Australia Pharmaceutical Filtration Market Size, Share, Trends and Forecast by Product, Technique, Application, Scale of Operation, and Region, 2025-2033

Australia Pharmaceutical Filtration Market Overview:

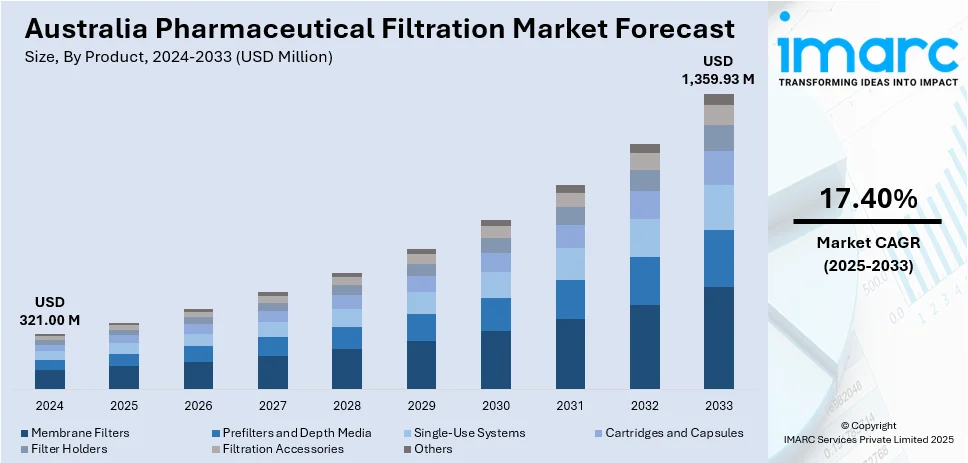

The Australia pharmaceutical filtration market size reached USD 321.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,359.93 Million by 2033, exhibiting a growth rate (CAGR) of 17.40% during 2025-2033. Rising biopharmaceutical production, strict therapeutic goods administration (TGA) regulations, increasing vaccine manufacturing, enhanced contamination control, adoption of single-use technologies, expansion of clinical trials, burgeoning investment in research and development (R&D) facilities, growth in sterile injectable drugs, focus on good manufacturing practices (GMP), personalized medicine advancements, and improved membrane filtration system are some of the factors favoring the Australia pharmaceutical filtration market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 321.00 Million |

| Market Forecast in 2033 | USD 1,359.93 Million |

| Market Growth Rate 2025-2033 | 17.40% |

Australia Pharmaceutical Filtration Market Trends:

Increased Demand for Biopharmaceuticals

The growing reliance on biopharmaceutical products, including monoclonal antibodies, vaccines, and recombinant proteins, has created a significant need for high-performance filtration systems in Australia. Biopharmaceuticals are sensitive to contamination and require precise separation of particulates, microorganisms, and pyrogens during production. As companies expand biologics manufacturing capacity, especially in Melbourne and Sydney, demand for specialized filtration technologies such as sterile and virus filtration has surged. Moreover, the rise in chronic illnesses and demand for targeted treatments have further increased production volumes, placing pressure on manufacturers to adopt efficient, scalable filtration systems, which is driving the Australia pharmaceutical filtration market growth. Additionally, growing interest in cell and gene therapies is pushing pharmaceutical firms to invest in advanced filtration setups compatible with small-batch, high-value production.

To get more information on this market, Request Sample

Rising Focus on Contamination Control in Drug Manufacturing

Contamination control remains a priority for pharmaceutical manufacturers in Australia, as any breach can result in product recalls, regulatory sanctions, or compromised patient safety. To address this, companies are adopting multi-layered filtration protocols during every stage of drug development and production. The shift toward sterile injectable products and high-potency drugs has raised the bar for cleanliness standards, prompting firms to deploy filtration systems capable of removing submicron particles and microbial contaminants. Filters are also critical in ensuring the integrity of process water, air supply systems, and raw materials, aligning with GMP and PIC/S guidelines enforced in the country. As contamination-related downtime can significantly disrupt supply chains, companies are moving toward pre-validated, integrity-tested filters to reduce risk and maintain consistent output.

Stringent Regulatory Requirements by TGA and Global Health Bodies

Regulatory compliance continues to shape procurement and operational decisions in Australia’s pharmaceutical filtration landscape. The Therapeutic Goods Administration (TGA), along with international agencies like the US FDA and EMA, mandates rigorous validation and documentation of filtration processes. Companies must demonstrate filter integrity, compatibility with drug formulations, and reproducibility across batches. Furthermore, the requirement for aseptic processing in cleanrooms and controlled environments further drives demand for advanced filters that meet International Organization for Standardization (ISO) and GMP standards. Moreover, companies engaged in global exports must ensure that filtration practices align with international regulatory frameworks. As the TGA intensifies inspections and audits, manufacturers are proactively upgrading their filtration systems and maintaining detailed quality records to remain compliant, which significantly contributes to the market’s sustained momentum.

Australia Pharmaceutical Filtration Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on product, technique, application, and scale of operation.

