Australia Pet Supplement Market Size, Share, Trends and Forecast by Pet Type, Source, Distribution Channel, Application, and Region, 2025-2033

Australia Pet Supplement Market Size and Share:

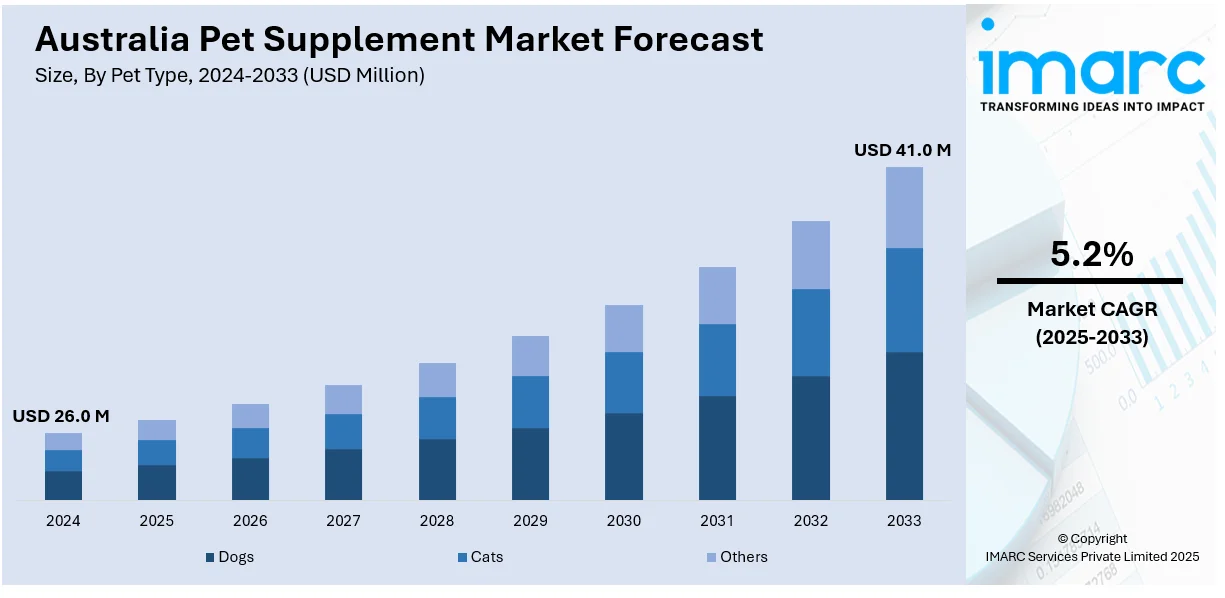

The Australia pet supplement market size reached USD 26.0 Million in 2024. Looking forward, the market is expected to reach USD 41.0 Million by 2033, exhibiting a growth rate (CAGR) of 5.2% during 2025-2033. The market is driven by increased awareness about pet health, rising demand for preventive care, the convenience of e-commerce, and personalized guidance through digital platforms, which empower pet parents to make informed decisions and easily access supplements for the well-being of their pets.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 26.0 Million |

| Market Forecast in 2033 | USD 41.0 Million |

| Market Growth Rate 2025-2033 | 5.2% |

Key Trends of Australia Pet Supplement Market:

Rising Awareness about Pet Health and Wellness

The growing awareness about pet health and nutrition is influencing the Australian pet supplement market, as more pet parents seek out products that promote long-term wellness. As individuals enhance their knowledge about the nutritional requirements of their pets, they are opting for supplements to boost immune function, tackle joint problems, and aid digestive wellness. Discussions on social media, combined with insights from veterinarians and pet nutritionists, are emphasizing the importance of preventive care. This trend is increasing interest in natural, organic, and holistic supplements, particularly as pet parents look for alternatives to conventional medicines. The needs of aging pets are also receiving more attention, prompting demand for supplements designed to improve mobility, cognitive function, and overall vitality in senior animals. Besides, the emphasis on preventive care is broadening the market and fostering innovation. In 2024, Petbarn launched "PetAI," a groundbreaking generative AI-powered solution to help Australian pet owners with personalized advice and product recommendations. Developed in collaboration with Microsoft and Insight Enterprises, PetAI provided tailored pet care guidance through Petbarn’s website and app. This innovation aimed to improve pet wellbeing by offering expert advice and easy access to products. As resources such as PetAI gain popularity, they are assisting in informing pet parents and strengthening the importance of supplements for preserving the well-being of pets, which further contributes to the growth of Australia pet supplement market share.

