Australia PET Packaging Market Size, Share, Trends and Forecast by Packaging Type, Form, Pack Type, Filling Technology, End User, and Region, 2025-2033

Australia PET Packaging Market Overview:

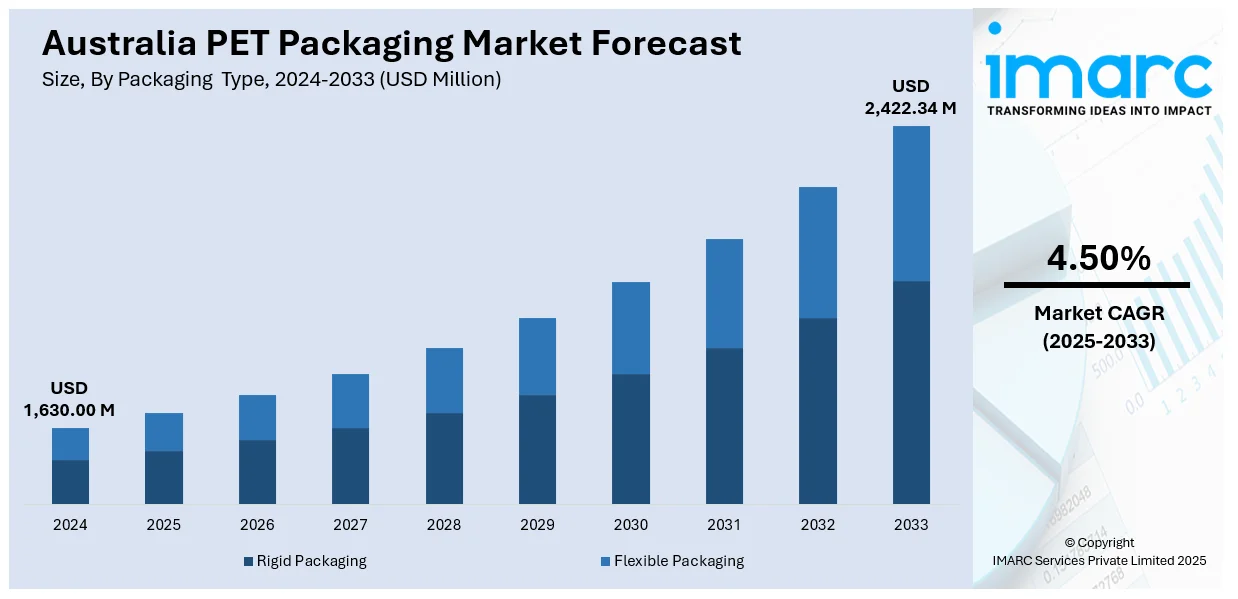

The Australia PET packaging market size reached USD 1,630.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,422.34 Million by 2033, exhibiting a growth rate (CAGR) of 4.50% during 2025-2033. The market is growing owing to the rising product demand in industries, such as food, beverage, and consumer goods, with growing emphasis on sustainability and green options. The growth is an indication of a move towards reusable and recyclable packaging in Australia.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,630.00 Million |

| Market Forecast in 2033 | USD 2,422.34 Million |

| Market Growth Rate 2025-2033 | 4.50% |

Australia PET Packaging Market Trends:

Shift Towards Lightweight and High-Strength PET Packaging

Australia's PET packaging sector is experiencing a remarkable shift towards lightweight but high-strength packaging materials. Companies are increasingly using technologies that allow them to minimize resin consumption without compromising structural integrity. This shift not only reduces material costs but also aligns with sustainability goals by reducing carbon footprints during transport and production. For example, in September 2024, CSIRO and Murdoch University unveiled the Bioplastics Innovation Hub in Perth in September 2024, which will assist Australia in making the switch to PET packaging using 100% compostable substitutes for traditional plastic packaging. Furthermore, lightweight PET packs are also more convenient to handle for consumers, which improves user experience without a compromise on durability. In addition, improvements in blow molding and preform design are enabling more customization, benefiting segments, such as beverages and personal care. Australia PET packaging market growth, share, and outlook directly correlate with these innovations, which enable environmental as well as economic efficiencies. This trend is in accordance with national waste reduction policies and emphasizes the manner in which PET packaging continues to be a bedrock of packaging innovation in Australia's vibrant consumer goods industry.

To get more information on this market, Request Sample

Adoption of Recycled PET (rPET) in Mainstream Packaging

The Australia market for PET packaging is experiencing a robust increase in the adoption of recycled PET, or rPET, across several industries. For instance, in January 2024, Circular Plastics Australia opened its biggest PET plastic bottle recycling plant in Melbourne, Victoria, that can recycle a maximum of one billion 600ml PET bottles a year into food-grade resin. Moreover, growing consumer demand for sustainable packaging and policy focus on circular economy approaches have driven producers to incorporate higher levels of rPET into their portfolios. Companies are making investments in technologies to enhance the clarity, strength, and safety of recycled PET so that performance is on par with virgin plastics. Applications of food-grade rPET, particularly in food containers and beverages, are increasing, further confirming its mainstream acceptance. Australia PET packaging market outlook are positively affected by the increasing use of rPET, as it shows the nation's dedication to eliminating plastic waste. Implementation of rPET is expected to be a standard industry practice, cementing sustainability against industry needs.

