Australia Pet Care Products Market Size, Share, Trends and Forecast by Pet Type, Type, and Region, 2025-2033

Australia Pet Care Products Market Overview:

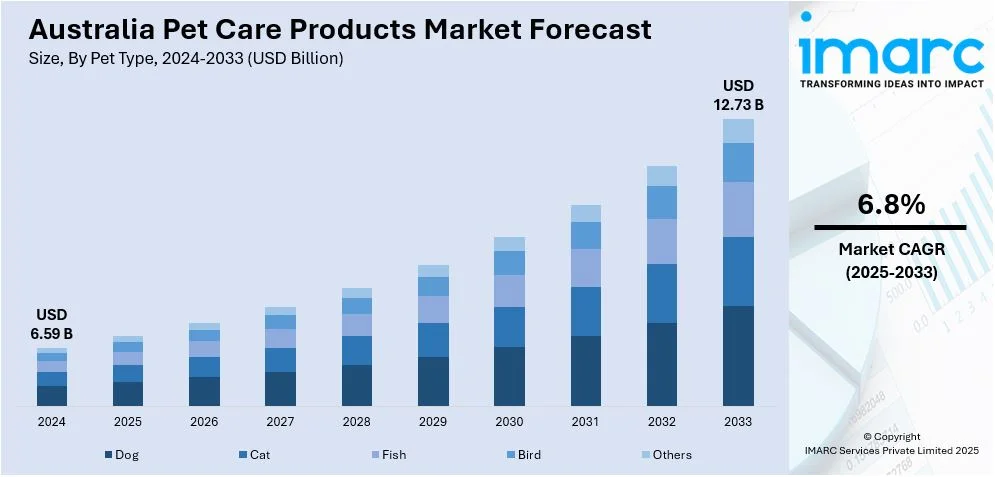

The Australia pet care products market size reached USD 6.59 Billion in 2024. Looking forward, the market is expected to reach USD 12.73 Billion by 2033, exhibiting a growth rate (CAGR) of 6.8% during 2025-2033. Increasing pet adoption rates, a growing awareness of pet health and wellness, and a rising demand for premium and natural pet food are some of the factors contributing to Australia pet care products market share. Additionally, innovations in pet grooming and healthcare products, along with the strong growth of e-commerce and online pet product sales, contribute significantly to market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.59 Billion |

| Market Forecast in 2033 | USD 12.73 Billion |

| Market Growth Rate 2025-2033 | 6.8% |

Key Trends of Australia Pet Care Products Market:

Shifting Perceptions and Boosting Cat Adoption

In the Australian pet care products market, there is a rising awareness of the importance of challenging myths regarding cats as pets. Despite having never had a cat, many Australians have unfavorable attitudes against cats, which limits adoption rates. To counter this, programs that encourage cat fostering are gaining popularity. These efforts frequently involve incentives like as product discounts, foster instruction, and professional help, all with the goal of changing public perceptions of cats. As a result, more pet owners are expected to choose cats as companions, boosting development in both cat adoption and the pet care industry, notably in feline-specific items like food, health care, and accessories. This shift is expected to positively influence the Australia pet care products market growth. For example, in March 2025, a study was conducted by WHISKAS, which revealed that many Australians overlooked cats as the perfect pets, with one in six admitting to disliking them, despite 74% having never owned a cat. To challenge this, WHISKAS launched the ‘Cat Conversion System,’ encouraging ‘cat haters’ to foster a feline. In partnership with rescue groups, the program includes discounts on WHISKAS products, fostering tips, and expert support, aiming to shift perceptions and boost adoption in Australia.