To get more information on this market, Request Sample

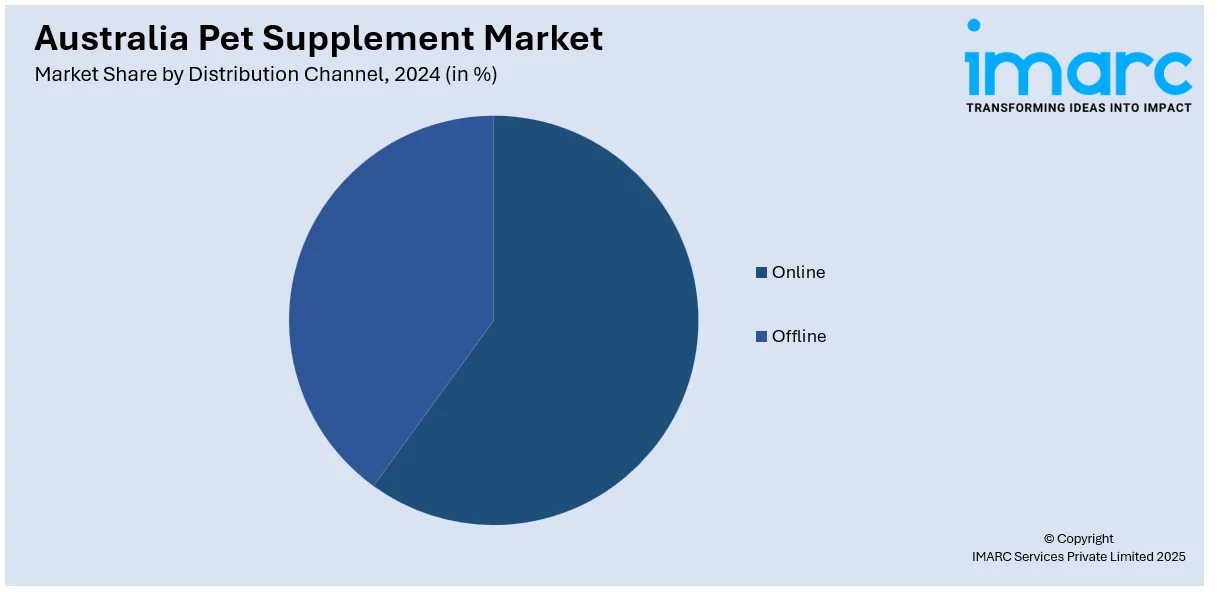

E-commerce and Convenient Shopping Channels

The size of the Australia e-commerce market was estimated at USD 536.0 Billion in 2024. Anticipating future trends, IMARC Group projects the market will attain USD 1,568.60 Billion by 2033, demonstrating a CAGR of 12.70% between 2025 and 2033. This wider increase in online shopping highlights the continuous growth opportunities for pet supplements marketed via digital platforms. With an increasing number of online shopping platforms, pet parents are leveraging the convenience and selection provided by digital channels. Online shopping enables users to compare components, read feedback, and choose specific supplements that may not be found in nearby shops. The ability to shop at any time, without the need to visit a physical outlet, is making it easier for pet parents to stay consistent with the supplement routines of their pets. Subscription offerings and focused promotions by specialized brands are further enhancing repeat buying, promoting loyalty and consistent engagement. This change is transforming the way individuals shop while also improving awareness about pet health items. The ease and variety available through online shopping are encouraging more pet parents to consider and purchase supplements designed for the unique requirements of their pets.

Growth Drivers of Australia Pet Supplement Market:

Pet Humanization and Increase in Preventative Pet Health Culture

One of the key drivers of the pet supplement business in Australia is the increasing pet humanization. Pet owners in Australia see their pets as part of their family and with that, an increasing emotional and financial investment in their health and well-being. This change in perception has driven robust demand for pet health products reflecting human health trends such as multivitamins, joint care supplements, probiotics, and skin and coat treatments. Pet owners in Sydney, Melbourne, and Brisbane are especially open to natural and organic supplements, reflecting their own life choices. There is also greater focus on preventative care as opposed to reactive treatment. Most Australians are now actively utilizing supplements to address common pet concerns such as anxiety, mobility issues, digestive health, and immunity. This emphasis on wholistic care has stimulated growth in specialty pet shops and also within veterinary clinics that prescribe individualized supplement regimens. Local brands are taking advantage of this cultural change also, promoting products with indigenous Australian ingredients like kangaroo-based omega oils and bush plant extracts that resonate with consumer loyalty for locally produced items, which further supports the Australia pet supplement market demand.

Growing Pet Ownership and Shifting Demographics

Another key driver for the pet supplement industry in Australia is the continual increase in pet ownership among younger and urban demographics. Demographic shifts, such as the rise in single-family homes and childless couples, have been responsible for a rise in demand for pets as emotional support. With such segments ready to spend on high-quality care, demand for high-tech pet healthcare products, particularly supplements, has increased dramatically. In larger cities such as Perth and Adelaide, living in apartments has resulted in a preference for smaller companion animals like cats and small-breed dogs, which tend to have distinct dietary and health needs. Breed size, age, or health issues-specific supplements are being sought after more and more. Additionally, more Australians who work at home are monitoring their pets' daily habits more closely, which means that sooner problems arise, such as bad digestion, stiffness in the joints, or stress, the corresponding supplements are more likely to be purchased. Retailers and internet sites are therefore broadening their pet health categories and subscription plans for pet supplements are on the rise, particularly among more technologically adept pet owners.