Growth of PET Packaging in Non-Food Industries

Apart from its historic dominance within the beverage segment, PET packaging is seeing the growing use within non-food segments in Australia. Categories like medicine, personal hygiene, and cleaning chemicals are in increasing demand to utilize PET with its clarity, safety, and aesthetic appeal. These markets appreciate PET's moisture resistance, chemical compatibility, and capacity for molding into tamper-evident forms. Branded aesthetics, including colored finishes and distinctive bottle shapes, increase the potential for branding, while recyclability appeals to changing consumer values. Australia PET packaging market share derive advantages from this diversification, which distributes demand across a range of verticals and normalizes industry performance. As the market continues to mature, this trend should fuel innovation in resin blends and barrier technologies so that PET packaging will continue to satisfy demanding requirements across a widening range of applications.

Australia PET Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on packaging type, form, pack type, filling technology, and end user.

Packaging Type Insights:

- Rigid Packaging

- Flexible Packaging

A detailed breakup and analysis of the market based on the pack type have also been provided in the report. This includes rigid packaging and flexible packaging.

Form Insights:

- Amorphous PET

- Crystalline PET

The report has provided a detailed breakup and analysis of the market based on the form. This includes amorphous PET and crystalline PET.

Pack Type Insights:

- Bottles and Jars

- Bags and Pouches

- Trays

- Lids/Caps and Closures

- Others

The report has provided a detailed breakup and analysis of the market based on the pack type. This includes bottles and jars, bags and pouches, trays, lids/caps and closures, and others.

Filling Technology Insights:

- Hot Fill

- Cold Fill

- Aseptic Fill

- Others

A detailed breakup and analysis of the market based on the filling technology have also been provided in the report. This includes hot fill, cold fill, aseptic fill, and others.

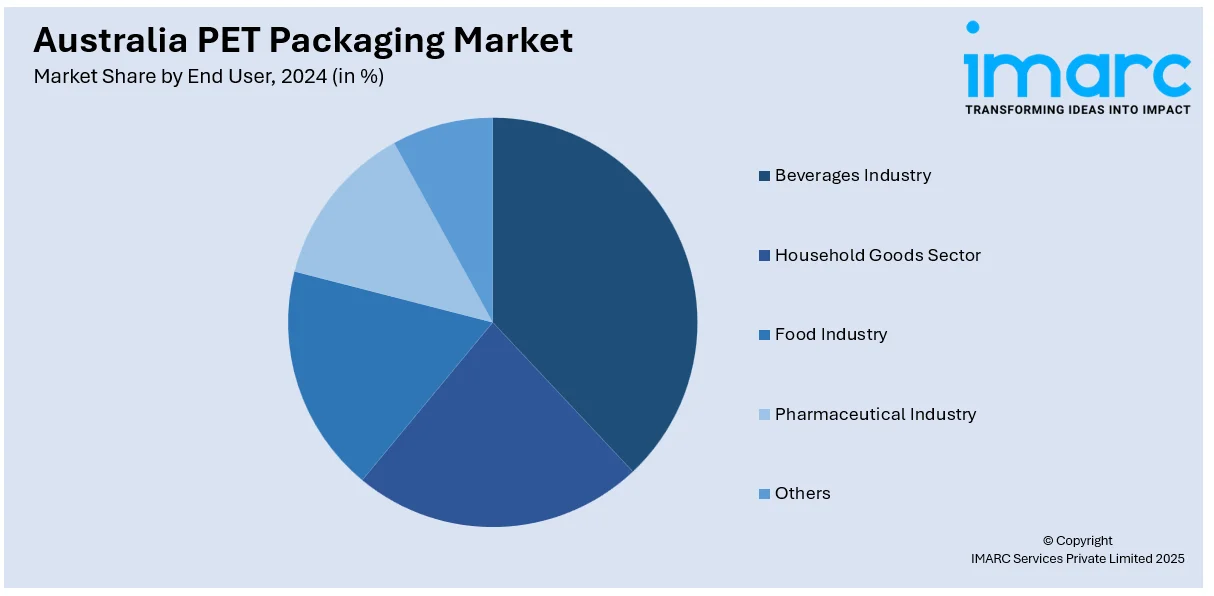

End User Insights:

- Beverages Industry

- Bottled Water

- Carbonated Soft Drinks

- Milk and Dairy Products

- Juices

- Beer

- Others

- Household Goods Sector

- Food Industry

- Pharmaceutical Industry

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes beverages industry (bottled water, carbonated soft drinks, milk and dairy products, juices, beer, and others), household goods sector, food industry, pharmaceutical industry, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia PET Packaging Market News:

- In September 2024, Detpak released more than 20 compostable, recyclable PBS-lined packaging solutions, offering environmentally friendly options to conventional PET packaging. The move promotes sustainability in Australia's packaging industry, complementing measures to minimize plastic waste, such as PET, by introducing workable, compostable alternatives in the takeaway foodservice market.

Australia PET Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Packaging Types Covered | Rigid Packaging, Flexible Packaging |

| Forms Covered | Amorphous PET, Crystalline PET |

| Pack Types Covered | Bottles and Jars, Bags and Pouches, Trays, Lids/Caps and Closures, Others |

| Filling Technologies Covered | Hot Fill, Cold Fill, Aseptic Fill, Others |

| End Users Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia PET packaging market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia PET packaging market on the basis of packaging type?

- What is the breakup of the Australia PET packaging market on the basis of form?

- What is the breakup of the Australia PET packaging market on the basis of pack type?

- What is the breakup of the Australia PET packaging market on the basis of filling technology?

- What is the breakup of the Australia PET packaging market on the basis of end user?

- What is the breakup of the Australia PET packaging market on the basis of region?

- What are the various stages in the value chain of the Australia PET packaging market?

- What are the key driving factors and challenges in the Australia PET packaging?

- What is the structure of the Australia PET packaging market and who are the key players?

- What is the degree of competition in the Australia PET packaging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia PET packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia PET packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia PET packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)