To get more information on this market, Request Sample

Fostering Innovation in Pet Care

The Australian pet care products market is increasingly focused on innovation, driven by rising demand for novel solutions in pet wellness and enrichment. Startups are creating novel goods such as alternative protein snacks, smart pet health monitoring equipment, and interactive enrichment toys. These innovations are being supported through accelerator programs and coaching, allowing small enterprises to expand their products. According to the Australia pet care products market analysis, this trend is helping to shape the evolution of pet care through improving the availability of cutting-edge goods for Australian pet owners. As customer expectations grow, the pet care market continues to witness an inflow of innovative solutions aimed at improving canine health, behavior, and general well-being. Growing support for these developments is projected to have a substantial impact on the market's future. For instance, in January 2024, Purina awarded USD 25,000 and support to innovative pet care startups from the US, Canada, and Australia in the eighth annual Pet Care Innovation Prize. Winners presented diverse solutions, including enrichment toys, alternative protein treats, and pet health monitoring tech. Each winner received mentorship and participated in an accelerator boot camp. This initiative underscores Purina's commitment to fostering innovation in the Australian pet care products market and enriching pets' lives.

Growth Drivers of Australia Pet Care Products Market:

Rise in Pet Ownership and Humanization

Australia is witnessing a steady increase in pet ownership, particularly among millennials, child-free couples, and older adults seeking companionship. This change is converting pets into full-fledged members of a family, affecting consumer trends to give importance to their health. Consequently, expenditure on pet care, especially the premiums and specialties, has exploded. The pet owners have become demanding, and they want to purchase high-quality pet-care products, health supplements, grooming materials, and fashion accessories. The emotional bond between the animal bin-owners is making the latter further invest in buying products that will offer the animal-protagonist comfort, security, and a higher quality of life. This strong emotional connection continues to be a significant driver of the Australia pet care products market growth.

Expansion of Veterinary and Wellness Services

The availability of advanced veterinary services, including diagnostics, surgeries, and chronic disease management, is playing a key role in the evolution of Australia’s pet care landscape. Alongside conventional care, holistic wellness options such as physiotherapy, dental care, and nutritional consultations are gaining popularity. The emergence of tele-veterinary platforms is enhancing convenience and access, particularly in remote or underserved regions. These services promote preventive care and early detection of health issues, increasing demand for related products such as medicated shampoos, supplements, functional treats, and prescription-based nutrition. As pet owners become more health-conscious, this trend is fostering a stronger, long-term reliance on wellness-focused pet care solutions.

Urbanization and Pet-Friendly Infrastructure

Australia’s urbanization is reshaping the way people care for their pets in high-density living environments. With more residents in apartments or smaller homes, there is a rising demand for space-efficient products like compact pet beds, multi-functional pet furniture, and indoor toilet training kits. The growth of pet-friendly infrastructure—such as parks, restaurants, and apartment complexes—further encourages pet adoption and reinforces a lifestyle that integrates pets into daily routines. This shift is driving consistent consumer interest in odor-control products, travel accessories, and home-cleaning solutions tailored for pet owners. As cities become more inclusive of pets, the demand for versatile and convenient pet care products continues to expand.

Opportunities of Australia Pet Care Products Market:

Premiumization and Customization Trends

Australia’s pet care market is witnessing a growing demand for premium and personalized products tailored to the specific needs of pets. Consumers are seeking solutions that go beyond basic care—such as breed-specific food formulas, hypoallergenic grooming products, and individualized wellness plans. This shift reflects a more thoughtful and health-conscious approach to pet ownership. It opens new avenues for brands to offer high-margin, niche products that address pets' age, size, activity level, and medical history. Customization also enhances customer loyalty, as owners value tailored experiences for their pets. As personalization becomes a key differentiator, companies that embrace this trend can unlock strong growth and long-term consumer relationships in a highly competitive market.

Growth of Digital Platforms and Subscription Models

The rapid expansion of e-commerce is transforming the Australia pet care market demand, offering convenience and personalization through online platforms. Direct-to-consumer channels allow brands to build closer relationships with pet owners, while innovations like auto-replenishment and curated subscription boxes simplify recurring purchases. These digital models cater to modern lifestyles, enabling hassle-free access to food, treats, and wellness products. Personalized recommendations based on pet profiles, purchase history, and seasonal needs are driving engagement and repeat sales. Subscription services also help brands create consistent revenue streams and stronger customer retention. As more consumers embrace digital shopping for their pets, companies that invest in robust online ecosystems stand to gain a significant competitive advantage.