Product Insights:

- Membrane Filters

- MCE Membrane Filters

- Coated Cellulose Acetate Membrane Filters

- PTFE Membrane Filters

- Nylon Membrane Filters

- PVDF Membrane Filters

- Others

- Prefilters and Depth Media

- Glass Fiber Filters

- PTFE Fiber Filters

- Single-Use Systems

- Cartridges and Capsules

- Filter Holders

- Filtration Accessories

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes membrane filters (MCE membrane filters, coated cellulose acetate membrane filters, PTFE membrane filters, nylon membrane filters, PVDF membrane filters, and others), prefilters and depth media (glass fiber filters and PTFE Fiber Filters), single-use systems, cartridges and capsules, filter holders, filtration accessories, and others.

Technique Insights:

- Microfiltration

- Ultrafiltration

- Crossflow Filtration

- Nanofiltration

- Others

A detailed breakup and analysis of the market based on the technique have also been provided in the report. This includes microfiltration, ultrafiltration, crossflow filtration, nanofiltration, and others.

Application Insights:

- Final Product Processing

- Active Pharmaceutical Ingredient Filtration

- Sterile Filtration

- Protein Purification

- Vaccines and Antibody Processing

- Formulation and Filling Solutions

- Viral Clearance

- Raw Material Filtration

- Media Buffer

- Pre-Filtration

- Bioburden Testing

- Cell Separation

- Water Purification

- Air Purification

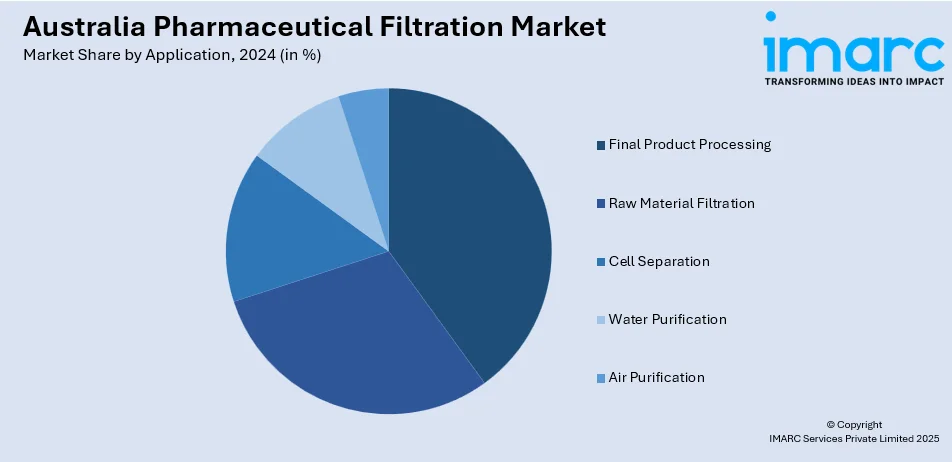

The report has provided a detailed breakup and analysis of the market based on the application. This includes final product processing (active pharmaceutical ingredient filtration, sterile filtration, protein purification, vaccines and antibody processing, formulation and filling solutions, and viral clearance), raw material filtration (media buffer, pre-filtration, and bioburden testing), cell separation, water purification, and air purification.

Scale of Operation Insights:

- Manufacturing Scale

- Pilot-Scale

- Research and Development Scale

A detailed breakup and analysis of the market based on the scale of operation have also been provided in the report. This includes manufacturing scale, pilot-scale, and research and development scale.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Pharmaceutical Filtration Market News:

- In March 2024, TFG Group and AquaVoda launched a 0.1-micron silicon carbide filtration skid for pharmaceutical and industrial use. The system removes 100% of suspended solids and 99.99% of bacteria, delivering a sustainable, high-recovery, low-energy solution aimed at enhancing filtration efficiency across Australia's growing pharmaceutical manufacturing sector.

- In June 2024, Danaher Corporation introduced the Supor Prime sterilizing grade filters, catering to manufacturers producing high-concentration biologics. The filters are engineered to improve process efficiency and ensure product sterility, addressing the growing demand for advanced filtration solutions in the biopharmaceutical industry.

Australia Pharmaceutical Filtration Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Techniques Covered | Microfiltration, Ultrafiltration, Crossflow Filtration, Nanofiltration, Others |

| Applications Covered |

|

| Scales of Operation Covered | Manufacturing Scale, Pilot-Scale, Research and Development Scale |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia pharmaceutical filtration market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia pharmaceutical filtration market on the basis of product?

- What is the breakup of the Australia pharmaceutical filtration market on the basis of technique?

- What is the breakup of the Australia pharmaceutical filtration market on the basis of application?

- What is the breakup of the Australia pharmaceutical filtration market on the basis of scale of operation?

- What is the breakup of the Australia pharmaceutical filtration market on the basis of region?

- What are the various stages in the value chain of the Australia pharmaceutical filtration market?

- What are the key driving factors and challenges in the Australia pharmaceutical filtration?

- What is the structure of the Australia pharmaceutical filtration market and who are the key players?

- What is the degree of competition in the Australia pharmaceutical filtration market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia pharmaceutical filtration market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia pharmaceutical filtration market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia pharmaceutical filtration industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)