Increasing Demand for Natural and Locally Sourced Products

One unique motivator of Australia pet supplement market growth is the increasing demand for natural, organic, and locally produced products. There is strong evidence of a demand for supplements that use locally produced ingredients like manuka honey, emu oil, and bush botanicals, which have strong links to natural healing qualities and being sustainable. It is particularly prevalent among environmental-conscious groups within Australia, where consumers are moving toward being actively anti-synthetic additives or highly processed supplements. This is being leveraged by local pet companies with a focus on Australian-made credentials, clean labeling, and open sourcing. In rural areas, this taste matches with wider backing for small business and Australian agriculture. Consequently, companies promoting their goods as green, ethical, and based in local culture are experiencing enhanced customer loyalty and fostering consistent growth in this niche yet growing sector.

Opportunities of Australia Pet Supplement Market:

Natural and Functional Supplement Line Expansion

According to the Australia pet supplement market analysis, the region is an optimal market for expansion of natural and functional pet supplements, driven by the nation's biodiversity and the consumer desire for clean-label products. Pet owners in Australia are increasingly interested in supplements with ingredients such as kangaroo oil, manuka honey, turmeric, green-lipped mussel, and bush botanicals that are native, organic, and sustainably sourced. This trend is mirrored in the wider health and wellbeing trends of the human supplement industry, which continues to shape pet product choices. Australian businesses can capitalize on the nation's reputation for high-quality, natural products to develop differentiated supplement products that appeal to domestic and export markets alike. Additionally, with increasing environmental consciousness, opportunities exist for differentiation through sustainable packaging and ethical sourcing. With more consumers turning away from synthetic additives, brands that can show transparency, origin traceability, and demonstrated efficacy through the use of local ingredients are primed to attract a loyal customer base both in Australia and overseas.

E-Commerce Expansion and Direct-to-Consumer Channels

The rapid growth of e-commerce in Australia is creating great opportunity for pet supplement brands to engage with more audiences through online sales and direct-to-consumer models. With the growth in internet penetration and evolving consumer behaviors, especially post-pandemic, as Australian pet owners are increasingly shifting to online channels for home delivery convenience, subscription schemes, and better availability of products. Small and emerging players now have a chance to compete with the big players through a robust online presence, differentiated marketing, and social media and digital storytelling engagement of consumers. Regional and rural pet owners, who might be restricted in physical access to specialty pet products, can now discover upscale supplements online. Increasingly, there is also potential for brands to customize their products based on online tools such as pet health tests or tailored supplement recommendations according to age, breed, or particular health status. This change toward online retailing creates a scalable and cost-effective avenue for penetration in the market and customer loyalty.

Integration of Pet Healthcare and Veterinary Partnerships

As veterinary practitioners in Australia move toward accepting integrative and preventive care strategies, there is increasing potential for pet supplement firms to partner directly with vet clinics and animal health professionals. Australian veterinarians increasingly have confidence in recommending nutritional supplements for the management of chronic conditions, recovery after surgery, and general health, particularly where these products enjoy quality assurance and scientific validity. This is a strategic market entry opportunity for supplement companies to establish credibility and long-term relationships with the veterinary profession. There is also scope for creating practitioner-only or vet-exclusive product lines or formulae addressing animal health requirements. In regions where veterinary access is limited such as remote or rural communities, telehealth platforms and mobile vet services are expanding, creating further opportunities for supplements to be incorporated into digital care plans. By aligning with veterinary practices and integrating products into clinical recommendations, brands can increase their credibility, enhance consumer confidence, and contribute meaningfully to animal healthcare outcomes in the Australian market.

Challenges of Australia Pet Supplement Market:

Regulatory Complexity and Lack of Standardization

One of the biggest challenges the Australian pet supplement market is the confusing and fragmented regulatory environment. Pet supplements are different from human supplements in that they tend to be in a regulatory grey zone, where they can be deemed veterinary medicines, complementary animal products, or generic pet items based on their ingredients and function. This absence of standardization causes confusion for manufacturers, retailers, and even veterinarians as to what is legally acceptable in terms of formulation, marketing, and labeling. Some therapeutic claims, for instance, must be registered with the Australian Pesticides and Veterinary Medicines Authority (APVMA), which can be time-consuming and costly. Niche or new brands might struggle to cope with this environment or to sustain the regulatory burden necessary to enter novel products. Furthermore, the lack of uniform labeling requirements can generate misleading product claims that reduce consumer confidence over time. To thrive, businesses need to reconcile regulatory compliance with product innovation while remaining nimble in the face of changing local regulation.

