a vast installed base requiring cooling solutions. Population growth patterns favor metropolitan corridors including Sydney, Melbourne, and Brisbane where compact apartment living generates demand for portable, space-efficient fans. The combination of new housing construction and replacement demand from existing households establishes favorable long-term market fundamentals.

Market Restraints:

What Challenges the Australia Pedestal Fan Market is Facing?

Competition from Integrated Cooling Systems and Air Conditioning

The widespread adoption of split-system and ducted air conditioning units across Australian households presents competitive pressure for pedestal fan manufacturers. Modern reverse-cycle systems offering both heating and cooling functionality provide year-round utility that standalone fans cannot replicate.

Price Competition and Margin Pressure from Imported Products

The influx of low-cost imported fan products from Asian manufacturing hubs creates pricing pressure across the Australian market. Generic and unbranded products available through online marketplaces and discount retailers erode margins for established brands investing in quality and innovation.

Seasonal Demand Variability and Inventory Management Challenges

The strongly seasonal nature of cooling appliance demand creates inventory management complexities for retailers and manufacturers throughout the annual cycle. Concentrated summer demand requires significant working capital investment while off-season periods generate minimal revenue activity.

Competitive Landscape:

The Australia pedestal fan market exhibits moderate competitive intensity with established international brands competing alongside domestic appliance specialists across multiple price tiers. Market participants differentiate through product innovation, energy efficiency credentials, design aesthetics, and retail distribution capabilities. Premium segments are dominated by technology-focused manufacturers offering smart connectivity and advanced airflow technologies, while value segments feature traditional designs competing primarily on price and availability. Major appliance retailers maintain significant channel power, influencing manufacturer access to consumers and promotional activities during peak demand periods. Brand loyalty remains relatively limited within the category, creating opportunities for innovative entrants to capture market share through distinctive product offerings.

Australia Pedestal Fan Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Standard Pedestal Fan, High Velocity Pedestal Fan, Smart Pedestal Fan |

| Applications Covered | Residential, Commercial, Industrial |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia pedestal fan market size was valued at USD 58.66 Million in 2025.

The Australia pedestal fan market is expected to grow at a compound annual growth rate of 7.25% from 2026-2034 to reach USD 110.12 Million by 2034.

The standard pedestal fan held the largest market share at 68% in 2025, driven by its affordability, reliability, widespread retail availability, and proven performance for residential cooling applications.

Key factors driving the Australia pedestal fan market include increasing frequency and intensity of heatwaves due to climate change, rising residential electricity costs incentivizing energy-efficient cooling alternatives, expanding residential construction and household formation, and growing consumer adoption of smart home technologies.

Major challenges include competition from integrated cooling systems and air conditioning units, price pressure from low-cost imported products, seasonal demand variability creating inventory management complexities, and margin erosion from aggressive retail discounting during peak selling periods.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)