Eco-Friendly and Ethical Product Demand

Sustainability has become a major consideration for Australian pet owners, many of whom actively seek out environmentally responsible and ethically produced products. There is growing interest in biodegradable waste bags, organic grooming items, plant-based formulas, and pet food made from sustainably sourced ingredients. Consumers are increasingly aligning their pet care choices with personal values, prioritizing cruelty-free testing, low-impact packaging, and transparent sourcing practices. This shift is not only reshaping product development but also influencing brand loyalty and trust. Companies that commit to sustainability and ethical standards are better positioned to attract a conscious consumer base and differentiate themselves in a competitive market. As eco-awareness continues to grow, so do opportunities in the green pet care segment.

Australia Pet Care Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on pet type and type.

Pet Type Insights:

- Dog

- Cat

- Fish

- Bird

- Others

The report has provided a detailed breakup and analysis of the market based on the pet type. This includes dog, cat, fish, bird, and others.

Type Insights:

.webp)

- Product

- Pet Litter

- Pet Grooming Products

- Fashion, Toys, and Accessories

- Food

- Dry Food

- Wet/Canned

- Treats/Snacks

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes product (pet litter, pet grooming products, fashion, toys, and accessories) and food (dry food, wet/canned, and treats/snacks).

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Pet Care Products Market News:

- In December 2024, Petbarn introduced PetAI, a generative AI-powered assistant designed to help Australian pet owners maintain their pets' health and happiness. Developed with Microsoft and Insight Enterprises, PetAI offers personalized pet care advice and product recommendations. Integrated into the Petbarn App, the AI tool leverages Greencross' veterinary expertise.

- In April 2024, Media entrepreneurs Michael Ryan and Nic Cann introduced FurMedia, a dedicated pet-centric media platform in Australia. This innovative digital out-of-home network operates within busy veterinary clinic reception areas nationwide, engaging close to 1.6 million pet owners each month. FurMedia features specially designed ‘pee-proof’ display screens and delivers curated, pet-friendly content tailored for waiting room environments.

- In July 2024, Real Pet Food Co., maker of Billy + Margot, became the first in Australia to secure approval for importing black soldier fly (BSF) meal for pet food. After two years of research, BSF was chosen as the main ingredient in its new insect-based dry dog food, sold exclusively at Petbarn stores and online.

- In September 2023, Panasonic made its debut in Australia’s pet care market with the introduction of a smart pet feeder and a four-stage filtration pet water fountain. These products are designed to support pet owners by ensuring their pets maintain a consistent feeding routine and have access to clean, fresh drinking water with ease.

Australia Pet Care Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Pet Types Covered | Dog, Cat, Fish, Bird, Others |

| Types Covered |

|

| Regions Covered | Australia Capital Territory and New South Wales, Victoria and Tasmania, Queensland, Northern Territory and Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia pet care products market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia pet care products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia pet care products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The pet care products market in Australia was valued at USD 6.59 Billion in 2024.

The Australia pet care products market is projected to exhibit a CAGR of 6.8% during 2025-2033.

The Australia pet care products market is projected to reach a value of USD 12.73 Billion by 2033.

A growing focus on pet humanization is a major trend, with consumers seeking premium, organic, and tailor-made products. Sustainability is influencing purchasing habits, driving interest in eco-friendly packaging and natural ingredients. E-commerce growth, personalized product offerings, and pet wellness innovations are also shaping the evolving pet care landscape in Australia.

The primary growth drivers of the market include rising pet ownership, increased disposable income, and a stronger emotional bond between owners and pets. Veterinary care advancements, pet insurance penetration, and the rise of pet-focused retail chains enhance accessibility, representing another major driver. Government pet-friendly policies and tech-enabled services further contribute to sustained market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)