Consumer Skepticism and Education Gaps

Although pet wellness product demand is increasing in Australia, most consumers do not believe in the real value of pet supplements, particularly when there is insufficient or ambiguous scientific support. In contrast to drugs that have to be prescribed by a veterinarian, over-the-counter pet supplements do not necessarily constitute must-haves, so their repeat purchase can be affected. In Australia's cities, where humanization of pets is greatest, there are more consumers willing to accept natural supplements, yet even they require transparency, evidence, and confidence that a product will work. Pet owners in regional and rural areas are less likely to know about supplements or to question their need at all. This is a particular challenge for brands seeking to gain trust from a wide range of demographics. There is an obvious need for more robust consumer education regarding the ways that supplements can assist with preventive care, management of chronic conditions, and better quality of life. Companies that do not offer clear information, evident usage guidelines, or scientist-approved endorsement are at risk of being thought of as marketing-based instead of truly health-aimed.

Supply Chain and Distribution Limitations in Distant Regions

Australia's extensive geography creates a special distribution hurdle for pet supplement companies, particularly in attempting to reach pet owners in rural and remote areas. While metropolitan markets such as Sydney and Melbourne are provided well by specialty pet shops and veterinary clinics, pet owners in the regions tend to have limited proximity to good-quality pet supplements. Delivery can take a long time, and logistics is expensive because of the distance and infrastructure constraints. It is especially challenging for chilled or sensitive forms of supplements, like liquid or probiotic products, which might need cold-chain logistics that are not always possible in isolated areas. Additionally, standalone pet retailers in small towns might be reluctant to carry specialty supplements because of reduced demand or unfamiliarity with the product. Without robust retail distribution or convenient online ordering, many pet owners in such areas are underserved. Such a gap in market penetration impinges on the larger growth opportunities of pet supplement brands seeking national coverage.

Australia Pet Supplement Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on pet type, source, distribution channel, and application.

Pet Type Insights:

- Dogs

- Cats

- Others

The report has provided a detailed breakup and analysis of the market based on the pet type. This includes dogs, cats, and others.

Source Insights:

- Organic

- Conventional

A detailed breakup and analysis of the market based on the source have also been provided in the report. This includes organic and conventional.

Distribution Channel Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online and offline.

Application Insights:

- Multivitamins

- Skin and Coat

- Hip and Joint

- Prebiotics and Probiotics

- Calming

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes multivitamins, skin and coat, hip and joint, prebiotics and probiotics, calming, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Advanced Pet Care

- Australian Pet Organics

- Groke Pet

- Lipa Pharmaceuticals

- Mighty Munch Australia Pty Ltd

- Natural Pet Supplements Australia

- Petmima

- Petz Park

- Zamipet Ltd

Australia Pet Supplement Market News:

- In July 2024, Australian startup Wonderfur launched its patented, freeze-dried pet supplement designed to boost the immune systems and improve overall health of pets. The product, made from Australian farm-fresh ingredients, includes key components like green-lipped mussels and turmeric.

- In February 2023, Leadr Pet, a pet wellness startup, launched a range of all-natural soft-chew supplements for cats and dogs. The products aimed to address common health issues like anxiety and stress using evidence-based, natural ingredients.

Australia Pet Supplement Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Pet Types Covered | Dogs, Cats, Others |

| Sources Covered | Organic, Conventional |

| Distribution Channels Covered | Online, Offline |

| Applications Covered | Multivitamins, Skin and Coat, Hip and Joint, Prebiotics and Probiotics, Calming, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Advanced Pet Care, Australian Pet Organics, Groke Pet, Lipa Pharmaceuticals, Mighty Munch Australia Pty Ltd, Natural Pet Supplements Australia, Petmima, Petz Park, Zamipet Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia pet supplement market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia pet supplement market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia pet supplement industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia pet supplement market was valued at USD 26.0 Million in 2024.

The Australia pet supplement market is projected to exhibit a CAGR of 5.2% during 2025-2033.

The Australia pet supplement market is expected to reach a value of USD 41.0 Million by 2033.

The Australia pet supplement market trends include rising demand for natural and organic products, increased use of native ingredients, and the growth of personalized, breed-specific formulations. E-commerce and subscription-based models are also gaining popularity, while pet owners increasingly seek preventive health solutions supported by veterinary recommendations and transparent, science-backed formulations.

The Australia pet supplement market is driven by increasing pet humanization, growing focus on preventive health, and rising demand for natural, locally sourced products. Expanding pet ownership across urban areas and strong e-commerce growth further support the market, alongside greater veterinary endorsement of supplements for long-term animal wellness.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)